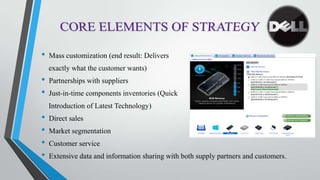

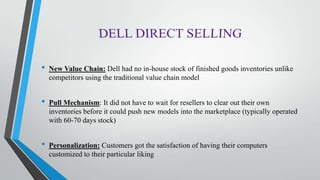

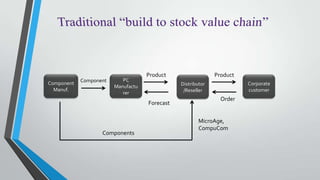

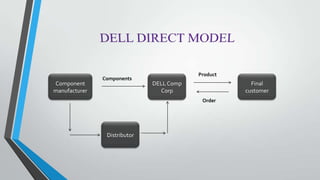

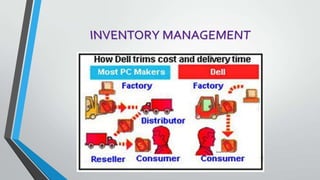

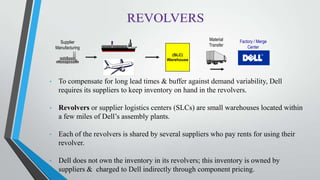

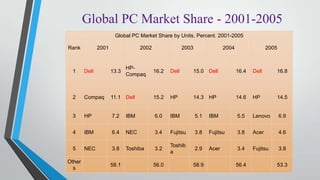

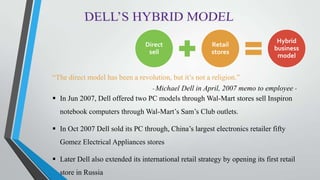

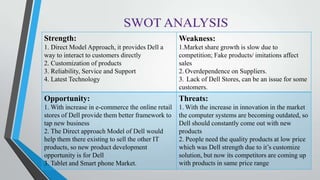

Michael Dell started Dell Computer in 1984 out of his dorm room at the University of Texas with $1000. Dell pioneered a direct sales model where it built computers to customer specifications and shipped directly to consumers without retailers. This allowed Dell to eliminate inventory costs and quickly introduce new technologies. By 2001, Dell became the largest PC maker in the world, but has faced challenges recently from the decline in PC sales as tablets and smartphones increased in popularity. In response, Dell went private in a $24 billion deal in 2013 to restructure away from its reliance on PCs.