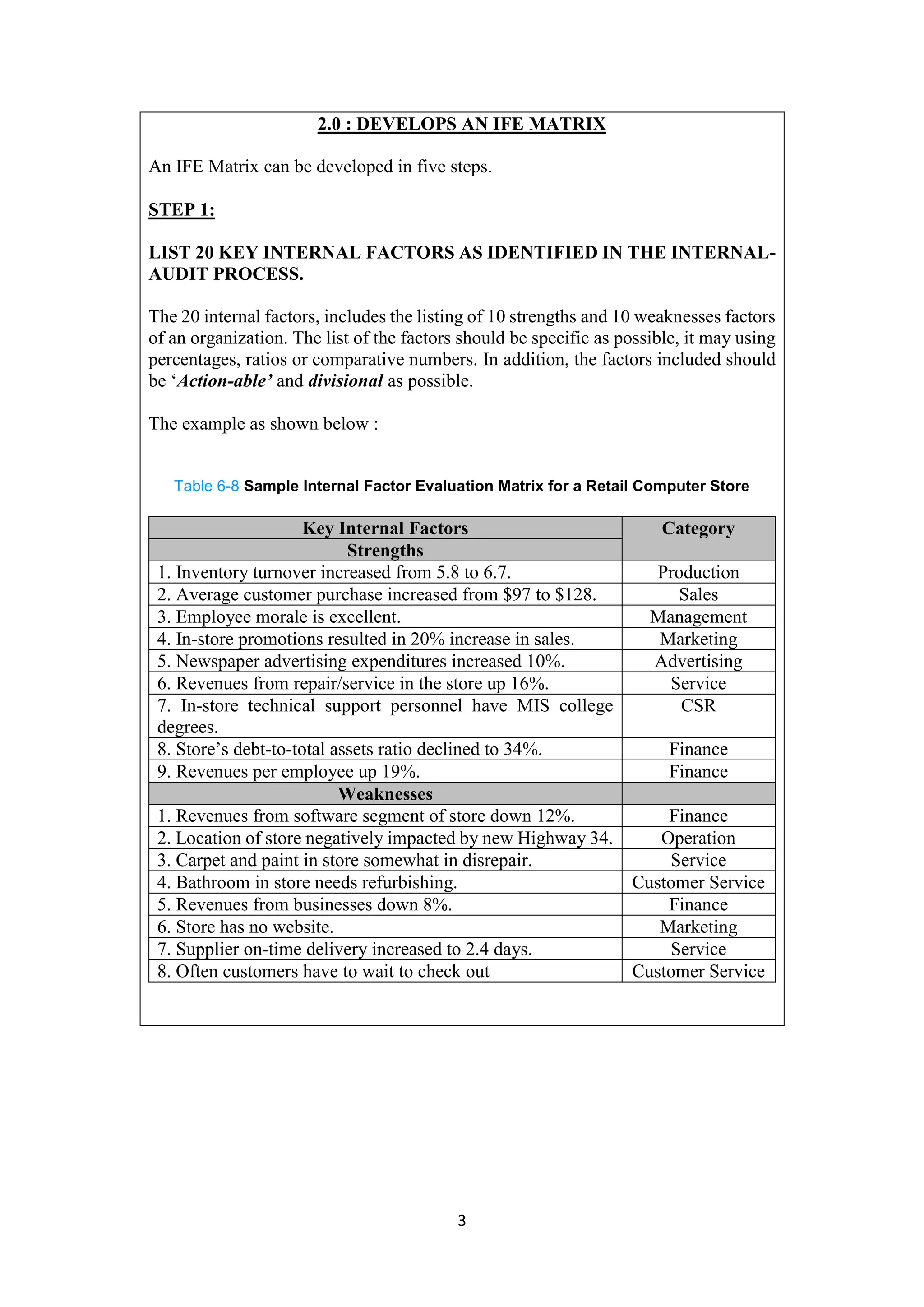

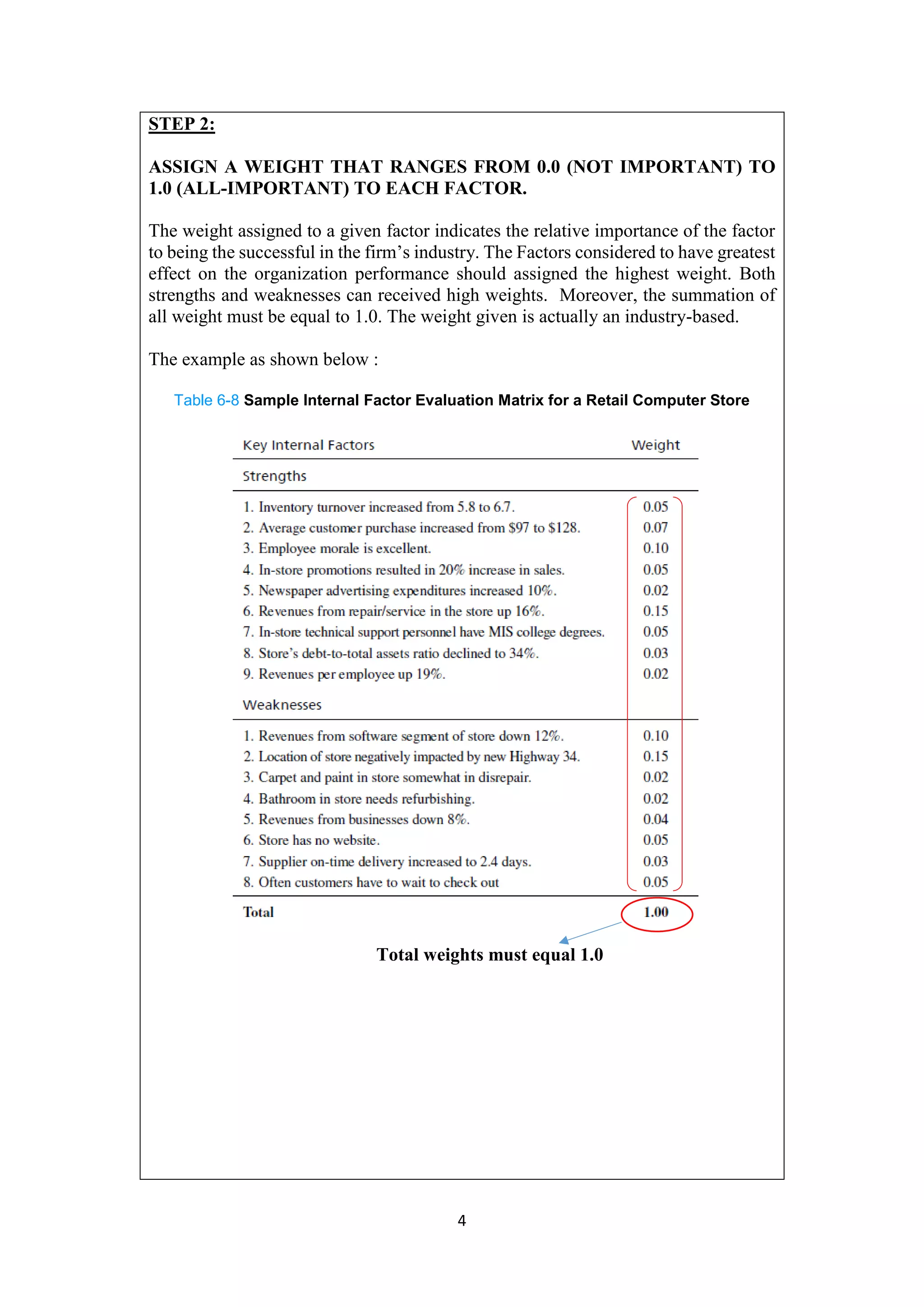

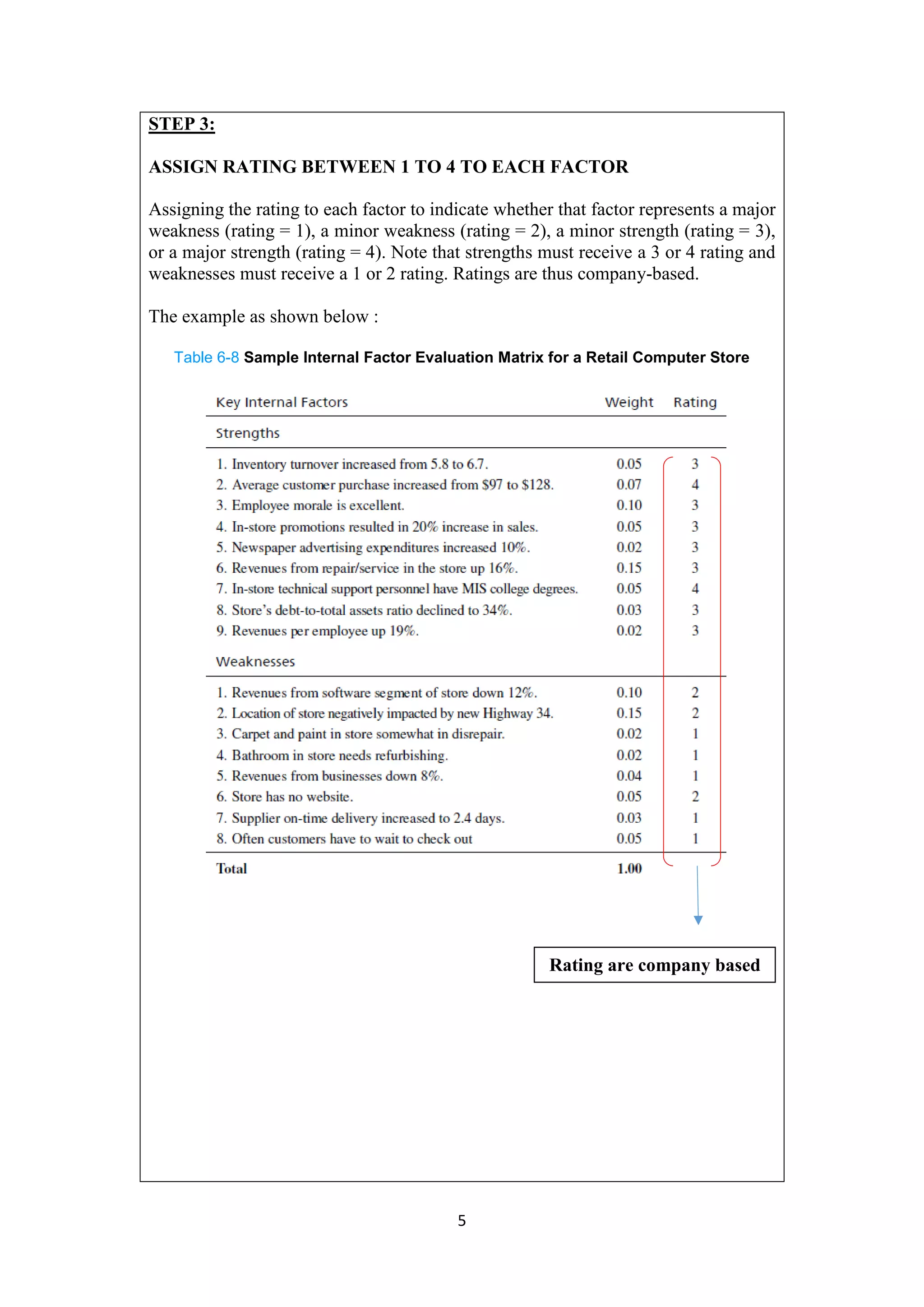

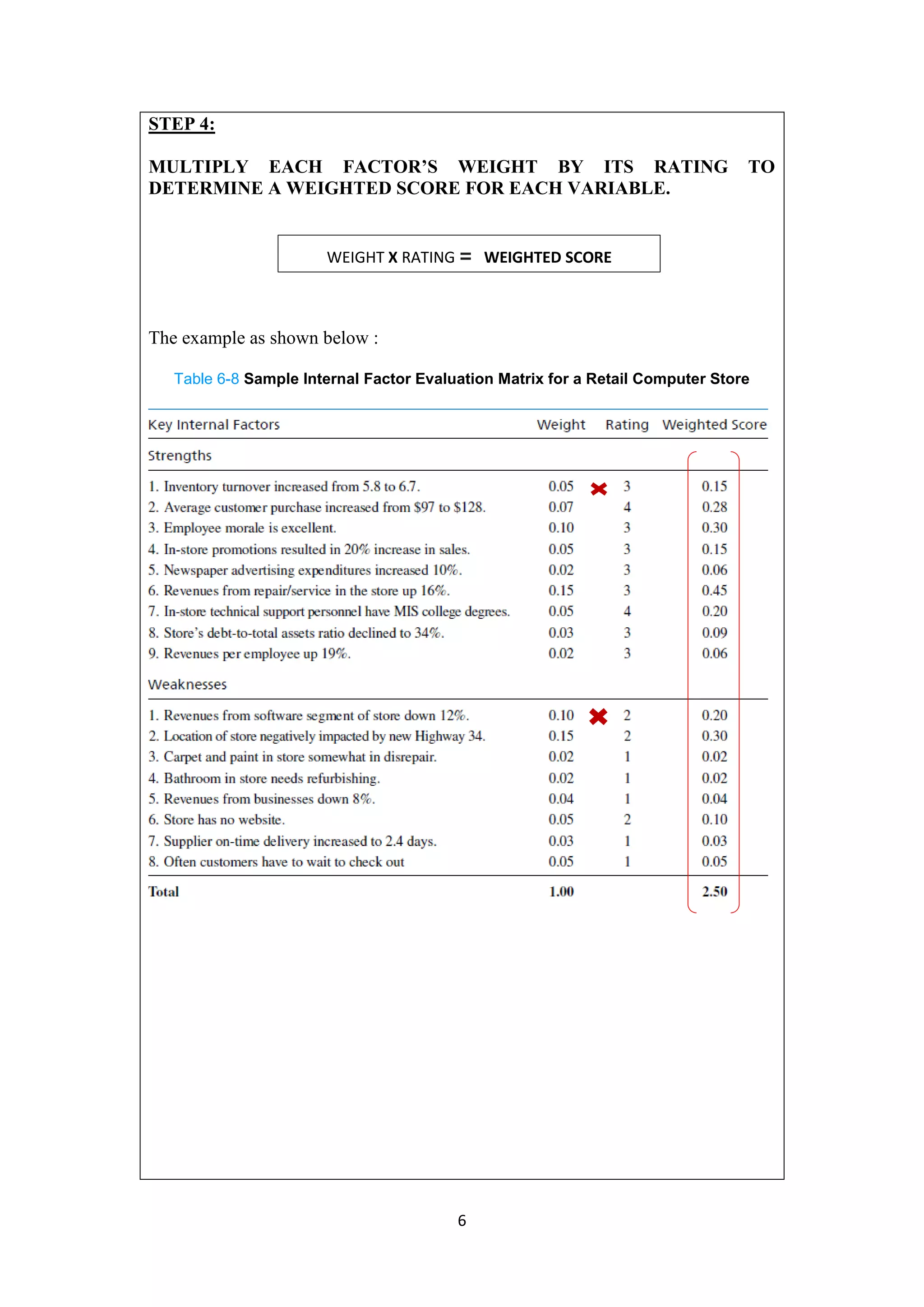

