RMP offers 5.1% yield growing 25% per year

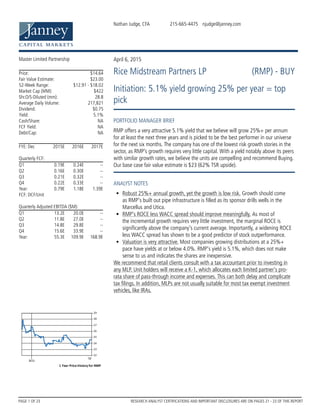

- 1. Nathan Judge, CFA 215-665-4475 njudge@janney.com Master Limited Partnership Price: $14.64 Fair Value Estimate: $23.00 52-Week Range: $12.91 - $18.02 Market Cap (MM): $422 Shr.O/S-Diluted (mm): 28.8 Average Daily Volume: 217,821 Dividend: $0.75 Yield: 5.1% Cash/Share: NA FCF Yield: NA Debt/Cap: NA FYE: Dec 2015E 2016E 2017E Quarterly FCF: Q1 0.19E 0.24E -- Q2 0.16E 0.30E -- Q3 0.21E 0.32E -- Q4 0.22E 0.33E -- Year: 0.79E 1.18E 1.39E FCF: DCF/Unit Quarterly Adjusted EBITDA ($M): Q1 13.2E 20.0E -- Q2 11.8E 27.0E -- Q3 14.8E 29.8E -- Q4 15.6E 33.9E -- Year: 55.3E 109.9E 168.9E April 6, 2015 Rice Midstream Partners LP (RMP) - BUY Initiation: 5.1% yield growing 25% per year = top pick PORTFOLIO MANAGER BRIEF RMP offers a very attractive 5.1% yield that we believe will grow 25%+ per annum for at least the next three years and is picked to be the best performer in our universe for the next six months. The company has one of the lowest risk growth stories in the sector, as RMP’s growth requires very little capital. With a yield notably above its peers with similar growth rates, we believe the units are compelling and recommend Buying. Our base case fair value estimate is $23 (62% TSR upside). ANALYST NOTES q Robust 25%+ annual growth, yet the growth is low risk. Growth should come as RMP's built out pipe infrastructure is filled as its sponsor drills wells in the Marcellus and Utica. q RMP's ROCE less WACC spread should improve meaningfully. As most of the incremental growth requires very little investment, the marginal ROCE is significantly above the company's current average. Importantly, a widening ROCE less WACC spread has shown to be a good predictor of stock outperformance. q Valuation is very attractive. Most companies growing distributions at a 25%+ pace have yields at or below 4.0%. RMP's yield is 5.1%, which does not make sense to us and indicates the shares are inexpensive. We recommend that retail clients consult with a tax accountant prior to investing in any MLP. Unit holders will receive a K-1, which allocates each limited partner's pro- rata share of pass-through income and expenses. This can both delay and complicate tax filings. In addition, MLPs are not usually suitable for most tax exempt investment vehicles, like IRAs. RESEARCH ANALYST CERTIFICATIONS AND IMPORTANT DISCLOSURES ARE ON PAGES 21 - 23 OF THIS REPORTPAGE 1 OF 23

- 2. Key Issue Our Position Timing Impact RESEARCH ANALYST CERTIFICATIONS AND IMPORTANT DISCLOSURES ARE ON PAGES 21 - 23 OF THIS REPORTPAGE 2 OF 23

- 3. Figure 1: 2015e Natural gas gathering volumes by customer Source: Company reports Figure 2: 2014 Revenue by customer Source: Company Reports 84% 16% Rice Energy ThirdParty 85% 15% Rice Energy ThirdParty RESEARCH ANALYST CERTIFICATIONS AND IMPORTANT DISCLOSURES ARE ON PAGES 21 - 23 OF THIS REPORTPAGE 3 OF 23

- 4. Figure 3: 2015e Gathering and compression volumes Source: Company reports Figure 4: 2015e fees per dekatherm of natural gas serviced Source: Company Reports Gathering volumes (MDth/d) Rice Energy 519 Third parties 93 Total Gathering Volumes 612 Compression volumes (MDth/d) Rice Energy 0 Third parties 93 Total Compression Volumes 93 Gathering Fee ($/Dth) Rice Energy 0.29 Third parties 0.43 Compression Fee ($/Dth) Rice Energy N/A Third parties 0.07 RESEARCH ANALYST CERTIFICATIONS AND IMPORTANT DISCLOSURES ARE ON PAGES 21 - 23 OF THIS REPORTPAGE 4 OF 23

