Market knowledge placemat may 7 13

•

1 like•922 views

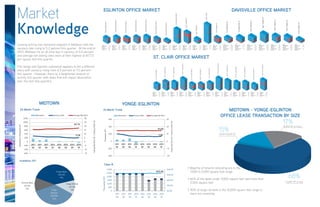

A market summary of the Yonge and Bloor commercial real estate market in Toronto.

Report

Share

Report

Share

Download to read offline

Recommended

Recommended

More Related Content

What's hot

What's hot (6)

Ernestina Birova - Condos - Re/max Ultimate - January 2016

Ernestina Birova - Condos - Re/max Ultimate - January 2016

Similar to Market knowledge placemat may 7 13

Similar to Market knowledge placemat may 7 13 (20)

Cushman & Wakefield Toronto Americas Marketbeat Office Q1 2019

Cushman & Wakefield Toronto Americas Marketbeat Office Q1 2019

JLL Louisville Office Insight & Statistics - Q4 2016

JLL Louisville Office Insight & Statistics - Q4 2016

Q1 2019 | Houston Office | Research & Forecast Report

Q1 2019 | Houston Office | Research & Forecast Report

JLL Pittsburgh Office Insight & Statistics - Q1 2020

JLL Pittsburgh Office Insight & Statistics - Q1 2020

More from Chris Fyvie

More from Chris Fyvie (20)

Downtown toronto office survey package august 25 2016

Downtown toronto office survey package august 25 2016

WTF Properties - Toronto Office Space July availability report

WTF Properties - Toronto Office Space July availability report

Plug in to peak productivity - Colliers Spark Report

Plug in to peak productivity - Colliers Spark Report

#Toronto Businesses now demanding their offices be close to accessible, rapid...

#Toronto Businesses now demanding their offices be close to accessible, rapid...

Recently uploaded

Recently uploaded (20)

9990771857 Call Girls in Dwarka Sector 2 Delhi (Call Girls) Delhi

9990771857 Call Girls in Dwarka Sector 2 Delhi (Call Girls) Delhi

BDSM⚡Call Girls in Sector 57 Noida Escorts >༒8448380779 Escort Service

BDSM⚡Call Girls in Sector 57 Noida Escorts >༒8448380779 Escort Service

Sector 62, Noida Call girls :8448380779 Noida Escorts | 100% verified

Sector 62, Noida Call girls :8448380779 Noida Escorts | 100% verified

9990771857 Call Girls Dwarka Sector 9 Delhi (Call Girls ) Delhi

9990771857 Call Girls Dwarka Sector 9 Delhi (Call Girls ) Delhi

Call Girls In Krishna Nagar Delhi (Escort)↫8447779280↬@SHOT 1500- NIGHT 5500→...

Call Girls In Krishna Nagar Delhi (Escort)↫8447779280↬@SHOT 1500- NIGHT 5500→...

Greater Vancouver Realtors Statistics Package April 2024

Greater Vancouver Realtors Statistics Package April 2024

9990771857 Call Girls in Dwarka Sector 08 Delhi (Call Girls) Delhi

9990771857 Call Girls in Dwarka Sector 08 Delhi (Call Girls) Delhi

Cheap Rate ✨➥9711108085▻✨Call Girls In Amar Colony (Delhi)

Cheap Rate ✨➥9711108085▻✨Call Girls In Amar Colony (Delhi)

Shapoorji Pallonji Joyville Vista Pune | Spend Your Family Time Together

Shapoorji Pallonji Joyville Vista Pune | Spend Your Family Time Together

9990771857 Call Girls in Dwarka Sector 3 Delhi (Call Girls) Delhi

9990771857 Call Girls in Dwarka Sector 3 Delhi (Call Girls) Delhi

9990771857 Call Girls in Dwarka Sector 7 Delhi (Call Girls) Delhi

9990771857 Call Girls in Dwarka Sector 7 Delhi (Call Girls) Delhi

Bptp The Amaario Launch Luxury Project Sector 37D Gurgaon Dwarka Expressway...

Bptp The Amaario Launch Luxury Project Sector 37D Gurgaon Dwarka Expressway...

