The document provides an overview of sustainable resource management in the UAE, including:

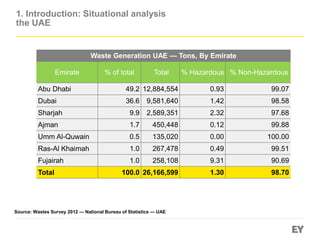

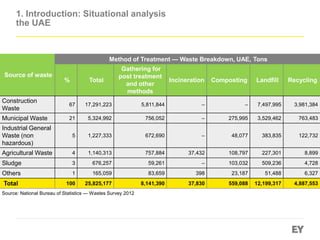

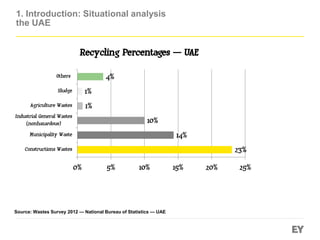

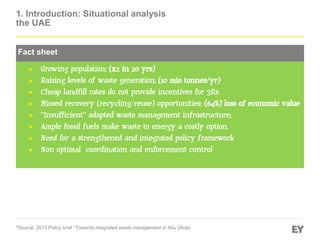

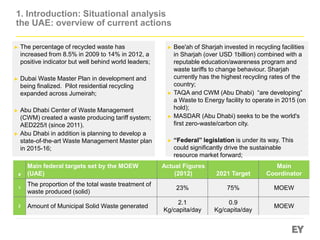

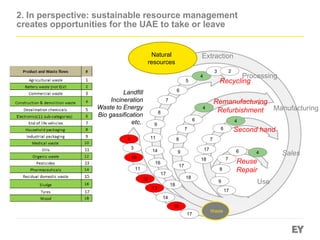

1. Current waste generation and treatment methods, with opportunities for improved recycling.

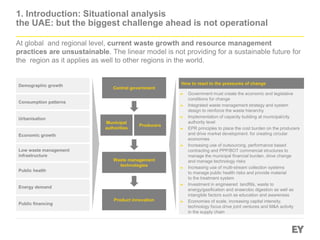

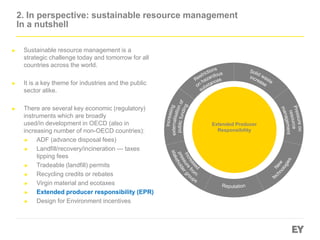

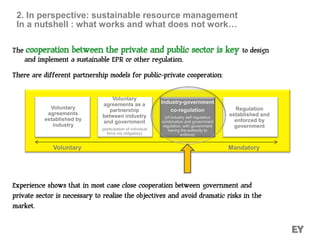

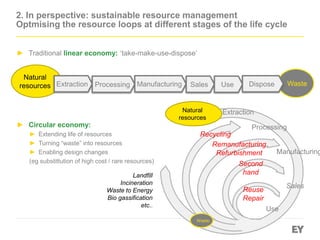

2. The need for integrated waste management strategies and policies to transition to a circular economy model.

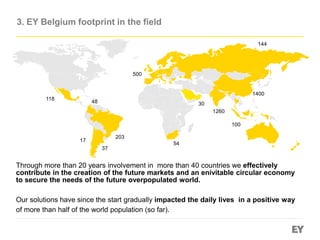

3. EY Belgium's expertise in sustainable resource management and working with governments on circular economy solutions globally.