The document provides an introduction to the Central Sales Tax (CST) Act of 1956 in India. Some key points:

- CST is levied by the central government but administered and collected by state governments. It is collected in the state from which goods begin inter-state movement.

- The Act divides goods into declared goods and other goods, with declared goods subject to a maximum tax rate of 4% that can only be levied once. Other goods face a tax rate of 10% or the state rate, whichever is higher.

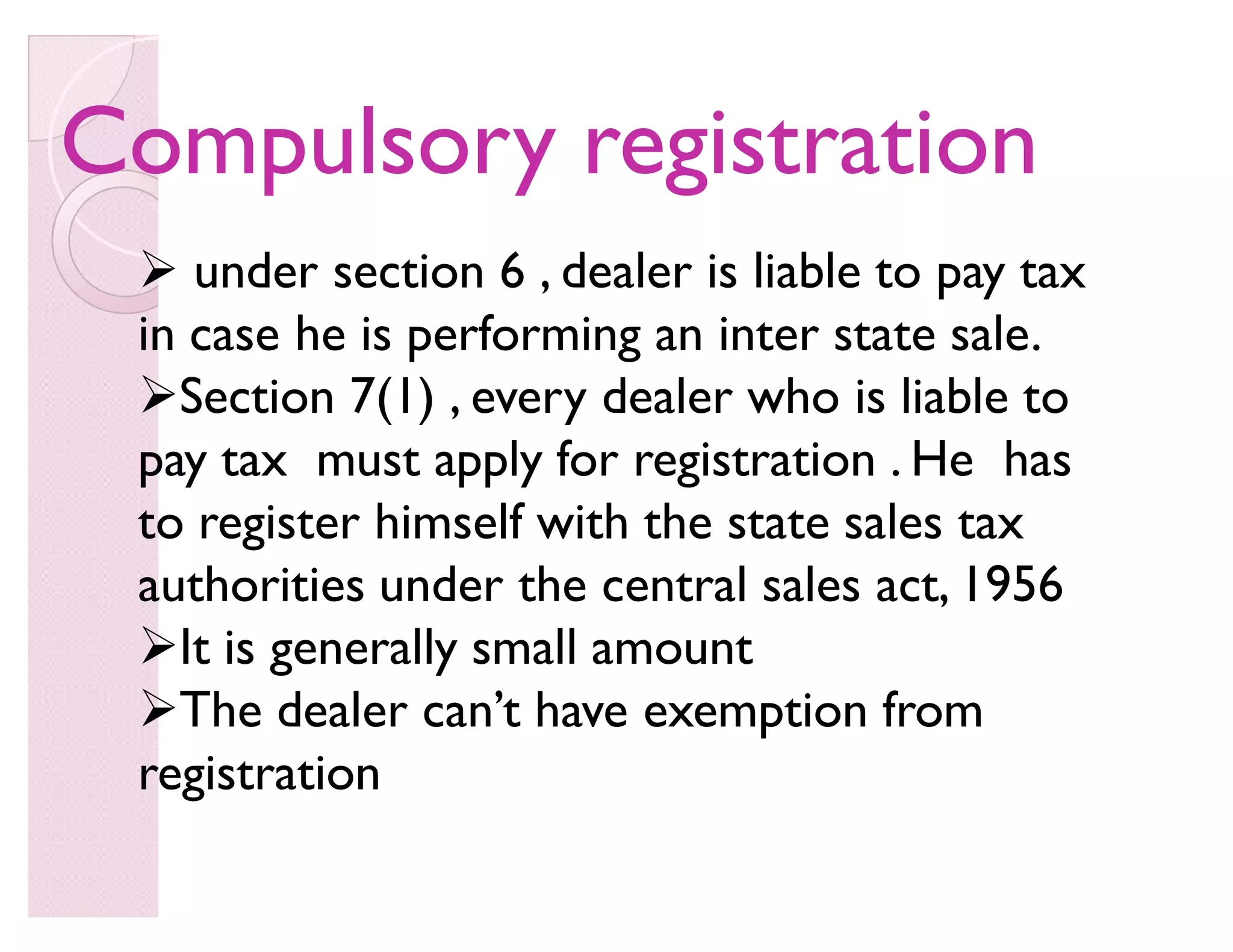

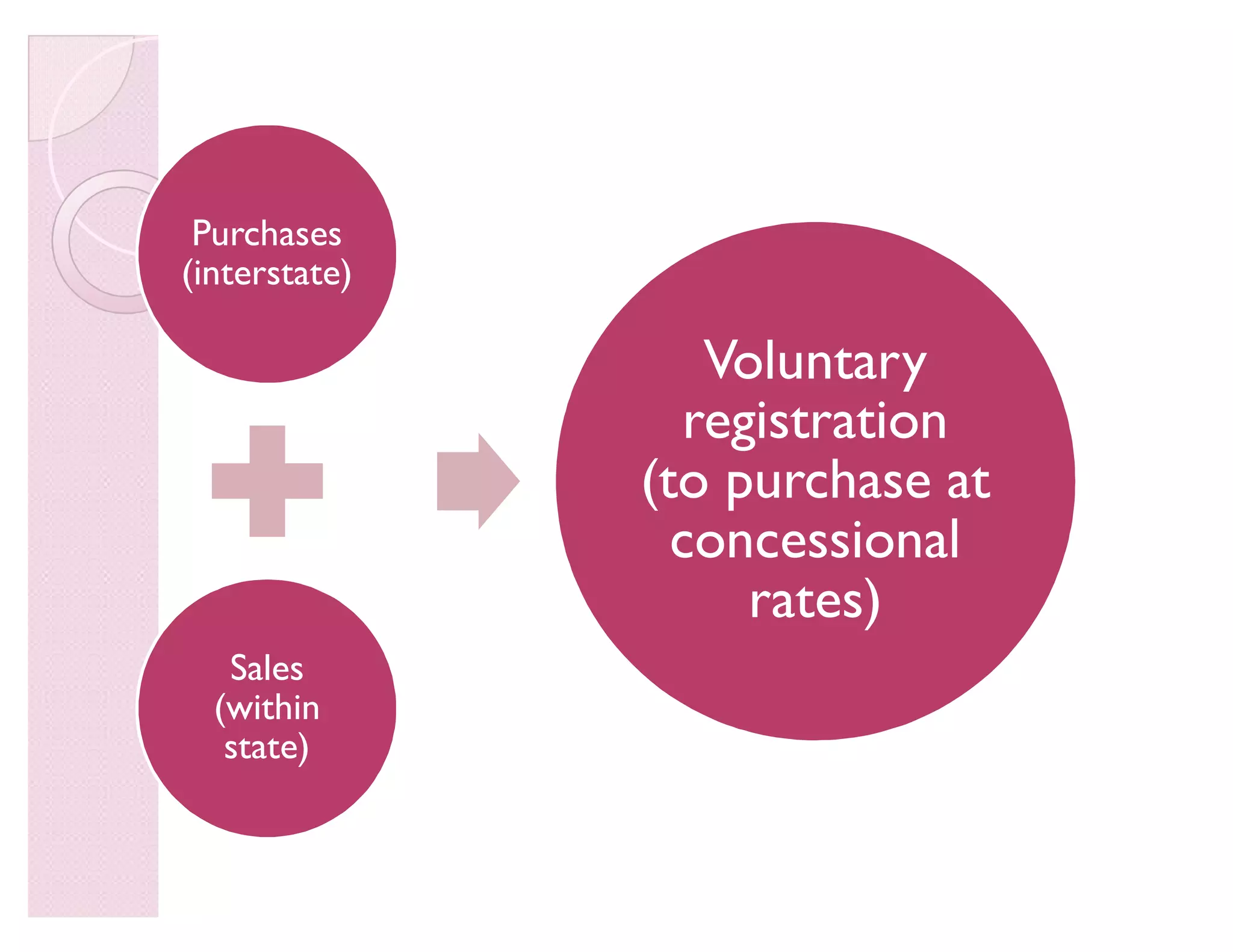

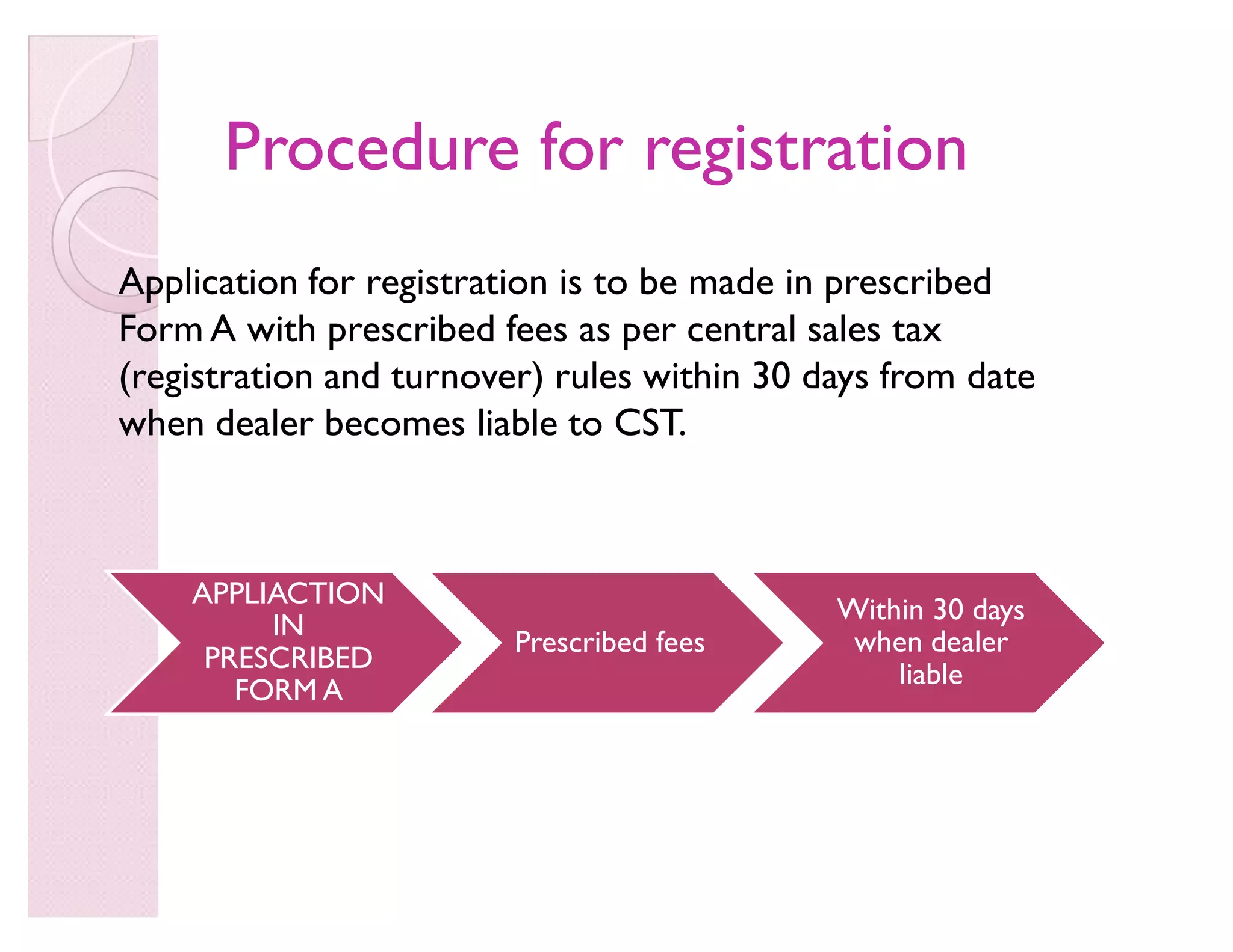

