Q2 2020 | The Woodlands Office | Research Snapshot

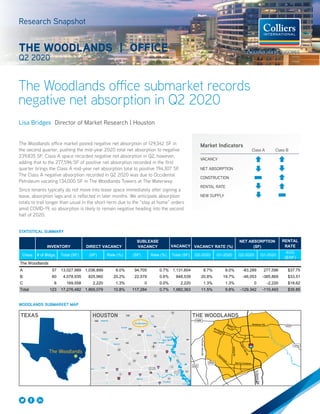

- 1. Market Indicators Class A Class B VACANCY NET ABSORPTION CONSTRUCTION RENTAL RATE NEW SUPPLY The Woodlands Trinity Bay Galveston Bay 225 Bellaire The Woodlands Pasadena IAH EFD HOU Cypress Katy Brookshire Lake Houston La Porte 146 League City Kingwood Spring Pearland 35 35 Richmond Waller Hockley 242 1488 1488 Conroe Magnolia Willis Lake Conroe Crosby CBD Ship Channel Clear Lake Baytown Mont Belvieu Dayton 149 149 Cleveland 105 105 105 321 330 Alvin Humble Atascocita Sugar Land Tomball 2920 2920 2920 The Woodlands office submarket records negative net absorption in Q2 2020 Research Snapshot THE WOODLANDS | OFFICE Q2 2020 STATISTICAL SUMMARY 1488 2920 249 1314 242 Huffsmith-Kohrville WoodlandsParkway ResearchForest Needham Rd. Grogan’sMillRd. Spring Stuebner GoslingRd. Kuykendahl ToHoustonCBD WOODLANDS SUBMARKET MAP VACANCY RENTAL RATE Class # of Bldgs. Total (SF) (SF) Rate (%) (SF) Rate (%) Total (SF) Q2-2020 Q1-2020 Q2-2020 Q1-2020 AVG ($/SF) The Woodlands A 57 13,027,989 1,036,899 8.0% 94,705 0.7% 1,131,604 8.7% 8.0% -83,289 277,596 $37.75 B 60 4,078,935 825,960 20.2% 22,579 0.6% 848,539 20.8% 19.7% -46,053 -385,869 $33.51 C 6 169,558 2,220 1.3% 0 0.0% 2,220 1.3% 1.3% 0 -2,220 $18.62 Total 123 17,276,482 1,865,079 10.8% 117,284 0.7% 1,982,363 11.5% 9.8% -129,342 -110,493 $35.85 INVENTORY DIRECT VACANCY SUBLEASE VACANCY VACANCY RATE (%) NET ABSORPTION (SF) The Woodlands office market posted negative net absorption of 129,342 SF in the second quarter, pushing the mid-year 2020 total net absorption to negative 239,835 SF. Class A space recorded negative net absorption in Q2, however, adding that to the 277,596 SF of positive net absorption recorded in the first quarter brings the Class A mid-year net absorption total to positive 194,307 SF. The Class A negative absorption recorded in Q2 2020 was due to Occidental Petroleum vacating 134,000 SF in The Woodlands Towers at The Waterway. Since tenants typically do not move into lease space immediately after signing a lease, absorption lags and is reflected in later months. We anticipate absorption totals to trail longer than usual in the short-term due to the “stay at home” orders amid COVID-19, so absorption is likely to remain negative heading into the second half of 2020. Lisa Bridges Director of Market Research | Houston HOUSTONTEXAS THE WOODLANDS

- 2. 2 The Woodlands Research Snapshot | Q2 2020 | Office | Colliers International2 The average quoted rental rates are a mix of direct and sublet rates and are based on a blend of gross and NNN. The graphs below are only intended to show rental rate trends. Actual gross rates are higher than the average rate shown in the graph. 0.0 5.0 10.0 15.0 20.0 25.0 $18.00 $20.00 $22.00 $24.00 $26.00 $28.00 $30.00 $32.00 $34.00 Class B Rental Rate and Vacancy Percentage The Woodlands, TX Class B Rents Class B Vacancy *Vacancy percentage includes direct and sublease space. 0 50,000 100,000 150,000 200,000 250,000 300,000 350,000 400,000 Available Sublease Space The Woodlands Class A Class B Available Sublease Space Q2 2020 Class A: 206,368 SF or 1.6% Class B: 38,199 SF or 0.8% 0.0 2.0 4.0 6.0 8.0 10.0 12.0 14.0 $24.00 $26.00 $28.00 $30.00 $32.00 $34.00 $36.00 $38.00 $40.00 Class A Rental Rate and Vacancy Percentage The Woodlands, TX Class A Rents Class A Vacancy *Vacancy percentage includes direct and sublease space.

