This document discusses model classes, credit risk measures, model implementation, back testing, and model control. It covers various types of models including trade models, pricing models, and risk models. It also discusses different ways of measuring credit risk including measures of severity such as exposure at default and loss given default, as well as measures of frequency like probability of default. Finally, it discusses pricing models that incorporate credit risk.

![Model Classes

Credit Risk Measures

Model Implementation

Back Testing

Model Control

Types of Measures

Severity

Frequency

Pricing Credit Risk

Statistical Measures

Single Netting Set

Definition (Potential Future Exposure)

PFE(t) = max 0, p(t)|τ = t

τ : time at which CP defaults

Definition (Expected Exposure (EE))

EE(t) = E[PFE]

Definition (Expected Positive Exposure)

EPE(T) =

1

T

T

0

EE(t) dt

c 2015 H¨aner Consulting Model Risk 27 / 166](https://image.slidesharecdn.com/modelrisk-131222082242-phpapp01/85/Model-Risk-for-Pricing-and-Risk-Models-in-Finance-27-320.jpg)

![Model Classes

Credit Risk Measures

Model Implementation

Back Testing

Model Control

Analysis

Models

Software Development

Gaussian Approximation

Need to estimate E[p(T)], E[p2(Ti )] at some future times T:

Performing Taylor expansion for price p around expected risk

factor:

p(x(T), T) ≈ p(x0(T), T) +

i

∂p(x0(T), T)

∂xi

∆xi (T)

+

1

2

ij

∂2p(x0(T), T)

∂xi ∂xj

∆xi (T)∆xj (T)

x0(T) ≡ E[x(T)]

∆xi (T) ≡ xi (T) − x0,i (T)

c 2015 H¨aner Consulting Model Risk 51 / 166](https://image.slidesharecdn.com/modelrisk-131222082242-phpapp01/85/Model-Risk-for-Pricing-and-Risk-Models-in-Finance-51-320.jpg)

![Model Classes

Credit Risk Measures

Model Implementation

Back Testing

Model Control

Analysis

Models

Software Development

Gaussian Approximation

The expectation value M of the price is hence

M(T) ≈ p(x0(T), T) +

1

2

ij

γij (T)Ωij (T)

M(T) ≡ E[p(x(T), T)]

γij (T) ≡

∂2p(x0(T), T)

∂xi ∂xj

Ωij (T) ≡ E[∆xi (T)∆xj (T)]

For the variance V we obtain up to second order in ∆x:

V (T) ≈

ij

δi (T)δj (T)Ωij (T)

V (T) ≡ E[(p(x(T), T) − E[p(x(T), T)])2

]

δi (T) ≡

∂p(x0(T), T)

∂xic 2015 H¨aner Consulting Model Risk 52 / 166](https://image.slidesharecdn.com/modelrisk-131222082242-phpapp01/85/Model-Risk-for-Pricing-and-Risk-Models-in-Finance-52-320.jpg)

![Model Classes

Credit Risk Measures

Model Implementation

Back Testing

Model Control

Analysis

Models

Software Development

Gaussian Dependency Modelling

Goal

Express random vector ξ with correlated ξi as

linear combination of

uncorrelated

random factors ηi :

ξ = Mη

E[ξi ξj ] − E[ξi ]E[ξj ] ≡ Ωij

E[ηi ηj ] − E[ηi ]E[ηj ] = λ2

i δij diagonal, pos. sem. def.

What to consider?

Ω?

correlation matrix?

c 2015 H¨aner Consulting Model Risk 86 / 166](https://image.slidesharecdn.com/modelrisk-131222082242-phpapp01/85/Model-Risk-for-Pricing-and-Risk-Models-in-Finance-86-320.jpg)

![Model Classes

Credit Risk Measures

Model Implementation

Back Testing

Model Control

Analysis

Models

Software Development

Principal Component Analysis

Dimensional Analysis

Risk factors ξi not dimension-less!

interest rate :[T−1]

stock price :[Cash]

volatility: [T−1

2 ]

→ Ωij may have different dimensions,i.e. Ω in general not a

physically meaningful quantity!

