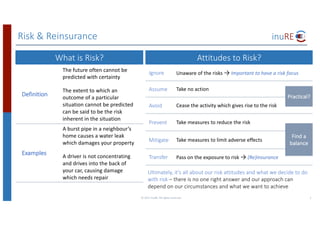

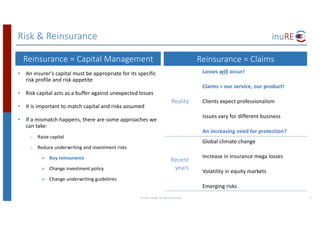

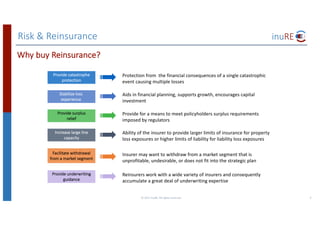

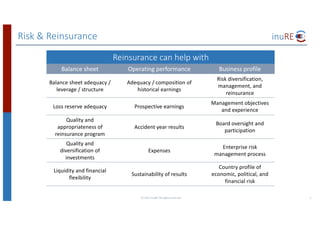

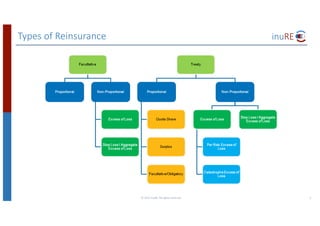

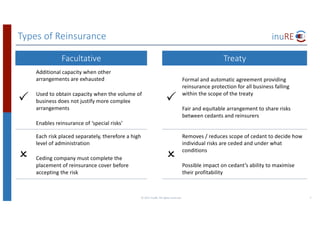

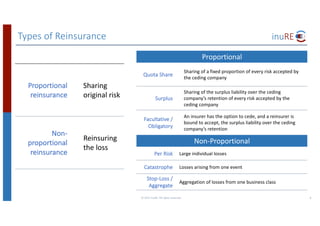

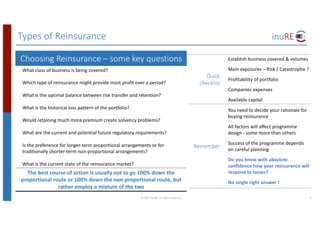

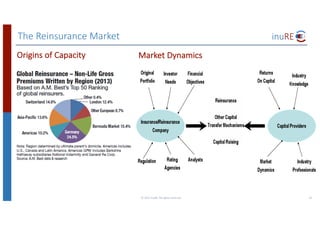

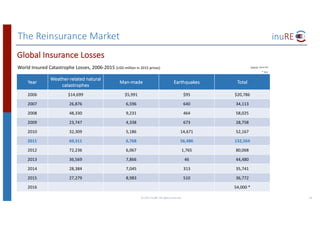

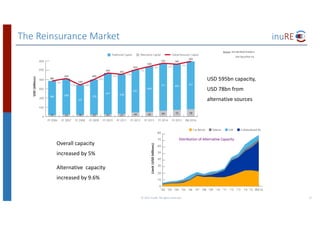

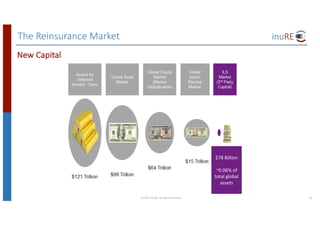

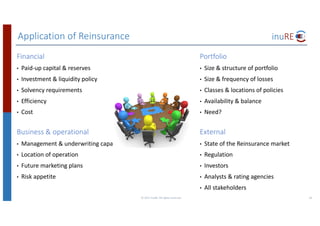

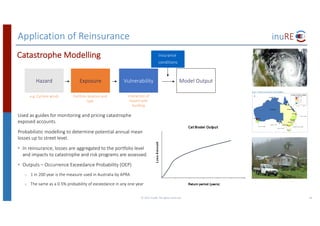

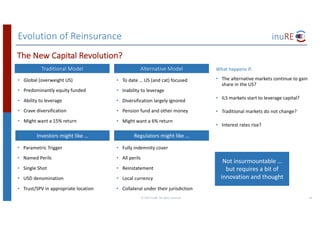

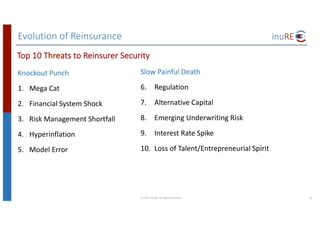

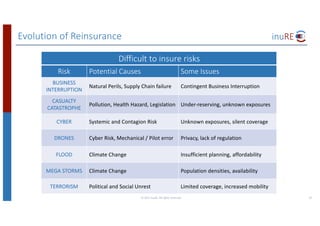

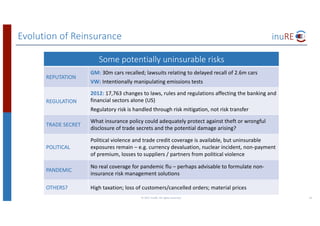

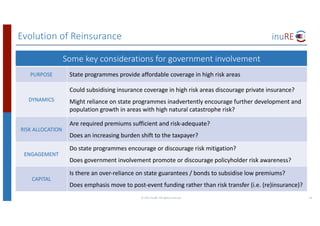

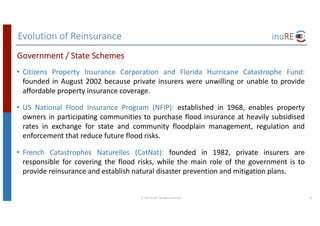

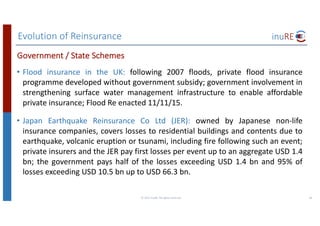

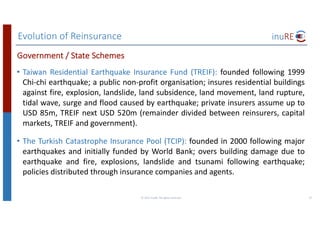

The document discusses the financial management of climate risks in the Pacific region, focusing on the role of reinsurance in balancing risk and capital management. It outlines different types of reinsurance, their applications, and factors influencing the choice of reinsurance, such as market conditions and regulatory requirements. Additionally, it highlights the importance of catastrophe modeling and the evolving landscape of the reinsurance market amidst increasing climate-related losses.