Tampa Bay 2018 Q1 Office Outlook

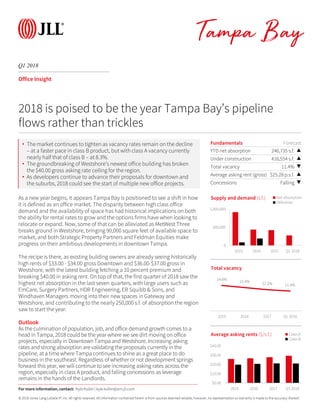

- 1. © 2018 Jones Lang LaSalle IP, Inc. All rights reserved. All information contained herein is from sources deemed reliable; however, no representation or warranty is made to the accuracy thereof. Q1 2018 Tampa Bay Office Insight As a new year begins, it appears Tampa Bay is positioned to see a shift in how it is defined as an office market. The disparity between high class office demand and the availability of space has had historical implications on both the ability for rental rates to grow and the options firms have when looking to relocate or expand. Now, some of that can be alleviated as MetWest Three breaks ground in Westshore, bringing 90,000 square feet of available space to market, and both Strategic Property Partners and Feldman Equities make progress on their ambitious developments in downtown Tampa. The recipe is there, as existing building owners are already seeing historically high rents of $33.00 - $34.00 gross Downtown and $36.00-$37.00 gross in Westshore, with the latest building fetching a 10 percent premium and breaking $40.00 in asking rent. On top of that, the first quarter of 2018 saw the highest net absorption in the last seven quarters, with large users such as EmCare, Surgery Partners, HDR Engineering, ER Squibb & Sons, and Windhaven Managers moving into their new spaces in Gateway and Westshore, and contributing to the nearly 250,000 s.f. of absorption the region saw to start the year. Outlook As the culmination of population, job, and office demand growth comes to a head in Tampa, 2018 could be the year where we see dirt moving on office projects, especially in Downtown Tampa and Westshore. Increasing asking rates and strong absorption are validating the proposals currently in the pipeline, at a time where Tampa continues to shine as a great place to do business in the southeast. Regardless of whether or not development springs forward this year, we will continue to see increasing asking rates across the region, especially in class A product, and falling concessions as leverage remains in the hands of the Landlords. Fundamentals Forecast YTD net absorption 246,735 s.f. ▲ Under construction 416,554 s.f. ▲ Total vacancy 11.4% ▼ Average asking rent (gross) $25.28 p.s.f. ▲ Concessions Falling ▼ 0 500,000 1,000,000 2015 2016 2017 Q1 2018 Supply and demand (s.f.) Net absorption Deliveries 2018 is poised to be the year Tampa Bay’s pipeline flows rather than trickles 14.6% 13.4% 12.2% 11.4% 2015 2016 2017 Q1 2018 Total vacancy $0.00 $10.00 $20.00 $30.00 $40.00 2015 2016 2017 Q1 2018 Average asking rents ($/s.f.) Class A Class B For more information, contact: Kyle Koller | kyle.koller@am.jll.com • The market continues to tighten as vacancy rates remain on the decline – at a faster pace in class B product, but with class A vacancy currently nearly half that of class B – at 8.3%. • The groundbreaking of Westshore’s newest office building has broken the $40.00 gross asking rate ceiling for the region. • As developers continue to advance their proposals for downtown and the suburbs, 2018 could see the start of multiple new office projects.

- 2. © 2018 Jones Lang LaSalle IP, Inc. All rights reserved. All information contained herein is from sources deemed reliable; however, no representation or warranty is made to the accuracy thereof. Q1 2018 Tampa Bay Office Statistics For more information, contact: Kyle Koller | kyle.koller@am.jll.com Class Inventory (s.f.) YTD total net absorption (s.f.) YTD total net absorption (% of stock) Direct vacancy (%) Total vacancy (%) Average asking rent ($ p.s.f.) YTD Completions (s.f.) Under Development (s.f.) Gateway/Bayside Totals 3,653,043 187,199 5.1% 12.1% 12.3% $22.30 0 0 I-75/I-4 Corridor Totals 6,332,171 -65,659 -1.0% 12.6% 12.7% $20.50 0 0 Northwest Totals 2,663,377 9,273 0.3% 9.6% 9.7% $20.94 0 148,800 Pinellas Outlying Totals 2,234,021 -28,856 -1.3% 26.9% 26.9% $18.44 0 0 St. Pete CBD Totals 2,168,064 3,483 0.2% 7.6% 7.7% $27.68 0 0 Tampa CBD Totals 6,024,782 56,002 0.9% 10.2% 10.5% $28.19 0 0 Westshore Totals 11,818,161 115,392 1.0% 8.2% 9.0% $30.37 0 267,754 Tampa Bay Totals 34,893,619 276,834 0.8% 11.0% 11.4% $25.28 0 416,554 Gateway/Bayside A 2,469,633 70,972 2.9% 5.5% 5.8% $23.87 0 0 I-75/I-4 Corridor A 3,280,175 -64,600 -2.0% 9.2% 9.3% $25.69 0 0 Northwest A 1,012,125 -2,243 -0.2% 2.1% 2.1% $26.85 0 148,800 Pinellas Outlying A 1,037,202 -7,010 -0.7% 20.3% 20.3% $21.06 0 0 St. Pete CBD A 1,633,077 -380 0.0% 6.8% 7.0% $28.82 0 0 Tampa CBD A 4,572,871 52,189 1.1% 10.7% 10.9% $29.50 0 0 Westshore A 7,409,363 75,169 1.0% 6.1% 6.7% $34.16 0 267,754 Tampa Bay A 21,414,446 124,097 0.6% 8.0% 8.3% $29.34 0 416,554 Gateway/Bayside B 1,183,410 116,227 9.8% 25.8% 25.8% $20.05 0 0 I-75/I-4 Corridor B 3,051,996 -1,059 0.0% 16.4% 16.4% $18.44 0 0 Northwest B 1,651,252 11,516 0.7% 14.2% 14.4% $20.34 0 0 Pinellas Outlying B 1,196,819 -21,846 -1.8% 32.7% 32.7% $16.96 0 0 St. Pete CBD B 534,987 3,863 0.7% 9.8% 9.8% $22.85 0 0 Tampa CBD B 1,451,911 3,813 0.3% 8.9% 9.1% $22.80 0 0 Westshore B 4,408,798 40,223 0.9% 11.7% 13.0% $25.54 0 0 Tampa Bay B 13,479,173 152,737 1.1% 15.8% 16.3% $20.99 0 0