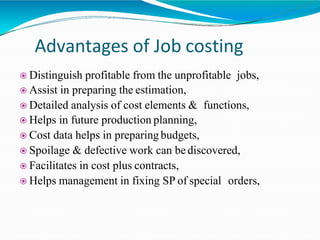

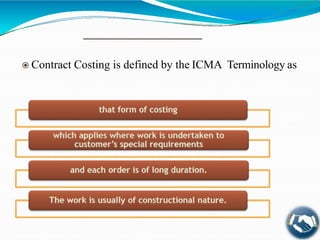

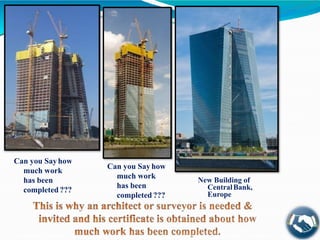

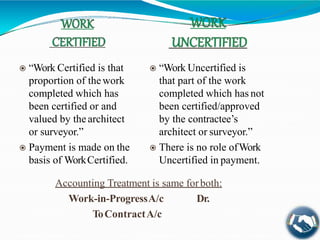

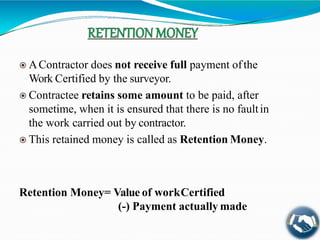

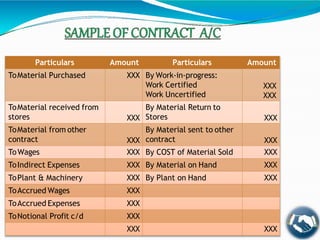

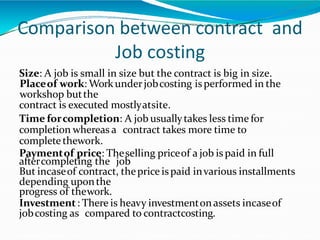

Job costing and contract costing are techniques used to determine costs. Job costing is used in job order industries to determine the costs of specific jobs or production lots separately. Contract costing is a variant of job costing applied to construction works, where each contract is treated as a separate cost unit. Key objectives of job and contract costing include determining profit/loss on each job/contract and identifying more versus less profitable jobs. Jobs have different requirements while contracts typically involve works over long durations and at sites away from the contractor's premises.