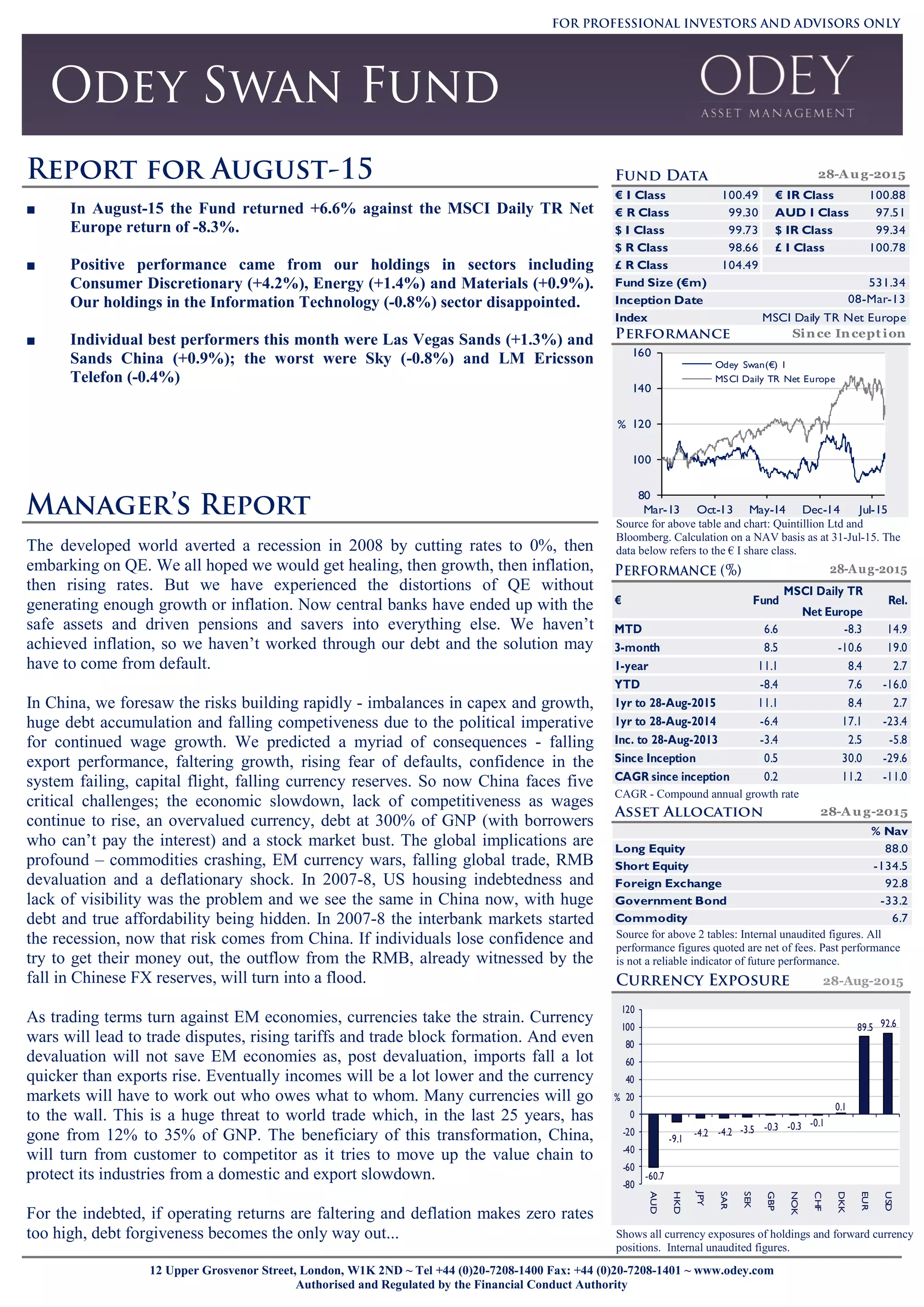

The fund returned +6.6% in August compared to -8.3% for the MSCI Europe index. Positive performance came from holdings in consumer discretionary (+4.2%), energy (+1.4%), and materials (+0.9%). Las Vegas Sands (+1.3%) and Sands China (+0.9%) were top performers, while Sky (-0.8%) and LM Ericsson Telefon (-0.4%) underperformed. The manager believes developed markets face earnings risk with high valuations and sees further global economic adjustments ahead, rather than the crisis being over, as China addresses debt, competitiveness and slowing growth issues in a deflationary environment.