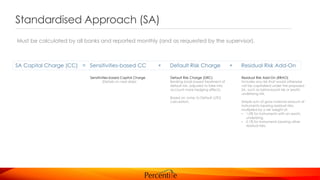

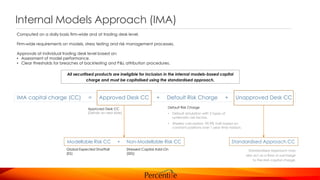

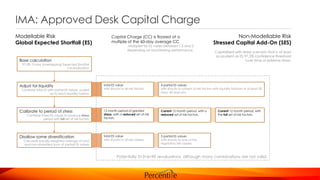

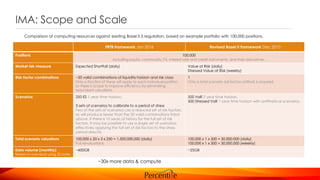

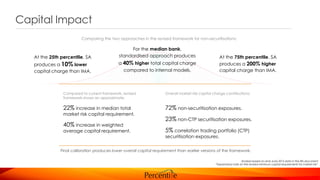

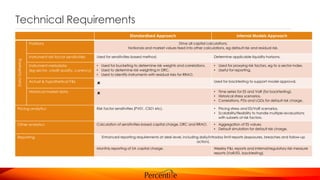

The document summarizes the Fundamental Review of the Trading Book (FRTB), which establishes new capital requirements for market risk. It outlines the standardized approach and internal models approach, both of which involve calculating expected shortfall and stressed value-at-risk. Banks will need to store and process significantly more market data to meet the new requirements, which are estimated to increase median capital requirements by 22% and weighted average capital requirements by 40%. Technical challenges include automating extensive data gathering, pricing, and reporting to support the new risk measurement approaches and capital calculations.