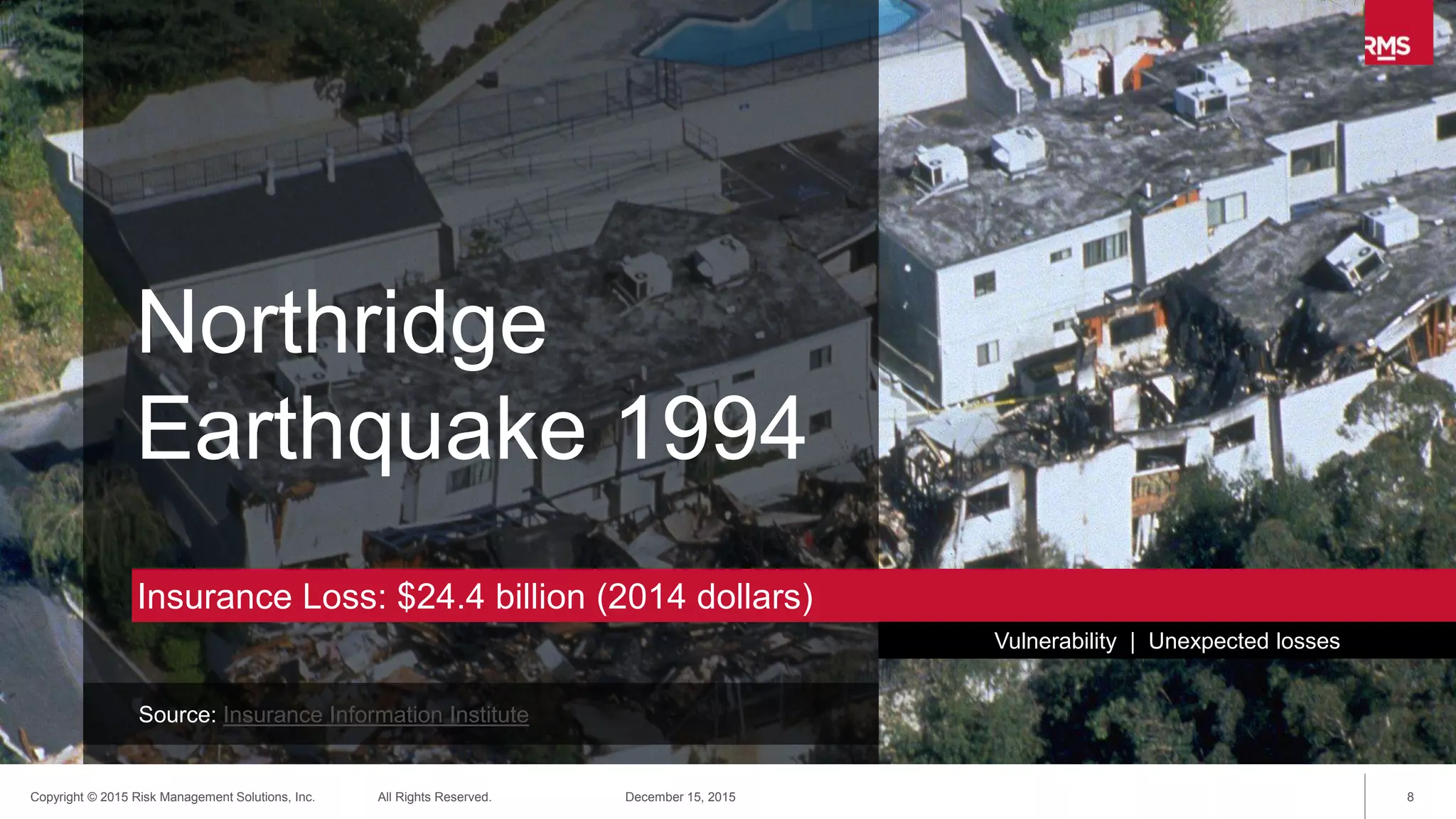

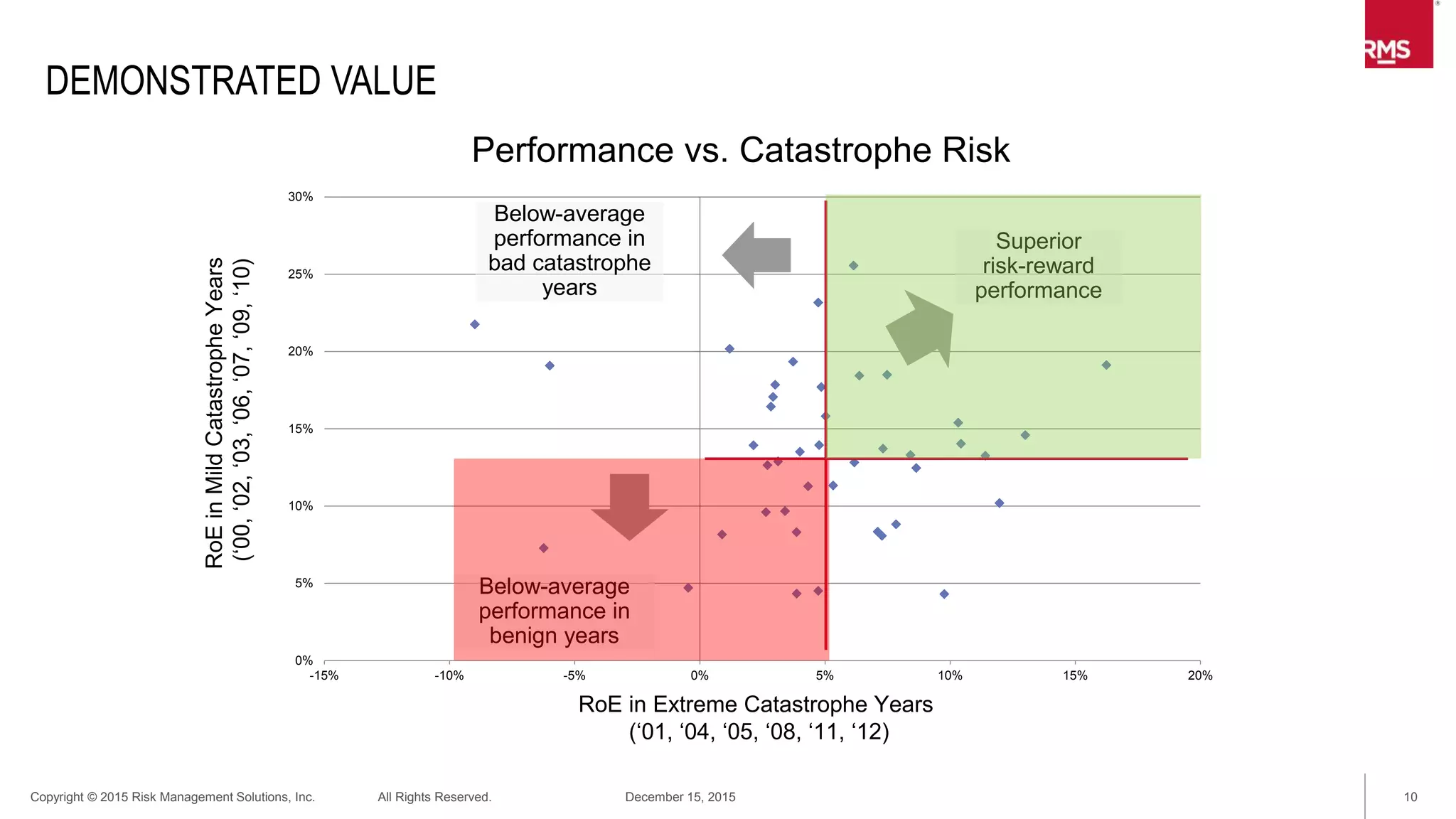

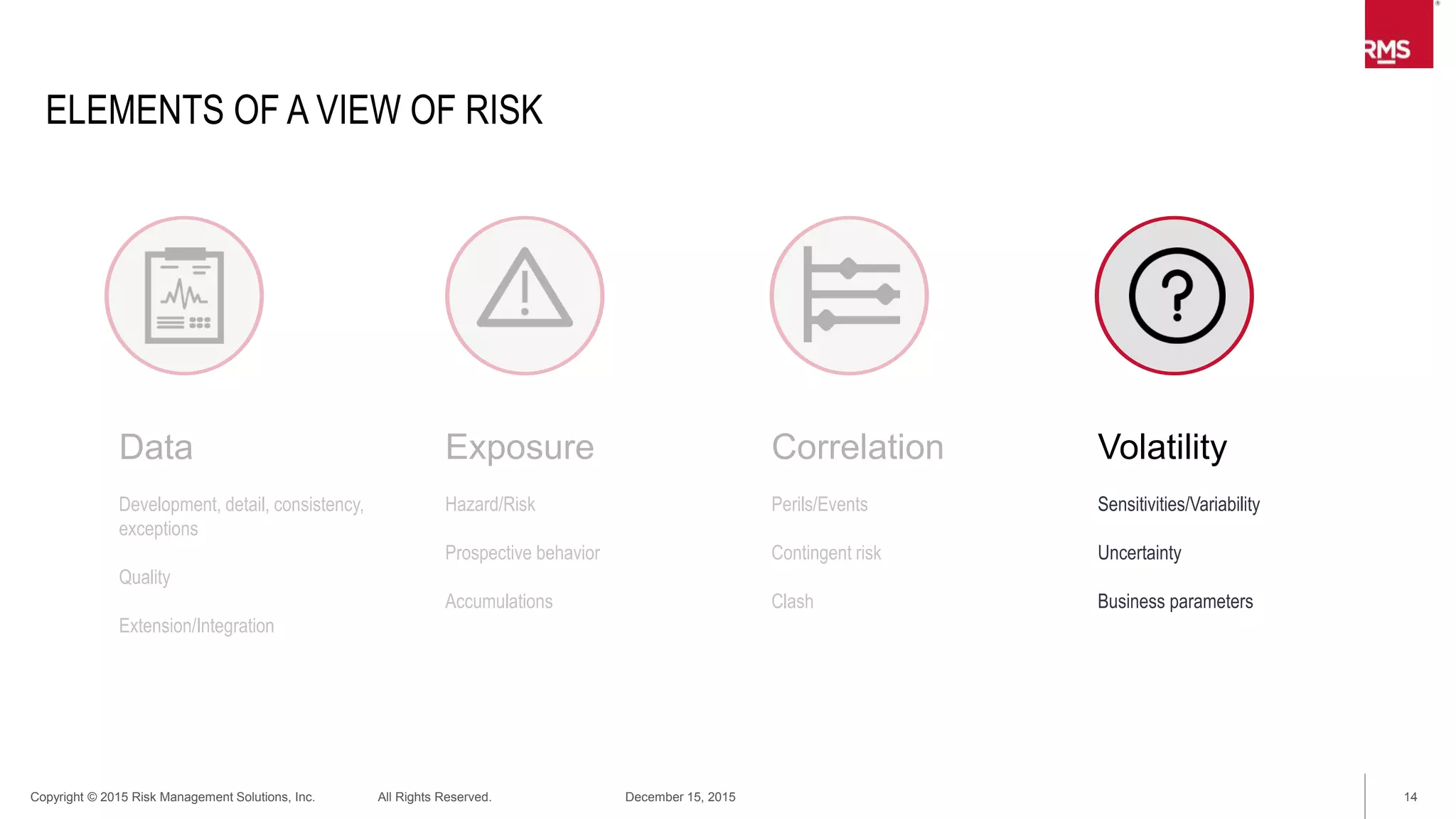