Market knowledge placemat may 7 13

- 1. Market Knowledge 17% 10,000 SF or more 15% 5,000-10,000 SF 68% 5,000 SF or less MIDTOWN - YONGE-EGLINTON OFFICE LEASE TRANSACTION BY SIZE > Majority of tenants relocating are in the 1,000 to 5,000 square foot range > 66% of the deals under 5,000 square feet were less than 2,500 square feet > 90% of larger tenants in the 10,000 square feet range or more are renewing Leasing activity has remained stagnant in Midtown with the vacancy rate rising to 5.2 percent this quarter. At the end of 2012, Midtown hit an all-time low in vacancy of 5.0 percent and average net asking rates were at their highest at $17.73 per square foot this quarter. The Yonge and Eglinton submarket appears to tell a different story with vacancy rising from 6.5 percent to 7.0 percent this quarter. However, there as a heightened amount of activity this quarter with deals that will impact absorption over the next few quarters. First Quarter 2013 Market Snapshot Q4 2012 Q1 2013 Trend Office Inventory 17,795,438 17,795,438 Net Absorption 25,976 (48,786) MAP Vacancy Rate 5.0% 5.2% Availability Rate 6.4% 6.2% Average Asking Net Rent $17.07 $17.70 Average Additional Rent $18.18 $18.36 Average Asking Gross Rent $35.25 $36.06 24 Month Trend Inventory Availability by Market Inventory (SF) No new development updates at this time. Availability (SF) Market Profile New Developments Update TTC access via subway, LRT and bus routes. Office Market Dashboard | Midtown $17.70 5.2% -15 -10 -5 0 5 10 15 20 25 30 -600 -400 -200 0 200 400 600 800 1,000 1,200 2011 Q2 2011 Q3 2011 Q4 2012 Q1 2012 Q2 2012 Q3 2012 Q4 2013 Q1 AskingNetRent($)/VacancyRate(%) Absorption(ThousandsSF) Absorption Vacancy Rate Average Net Rent Yonge-Bloor 8,827,086 50% Yonge-St.Clair 2,467,401 14% Yonge- Eglinton 5,077,134 28% Toronto West 1,423,817 8% Yonge-Bloor 452,766 41% Yonge-St.Clair 127,376 11%Yonge- Toronto West 121,134 11% CLASS A BUILDING AREA 132,000 AVAILABLE 5,990 NET ASK $15.00 ADDITIONAL RENT $18.70 GROSS ASK $33.70 CLASS B BUILDING AREA 82,443 AVAILABLE 51,012 NET ASK $18.00 ADDITIONAL RENT $20.11 GROSS ASK $38.11 CLASS A BUILDING AREA 110,357 AVAILABLE 13,802 NET ASK $15.00 ADDITIONAL RENT $18.79 GROSS ASK $33.79 CLASS B BUILDING AREA 196,650 AVAILABLE 46,259 NET ASK $16.00 ADDITIONAL RENT $19.90 GROSS ASK $35.90 CLASS B BUILDING AREA 112,284 AVAILABLE 12,690 NET ASK $13.50 ADDITIONAL RENT $17.15 GROSS ASK $30.65 CLASS B BUILDING AREA 53,000 AVAILABLE 12,782 NET ASK $13.00 ADDITIONAL RENT $16.00 GROSS ASK $29.00 CLASS C BUILDING AREA 111,133 AVAILABLE 39,162 NET ASK $15.50 ADDITIONAL RENT $16.65 GROSS ASK $32.15 CLASS A BUILDING AREA 322,806 AVAILABLE 6,130 NET ASK $20.00 ADDITIONAL RENT $23.09 GROSS ASK $43.09 CLASS A BUILDING AREA 223,382 AVAILABLE 55,007 NET ASK $16.00 ADDITIONAL RENT $20.99 GROSS ASK $36.99 CLASS C BUILDING AREA 60,275 AVAILABLE 4,050 NET ASK $11.50 ADDITIONAL RENT $15.97 GROSS ASK $27.47 CLASS A BUILDING AREA 521,190 AVAILABLE 10,256 NET ASK - ADDITIONAL RENT $23.09 GROSS ASK - 