c 2015 H¨aner Consulting Model Risk 87 / 166](https://image.slidesharecdn.com/modelrisk-131222082242-phpapp01/85/Model-Risk-for-Pricing-and-Risk-Models-in-Finance-87-320.jpg)

![Model Classes

Credit Risk Measures

Model Implementation

Back Testing

Model Control

Analysis

Models

Software Development

Principal Component Analysis

Solution

Consider instead of Ω following matrix Φ:

Φij ≡

∂f (ξ)

∂ξi

∂f (ξ)

∂ξj

Ωij

f : some function

For dimensionality [Φ]:

[Φij ] =

[f ]

[ξi ]

[f ]

[ξj ]

[ξi ][ξj ] = [f 2

] ∀i, j (3)

c 2015 H¨aner Consulting Model Risk 88 / 166](https://image.slidesharecdn.com/modelrisk-131222082242-phpapp01/85/Model-Risk-for-Pricing-and-Risk-Models-in-Finance-88-320.jpg)

![Model Classes

Credit Risk Measures

Model Implementation

Back Testing

Model Control

Analysis

Models

Software Development

Maximum Likelihood Estimation

Systematic way to calibrate

Approach

Parametric model with parameters α ↔ parametric measure µα:

µα(Γ) = e−Sα(Γ)

D[Γ]

Assume: historical path ΓH is the most likely one. Find α∗ such

that:

µα∗ (ΓH) = max

α

µα(ΓH)

c 2015 H¨aner Consulting Model Risk 93 / 166](https://image.slidesharecdn.com/modelrisk-131222082242-phpapp01/85/Model-Risk-for-Pricing-and-Risk-Models-in-Finance-93-320.jpg)

![Model Classes

Credit Risk Measures

Model Implementation

Back Testing

Model Control

Analysis

Models

Software Development

Parities

Example (Relative Purchasing Power Parity)

pf (t1)(1 + if )X(t2) = pd (t2)(1 + id )

pd/f : domestic/foreign price

id/f : domestic/foreign 1 yr inflation rate

X : Exchange rate

Yields after averaging

E[X(t2)]

X(t1)

=

1 + Id

1 + If

where I is the expected inflation rate.

c 2015 H¨aner Consulting Model Risk 98 / 166](https://image.slidesharecdn.com/modelrisk-131222082242-phpapp01/85/Model-Risk-for-Pricing-and-Risk-Models-in-Finance-98-320.jpg)

![Model Classes

Credit Risk Measures

Model Implementation

Back Testing

Model Control

Analysis

Models

Software Development

Parities

Example (International Fisher Effect (Uncovered Parity))

(1 + rd/f ) = (1 + ρd/f )(1 + id/f )

rd/f : domestic/foreign nominal 1 yr interest rate

ρd/f : real rdomestic/foreign 1 yr interest rate

Assumingρd = ρf gives

E[X(t2)]

X(t1)

=

1 + rd

1 + rf

c 2015 H¨aner Consulting Model Risk 99 / 166](https://image.slidesharecdn.com/modelrisk-131222082242-phpapp01/85/Model-Risk-for-Pricing-and-Risk-Models-in-Finance-99-320.jpg)

![Model Classes

Credit Risk Measures

Model Implementation

Back Testing

Model Control

Analysis

Models

Software Development

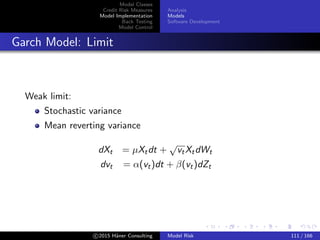

Garch Model

The dynamics of the returns is then assumed to follow a

Garch(1,1) process

Xn = µ + n t ∼ iid(0, σ2

n) (6)

σ2

n+1 = α + βσ2

n + γ 2

n (7)

The asymptotic value σ2

∞ = limn→∞ E[σ2

n] is then obtained by

equation (7) noting, that E[ 2] = σ2 and E[σ2

n+1] → E[σ2

n]:

σ∞ =

α

1 − β − γ

(8)

c 2015 H¨aner Consulting Model Risk 110 / 166](https://image.slidesharecdn.com/modelrisk-131222082242-phpapp01/85/Model-Risk-for-Pricing-and-Risk-Models-in-Finance-110-320.jpg)

![Model Classes

Credit Risk Measures

Model Implementation

Back Testing

Model Control

Regulatory Requirements

Measuring Model Performance

Radon-Nikodym Derivative

Distance of model Q and end empirical measure P in terms of dP

dQ:

EP[f ] = EQ[

dP

dQ

f ] (9)

Compare P and Q

Direct dP

dQ ≈ id?

