JLL Detroit Office Insight & Statistics - Q1 2018

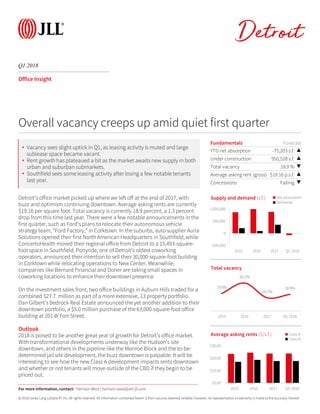

- 1. © 2018 Jones Lang LaSalle IP, Inc. All rights reserved. All information contained herein is from sources deemed reliable; however, no representation or warranty is made to the accuracy thereof. Q1 2018 Detroit Office Insight Detroit’s office market picked up where we left off at the end of 2017, with buzz and optimism continuing downtown. Average asking rents are currently $19.16 per square foot. Total vacancy is currently 18.9 percent, a 1.3 percent drop from this time last year. There were a few notable announcements in the first quarter, such as Ford’s plans to relocate their autonomous vehicle strategy team, “Ford Factory,” in Corktown. In the suburbs, auto supplier Auria Solutions opened their first North American Headquarters in Southfield, while ConcertoHealth moved their regional office from Detroit to a 15,493-square- foot space in Southfield. Ponyride, one of Detroit’s oldest coworking operators, announced their intention to sell their 30,000-square-foot building in Corktown while relocating operations to New Center. Meanwhile, companies like Bernard Financial and Doner are taking small spaces in coworking locations to enhance their downtown presence. On the investment sales front, two office buildings in Auburn Hills traded for a combined $27.7 million as part of a more extensive, 13 property portfolio. Dan Gilbert’s Bedrock Real Estate announced the yet another addition to their downtown portfolio, a $5.0 million purchase of the 63,000-square-foot office building at 201 W Fort Street. Outlook 2018 is poised to be another great year of growth for Detroit’s office market. With transformational developments underway like the Hudson’s site downtown, and others in the pipeline like the Monroe Block and the to-be- determined jail site development, the buzz downtown is palpable. It will be interesting to see how the new Class A development impacts rents downtown and whether or not tenants will move outside of the CBD if they begin to be priced out. Fundamentals Forecast YTD net absorption -75,203 s.f. ▲ Under construction 950,528 s.f. ▲ Total vacancy 18.9 % ▼ Average asking rent (gross) $19.16 p.s.f. ▲ Concessions Falling ▼ -500,000 0 500,000 1,000,000 2015 2016 2017 Q1 2018 Supply and demand (s.f.) Net absorption Deliveries Overall vacancy creeps up amid quiet first quarter 19.0% 20.2% 18.5% 18.9% 2015 2016 2017 Q1 2018 Total vacancy $0.00 $10.00 $20.00 $30.00 2015 2016 2017 Q1 2018 Average asking rents ($/s.f.) Class A Class B For more information, contact: Harrison West | harrison.west@am.jll.com • Vacancy sees slight uptick in Q1, as leasing activity is muted and large sublease space became vacant. • Rent growth has plateaued a bit as the market awaits new supply in both urban and suburban submarkets. • Southfield sees some leasing activity after losing a few notable tenants last year.