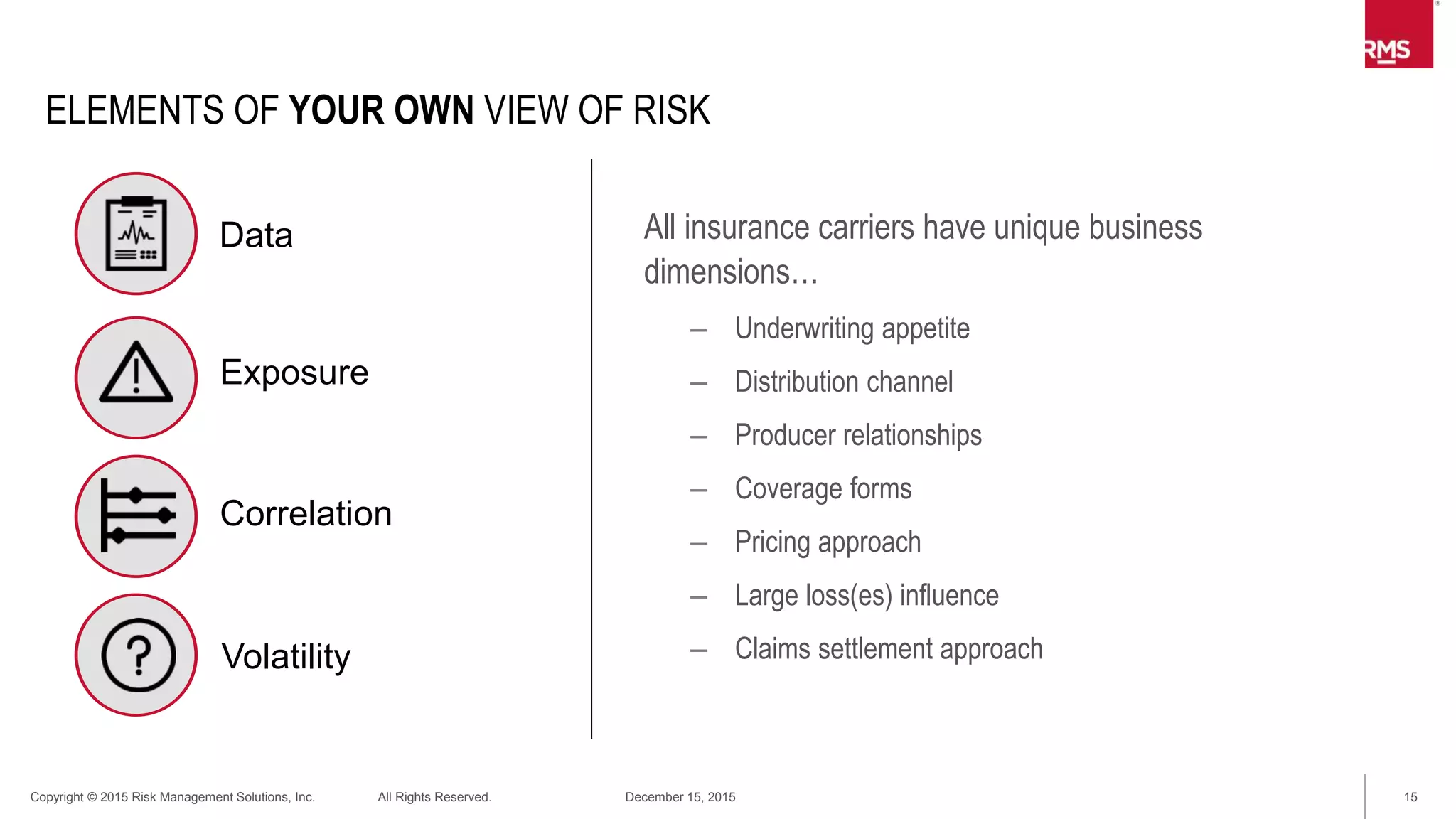

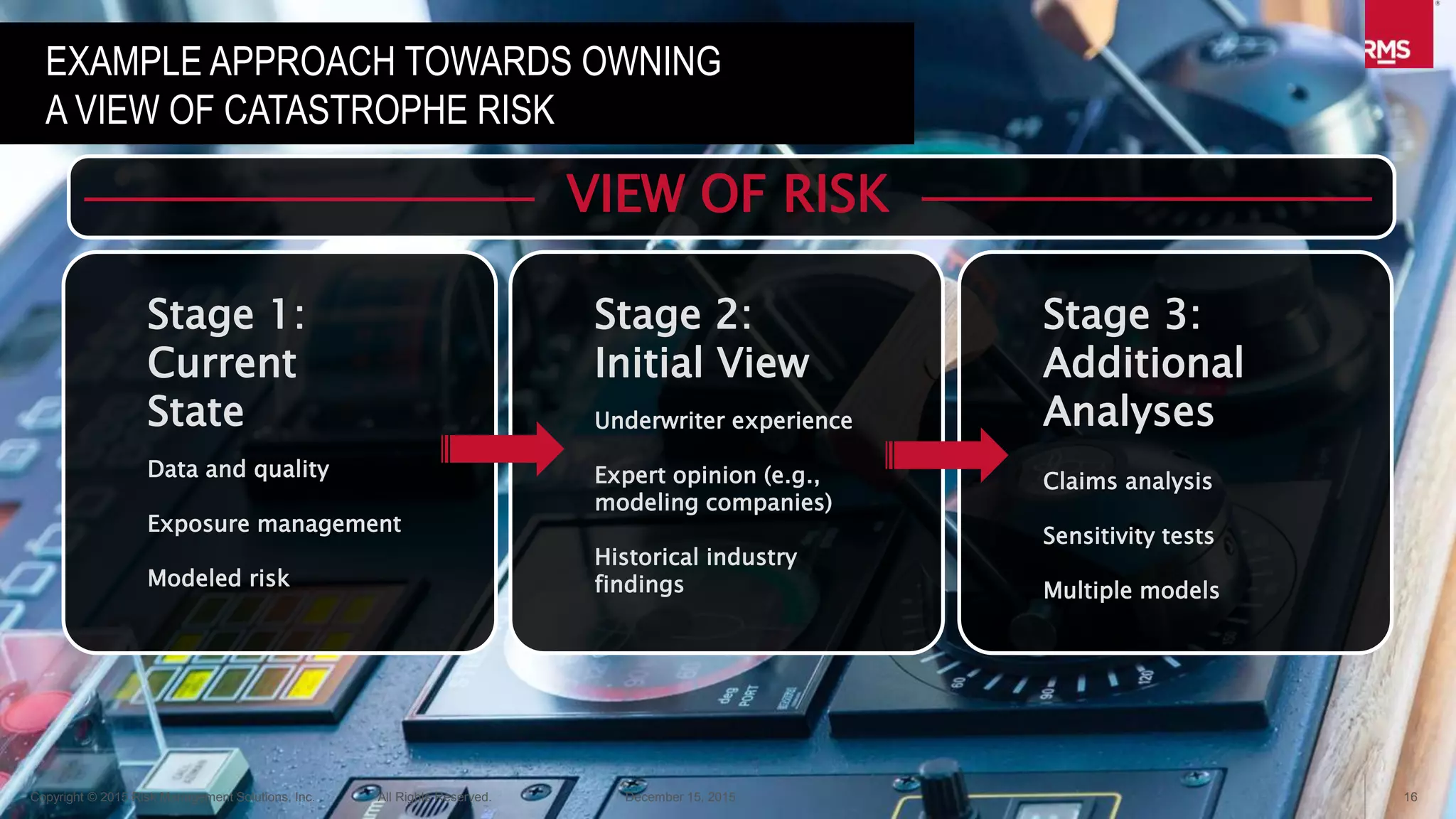