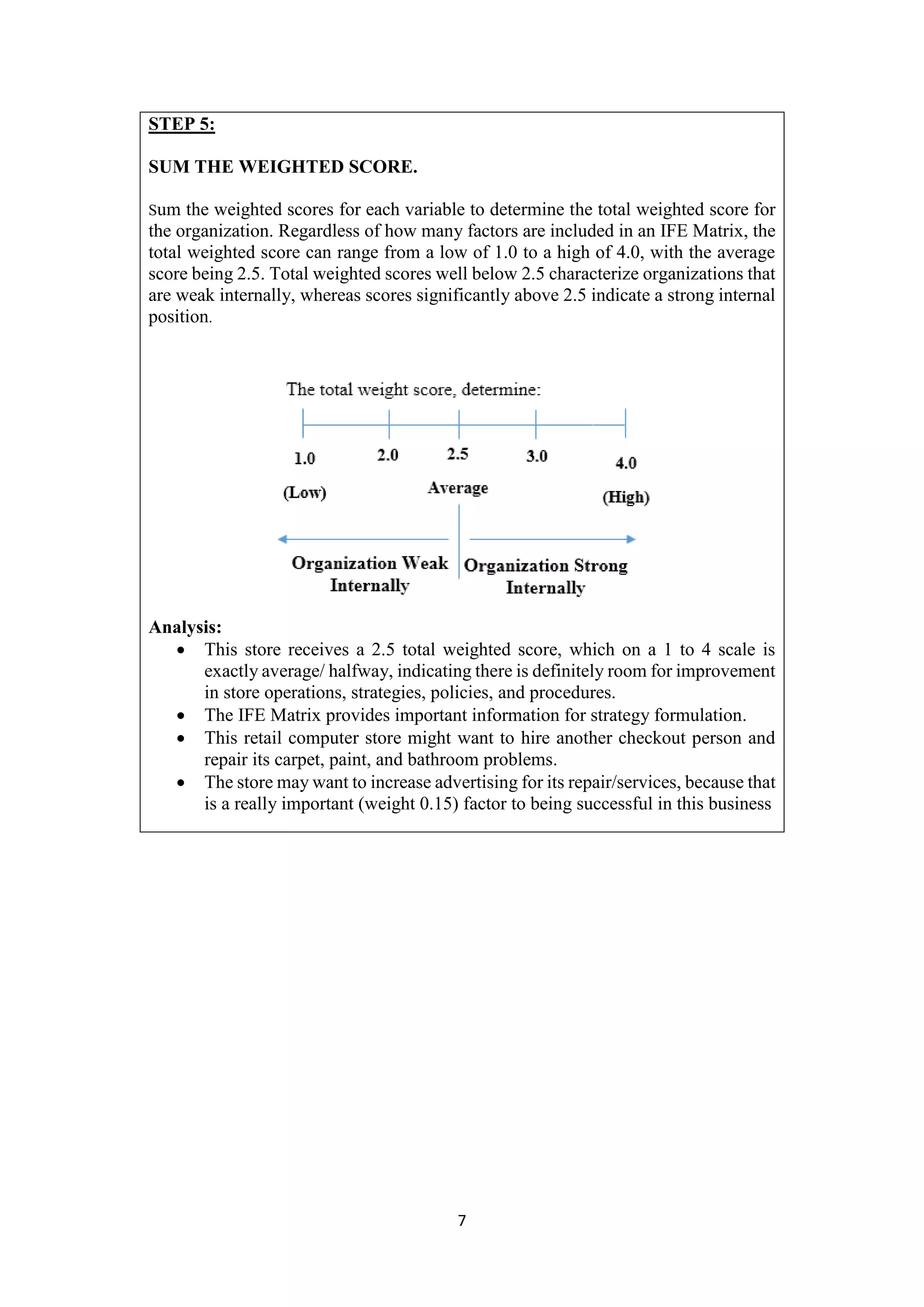

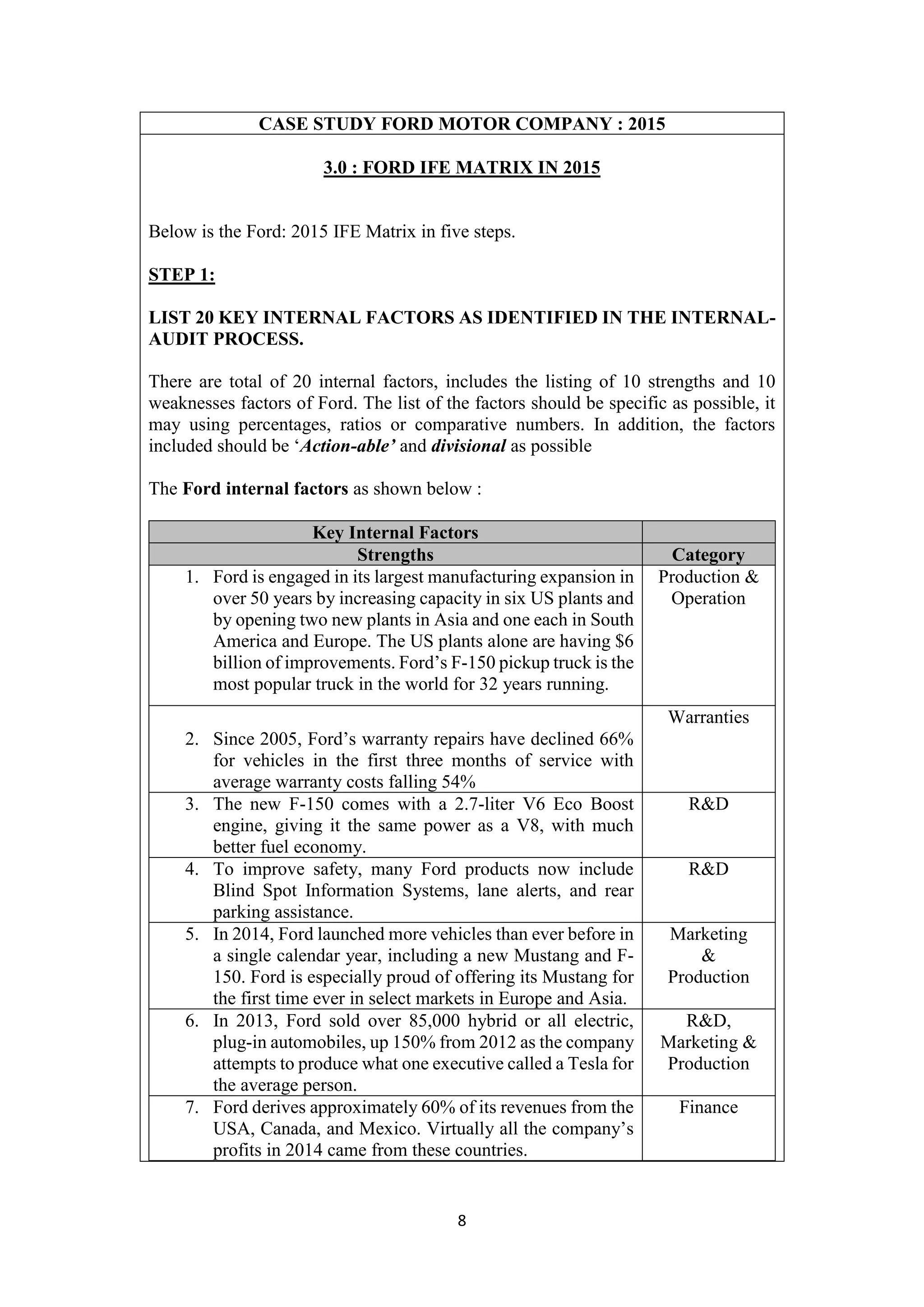

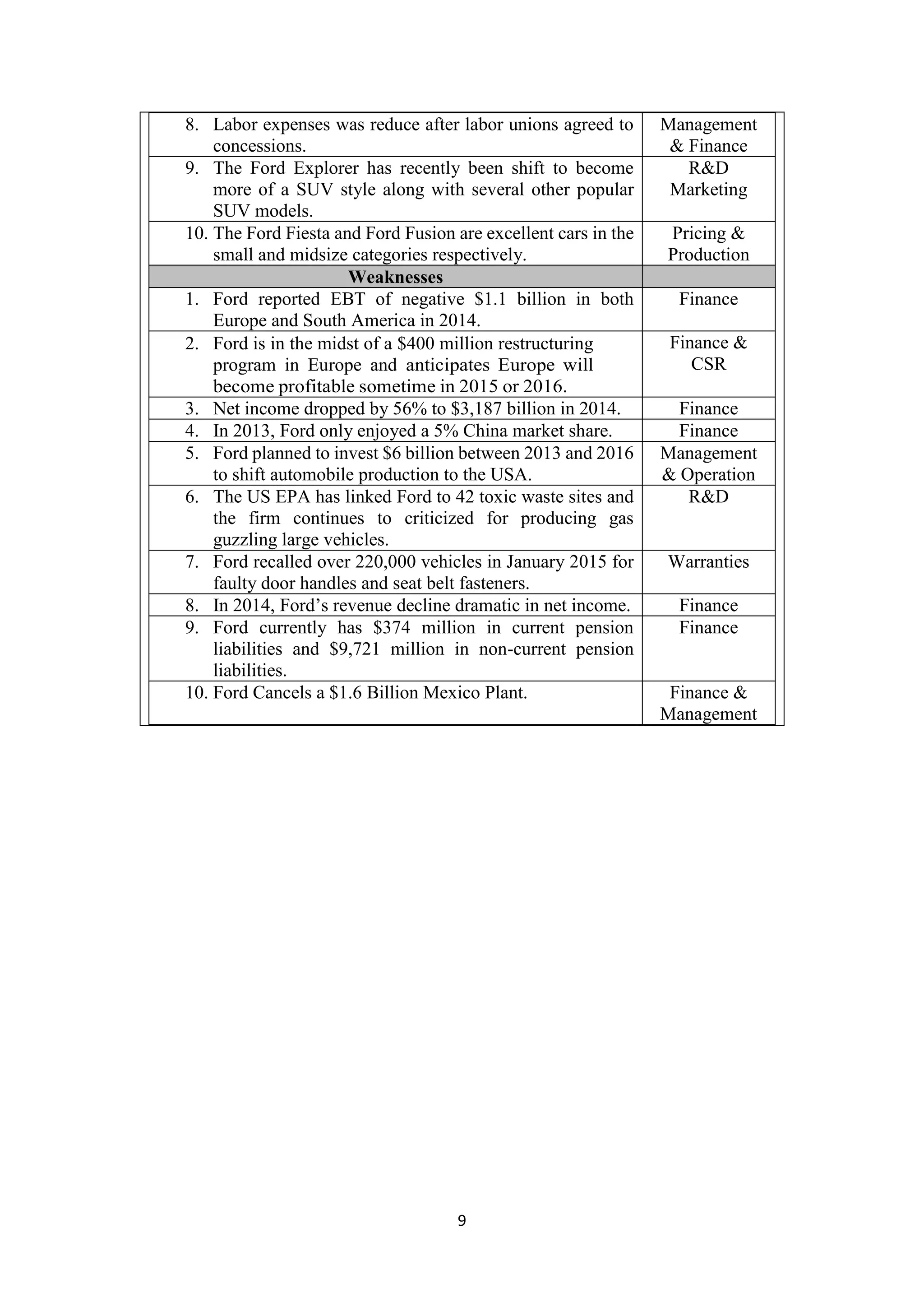

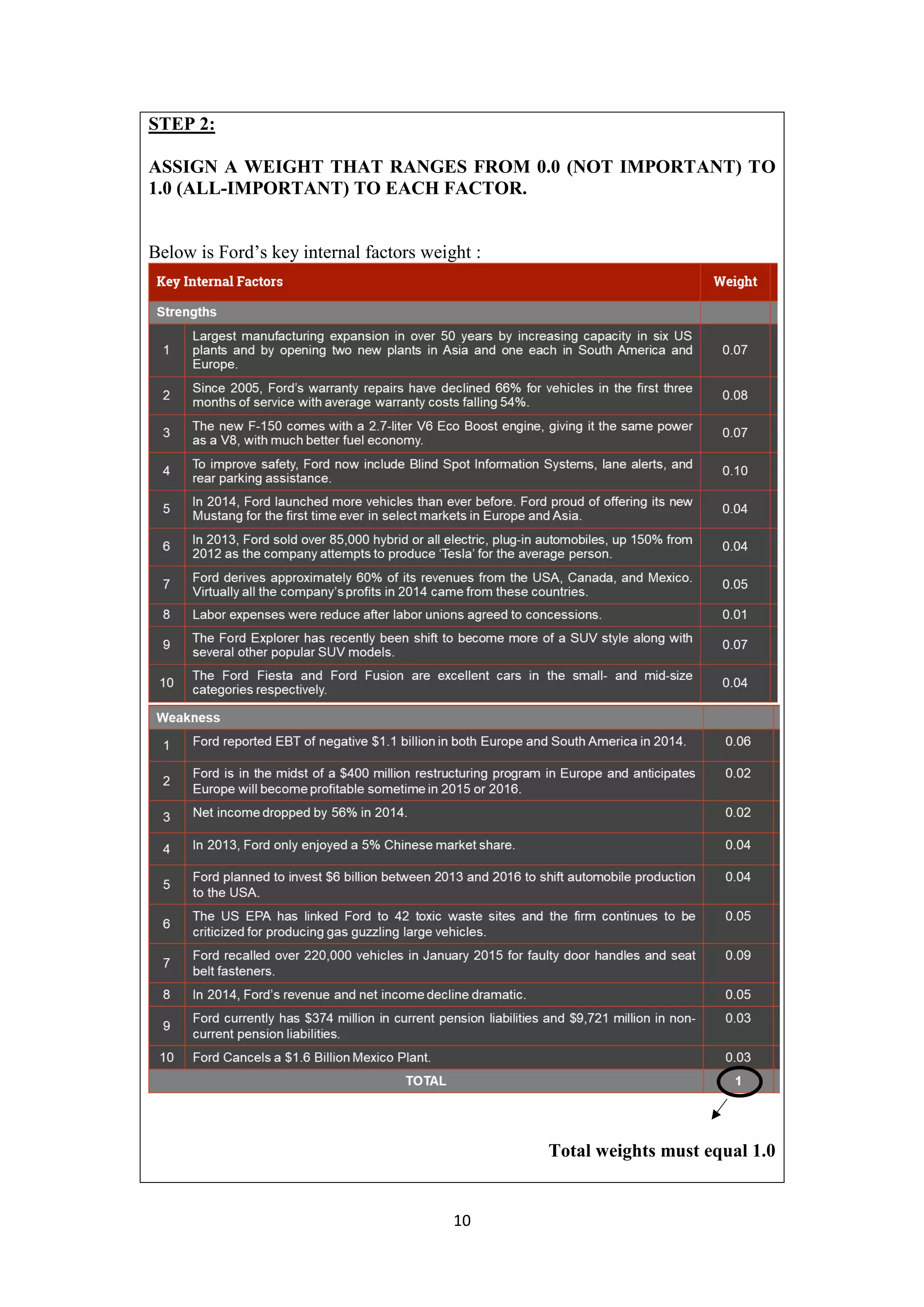

