This document contains questions and answers related to VAT audit issues. Some key points addressed include:

- A dealer changing from the composition scheme to the normal VAT system does not need to declare stock on hand from the previous year.

- A works contractor under the composition scheme is not eligible for standard deductions before tax is levied.

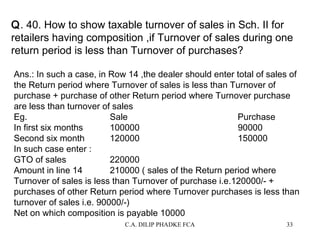

- Excess purchases in one period under the composition scheme for retailers cannot be adjusted in later periods.

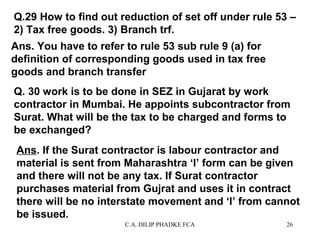

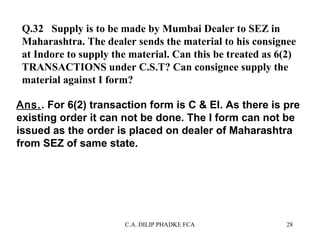

- A contractor can issue Form C for materials purchased from outside Maharashtra if used for works contracts within Maharashtra.

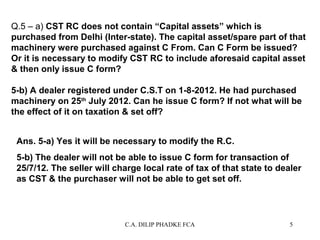

- Modifying the CST registration to include a capital asset is necessary before Form C can be issued for its purchase.