JLL Detroit Office Insight & Statistics - Q4 2018

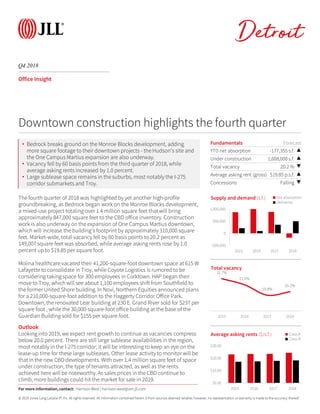

- 1. © 2019 Jones Lang LaSalle IP, Inc. All rights reserved. All information contained herein is from sources deemed reliable; however, no representation or warranty is made to the accuracy thereof. Q4 2018 Detroit Office Insight The fourth quarter of 2018 was highlighted by yet another high-profile groundbreaking, as Bedrock began work on the Monroe Blocks development, a mixed-use project totaling over 1.4 million square feet that will bring approximately 847,000 square feet to the CBD office inventory. Construction work is also underway on the expansion of One Campus Martius downtown, which will increase the building’s footprint by approximately 310,000 square feet. Market-wide, total vacancy fell by 60 basis points to 20.2 percent as 149,007 square feet was absorbed, while average asking rents rose by 1.0 percent up to $19.85 per square foot. Molina healthcare vacated their 41,200-square-foot downtown space at 615 W Lafayette to consolidate in Troy, while Coyote Logistics is rumored to be considering taking space for 300 employees in Corktown. HAP began their move to Troy, which will see about 1,100 employees shift from Southfield to the former United Shore building. In Novi, Northern Equities announced plans for a 210,000-square-foot addition to the Haggerty Corridor Office Park. Downtown, the renovated Lear building at 230 E. Grand River sold for $237 per square foot , while the 30,000-square-foot office building at the base of the Guardian Building sold for $155 per square foot. Outlook Looking into 2019, we expect rent growth to continue as vacancies compress below 20.0 percent. There are still large sublease availabilities in the region, most notably in the I-275 corridor; it will be interesting to keep an eye on the lease-up time for these large subleases. Other lease activity to monitor will be that in the new CBD developments. With over 1.4 million square feet of space under construction, the type of tenants attracted, as well as the rents achieved here will be noteworthy. As sales prices in the CBD continue to climb, more buildings could hit the market for sale in 2019. Fundamentals Forecast YTD net absorption -177,355 s.f. ▲ Under construction 1,608,000 s.f. ▲ Total vacancy 20.2 % ▼ Average asking rent (gross) $19.85 p.s.f. ▲ Concessions Falling ▼ -500,000 0 500,000 1,000,000 2015 2016 2017 2018 Supply and demand (s.f.) Net absorption Deliveries Downtown construction highlights the fourth quarter 21.7% 21.0% 19.8% 20.2% 2015 2016 2017 2018 Total vacancy $0.00 $10.00 $20.00 $30.00 2015 2016 2017 2018 Average asking rents ($/s.f.) Class A Class B For more information, contact: Harrison West | harrison.west@am.jll.com • Bedrock breaks ground on the Monroe Blocks development, adding more square footage to their downtown projects - the Hudson’s site and the One Campus Martius expansion are also underway. • Vacancy fell by 60 basis points from the third quarter of 2018, while average asking rents increased by 1.0 percent. • Large sublease space remains in the suburbs, most notably the I-275 corridor submarkets and Troy.