- 5. RESEARCH ANALYST CERTIFICATIONS AND IMPORTANT DISCLOSURES ARE ON PAGES 21 - 23 OF THIS REPORTPAGE 5 OF 23

- 6. RESEARCH ANALYST CERTIFICATIONS AND IMPORTANT DISCLOSURES ARE ON PAGES 21 - 23 OF THIS REPORTPAGE 6 OF 23

- 7. Total Quarterly Distribution per Unit Target Amount Unitholders Incentive Distribution Rights Holders Minimum Quarterly Distribtuion $0.1875 100% 0% First Target Distribution above $0.1875 up to $0.2156 100% 0% Second Target Distribution above $0.2156 up to $0.2344 85% 15% Third Target Distribution above $0.2344 up to $0.2813 75% 25% Thereafter above $0.2813 50% 50% RESEARCH ANALYST CERTIFICATIONS AND IMPORTANT DISCLOSURES ARE ON PAGES 21 - 23 OF THIS REPORTPAGE 7 OF 23

- 8. Holder Name % of Outstanding Holder Total Shares 1 Morgan Stanley 16.8% 4,834,000 2 Harvest Fund Advisors 13.2% 3,807,000 3 Goldman Sachs Asset Management 10.8% 3,098,000 4 Oppenheimer Funds 8.3% 2,380,000 5 AT Investment Advisers 7.2% 2,079,000 6 Jennison Associates 3.9% 1,108,000 7 SG Americas Securities 3.1% 900,000 8 Credit Suisse Securities 3.0% 865,000 9 Mason Street Advisors 2.6% 750,000 10 Waddell & Reed 2.4% 704,000 RESEARCH ANALYST CERTIFICATIONS AND IMPORTANT DISCLOSURES ARE ON PAGES 21 - 23 OF THIS REPORTPAGE 8 OF 23

- 9. Timing Catalyst Comments 1H16 Dropdown of Ohio gathering assets Meaningful upside if occurs faster than expected` 2Q15 Distribution growth announced Execution supports +20% organic annual distribution growth YE2015 PLR received from IRS on water assets Increases likelihood of +20% distribution growth -30% -25% -20% -15% -10% -5% 0% 5% 10% 15% Dec14 Feb15 Mar15 RMP Relative to S&P 500 Relative to MLP Index RMP/AM underperformance to AM perplexing? RESEARCH ANALYST CERTIFICATIONS AND IMPORTANT DISCLOSURES ARE ON PAGES 21 - 23 OF THIS REPORTPAGE 9 OF 23

- 10. RESEARCH ANALYST CERTIFICATIONS AND IMPORTANT DISCLOSURES ARE ON PAGES 21 - 23 OF THIS REPORTPAGE 10 OF 23

- 11. RESEARCH ANALYST CERTIFICATIONS AND IMPORTANT DISCLOSURES ARE ON PAGES 21 - 23 OF THIS REPORTPAGE 11 OF 23

- 12. Ohio Gathering EBITDA(2017e) $110.0 Market Multiple avg 9.5 x TEV $1,045 Funding 50% debt $523 50% equity $523 Ohio Gathering EBITDA 110.0 Interest expense 4.0% -20.9 Maintenance capital -7.8 DCF pre IDR 81.3 Increase in units Equity to raise 522.5$ Unit price / 20.00$ Additional units 26.1 2015e DCF for RMP 48.3$ +Ohio Gathering DCF 81.3 Combined DCF 129.6$ Previous units 61.2 Additional units issued 26.1 Total units 87.3 DCF/Unit 1.48 Previous DCF/unit 0.79 Accretion/(Dilution) 88% RESEARCH ANALYST CERTIFICATIONS AND IMPORTANT DISCLOSURES ARE ON PAGES 21 - 23 OF THIS REPORTPAGE 12 OF 23

