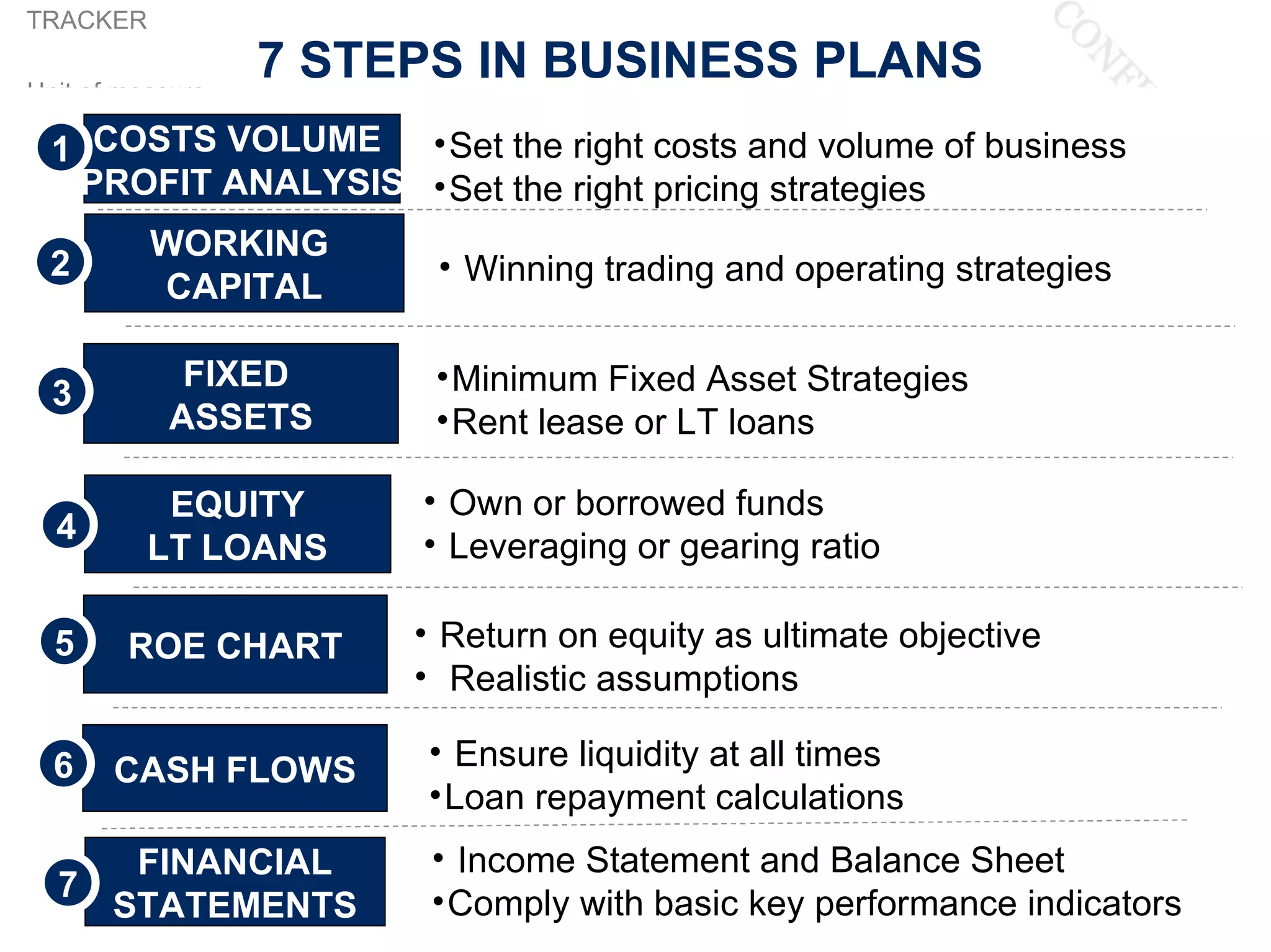

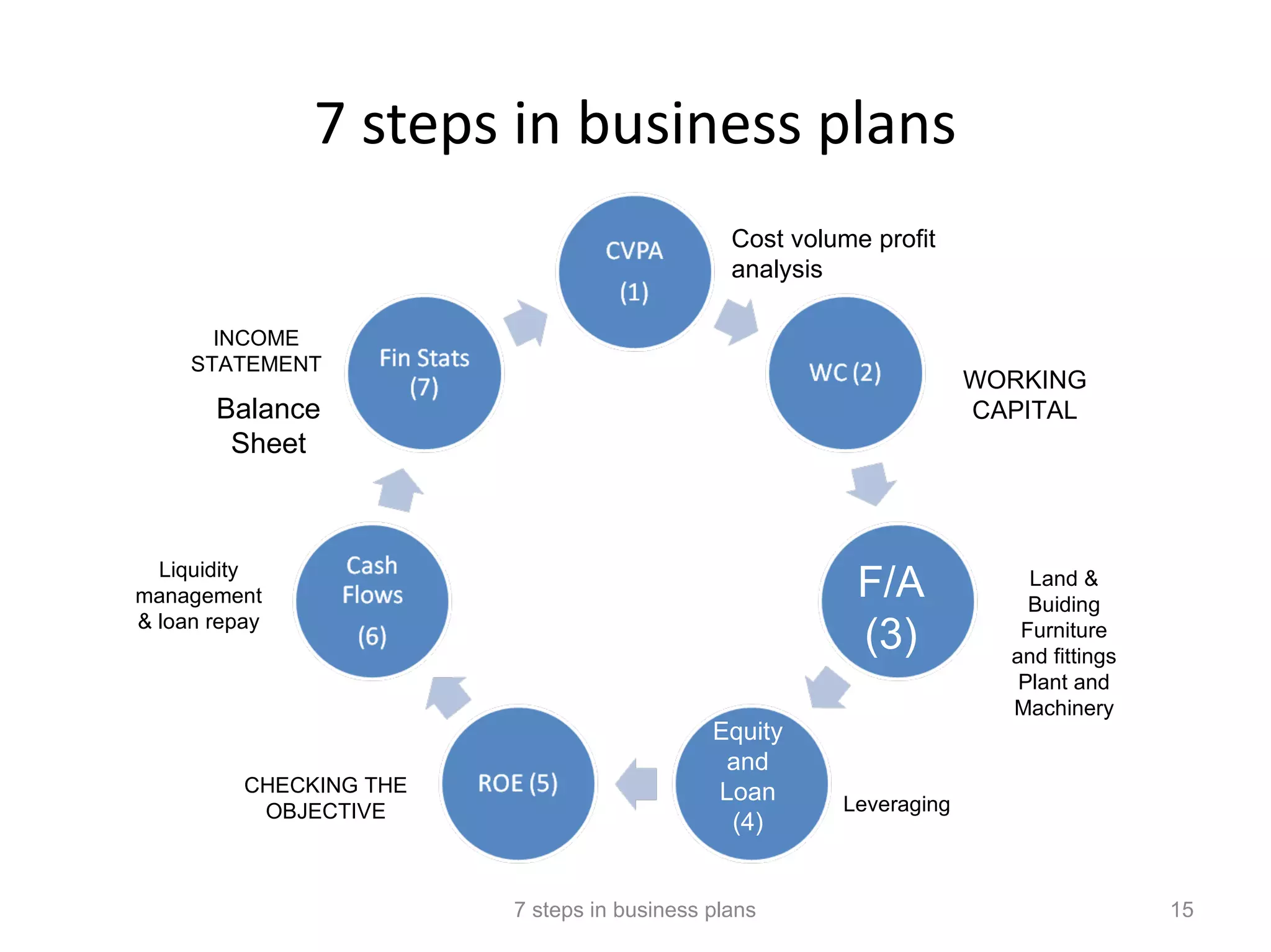

The document outlines 7 steps for developing a business plan: 1) conduct a cost-volume-profit analysis, 2) determine working capital requirements, 3) determine fixed asset strategies, 4) determine equity and loan financing needs, 5) set a target return on equity using the DuPont model, 6) project cash flows, and 7) construct financial statements. Each step is then described in more detail over several pages.