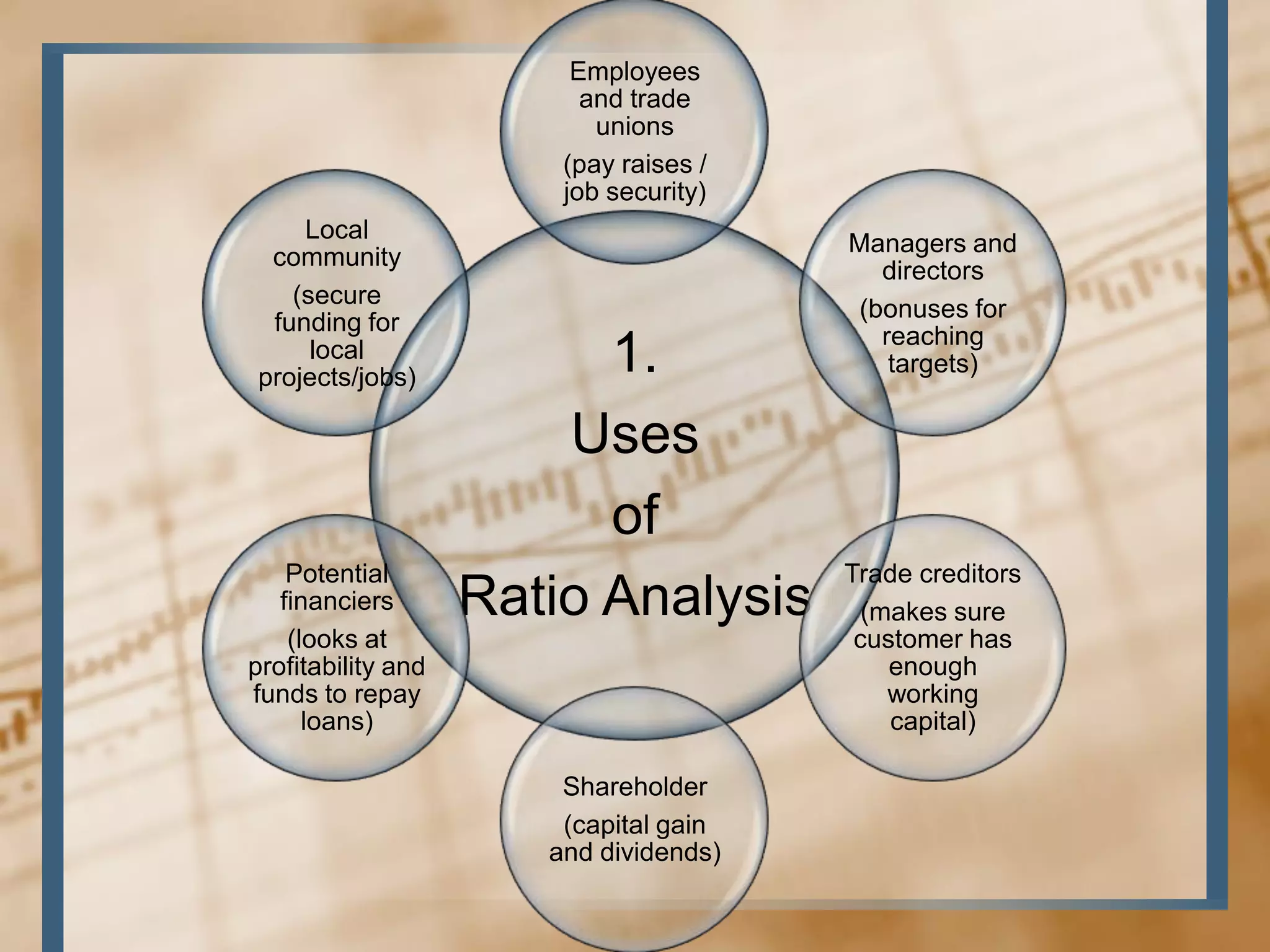

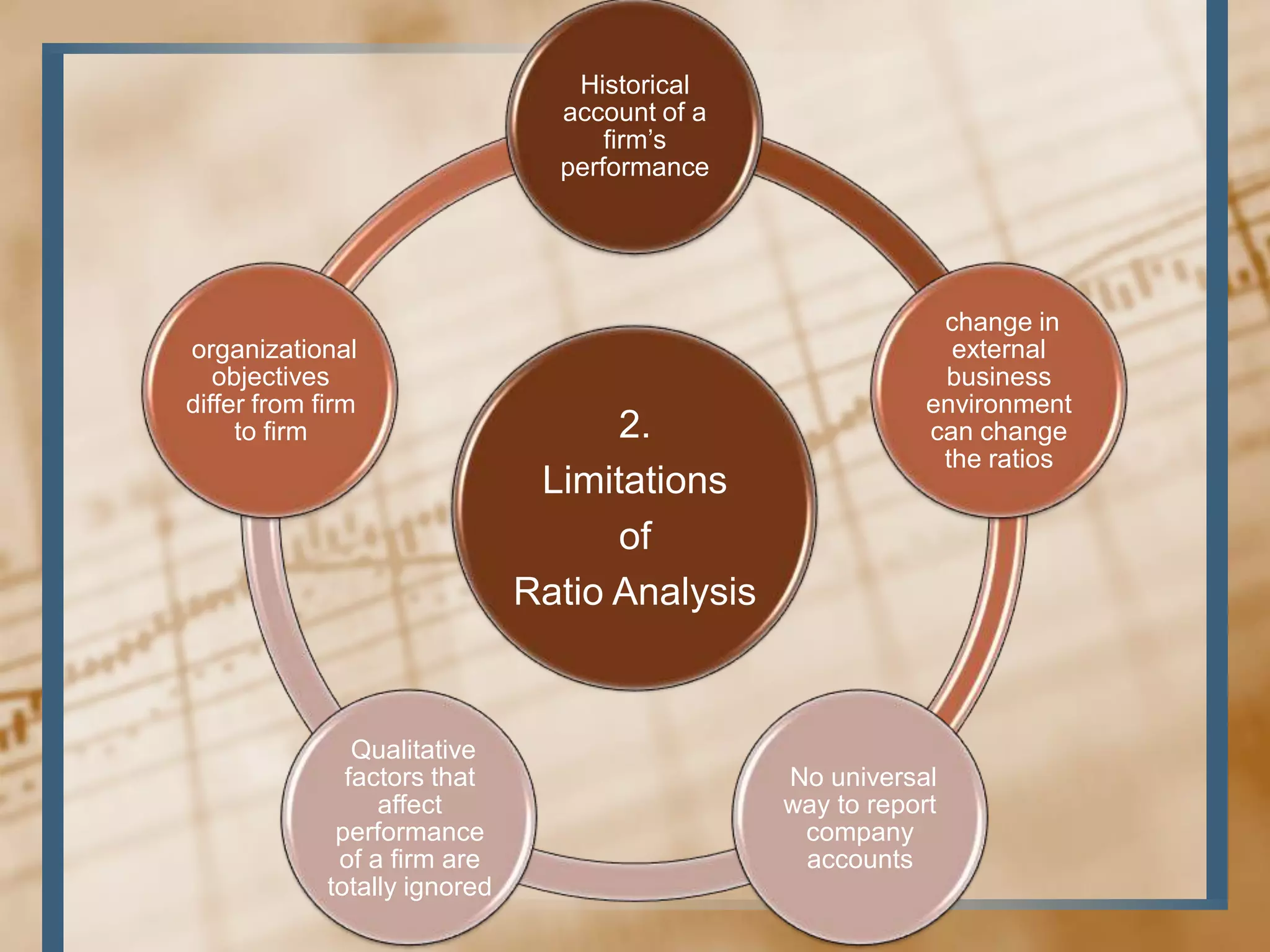

The document discusses the purpose and methods of ratio analysis in evaluating a business's financial performance. It covers various types of financial ratios, including profitability, liquidity, efficiency, and gearing ratios, and explains their significance for decision-making and comparisons within the industry. Additionally, it highlights the limitations of ratio analysis, emphasizing the need for a holistic understanding of a company's situation by considering qualitative factors as well.