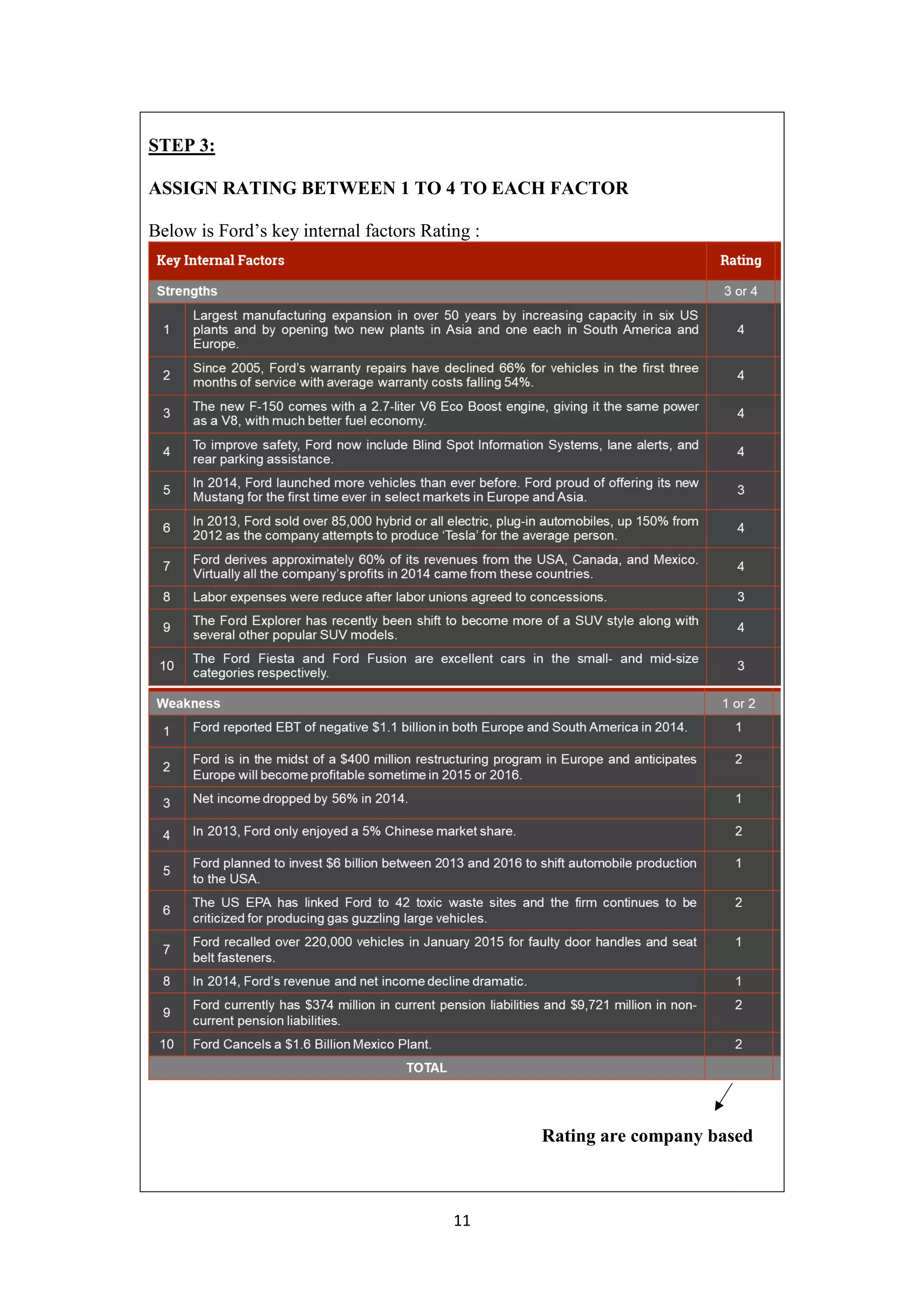

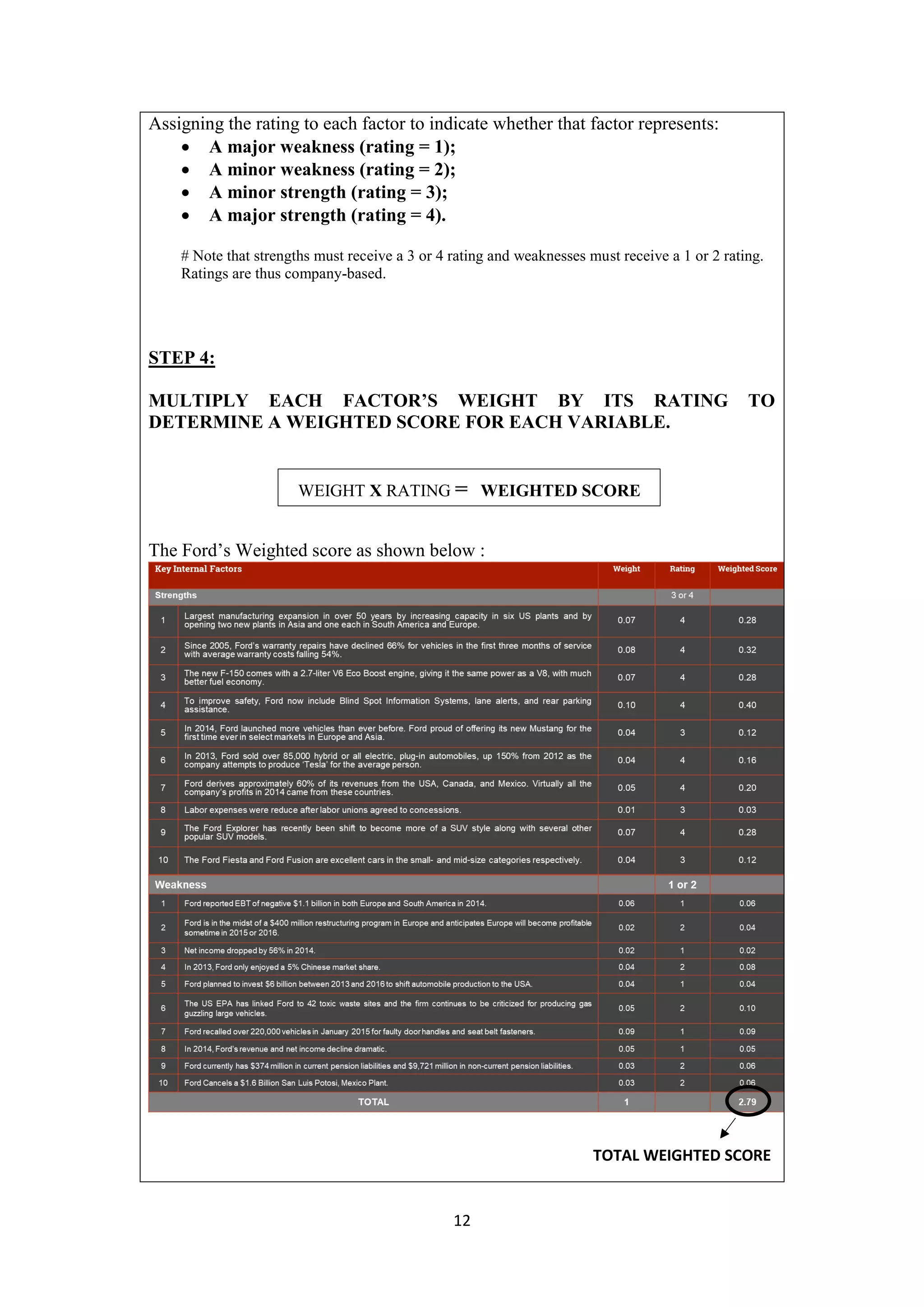

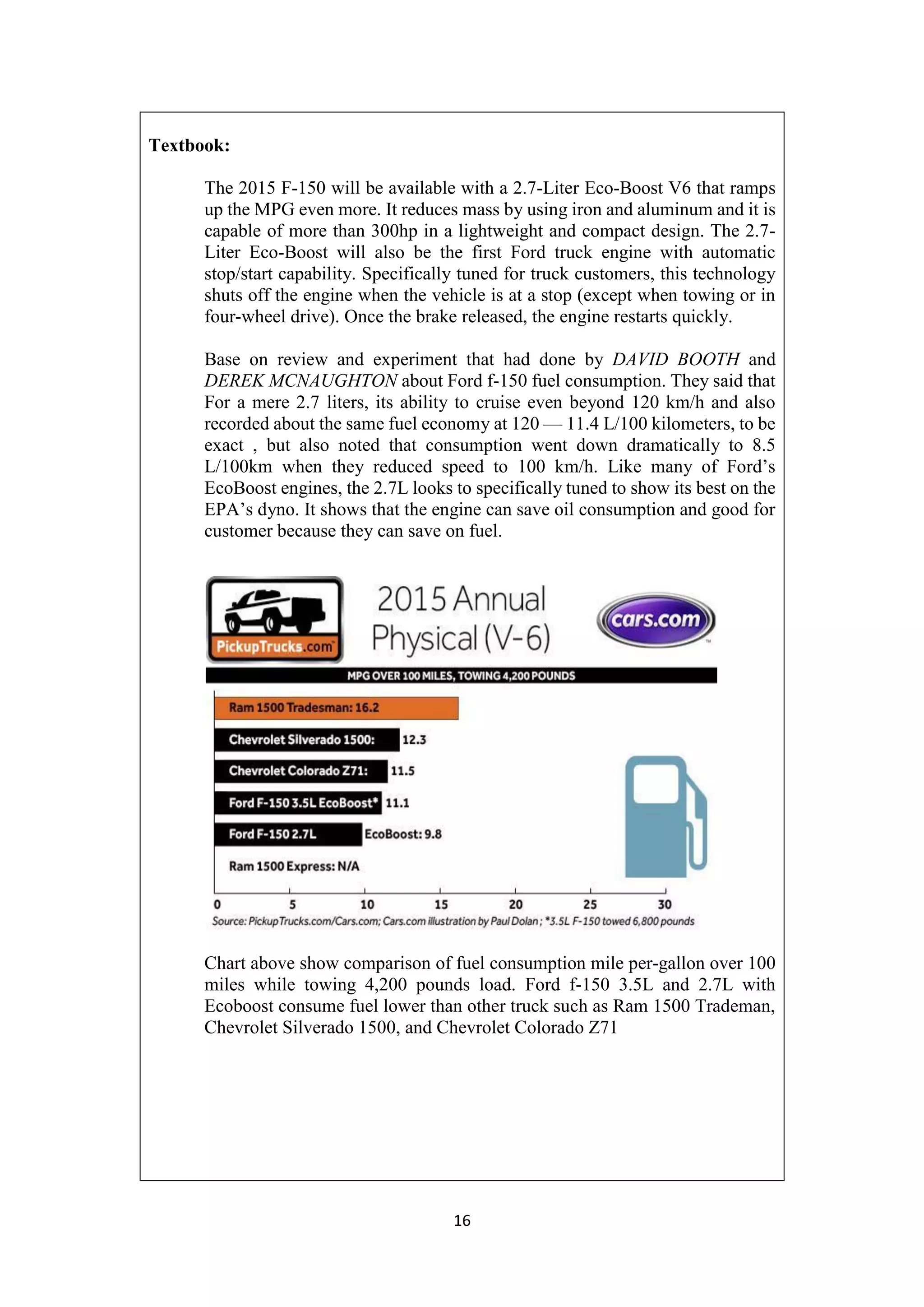

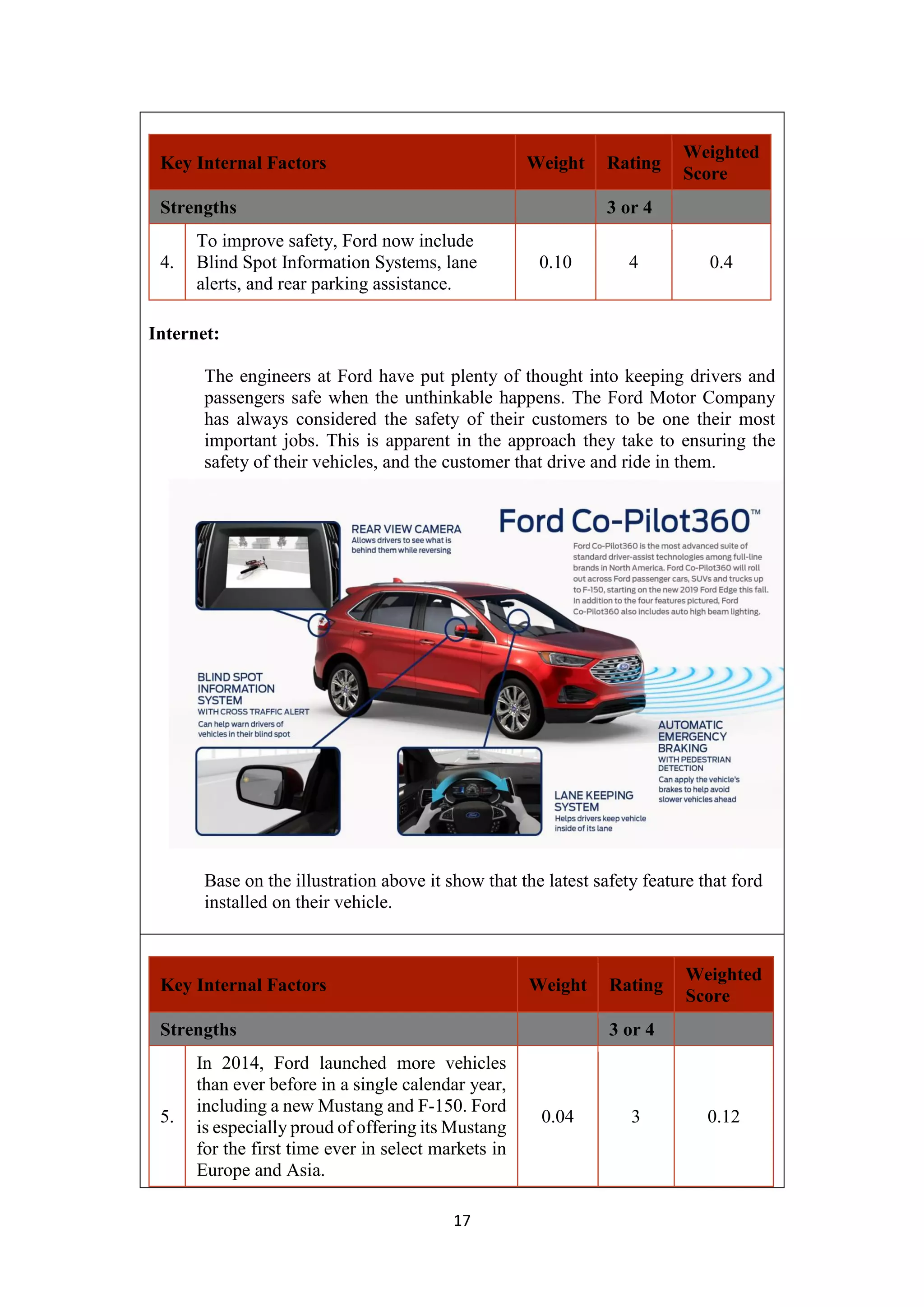