- 13. $11 $23 $10.00 $15.00 $20.00 $25.00 $30.00 $35.00 12 Month Fair Value Targets: Base, Bear, Bull12 Month Fair Value Targets: Base, Bear, Bull12 Month Fair Value Targets: Base, Bear, Bull12 Month Fair Value Targets: Base, Bear, Bull $33 RESEARCH ANALYST CERTIFICATIONS AND IMPORTANT DISCLOSURES ARE ON PAGES 21 - 23 OF THIS REPORTPAGE 13 OF 23

- 14. R² = 0.7509 0% 2% 4% 6% 8% 10% 12% 0% 5% 10% 15% 20% 25% 30% CurentYield 3 year CAGR Distribution Growth RMP 0.0 x 2.0 x 4.0 x 6.0 x 8.0 x 10.0 x 12.0 x 14.0 x 16.0 x 18.0 x Jan-15 Feb-15 Feb-15 Feb-15 Feb-15 Mar-15 Mar-15 Mar-15 Mar-15 EV/1 yr fwd EBITDA EV/2 yr fwd EBITDA 0 50 100 150 200 250 300 350 400 450 01/2015 02/2015 03/2015 1 yr fwd div spread to 10 year Baa corp yld 2 yr fwd div spread to 10yr Baa corp yld 0 x 2 x 4 x 6 x 8 x 10 x 12 x 14 x 14-Jan-15 14-Feb-15 P/DCF 1yr fwd P/DCF 2yr fwd RESEARCH ANALYST CERTIFICATIONS AND IMPORTANT DISCLOSURES ARE ON PAGES 21 - 23 OF THIS REPORTPAGE 14 OF 23

- 15. 2015 2016 2017 2018 2019 2020 2021 2022 Dividend 0.69 0.86 1.07 1.35 1.38 1.46 1.55 1.64 Risk free rate 5.0% Equity Risk premium 2.5% Beta 0.85 Company-Specific Risk 2.0% Cost of Equity 9.13% CAPM weighting 50% Yield Cost of Equity 4.9% Yield COE weighting 50% Cost of Equity 7.0% Medium term growth rate 6.0% Terminal growth rate 1.0% Terminal multiple 16.8 Terminal discount factor 0.62 Discounted DPS -> 2022 7.68 Terminal value of DPS ($/share) 17.18 Value per share ($) 24.86$ RESEARCH ANALYST CERTIFICATIONS AND IMPORTANT DISCLOSURES ARE ON PAGES 21 - 23 OF THIS REPORTPAGE 15 OF 23

- 16. Stock Market EV/EBITDA Distribution Coverage P/DCF Net Debt/EBITDA Company Name/Sector Ticker Rating Price Cap 2015e 2016e 2017e 13- '14 14-'15 15-'16 16-'17 2015e 2015e 2015e 2016e 2017e 2015e Rice Midstream Partners LP RMP Buy 14.73 842 18.8x 11.4x 8.7x N/A 201% 25% 25% 5.1% 1.13 18.5x 12.4x 10.6x 2.7 Nat Gas G&P American Midstream Partners, LP AMID 16.89 380 9.6x 7.3x 5.8x 6% 1% 2% 4% 11.2% 1.14 7.8x 7.3x 6.8x 4.0 Antero Midstream Partners LP AM 24.57 5,589 34.4x 18.3x 12.5x N/A 482% 30% 29% 3.2% 1.16 26.8x 15.6x 12.1x -1.5 Crestw ood Midstream Partners LP CMLP 14.84 2,748 9.6x 8.8x 7.7x -3% 0% 2% 3% 11.1% 1.02 8.9x 7.9x 7.9x 4.1 DCPMidstream Partners, LP DPM 37.55 4,213 9.4x 8.6x 7.5x 7% 5% 3% 3% 8.5% 1.17 10.1x 9.5x 9.7x 3.1 EnLink Midstream Partners, L.P. ENLK 25.11 6,307 13.1x 9.6x 7.9x 8% 7% 8% 8% 6.3% 1.06 15.0x 12.1x 11.2x 2.8 EQT Midstream Partners LP EQM 79.81 6,848 14.1x 10.1x 7.8x 29% 22% 19% 14% 3.3% 1.86 16.3x 13.9x 12.4x 1.2 MarkWest Energy Partners, L.P. MWE 65.50 13,195 18.2x 14.8x 12.6x 5% 4% 7% 8% 5.6% 0.99 17.8x 15.7x 14.0x 3.6 Marlin Midstream Partners LP FISH Buy 22.41 602 13.2x 10.9x 9.5x 83% 17% 14% 14% 7.6% 1.26 10.5x 9.8x 8.3x 0.2 QEPMidstream Partners LP QEPM 15.62 826 12.6x 14.5x 14.3x 38% 9% 8% 1% 8.0% 1.12 11.2x 11.4x 11.5x -0.2 Regency Energy Partners LP RGP 23.23 9,689 12.2x 10.7x 9.9x 6% 2% 2% 3% 8.7% 0.96 11.9x 10.6x 10.0x 4.7 Summit Midstream Partners LP SMLP 32.85 1,917 11.6x 8.5x 6.7x 17% 10% 10% 8% 7.1% 0.93 15.2x 13.7x 11.3x 3.4 Targa Resources Partners LP NGLS 41.00 7,256 8.9x 7.5x 6.7x 9% 9% 6% 3% 8.4% 1.12 10.6x 9.1x 8.8x 2.5 Western Gas Partners, LP WES 66.54 9,154 15.4x 12.0x 9.7x 16% 15% 13% 12% 4.6% 1.23 17.8x 15.2x 12.7x 3.1 YieldDistribution Growth RESEARCH ANALYST CERTIFICATIONS AND IMPORTANT DISCLOSURES ARE ON PAGES 21 - 23 OF THIS REPORTPAGE 16 OF 23

