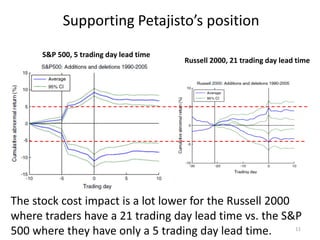

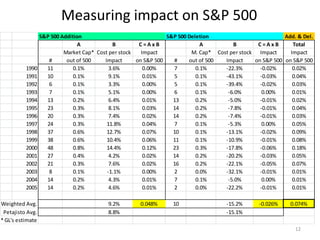

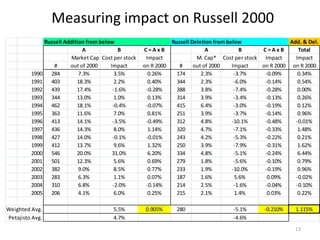

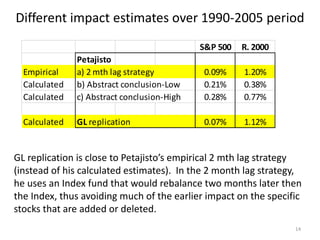

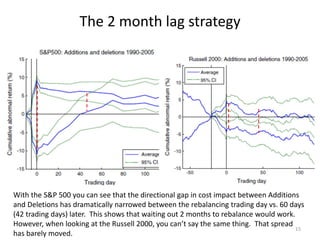

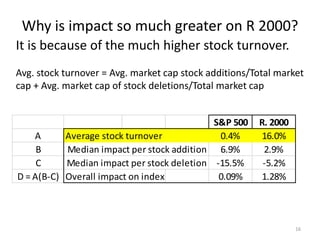

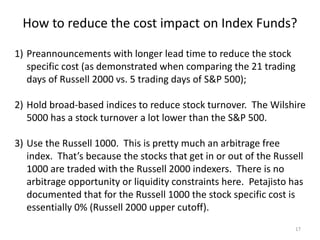

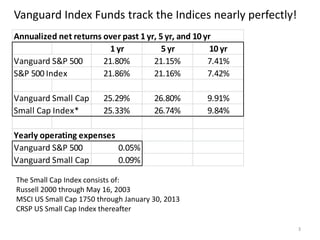

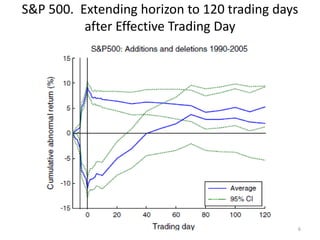

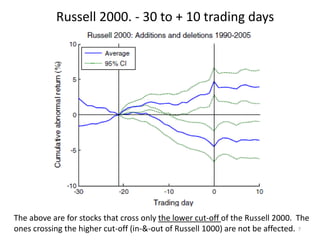

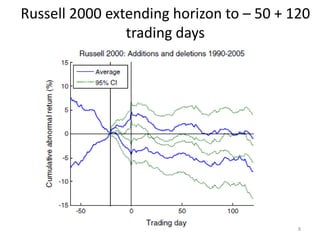

1) Index fund rebalancing can impose hidden costs on investors due to liquidity constraints when funds buy or sell large positions in constituent stocks. This impacts funds tracking indexes with high turnover like the Russell 2000 more than the S&P 500.

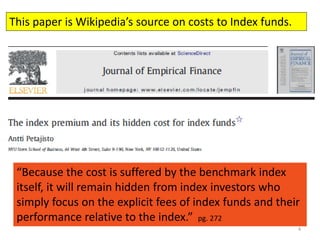

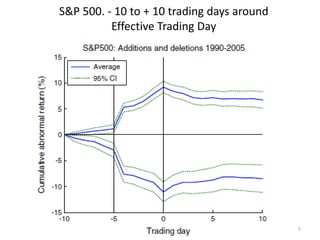

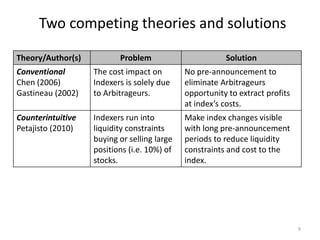

2) Two competing theories explain this - conventional view says arbitrageurs exploit rebalancing for profit, while counterintuitive view says funds face liquidity constraints due to large demand shocks.

3) Evidence shows longer notification periods before Russell 2000 changes reduces stock-specific costs, supporting liquidity constraints view. Cost impact is much higher for Russell 2000 than S&P 500 due to higher turnover.

![Trading ahead of index fund rebalancing

“… estimated [costs] to be at least 21 to 28 bp

annually for S&P 500 index funds, and at least

38 to 77 bp per year for Russell 2000 funds.”

Wikipedia article on High Frequency Trading

2](https://image.slidesharecdn.com/arbitrageurs-140515230139-phpapp01/85/Arbitrageurs-2-320.jpg)

![Petajisto’s Argument

10

“If index funds suddenly and unexpectedly rushed out to buy

10% [representative level] of all the shares of a firm [S&P 500

addition], who would sell those shares to them?” For a $10

billion market cap firm, that would be a $1 billion demand

shock that would have a dramatic price impact.

This is why S&P preannounces the index changes five trading

days before the effective day of the change, as they want to

give active traders enough time to get ready to meet such large

demand. Thus, arbitrageurs provide the liquidity to meet

indexers demand.](https://image.slidesharecdn.com/arbitrageurs-140515230139-phpapp01/85/Arbitrageurs-10-320.jpg)