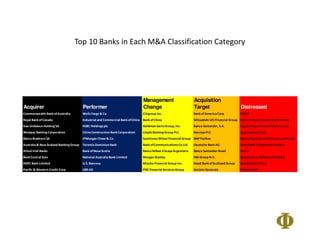

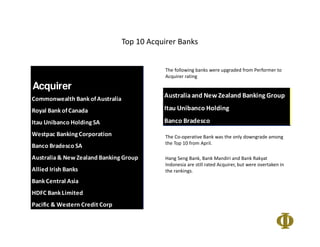

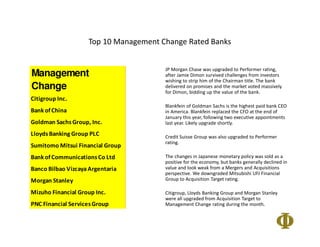

The document provides an overview and analysis of the global banking industry in May 2013. It summarizes that the banking industry saw mixed trends in mergers and acquisitions activity, with overall market capitalization increasing by $51 billion. Specifically, US and European banks improved while Japanese banks declined. It also discusses a failed acquisition in the UK and provides rankings of the top 10 banks in various M&A categories.