- 17. 0.00 0.20 0.40 0.60 0.80 1.00 1.20 $0 $20 $40 $60 $80 $100 $120 $140 $160 $180 2015E 2016E 2017E DCF (lhs) EBITDA (lhs) Dividends/unit (rhs) 2015E 2016E 2017E Debt analysis/coverage Net Debt/EBITDA 2.7 2.7 2.1 EBITDA/Interest Coverage 17.8 7.2 7.5 Net debt to total capital 30.4% 38.9% 32.1% Maintenance Cap Ex as % of depreciation 82% 93% 112% Return Analysis ROIC 10.1% 13.3% 14.4% WACC 8.5% 8.1% 8.4% ROIC - WACC spread 0.1% 3.3% 4.4% RESEARCH ANALYST CERTIFICATIONS AND IMPORTANT DISCLOSURES ARE ON PAGES 21 - 23 OF THIS REPORTPAGE 17 OF 23

- 18. 2014 1Q15E 2Q15E 3Q15E 4Q15E 2015E 1Q16E YoY growth 2Q16E YoY growth 3Q16E YoY growth 4Q16E YoY growth 2016E YoY growth 2017E YoY growth Rice Midstream Income Statement ($mn unless otherwise stated) Operating revenues Third parties 4.59 3.76 2.19 4.67 4.48 15.10 7.50 99.2% 8.50 288.1% 9.6 105.5% 5.49 22.5% 31.06 105.7% 51.18 64.8% Affiliate 1.86 12.25 12.19 13.29 14.49 52.21 21.58 76.2% 23.08 89.3% 26.4 98.9% 29.52 103.8% 99.81 91.2% 142.16 42.4% Total revenue 6.45 16.01 14.38 17.95 18.97 67.31 29.08 81.6% 31.58 119.6% 36.0 100.6% 35.02 84.6% 130.87 94.4% 193.34 47.7% Direct operating expense 3.96 0.64 0.58 0.72 0.76 2.69 4.94 1.58 2.88 -0.24 9.16 9.67 Gross Margin 2.49 15.37 13.81 17.23 18.21 64.62 24.13 57.0% 30.00 117.3% 33.13 92.2% 35.26 93.6% 121.71 88% 183.67 Gross Margin % 38.6% 96% 96% 96% 96% 96.0% 83% 95% 92% 101% 93.0% 95.0% Indirect operating expenses General and administrative expense 9.86 2.21 1.99 2.48 2.62 9.30 4.10 3.00 3.31 1.38 11.80 14.80 % of GM 396% 14% 14% 14% 17% 14% 17% 10% 10% 4% 10% 8% Incentive unit expense 11.97 Stock compensation expense 0.74 Acquisition costs 1.52 Amoritization of intangible assets 1.16 Other 0.00 Depreciation and amortization 2.86 1.00 1.20 1.50 1.80 5.50 2.00 2.50 2.50 2.71 9.71 11.74 Total operating expense 32.06 3.85 3.76 4.70 5.18 17.49 11.05 7.08 8.69 3.85 30.67 36.21 Operating income -25.61 12.16 10.62 13.25 13.79 49.82 18.03 48.3% 24.50 130.7% 27.32 106.1% 31.17 126.0% 100.20 101.1% 157.13 56.8% Interest expense 11.61 0.70 0.75 0.75 0.90 3.10 1.89 1.90 0.50 6.60 10.89 22.63 Other expense 0.11 Income tax paid/benefit 10.71 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 