- 2. © 2019 Jones Lang LaSalle IP, Inc. All rights reserved. All information contained herein is from sources deemed reliable; however, no representation or warranty is made to the accuracy thereof. Q4 2018 Office Statistics Detroit For more information, contact: Harrison West | harrison.west@am.jll.com Class Inventory (s.f.) Total net absorption (s.f.) YTD total net absorption (s.f.) YTD total net absorption (% of stock) Direct vacancy (%) Total vacancy (%) Average direct asking rent ($ p.s.f.) YTD Completions (s.f.) Under Development (s.f.) Birmingham/Bloomfield Totals 3,979,668 19,612 -27,996 -0.7% 18.8% 19.0% $27.42 0 0 Dearborn Totals 2,705,625 -2,714 83,713 3.1% 24.3% 24.5% $17.32 150,000 0 Downriver Totals 483,907 2,434 13,885 2.9% 36.8% 38.3% $12.82 0 0 Farmington/Farmington Hills Totals 4,658,516 -82,651 -126,444 -2.7% 17.4% 18.5% $18.10 0 0 Macomb Totals 1,333,505 51,072 89,349 6.7% 10.6% 10.6% $14.67 0 0 North Oakland Totals 2,260,888 40,320 107,470 4.8% 16.5% 16.5% $18.34 53,240 0 Northern I-275 Corridor Totals 4,467,691 74,018 10,096 0.2% 10.5% 12.3% $19.32 0 0 Royal Oak / SE Oakland Totals 782,998 11,106 76,612 9.8% 5.6% 5.7% $16.82 76,288 55,000 Southern I-275 Corridor Totals 1,077,525 1,948 -108,132 -10.0% 0.0% 23.3% $0.00 0 0 Southfield Totals 13,235,696 -44,679 -174,845 -1.3% 28.2% 30.3% $18.17 0 0 Troy Totals 11,003,062 49,733 -161,799 -1.5% 23.0% 25.3% $19.73 0 0 Washtenaw Totals 6,673,772 -4,262 -14,614 -0.2% 9.6% 11.1% $25.80 60,000 30,000 Suburbs Totals 52,662,853 115,937 -273,399 -0.5% 19.6% 21.6% $19.55 339,528 85,000 CBD Totals 13,477,209 -2,806 72,682 0.5% 13.9% 15.2% $22.24 160,000 1,523,000 New Center Totals 1,486,775 35,876 23,362 1.6% 18.1% 18.2% $19.22 0 0 Urban Totals 14,963,984 33,070 96,044 0.6% 14.3% 15.5% $21.64 160,000 1,523,000 Detroit Totals 67,626,837 149,007 -177,355 -0.3% 18.4% 20.2% $19.85 499,528 1,608,000 Birmingham/Bloomfield A 1,569,497 16,564 -8,411 -0.5% 26.9% 27.2% $29.52 0 0 Dearborn A 446,890 0 -1,150 -0.3% 1.0% 1.0% $24.00 150,000 0 Farmington/Farmington Hills A 618,109 1,453 36,885 6.0% 8.1% 8.1% $22.69 0 0 Macomb A 295,494 -2,022 -2,474 -0.8% 3.7% 3.7% $18.97 0 0 North Oakland A 541,905 1,071 54,842 10.1% 15.3% 15.3% $20.85 53,240 0 Northern I-275 Corridor A 1,113,719 4,279 -4,891 -0.4% 6.4% 7.3% $19.98 0 0 Royal Oak / SE Oakland A 76,288 0 76,288 100.0% 0.0% 0.0% $0.00 76,288 55,000 Southern I-275 Corridor A 832,753 0 -109,432 -13.1% 0.0% 30.1% $0.00 0 0 Southfield A 2,970,217 -9,987 -37,048 -1.2% 24.0% 27.0% $21.06 0 0 Troy A 1,924,131 31,181 50,769 2.6% 14.4% 18.2% $24.90 0 0 Washtenaw A 3,278,983 18,473 127,960 3.9% 8.7% 8.7% $29.05 60,000 30,000 Suburbs A 13,667,986 61,012 183,338 1.3% 14.0% 17.2% $24.64 339,528 235,000 CBD A 6,354,714 22,124 83,445 1.3% 8.9% 11.0% $23.78 160,000 1,523,000 Urban A 6,354,714 22,124 83,445 1.3% 8.9% 11.0% $23.78 160,000 1,523,000 Detroit A 20,022,700 83,136 266,783 1.3% 12.4% 15.2% $24.44 499,528 1,608,000 Birmingham/Bloomfield B 2,410,171 3,048 -19,585 -0.8% 13.5% 13.7% $24.08 0 0 Dearborn B 2,258,735 -2,714 84,863 3.8% 28.9% 29.1% $17.26 0 0 Downriver B 483,907 2,434 13,885 2.9% 36.8% 38.3% $12.82 0 0 Farmington/Farmington Hills B 4,040,407 -84,104 -163,329 -4.0% 18.8% 20.1% $17.82 0 0 Macomb B 991,381 53,094 91,823 9.3% 13.2% 13.2% $14.43 0 0 North Oakland B 1,718,983 39,249 52,988 3.1% 16.8% 16.9% $17.43 0 0 Northern I-275 Corridor B 3,353,972 69,739 14,987 0.4% 11.9% 13.9% $19.20 0 0 Royal Oak / SE Oakland B 706,710 11,106 324 0.0% 6.2% 6.3% $16.82 0 0 Southern I-275 Corridor B 244,772 1,948 1,300 0.5% 0.0% 0.0% $0.00 0 0 Southfield B 10,265,479 -34,692 -137,797 -1.3% 29.4% 31.3% $17.20 0 0 Troy B 9,078,931 18,552 -202,511 -2.2% 24.8% 26.8% $18.82 0 0 Washtenaw B 3,394,789 -22,735 -193,685 -5.7% 10.4% 13.4% $21.20 0 0 Suburbs B 38,948,237 54,925 -456,737 -1.2% 21.6% 23.2% $18.02 0 0 CBD B 7,122,495 -24,930 -10,763 -0.2% 18.3% 19.0% $20.53 0 0 New Center B 1,486,775 35,876 23,362 1.6% 18.1% 18.2% $19.22 0 0 Urban B 8,609,270 10,946 12,599 0.1% 18.3% 18.8% $20.08 0 0 Detroit B 47,557,507 65,871 -444,138 -0.9% 21.0% 22.4% $18.26 0 0