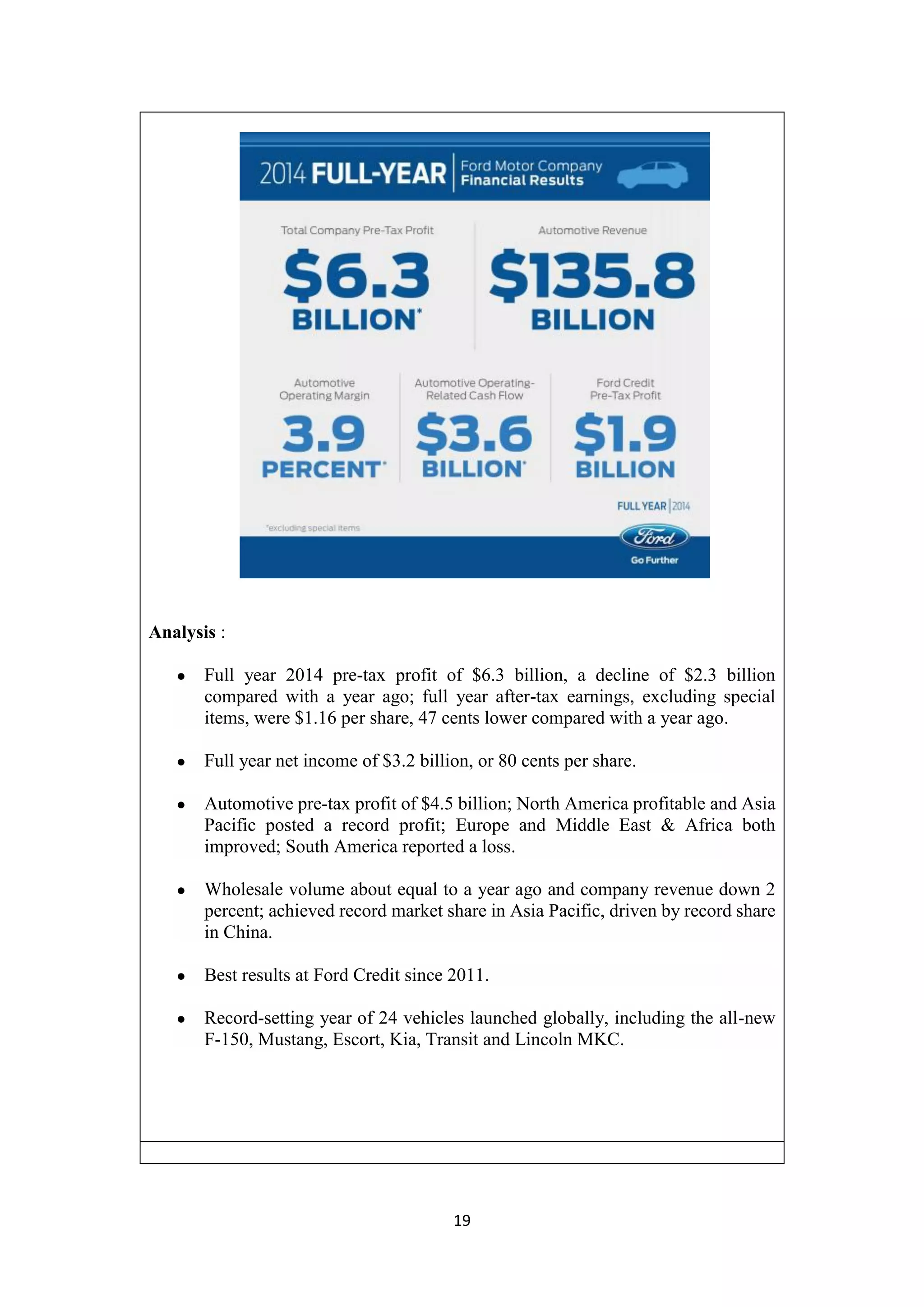

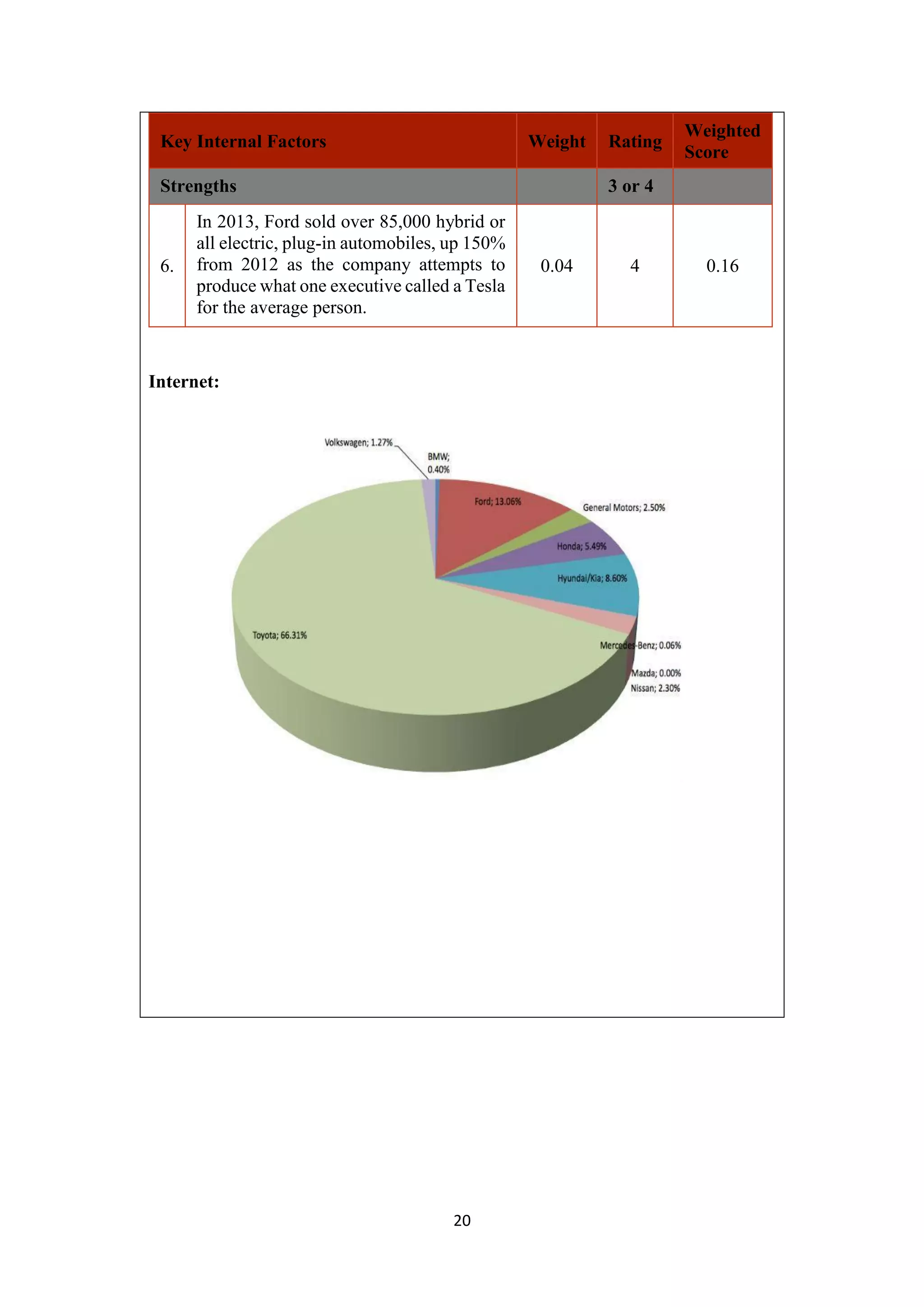

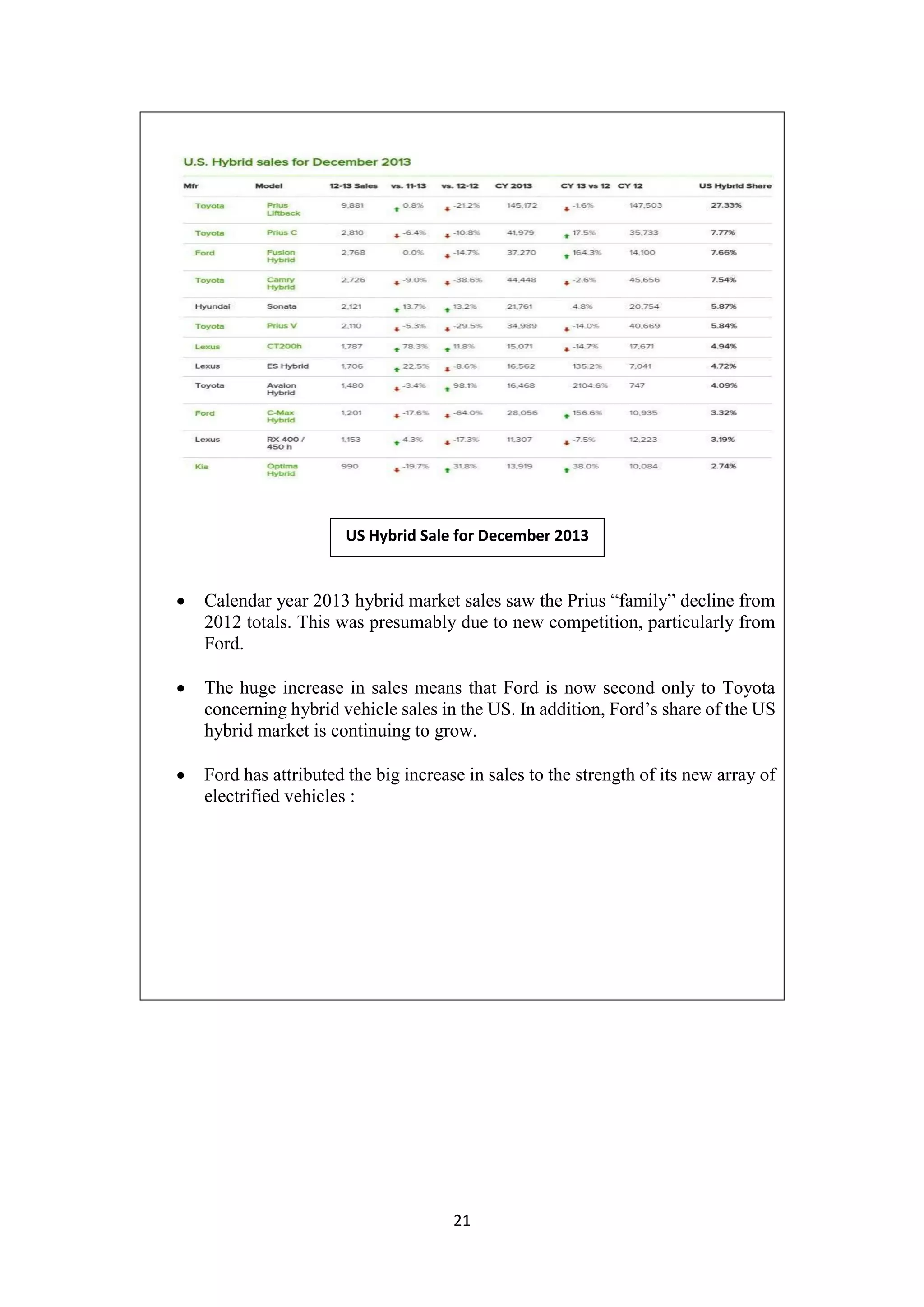

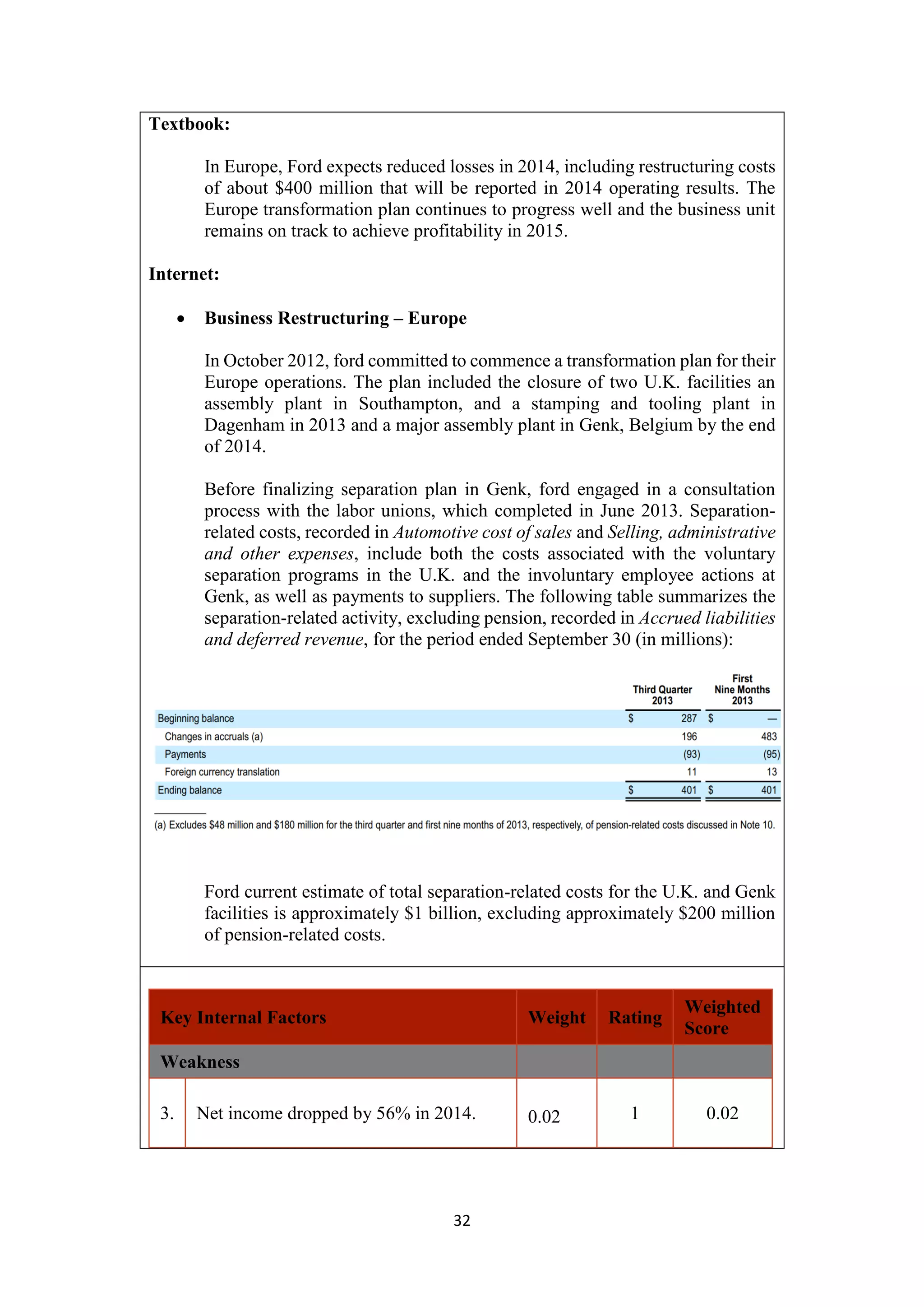