Income from continuing operations -26.625 11.46 9.87 12.50 12.89 46.72 16.14 40.8% 22.60 129.0% 26.82 114.5% 24.57 90.6% 89.31 91.2% 134.50 50.6% Loss from discontinued operations -3.78 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 Net Loss -30.40 11.46 9.87 12.50 12.89 46.72 16.14 22.60 26.82 24.57 89.31 134.50 Interest expense 11.61 0.7 0.8 0.8 0.9 3.1 1.9 1.9 0.5 6.6 10.9 22.6 Income tax benefit -10.71 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Depreciation expense 2.86 1.0 1.2 1.5 1.8 5.5 2.0 2.5 2.5 2.7 9.7 11.7 Acquisition costs 1.52 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Amortization of intangible assets 1.16 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Non-cash stock compensation expense 0.74 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Incentive unit expsnes 11.97 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Loss from discontinued operations, net of tax 3.78 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Adjusted EBITDA -7.48 13.2 11.8 14.8 15.6 55.3 20.0 52.2% 27.0 128.4% 29.8 102.1% 33.9 117.3% 109.9 98.7% 168.9 53.6% Cash interest expense 0 0.63 0.63 0.63 0.63 2.50 1.7 1.7 0.3 6.4 10.09 21.83 Maintenance cap ex 0.123 1.13 1.13 1.13 1.13 4.50 1.6 2.3 2.5 2.6 9.00 13.20 Distributable cash flow 1.36 11.41 10.07 13.00 13.84 48.32 16.7 46.7% 23.0 128.4% 27.0 107.8% 24.9 79.7% 90.82 87.9% 133.8 47.4% DCF/LP unit 0.19 0.16 0.21 0.22 0.79 0.24 0.30 0.32 0.33 1.18 1.39 Common/subordinated unit distribution 10.60 10.60 10.60 10.60 42.40 12.91 14.88 15.83 16.22 59.84 80.69 Number of units 61.20 61.20 61.20 61.20 61.20 65.07 65.07 65.07 65.07 65.07 74.00 Distribution per common unit 0.188 0.188 0.188 0.188 0.750 0.1984 5.8% 0.231 23.2% 0.25 33.3% 0.2580 37.6% 0.9374 25.0% 1.17 25.0% Total distributions 11.48 10.60 10.60 10.60 43.28 12.91 15.03 16.27 16.79 61.00 86.73 Total Distribution per unit 0.1875 0.1875 0.1875 0.1875 0.75 0.1984 0.2310 0.2500 0.2580 0.9374 25.0% 1.1720 25.0% YoY growth 5.8% 16.5% 8.2% 3.2% Coverage ratio 0.99 0.95 1.23 1.31 1.12 1.30 1.53 1.66 1.48 1.49 1.54 RESEARCH ANALYST CERTIFICATIONS AND IMPORTANT DISCLOSURES ARE ON PAGES 21 - 23 OF THIS REPORTPAGE 18 OF 23