75EGLINTONAVEE 8 7 6 5 4 3 2 1 1EGLINTONAVEE 8 7 6 5 4 3 2 1 40EGLINTONAVEE 9 8 7 6 5 4 3 2 1 90EGLINTONAVEE 9 8 7 6 5 4 3 2 1 150EGLINTONAVEE 10 9 8 7 6 5 4 3 2 1 160EGLINTONAVEE 7 6 5 4 3 2 1 245EGLINTONAVEE 4 3 2 1 20EGLINTONAVEW 22 21 20 19 18 17 16 15 14 13 12 11 10 9 8 7 6 5 4 3 2 1 2200YONGEST 17 16 15 14 13 12 11 10 9 8 7 6 5 4 3 2 1 2221YONGEST 6 5 4 3 2 1 2300YONGEST 30 29 28 27 26 25 24 23 22 21 20 19 18 17 16 15 14 13 12 11 10 9 8 7 6 5 4 3 2 1 CLASS B BUILDING AREA 69,824 AVAILABLE 33,619 NET ASK $17.50 ADDITIONAL RENT $17.62 GROSS ASK $35.12 2323YONGEST 8 7 6 5 4 3 2 1 Eglinton Office Market Trend MAP Inventory Availability by Market Inventory (SF) Availability (SF) ge/St. Clair ban growth 5 0 AskingNetRent($)/VacancyRate(%) nt Yonge-Bloor 8,827,086 50% Yonge-St.Clair 2,467,401 14% Yonge- Eglinton 5,077,134 28% Toronto West 1,423,817 8% Yonge-Bloor 452,766 41% Yonge-St.Clair 127,376 11%Yonge- Eglinton 406,984 37% Toronto West 121,134 11% First Quarter 2013 Submarket Snapshot Q4 2012 Q1 2013 Trend Office Inventory 5,077,134 5,077,134 Net Absorption 5,378 (23,054) MAP Vacancy Rate 6.5% 7.0% Availability Rate 9.2% 8.0% Average Asking Net Rent $14.61 $14.88 Average Additional Rent $17.67 $18.11 Average Asking Gross Rent $32.28 $32.99 Available Supply Split Gross Rent 24 Month Trend Class AAA/A Class B New Developments Update No new development updates at this time. Class C Office Submarket Dashboard | $37.20 $0.00 $10.00 $20.00 $30.00 $40.00 0 500 1,000 1,500 2,000 2011 Q2 2011 Q3 2011 Q4 2012 Q1 2012 Q2 2012 Q3 2012 Q4 2013 Q1 Thousands(SF) Not Available Space Direct Available Sublease Available Gross Rent $33.45 $0.00 $10.00 $20.00 $30.00 $40.00 0 500 1,000 1,500 2,000 2,500 3,000 2011 Q2 2011 Q3 2011 Q4 2012 Q1 2012 Q2 2012 Q3 2012 Q4 2013 Q1 Thousands(SF) $27.73 $10.00 $20.00 $30.00 $40.00 500 1,000 1,500 Thousands(SF) Midtown: Yonge-Eglinton $14.88 7.0% -20 -10 0 10 20 30 -400 -200 0 200 400 600 2011 Q2 2011 Q3 2011 Q4 2012 Q1 2012 Q2 2012 Q3 2012 Q4 2013 Q1 AskingNetRent($)/VacancyRate(%) Thousands(SF) Absorption Vacancy Rate Average Net Rent First Quarter 2013 Submarket Snapshot Q4 2012 Q1 2013 Trend Office Inventory 5,077,134 5,077,134 Net Absorption 5,378 (23,054) MAP Vacancy Rate 6.5% 7.0% Availability Rate 9.2% 8.0% Average Asking Net Rent $14.61 $14.88 Average Additional Rent $17.67 $18.11 Average Asking Gross Rent $32.28 $32.99 Available Supply Split Gross Rent 24 Month Trend Class AAA/A Class B New Developments Update No new development updates at this time. Office Submarket Dashboard | $37.20 $0.00 $10.00 $20.00 $30.00 $40.00 0 500 1,000 1,500 2,000 2011 Q2 2011 Q3 2011 Q4 2012 Q1 2012 Q2 2012 Q3 2012 Q4 2013 Q1 Thousands(SF) Not Available Space Direct Available Sublease Available Gross Rent $33.45 $0.00 $10.00 $20.00 $30.00 $40.00 0 500 1,000 1,500 2,000 2,500 3,000 2011 Q2 2011 Q3 2011 Q4 2012 Q1 2012 Q2 2012 Q3 2012 Q4 2013 Q1 Thousands(SF) Midtown: Yonge-Eglinton $14.88 7.0% -20 -10 0 10 20 30 -400 -200 0 200 400 600 2011 Q2 2011 Q3 2011 Q4 2012 Q1 2012 