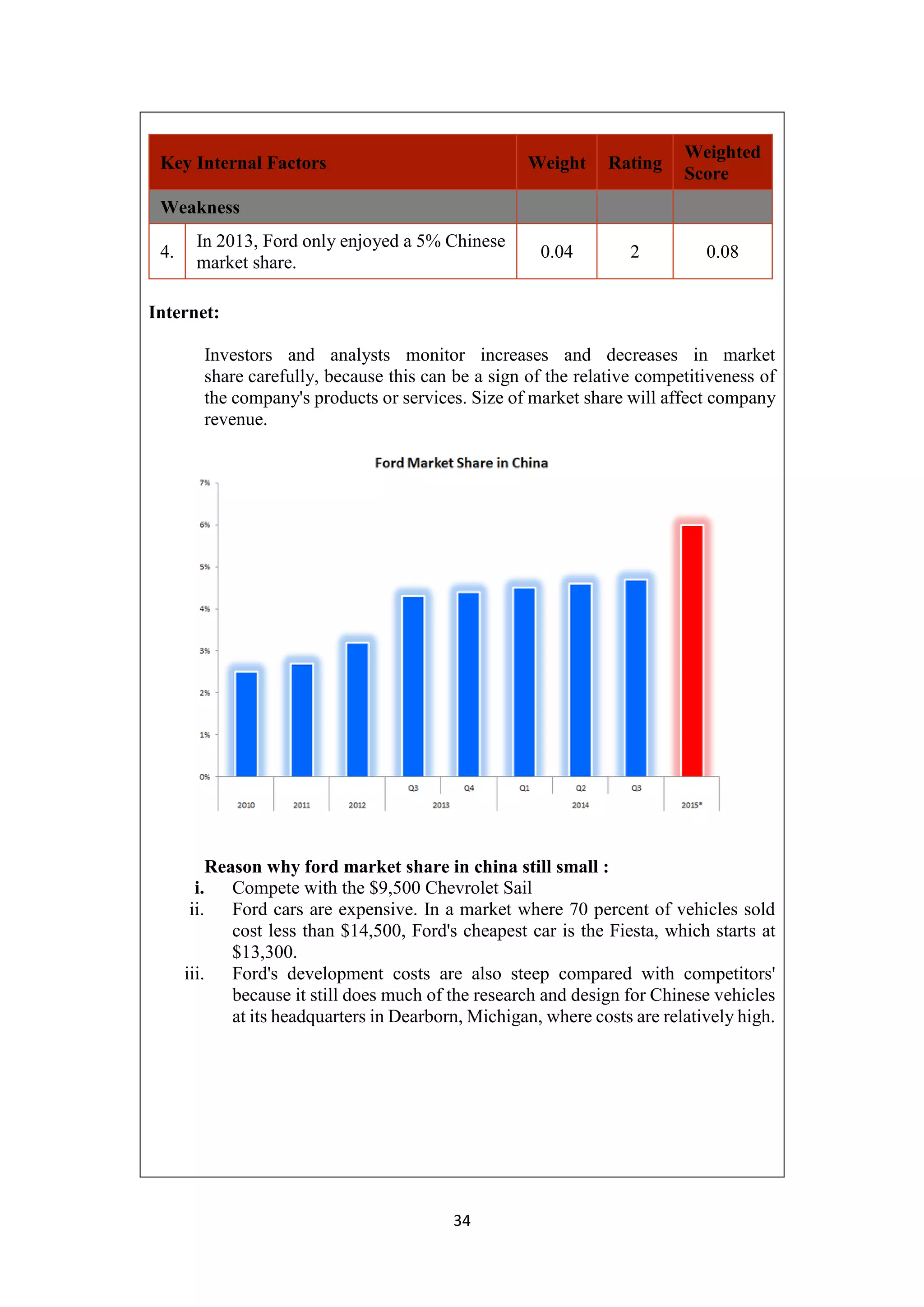

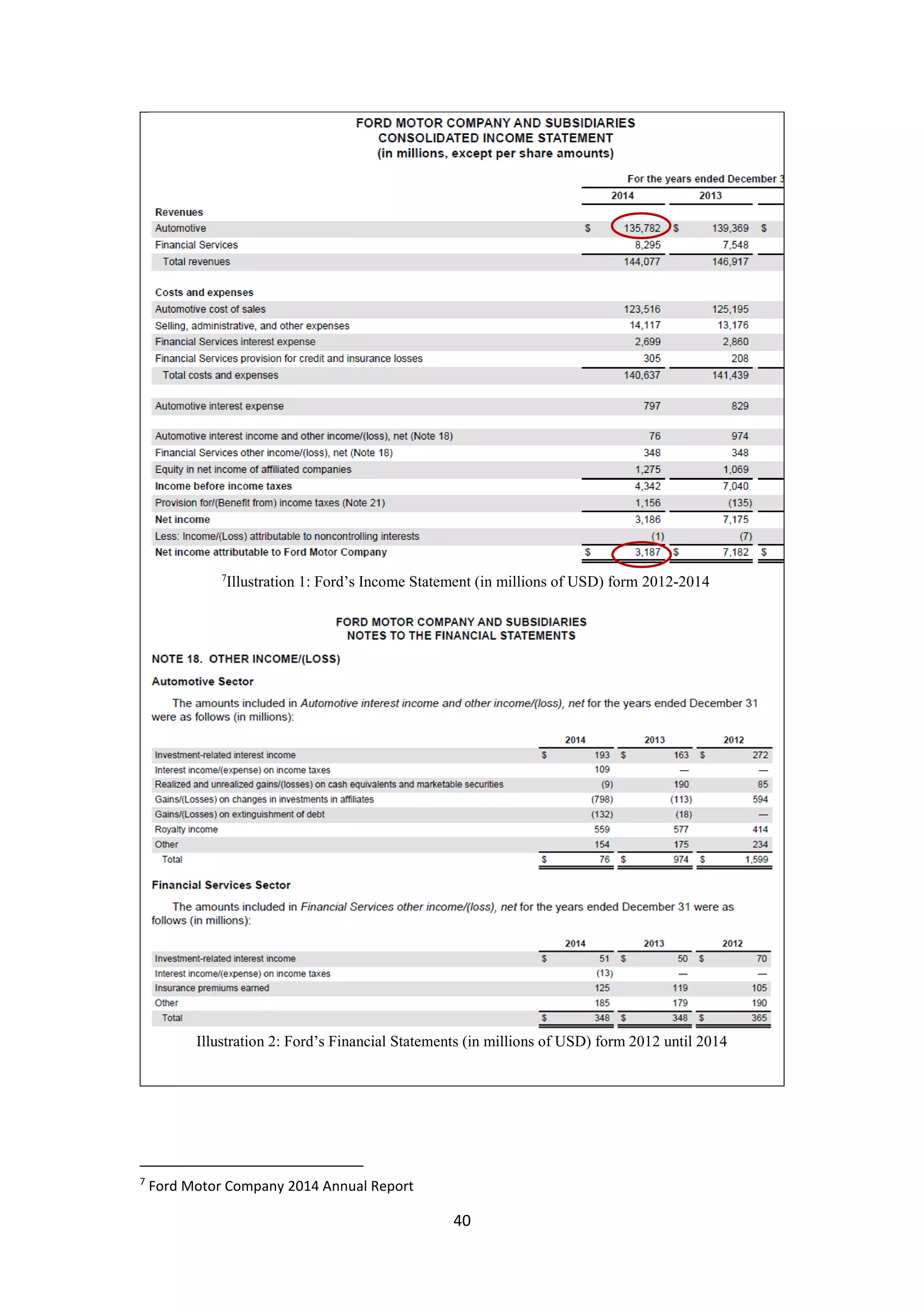

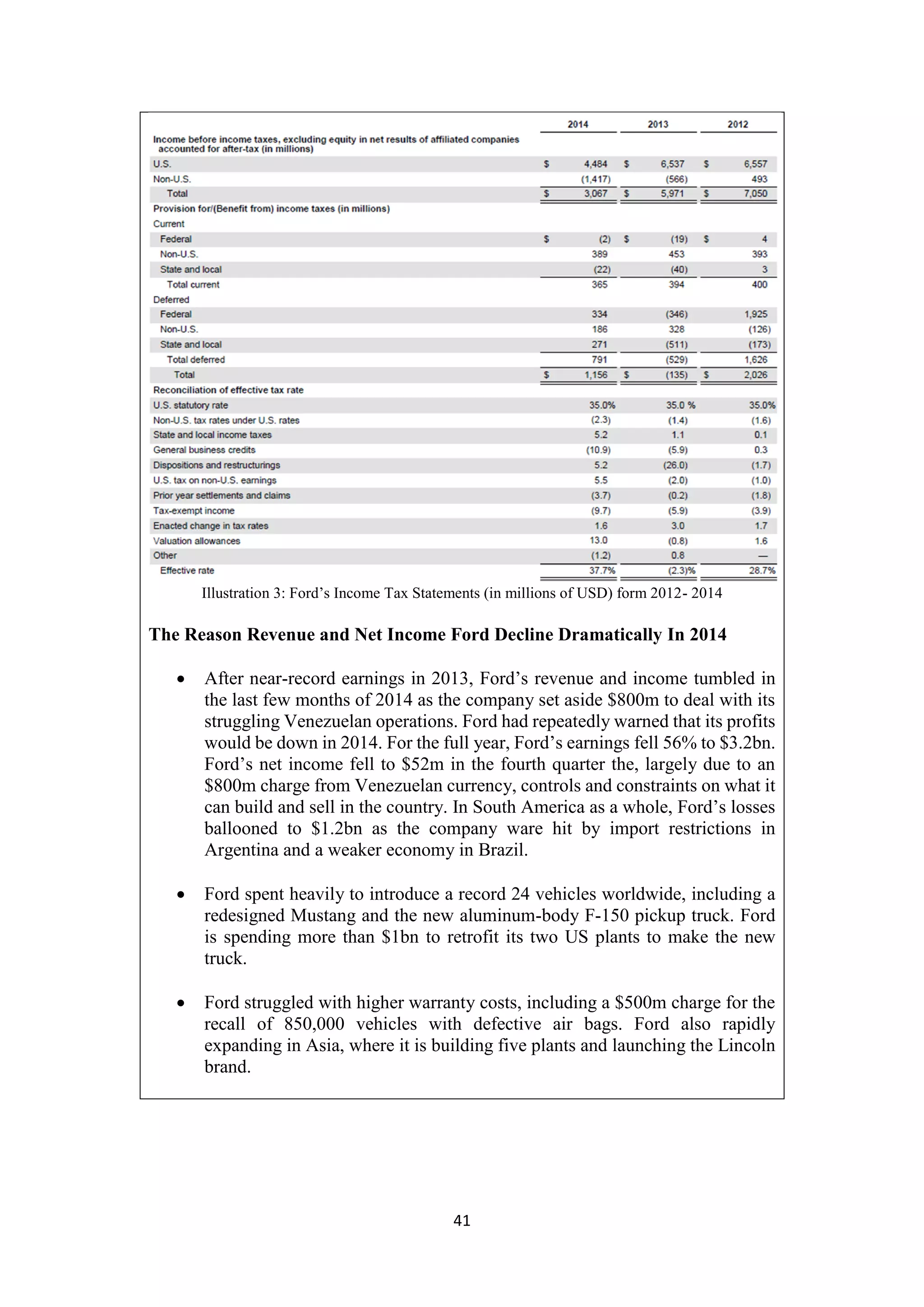

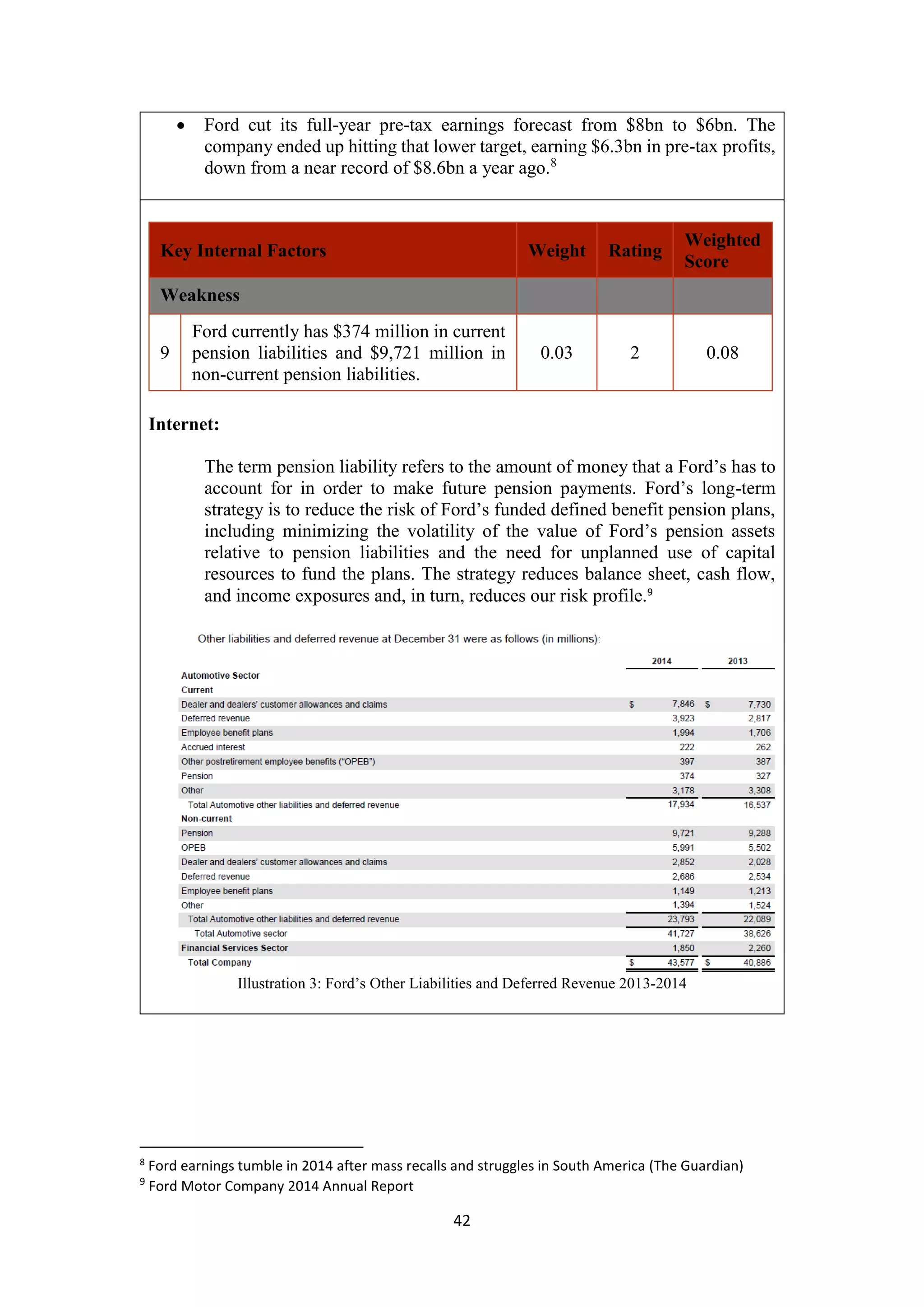

