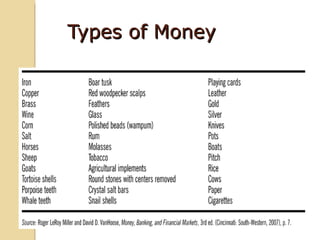

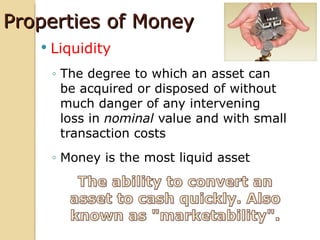

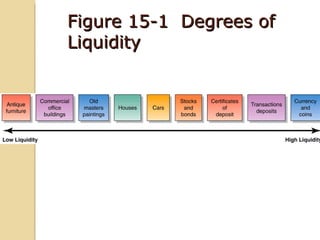

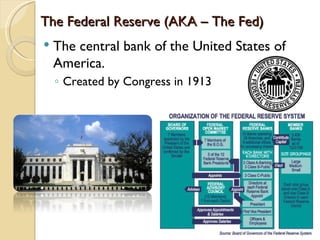

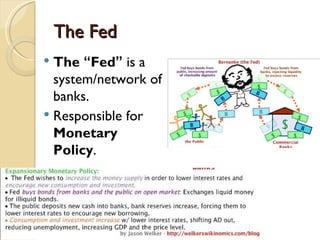

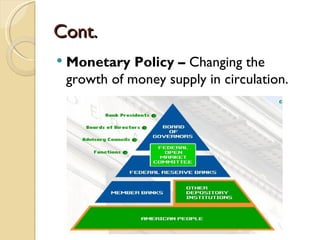

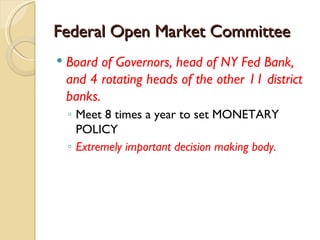

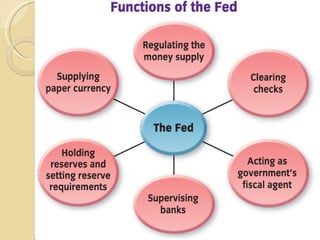

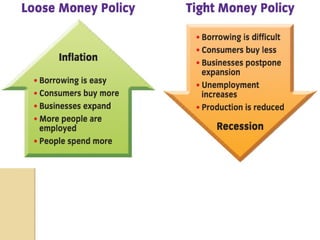

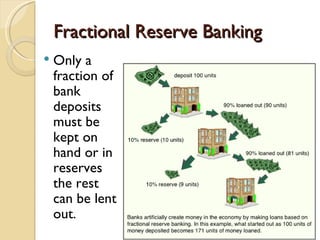

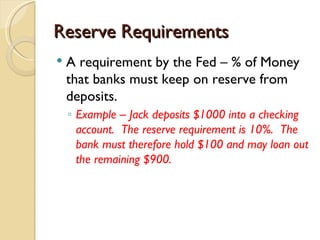

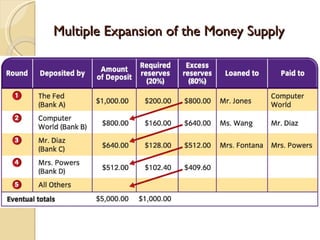

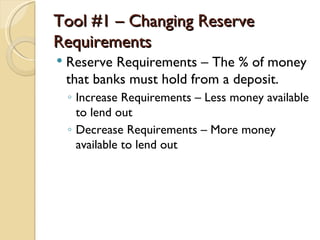

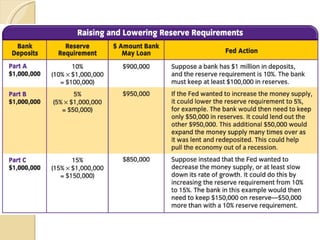

The document provides an overview of money and banking concepts including the functions of money, types of money, and properties of money. It also summarizes the role of the Federal Reserve in regulating the US money supply through tools like open market operations, changing reserve requirements, and adjusting interest rates. The Federal Reserve aims to promote price stability and maximum employment through its monetary policy decisions.