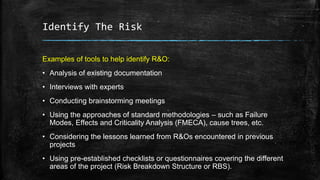

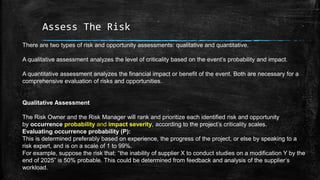

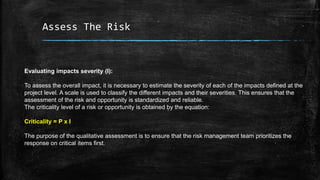

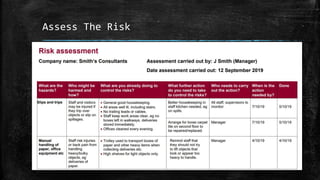

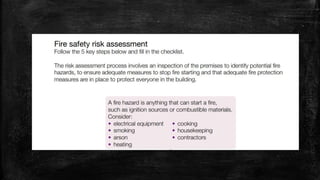

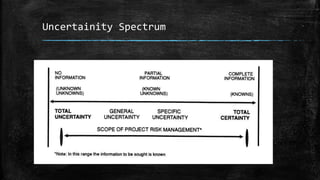

This document provides an overview of risk and crisis management. It discusses key concepts like what risk is, the steps of risk management which include identifying, assessing, treating and monitoring risk, and different types of risk assessment. It also covers risk space and defines different categories of risks based on observability and controllability. The document is intended to teach about risk management processes and how to characterize and evaluate risks.