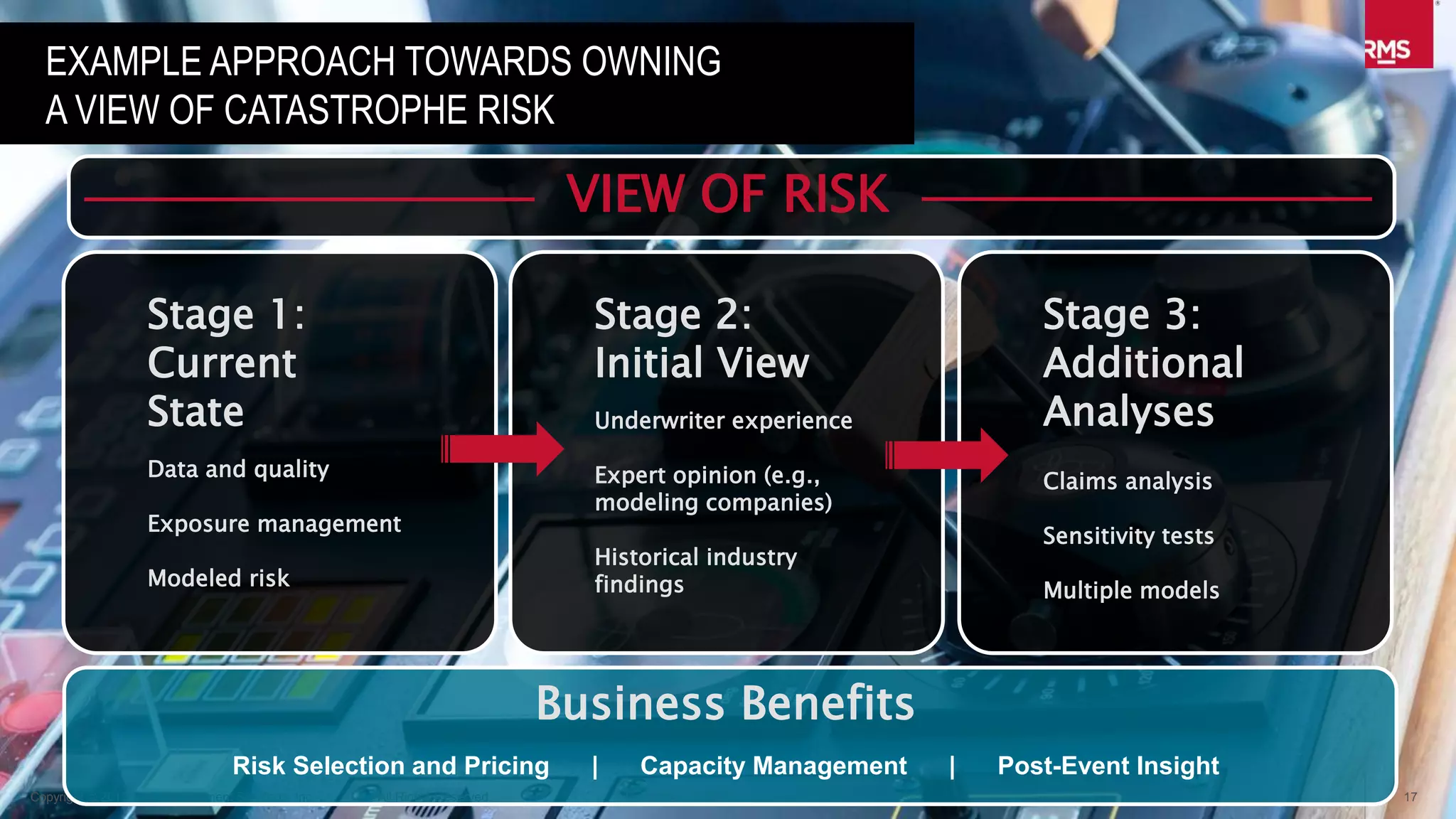

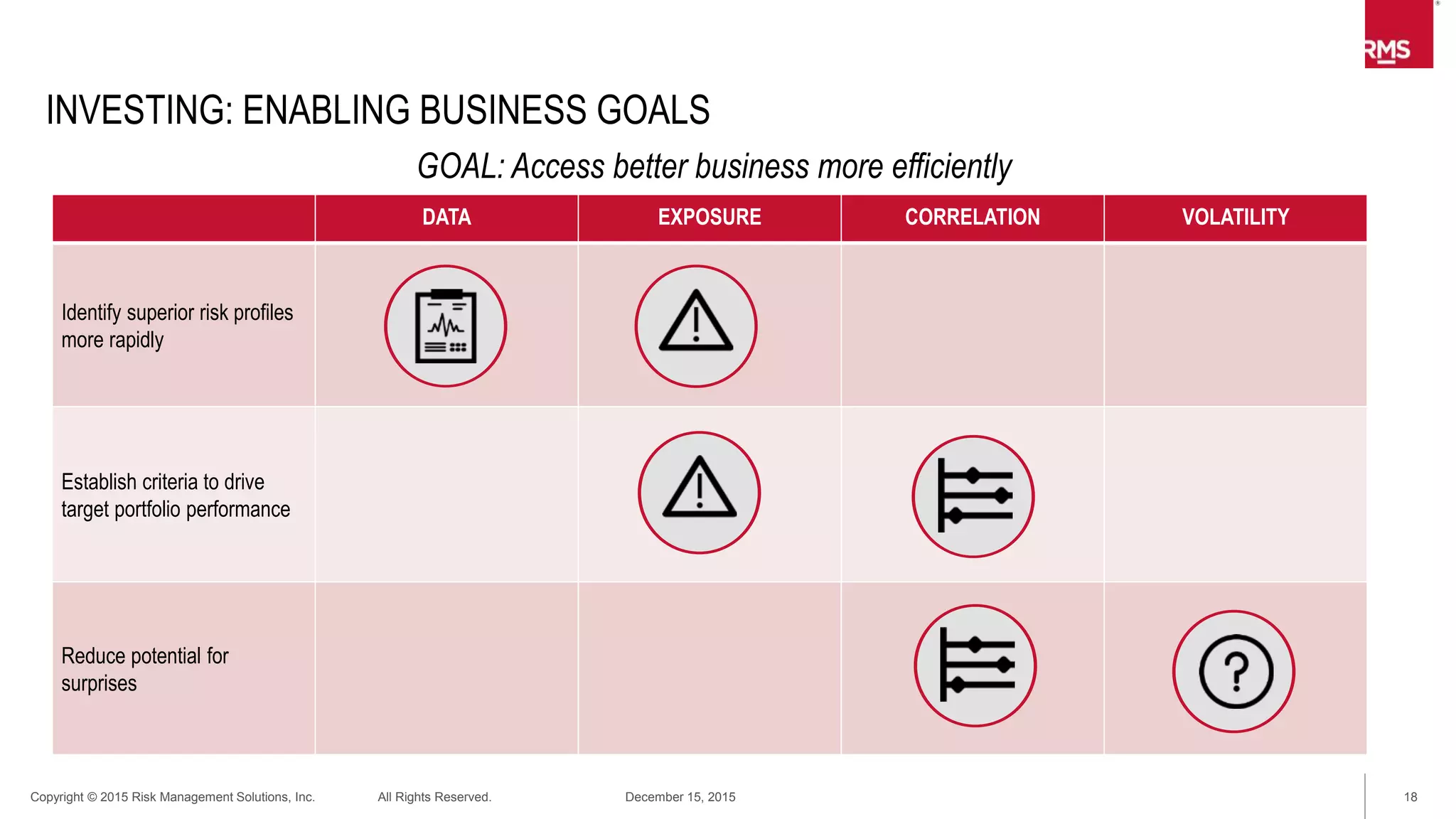

The document discusses the importance of 'owning your view of risk' in a changing market, emphasizing the need for businesses to understand their unique risk profiles and establish effective risk management practices. It outlines the components necessary for building a comprehensive view of risk, including data analysis, correlation, and business parameters. The document also highlights the benefits of this approach for risk selection, pricing, and overall business performance.