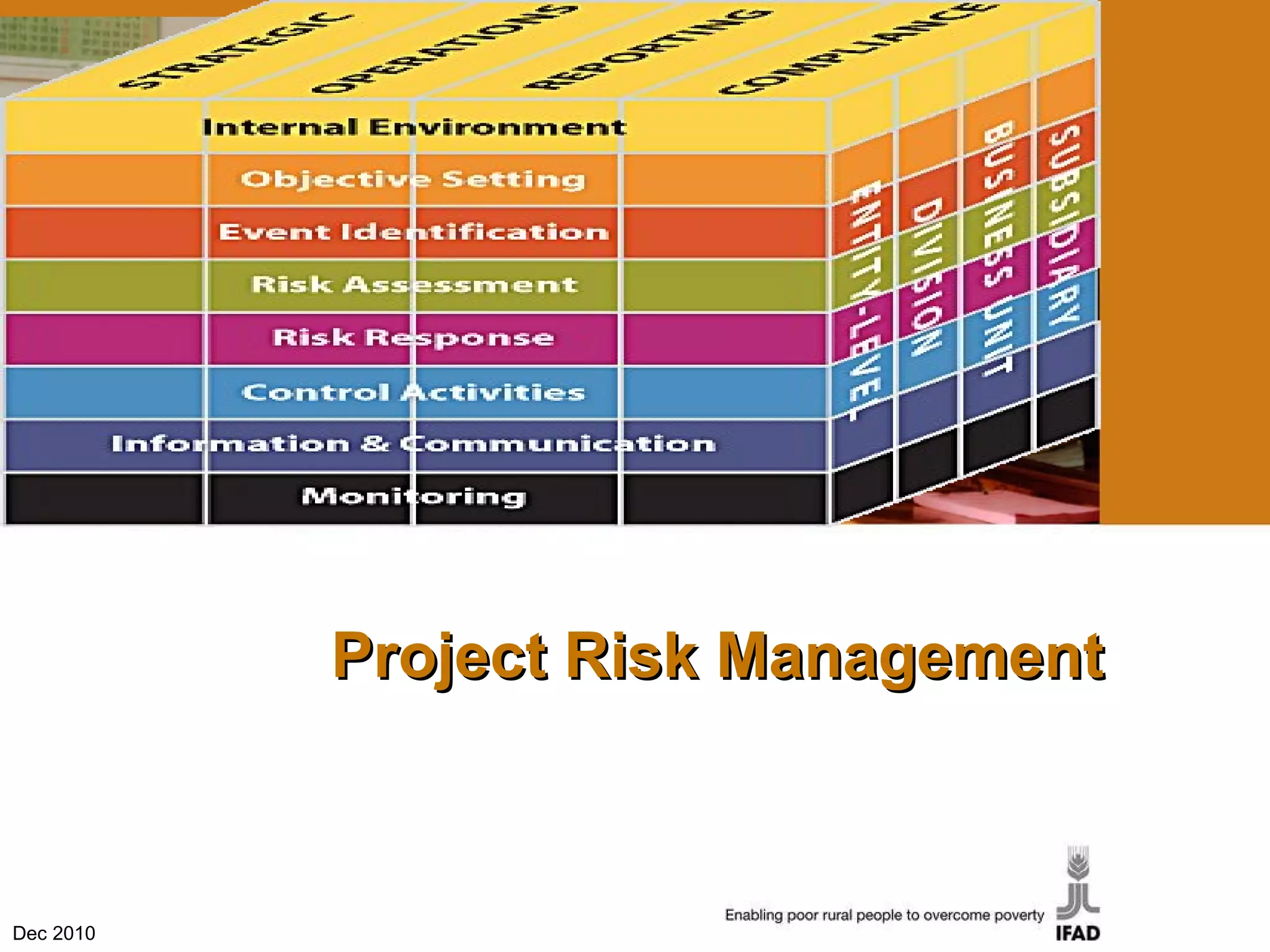

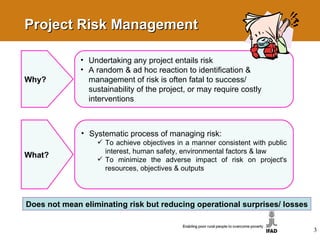

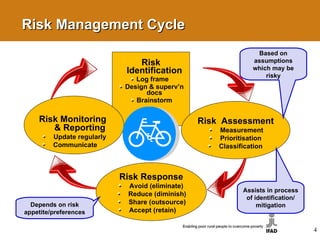

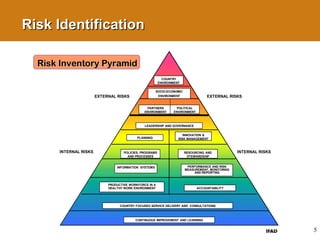

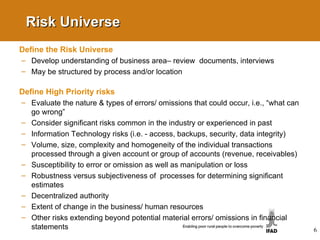

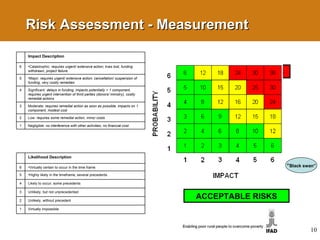

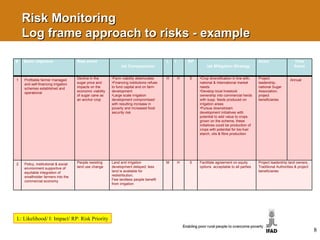

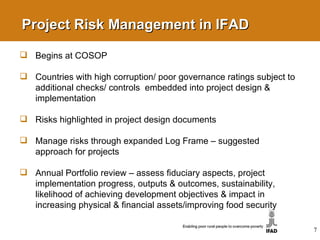

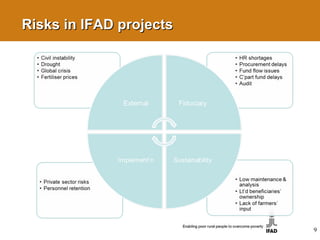

The document discusses project risk management. It defines risk as the uncertainty of an action or activity that may impact project objectives. Project risk management is a systematic process used to identify, assess, and respond to risks to minimize negative impacts. The key steps in the risk management cycle are risk identification, assessment, prioritization, response, monitoring, and reporting. Risks should be regularly updated and communicated.