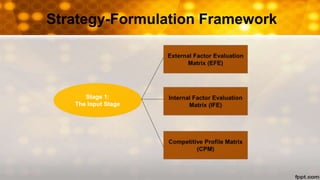

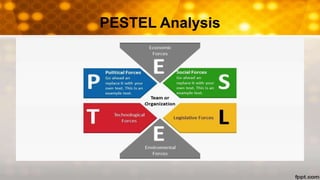

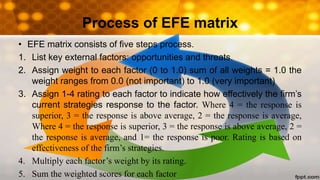

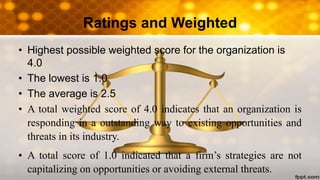

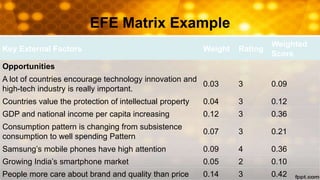

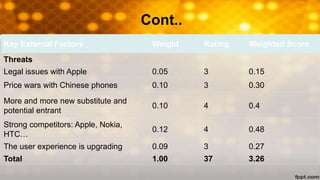

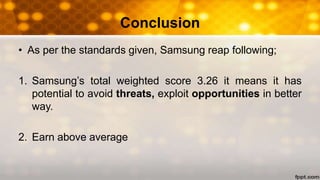

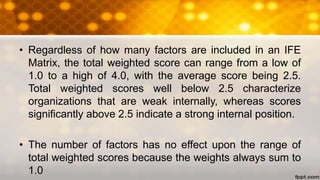

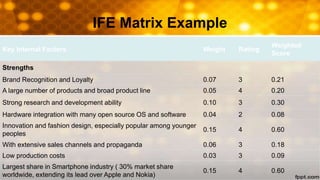

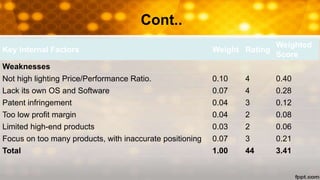

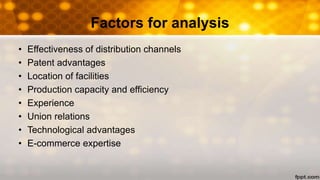

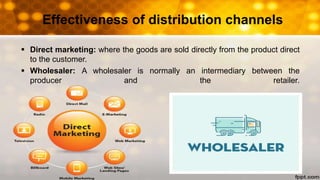

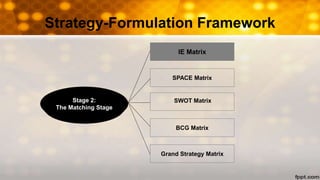

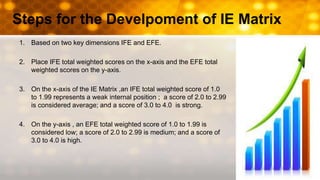

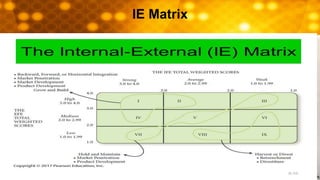

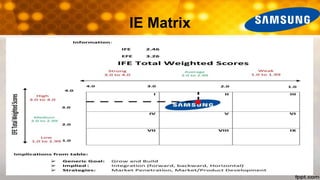

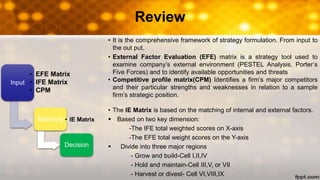

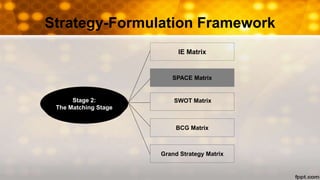

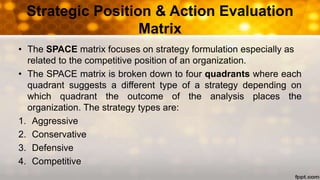

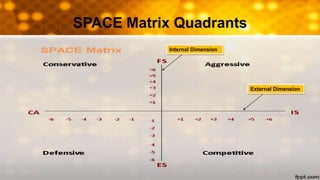

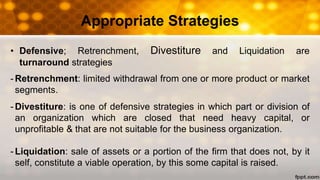

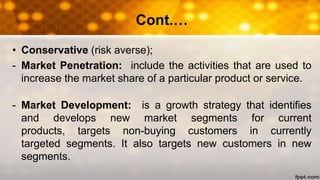

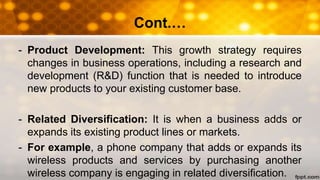

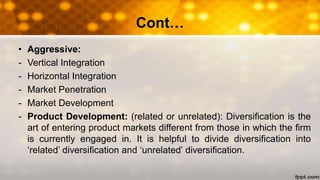