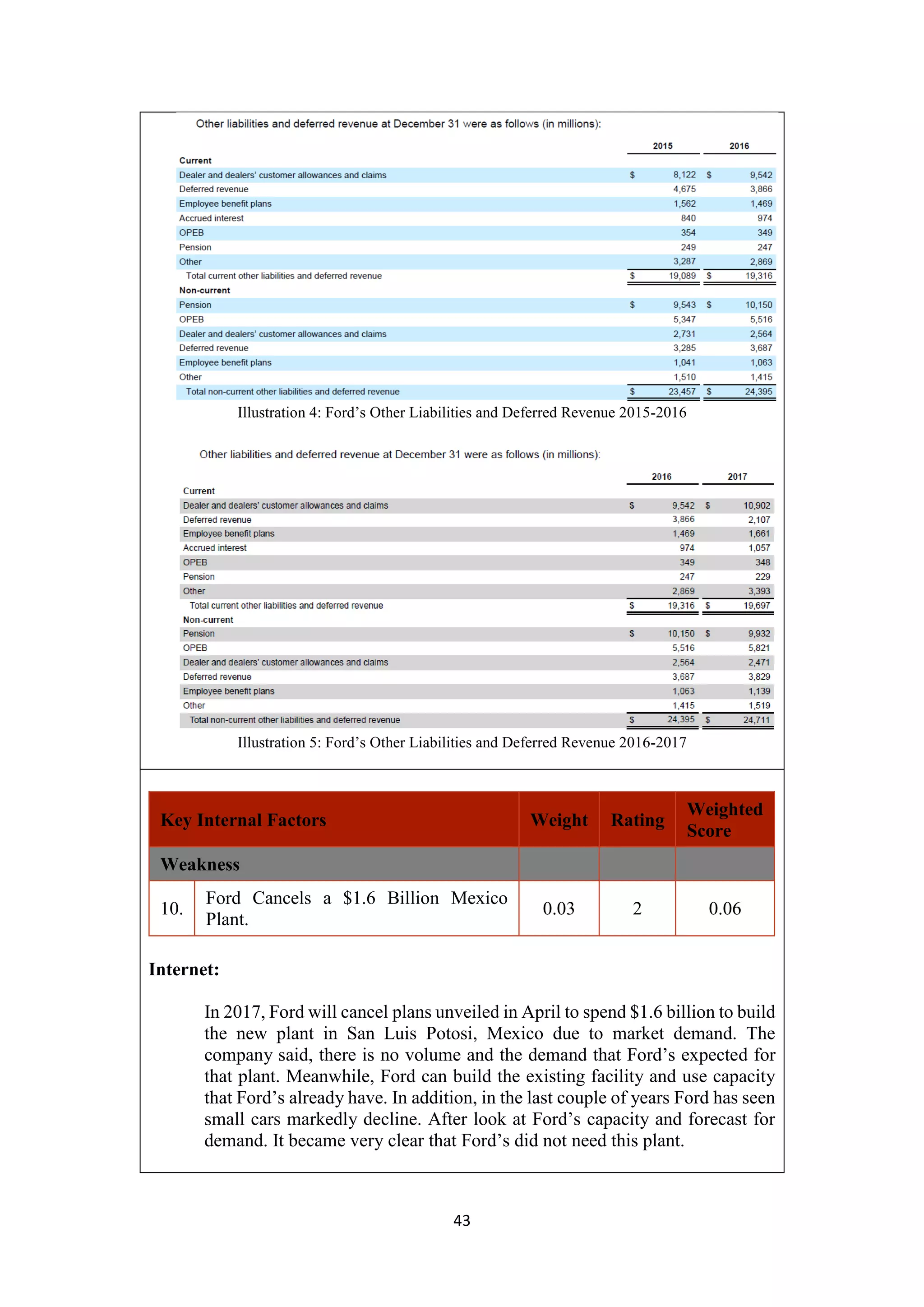

The document discusses constructing an internal factor evaluation (IFE) matrix for Ford Motor Company in 2015. It provides the 20 key internal factors for Ford identified through an internal audit, assigns weights and ratings to each factor, and calculates the total weighted score. The analysis finds that Ford has an above average total weighted score of 2.79, indicating room for improvement, and that door handle and seat belt issues were a notable weakness.