- 19. Rice Midstream Balance Sheet ($mn unless otherwise stated)1Q15E 2Q15E 3Q15E 4Q15E 2015E 2016E 2017E Assets Current assets Cash 18 10 4 1 1 21 140 Accounts receivable 0 0 0 0 0 0 0 Pre-paid expenses and other 0 0 0 0 0 0 0 Total current assets 18 10 5 1 1 21 140 PP&E 270 315 360 404 404 489 561 Intangible assets 48 48 48 48 48 48 48 Deferred finance cost 3 3 3 3 3 2 1 Goodwill 38 38 38 38 38 38 38 Total assets 378 415 454 495 495 599 789 Liabilities and partners' capital Current liabilities Accounts payable 0 0 0 0 0 0 0 Accrued capital expenditures 0 0 0 0 0 0 0 Due to related party 0 0 0 0 0 0 0 Other accrued liabilities 1 1 1 1 1 1 1 Total current liabilities 2 2 2 2 2 2 2 Long term debt 38 75 113 152 152 326 530 Total liabilities 39 77 114 153 153 327 531 Partner capital 339 339 340 342 342 450 703 Total liabilities and partners' capital 378 415 454 495 495 777 1235 Cash Flow Summary Beginning cash balance 25 18 10 4 25 1 21 +distributable cash flow 11 10 13 14 48 91 134 - Distributions 11 11 11 11 42 58 76 - Growth Cap ex 45 45 45 45 181 85 70 - Acquisitions 0 0 0 0 0 178 268 Excess Cash/(Shortfall) -19 -28 -33 -38 -150 -229 -260 Equity funding 0 0 0 0 0 89 134 Debt funding 38 38 38 39 152 174 204 Ending cash balance 18 10 4 1 2 34 78 Gross Debt 38 75 113 152 152 326 530 Net Debt 19 65 108 150 150 305 390 RESEARCH ANALYST CERTIFICATIONS AND IMPORTANT DISCLOSURES ARE ON PAGES 21 - 23 OF THIS REPORTPAGE 19 OF 23

- 20. RESEARCH ANALYST CERTIFICATIONS AND IMPORTANT DISCLOSURES ARE ON PAGES 21 - 23 OF THIS REPORTPAGE 20 OF 23

- 21. IMPORTANT DISCLOSURES Research Analyst Certification I, Nathan Judge, the Primarily Responsible Analyst for this research report, hereby certify that all of the views expressed in this research report accurately reflect my personal views about any and all of the subject securities or issuers. No part of my compensation was, is, or will be, directly or indirectly, related to the specific recommendations or views I expressed in this research report. Janney Montgomery Scott LLC ("Janney") Equity Research Disclosure Legend Rice Midstream Partners LP currently is, or during the past 12 months was, a Janney Montgomery Scott LLC client. Janney Montgomery Scott LLC, provided investment banking related services. Janney Montgomery Scott LLC managed or co-managed a public offering of securities for Rice Midstream Partners LP in the past 12 months. Janney Montgomery Scott LLC received compensation for investment banking services from Rice Midstream Partners LP in the past 12 months. Janney Montgomery Scott LLC intends to seek or expects to receive compensation for investment banking services from Rice Midstream Partners LP in the next three months. The research analyst is compensated based on, in part, Janney Montgomery Scott's profitability, which includes its investment banking revenues. Definition of Ratings BUY: Janney expects that the subject company will appreciate in value. Additionally, we expect that the subject company will outperform comparable companies within its sector. NEUTRAL: Janney believes that the subject company is fairly valued and will perform in line with comparable companies within its sector. Investors may add to current positions on short-term weakness and sell on strength as the valuations or fundamentals become more or less attractive. SELL: Janney expects that the subject company will likely decline in value and will underperform comparable companies within its sector. Price Charts Janney Montgomery Scott Ratings Distribution as of 12/31/14 IB Serv./Past 12 Mos. Rating Count Percent Count Percent BUY [B] 140 50.36 21 15.00 NEUTRAL [N] 137 49.28 14 10.22 SELL [S] 1 0.36 0 0.00 RESEARCH ANALYST CERTIFICATIONS AND IMPORTANT DISCLOSURES ARE ON PAGES 21 - 23 OF THIS REPORTPAGE 21 OF 23