Expectation values Empirical expectation measures in terms of

model expectations

Relative Entropy Kullback-Leibler entropy → information

geometry (see [?])

c 2015 H¨aner Consulting Model Risk 151 / 166](https://image.slidesharecdn.com/modelrisk-131222082242-phpapp01/85/Model-Risk-for-Pricing-and-Risk-Models-in-Finance-151-320.jpg)

![Model Classes

Credit Risk Measures

Model Implementation

Back Testing

Model Control

Regulatory Requirements

Measuring Model Performance

Radon-Nikodym Derivative

Let ξ be a scalar stochastic variable (e.g. portfolio price π(t))

Definition

P empirical, Q model CDF

Ψ : [0, 1] → [0, 1] (10)

Ψ(α) = P(Q−1

(α)) (11)

Radon-Nikodym derivative ψ

EP[f ] = EQ[ψ(α)f ] (12)

ψ(α) =

dΨ(α)

dα

(13)

c 2015 H¨aner Consulting Model Risk 152 / 166](https://image.slidesharecdn.com/modelrisk-131222082242-phpapp01/85/Model-Risk-for-Pricing-and-Risk-Models-in-Finance-152-320.jpg)

![Model Classes

Credit Risk Measures

Model Implementation

Back Testing

Model Control

Regulatory Requirements

Measuring Model Performance

Example

(a)

0.0 0.2 0.4 0.6 0.8 1.0

α

0.0

0.2

0.4

0.6

0.8

1.0

Ψ(α)

[x]=100.00;σ=0.40

[x]=110.00;σ=0.40

[x]=90.00;σ=0.40

[x]=100.00;σ=0.44

[x]=100.00;σ=0.36

0.8

1.0

1.2

1.4

1.6

1.8

ψ(α)

[x]=100.00;σ=0.40

[x]=110.00;σ=0.40

[x]=90.00;σ=0.40

[x]=100.00;σ=0.44

[x]=100.00;σ=0.36

c 2015 H¨aner Consulting Model Risk 153 / 166](https://image.slidesharecdn.com/modelrisk-131222082242-phpapp01/85/Model-Risk-for-Pricing-and-Risk-Models-in-Finance-153-320.jpg)

![Model Classes

Credit Risk Measures

Model Implementation

Back Testing

Model Control

Regulatory Requirements

Measuring Model Performance

Cumulative Distribution Functions

Cumulative distribution function (CDF) for some state variable ξ

expressed as expectation:

Definition

P(ξ0) = EP[Θ(ξ − ξ0)] (14)

where Θ is the Heaviside function.

c 2015 H¨aner Consulting Model Risk 154 / 166](https://image.slidesharecdn.com/modelrisk-131222082242-phpapp01/85/Model-Risk-for-Pricing-and-Risk-Models-in-Finance-154-320.jpg)

![Model Classes

Credit Risk Measures

Model Implementation

Back Testing

Model Control

Regulatory Requirements

Measuring Model Performance

Problems using metrics for Ψ

20 40 60 80 100 120 140 160

strike K

0.6

0.7

0.8

0.9

1.0

1.1

1.2

1.3

1.4

1.5

EE

EE

[x]=100.00;σ=0.40

[x]=110.00;σ=0.40

[x]=90.00;σ=0.40

[x]=100.00;σ=0.44

[x]=100.00;σ=0.36

Figure : Comparing EEs for a forward using log-normal distributions with

different parameters

c 2015 H¨aner Consulting Model Risk 160 / 166](https://image.slidesharecdn.com/modelrisk-131222082242-phpapp01/85/Model-Risk-for-Pricing-and-Risk-Models-in-Finance-160-320.jpg)