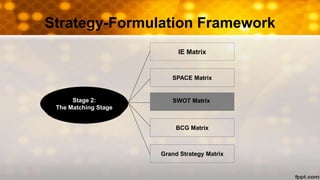

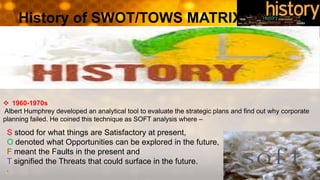

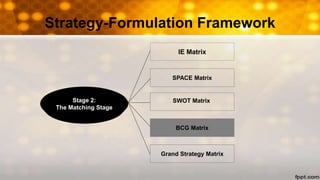

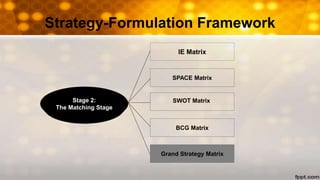

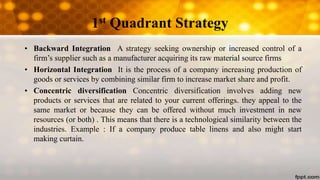

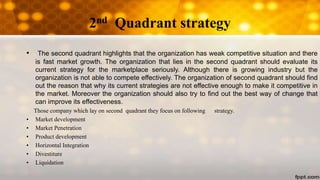

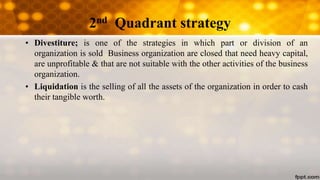

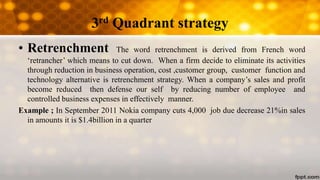

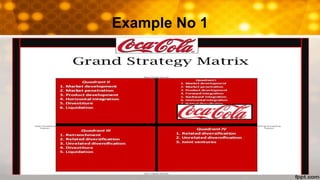

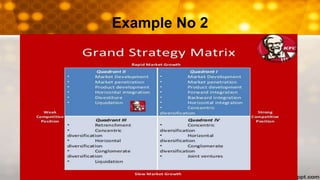

The document discusses various strategy formulation frameworks used in organizational management, including the external factor evaluation (EFE) matrix and internal factor evaluation (IFE) matrix, designed to assess companies' external and internal environments. Additionally, it introduces tools like the competitive profile matrix (CPM), which analyzes competitors’ strengths and weaknesses, and the internal-external (IE) matrix, which categorizes organizational strategies. It concludes with a glossary of relevant terms related to aggressive, conservative, and defensive strategies in management.