Q2 2012 Q3 2012 Q4 2013 Q1 AskingNetRent($)/VacancyRate(%) Thousands(SF) Absorption Vacancy Rate Average Net Rent MIDTOWN YONGE-EGLINTON CLASS C BUILDING AREA 58,800 AVAILABLE 6,808 NET ASK $14.00 ADDITIONAL RENT $12.98 GROSS ASK $26.98 124MERTONST 5 4 3 2 1 CLASS C BUILDING AREA 59,570 AVAILABLE 8,631 NET ASK - ADDITIONAL RENT $15.52 GROSS ASK - 130MERTONST 6 5 4 3 2 1 CLASS B BUILDING AREA 66,600 AVAILABLE 3,560 NET ASK $16.00 ADDITIONAL RENT $19.90 GROSS ASK $35.90 CLASS B BUILDING AREA 105,899 AVAILABLE 5,623 NET ASK $16.00 ADDITIONAL RENT $19.29 GROSS ASK $35.29 CLASS A BUILDING AREA 101,693 AVAILABLE 4,784 NET ASK $16.00 ADDITIONAL RENT $19.96 GROSS ASK $35.96 CLASS A BUILDING AREA 128,355 AVAILABLE 26,600 NET ASK $16.00 ADDITIONAL RENT $20.45 GROSS ASK $36.45 CLASS C BUILDING AREA 31,500 AVAILABLE 4,795 NET ASK - ADDITIONAL RENT $15.00 GROSS ASK - 1835YONGEST 7 6 5 4 3 2 1 1867YONGEST 11 10 9 8 7 6 5 4 3 2 1 1881YONGEST 8 7 6 5 4 3 2 1 1920YONGEST 6 5 4 3 2 1 G 2040YONGEST 3 2 1 Davisville Office Market 2STCLAIRAVEE 15 14 13 12 11 10 9 8 7 6 5 4 3 2 1 21STCLAIRAVEE 14 12 11 10 9 8 7 6 5 4 3 2 1 40STCLAIRAVEW 14 12 11 10 9 8 7 6 5 4 3 2 1 45STCLAIRAVEW 14 12 11 10 9 8 7 6 5 4 3 2 1 1STCLAIRAVEW 12 11 10 9 8 7 6 5 4 3 2 1 CLASS A BUILDING AREA 242,242 AVAILABLE 3,756 NET ASK $19.00 ADDITIONAL RENT $21.22 GROSS ASK $40.22 CLASS A BUILDING AREA 145,425 AVAILABLE 17,256 NET ASK $18.00 ADDITIONAL RENT $23.16 GROSS ASK $41.16 CLASS B BUILDING AREA 84,464 AVAILABLE 12,412 NET ASK $15.50 ADDITIONAL RENT $17.12 GROSS ASK $32.62 CLASS B BUILDING AREA 83,660 AVAILABLE 2,718 NET ASK $13.00 ADDITIONAL RENT $21.47 GROSS ASK $34.47 CLASS B BUILDING AREA 122,519 AVAILABLE 2,245 NET ASK $14.50 ADDITIONAL RENT $20.14 GROSS ASK $34.64 CLASS B BUILDING AREA 107,443 AVAILABLE 5,017 NET ASK $14.50 ADDITIONAL RENT $17.10 GROSS ASK $31.60 CLASS B BUILDING AREA 113,264 AVAILABLE 9,225 NET ASK $21.00 ADDITIONAL RENT $21.18 GROSS ASK $42.18 CLASS A BUILDING AREA 273,740 AVAILABLE 20,820 NET ASK $26.00 ADDITIONAL RENT $24.00 GROSS ASK $50.00 CLASS B BUILDING AREA 246,295 AVAILABLE 3,888 NET ASK $18.00 ADDITIONAL RENT $21.33 GROSS ASK $39.33 CLASS B BUILDING AREA 79,318 AVAILABLE 6,589 NET ASK $13.00 ADDITIONAL RENT $14.40 GROSS ASK $27.40 CLASS B BUILDING AREA 251,065 AVAILABLE 32,288 NET ASK $18.00 ADDITIONAL RENT $20.49 GROSS ASK $38.49 CLASS B BUILDING AREA 63,370 AVAILABLE 14,412 NET ASK $13.67 ADDITIONAL RENT $17.23 GROSS ASK $30.90 CLASS A BUILDING AREA 171,744 AVAILABLE 1,335 NET ASK $19.00 ADDITIONAL RENT $22.34 GROSS ASK $41.34 30STCLAIRAVEW 17 16 15 14 13 12 11 10 9 8 7 6 5 4 3 2 1 2STCLAIRAVEW 21 20 19 18 17 16 15 14 13 12 11 10 9 8 7 6 5 4 3 2 1 1STCLAIRAVEE 10 9 8 7 6 5 4 3 2 1 22STCLAIRAVEE 20 19 18 17 16 15 14 12 11 10 9 8 7 6 5 4 3 2 1 95STCLAIRAVEW 18 17 16 15 14 12 11 10 9 8 7 6 5 4 3 2 1 60STCLAIRAVEE 10 9 8 7 6 5 4 3 2 1 65STCLAIRAVEE 10 9 8 7 6 5 4 3 2 1 55STCLAIRAVEW 9 8 7 6 5 4 3 2 1 St. Clair Office Market EGLINTON OFFICE MARKET DAVISVILLE OFFICE MARKET ST. CLAIR OFFICE MARKET