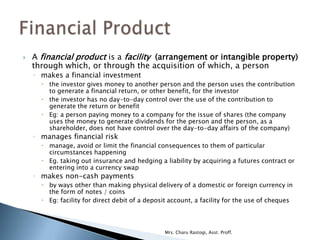

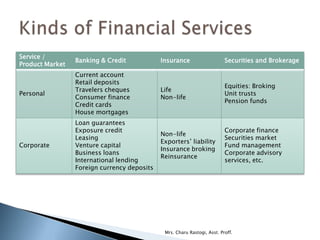

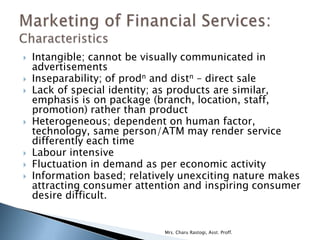

The document lists major financial services marketing companies in India and discusses the evolution and functions of money. It then covers key topics related to financial services including intermediation, risk management, types of financial products and services, and characteristics of the financial services industry such as intangibility and lack of product identity. The document discusses trends impacting financial services like changing customer behavior, deregulation, and technological innovation. It concludes by mentioning the Department of Financial Services in India and financial inclusion initiatives.