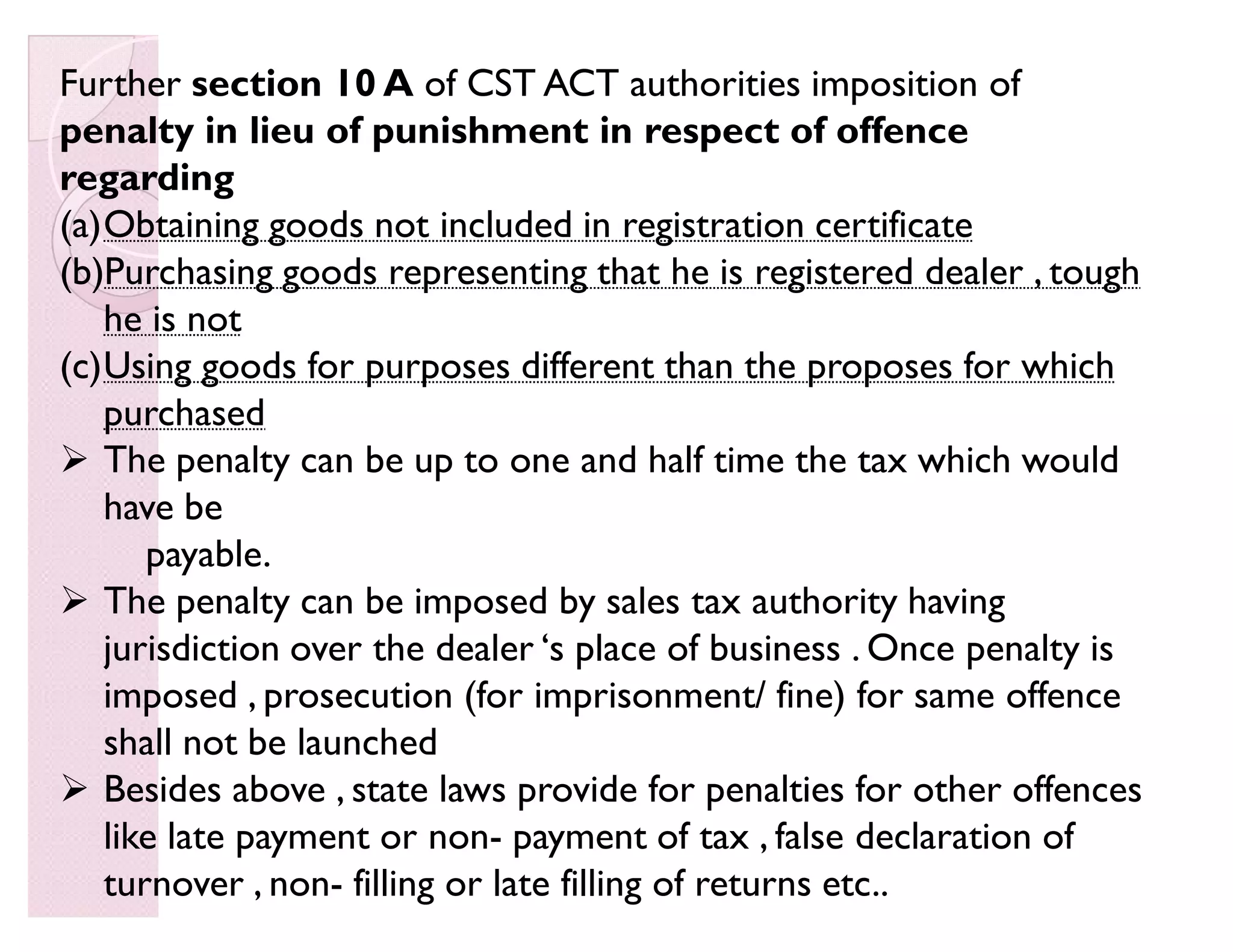

- Registered dealers must file CST returns with the notified authority in their state. The authority assesses tax liability and orders refunds or penalties. Concess