- 22. *Percentages of each rating category where Janney has performed Investment Banking services over the past 12 months. Other Disclosures Janney Montgomery Scott LLC, is a U.S. broker-dealer registered with the U.S. Securities and Exchange Commission and a member of the New York Stock Exchange, the Financial Industry Regulatory Authority and the Securities Investor Protection Corp. This report is for your information only and is not an offer to sell or a solicitation of an offer to buy the securities or instruments named or described in this report. Interested parties are advised to contact the entity with which they deal or the entity that provided this report to them, should they desire further information. The information in this report has been obtained or derived from sources believed by Janney Montgomery Scott LLC, to be reliable. Janney Montgomery Scott LLC, however, does not represent that this information is accurate or complete. Any opinions or estimates contained in this report represent the judgment of Janney Montgomery Scott LLC at this time and are subject to change without notice. Investment opinions are based on each stock's 6-12 month return potential. Our ratings are not based on formal price targets, however, our analysts will discuss fair value and/or target price ranges in research reports. Decisions to buy or sell a stock should be based on the investor's investment objectives and risk tolerance and should not rely solely on the rating. Investors should read carefully the entire research report, which provides a more complete discussion of the analyst's views. Supporting information related to the recommendation, if any, made in the research report is available upon request. RESEARCH ANALYST CERTIFICATIONS AND IMPORTANT DISCLOSURES ARE ON PAGES 21 - 23 OF THIS REPORTPAGE 22 OF 23

- 23. Janney Montgomery ScottRESEARCH DEPARTMENT Andrew Maddaloni, Director of Research (215) 665-6234 TECHNOLOGY and MEDIA Internet Commerce & Services Shawn C. Milne – Managing Director (415) 981-9539 Mike Carroll - Associate (617) 367-3278 Entertainment & Digital Media Tony Wible, CFA – Managing Director (908) 470-3160 Murali Sankar, CFA – Vice President (212) 888-2525 Digital Advertising Murali Sankar, CFA – Vice President (212) 888-2525 IT Outsourcing / Professional Services Joseph D. Foresi – Managing Director (617) 557-2972 Robert Simmons, CFA – Associate (646) 840-3219 CONSUMER and RETAIL Food, Agribusiness & Foodservice Eric J. Larson, CFA – Managing Director (952) 886-7215 Kristen Owen, CFA – Associate (215) 665-6213 Gaming/Lodging, Travel & Leisure Brian McGill – Managing Director (215) 665-6485 Tyler Batory – Associate (215) 665-4448 Restaurants Mark Kalinowski – Managing Director (212) 940-6997 Ryan Kidd – Associate (215) 665-6385 Branded Apparel, Footwear, and Retail Eric Tracy – Managing Director (202) 955-4340 Michael Karapetian – Vice President (202) 955-4341 Hardline Retailers David Strasser – Managing Director (646) 840-4609 Sarang Vora – Sr. Associate (646) 840-4605 Softline Retail – Specialty Apparel Adrienne Yih – Managing Director (202) 499-4493 Gabriella Carbone – Sr. Associate (212) 888-2359 ACCOUNTING & TAX POLICY Forensic Accounting Michael Gyure – Director (440) 364-7473 FINANCIALS BDCs Mitchel Penn, CFA – Managing Director (410) 583-5976 Consumer & Specialty Finance/Mid-Cap Banks Sameer Gokhale, CPA – Managing Director (646) 840-3215 Owen Lau, CFA – Sr. Associate (646) 840-3213 Insurance Robert Glasspiegel, CFA – Managing Director (860) 856-5730 Larry Greenberg, CFA – Managing Director (860) 856-5731 Ryan Byrnes – Vice President (860) 856-5732 Lutjon Celkupa - Associate (860) 856-5734 INFRASTRUCTURE MLPs & Energy Infrastructure Nathan Judge, CFA – Managing Director (215) 665-4475 Michael Gyure – Director (440) 364-7473 Utilities & Water Infrastructure Michael Gaugler – Managing Director (215) 665-1359 Katherine Burke - Associate (646) 840-3207 HEALTHCARE Biotechnology David Lebowitz, MPH, CFA – Managing Director(212) 940-6985 Life Sciences Technology Paul Knight – Managing Director (212) 888-2696 Bryan Kipp - Associate (212) 888-2387 Specialty Pharmaceuticals Chiara Russo – Vice President (617) 557-2984 TECHNICAL ANALYSIS Technical Strategy Dan Wantrobski, CMT – Managing Director (215) 665-4446 SUPERVISORY ANALYSTS Richard Jacobs - Director (215) 665-6290 Irene H. Buhalo – Vice President (215) 665-6510 Holly Guthrie – Vice President (215) 665-1268