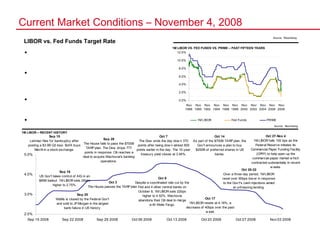

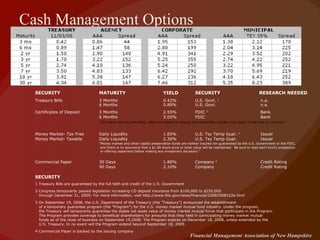

The document summarizes a presentation given by the Financial Management Association of New Hampshire on safeguarding cash and investments during turbulent economic times. The presentation addressed the current financial crisis, economic outlook, condition of the financial industry, cash management options, and investment policy guidelines. Panelists discussed issues like capital adequacy, the future of securitization and universal banking, and strategies for preserving capital while generating yield.