- 3. 3 North American Research & Forecast Report | Q4 2014 | Office Market Outlook | Colliers International Copyright © 2015 Colliers International. The information contained herein has been obtained from sources deemed reliable. While every reasonable effort has been made to ensure its accuracy, we cannot guarantee it. No responsibility is assumed for any inaccuracies. Readers are encouraged to consult their professional advisors prior to acting on any of the material contained in this report. Colliers International | Market 000 Address, Suite # 000 Address, Suite # +1 000 000 0000 colliers.com/<<market>> FOR MORE INFORMATION Lisa Bridges Director of Market Research | Houston +1 713 830 2125 lisa.bridges@colliers.com 3 North American Research & Forecast Report | Q4 2014 | Office Market Outlook | Colliers International Copyright © 2015 Colliers International. The information contained herein has been obtained from sources deemed reliable. While every reasonable effort has been made to ensure its accuracy, we cannot guarantee it. No responsibility is assumed for any inaccuracies. Readers are encouraged to consult their professional advisors prior to acting on any of the material contained in this report. Colliers International | Market 000 Address, Suite # 000 Address, Suite # +1 000 000 0000 colliers.com/<<market>> 3 North American Research & Forecast Report | Q4 2014 | Office Market Outlook | Colliers International Copyright © 2020 Colliers International. The information contained herein has been obtained from sources deemed reliable. While every reasonable effort has been made to ensure its accuracy, we cannot guarantee it. No responsibility is assumed for any inaccuracies. Readers are encouraged to consult their professional advisors prior to acting on any of the material contained in this report. Colliers International | The Woodlands 1790 Hughes Landing Blvd., Suite 250 The Woodlands, TX 77380 +1 713 830 4011 colliers.com/thewoodlands Absorption and New Supply WOODLANDS CLASS A OFFICE WOODLANDS CLASS B OFFICE -400,000 -200,000 0 200,000 400,000 600,000 800,000 1,000,000 1,200,000 1,400,000 1,600,000 1,800,000 2,000,000 2,200,000 2,400,000 2,600,000 Net Absorption New Supply -500,000 -400,000 -300,000 -200,000 -100,000 0 100,000 200,000 Net Absorption New Supply

- 4. Our philosophy revolves around the fact that the best possible results come from linking our global enterprise with local advisors who understand your business, your market, and how to integrate real estate into a successful business strategy. C O L L I E R S I N T E R N A T I O N A L G L O B A L L O C A T I O N S COMMERCIAL REAL ESTATE SECTORS REPRESENTED OFFICE INDUSTRIAL LAND RETAIL HEALTHCARE MULTIFAMILY HOTEL $129BTRANSACTION VALUE 2BSF UNDER MANAGEMENT $3.5BIN REVENUE 443OFFICES 18,700PROFESSIONALS 430ACCREDITED MEMBERS 68COUNTRIES SIOR ADVANTAGE Colliers International (NASDAQ, TSX: CIGI) is a leading real estate professional services and investment management company. With operations in 68 countries, our more than 15,000 enterprising professionals work collaboratively to provide expert advice to maximize the value of property for real estate occupiers, owners and investors. For more than 25 years, our experienced leadership, owning approximately 40% of our equity, has delivered compound annual investment returns of almost 20% for shareholders. In 2019, corporate revenues were more than $3.0 billion ($3.5 billion including affiliates), with $33 billion of assets under management in our investment management segment. Learn more about how we accelerate success at corporate.colliers.com, Twitter @Colliers or LinkedIn. Colliers professionals think differently, share great ideas and offer thoughtful and innovative advice to accelerate the success of its clients. Colliers has been ranked among the top 100 global outsourcing firms by the International Association of Outsourcing Professionals for 13 consecutive years, more than any other real estate services firm. Colliers is ranked the number one property manager in the world by Commercial Property Executive for two years in a row. PROPERTY POSITIONING & MARKETING REAL ESTATEINVESTMENT VALUATION& ADVISORY CORPORATE SOLUTIONS MANAGEMENT REALESTATE REPRESENTATION LANDLORD REPRESENTATION TENANT LOCA TION INTELLIGENCE MA RKET RESEARCH& CAPITAL MARKETS PROJECT MANAGEMENT COLLIERS SPECIALIZATIONS and REAL ESTATE SERVICE REPRESENTATION DATACENTERS HE ALTHCARE HOTELS & HOSPITALITY SERVICES IND USTRIAL LAND HOUSING&MULTIFAMILY SER VICES MARINA, LEISURE & GOLF COURSE OFFICE RETAIL SPECIALPURPOSE