- 2. © 2018 Jones Lang LaSalle IP, Inc. All rights reserved. All information contained herein is from sources deemed reliable; however, no representation or warranty is made to the accuracy thereof. Q1 2018 Office Statistics Detroit For more information, contact: Harrison West | harrison.west@am.jll.com Class Inventory (s.f.) Total net absorption (s.f.) YTD total net absorption (s.f.) YTD total net absorption (% of stock) Direct vacancy (%) Total vacancy (%) Average direct asking rent ($ p.s.f.) YTD Completions (s.f.) Under Development (s.f.) Birmingham/Bloomfield Totals 3,979,668 -39,042 -39,042 -1.0% 18.4% 18.7% $26.90 0 0 Dearborn Totals 2,705,625 36,794 36,794 1.4% 26.3% 26.5% $16.54 0 150,000 Downriver Totals 483,907 12,697 12,697 2.6% 37.9% 38.6% $14.83 0 0 Farmington/Farmington Hills Totals 4,658,516 -11,033 -11,033 -0.2% 17.5% 17.5% $18.84 0 0 Macomb Totals 1,286,875 4,196 4,196 0.3% 18.9% 18.9% $16.56 0 0 North Oakland Totals 2,207,648 -15,702 -15,702 -0.7% 21.5% 22.0% $18.94 0 53,240 Northern I-275 Corridor Totals 4,467,691 -22,600 -22,600 -0.5% 10.8% 12.4% $19.04 0 0 Royal Oak / SE Oakland Totals 706,710 471 471 0.1% 6.2% 6.3% $17.38 0 131,288 Southern I-275 Corridor Totals 1,077,525 -110,080 -110,080 -10.2% 0.2% 11.3% $15.00 0 0 Southfield Totals 13,235,696 -24,502 -24,502 -0.2% 26.3% 27.5% $17.60 0 0 Troy Totals 11,003,062 81,036 81,036 0.7% 20.6% 21.3% $18.39 0 0 Washtenaw Totals 6,613,772 -5,854 -5,854 -0.1% 8.8% 9.8% $22.60 0 90,000 Suburbs Totals 52,426,695 -93,619 -93,619 -0.2% 19.1% 20.1% $18.80 0 424,528 CBD Totals 13,317,209 -4,563 -4,563 0.0% 13.7% 14.4% $21.92 0 526,000 New Center Totals 1,776,919 22,979 22,979 1.3% 17.6% 17.6% $18.68 0 0 Urban Totals 15,094,128 18,416 18,416 0.1% 14.2% 14.8% $21.50 0 526,000 Detroit Totals 67,520,823 -75,203 -75,203 -0.1% 18.0% 18.9% $19.16 0 950,528 Birmingham/Bloomfield A 1,569,497 -21,124 -21,124 -1.3% 26.7% 27.1% $29.02 0 0 Dearborn A 446,890 -1,150 -1,150 -0.3% 1.0% 1.0% $27.50 0 150,000 Farmington/Farmington Hills A 618,109 -1,888 -1,888 -0.3% 14.3% 14.3% $24.07 0 0 Macomb A 295,494 9 9 0.0% 0.7% 0.7% $19.79 0 0 North Oakland A 488,665 -1,705 -1,705 -0.3% 22.6% 22.6% $21.22 0 53,240 Northern I-275 Corridor A 1,113,719 5,949 5,949 0.5% 6.1% 6.9% $18.98 0 0 Royal Oak / SE Oakland A 0 0 0 0.0% 0.0% 0.0% $0.00 0 131,288 Southern I-275 Corridor A 832,753 -109,432 -109,432 -13.1% 0.0% 14.4% $0.00 0 0 Southfield A 2,970,217 15,983 15,983 0.5% 22.8% 23.6% $22.78 0 0 Troy A 1,924,131 62,072 62,072 3.2% 15.0% 17.0% $21.83 0 0 Washtenaw A 3,218,983 23,381 23,381 0.7% 9.5% 10.9% $25.35 0 90,000 Suburbs A 13,478,458 -27,905 -27,905 -0.2% 14.6% 16.4% $23.95 0 424,528 CBD A 6,194,714 -36,105 -36,105 -0.6% 9.5% 10.7% $23.69 0 526,000 Urban A 6,194,714 -36,105 -36,105 -0.6% 9.5% 10.7% $23.69 0 526,000 Detroit A 19,673,172 -64,010 -64,010 -0.3% 13.0% 14.6% $23.90 0 950,528 Birmingham/Bloomfield B 2,410,171 -17,918 -17,918 -0.7% 13.0% 13.2% $23.56 0 0 Dearborn B 2,258,735 37,944 37,944 1.7% 31.4% 31.6% $16.46 0 0 Downriver B 483,907 12,697 12,697 2.6% 37.9% 38.6% $14.83 0 0 Farmington/Farmington Hills B 4,040,407 -9,145 -9,145 -0.2% 18.0% 18.0% $18.11 0 0 Macomb B 991,381 4,187 4,187 0.4% 24.4% 24.4% $16.44 0 0 North Oakland B 1,718,983 -13,997 -13,997 -0.8% 21.2% 21.8% $18.39 0 0 Northern I-275 Corridor B 3,353,972 -28,549 -28,549 -0.9% 12.3% 14.2% $19.05 0 0 Royal Oak / SE Oakland B 706,710 471 471 0.1% 6.2% 6.3% $17.38 0 0 Southern I-275 Corridor B 244,772 -648 -648 -0.3% 0.8% 0.8% $15.00 0 0 Southfield B 10,265,479 -40,485 -40,485 -0.4% 27.3% 28.6% $16.42 0 0 Troy B 9,078,931 18,964 18,964 0.2% 21.7% 22.2% $17.49 0 0 Washtenaw B 3,394,789 -29,235 -29,235 -0.9% 8.2% 8.7% $20.10 0 0 Suburbs B 38,948,237 -65,714 -65,714 -0.2% 20.7% 21.4% $17.41 0 0 CBD B 7,122,495 31,542 31,542 0.4% 17.4% 17.6% $20.82 0 0 New Center B 1,776,919 22,979 22,979 1.3% 17.6% 17.6% $18.68 0 0 Urban B 8,899,414 54,521 54,521 0.6% 17.4% 17.6% $20.40 0 0 Detroit B 47,847,651 -11,193 -11,193 0.0% 20.1% 20.7% $17.75 0 0