Managing Financial Resources Module Handbook

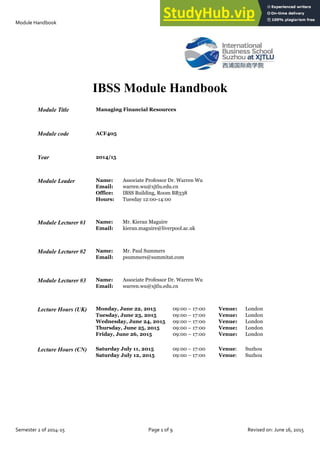

- 1. Module Handbook ACF405 Managing Financial Resources Semester 2 of 2014-15 Page 1 of 9 Revised on: June 16, 2015 IBSS Module Handbook Module Title Managing Financial Resources Module code ACF405 Year 2014/15 Module Leader Name: Associate Professor Dr. Warren Wu Email: warren.wu@xjtlu.edu.cn Office: IBSS Building, Room BB338 Hours: Tuesday 12:00-14:00 Module Lecturer #1 Name: Mr. Kieran Maguire Email: kieran.maguire@liverpool.ac.uk Module Lecturer #2 Name: Mr. Paul Summers Email: psummers@summitat.com Module Lecturer #3 Name: Associate Professor Dr. Warren Wu Email: warren.wu@xjtlu.edu.cn Lecture Hours (UK) Monday, June 22, 2015 09:00 – 17:00 Venue: London Tuesday, June 23, 2015 09:00 – 17:00 Venue: London Wednesday, June 24, 2015 09:00 – 17:00 Venue: London Thursday, June 25, 2015 09:00 – 17:00 Venue: London Friday, June 26, 2015 09:00 – 17:00 Venue: London Lecture Hours (CN) Saturday July 11, 2015 09:00 – 17:00 Venue: Suzhou Saturday July 12, 2015 09:00 – 17:00 Venue: Suzhou

- 2. Module Handbook ACF405 Managing Financial Resources Semester 2 of 2014-15 Page 2 of 9 Revised on: June 16, 2015 Aims 1. To provide students with an understanding of the responsibilities of organizations to various stakeholders, the context of financial information requirements, and interpretation of financial statements. 2. To enable students to understand how managers exercise control of financial resources and make financial decisions in order to optimize shareholder wealth. 3. To provide students with an understanding of the value chain and how financial resources can be managed to add value and how linkages between financial resources and value systems are created for competitive advantage. 4. To help students understand how and from where business can raise capital. Required Textbooks For Financial Accounting and Reporting: Atrill, Peter, and Eddie McLaney (2014). Accounting and Finance for Non-specialists, 9th Edition. Pearson. ISBN: 978-1292062716 Chapter Chapter Title Reading to be Prepared prior to Class Meeting 2 Financial Position No prior reading required 3 Financial Performance No prior reading required 5 Cash Flows No prior reading required 6 Analysis and Interpretation No prior reading required For Managerial Accounting: Atrill, Peter, and Eddie McLaney (2013). Accounting and Finance for Non-specialists, 8th Edition. Pearson. ISBN:978-0-273-77816-5 Chapter Chapter Title Reading to be Prepared prior to Class Meeting 7 The Relevance and Behaviour of Costs No prior reading required 8 Full Costing No prior reading required 9 Budgeting No prior reading required 10 Making Capital Investment Decisions No prior reading required For Financial Decisions: Ross, Stephen A., Westerfield, Randolph W., and Jaffe, Jeffrey (2010). Corporate Finance, International Edition. McGraw-Hill Irwin. ISBN: 0-077-33762-x Chapter Chapter Title Reading to be Prepared prior to Class Meeting 7 Risk Analysis, Real Options, and Capital Budgeting Sensitivity, Scenario, Simulation, and Real-option Analyses 13 Risk, Cost of Capital, and Capital Budgeting Estimation and Determinants of Beta, Weighted Avg Cost of Capital 15 Long-term Financing: An Introduction Corporate Long-term Debt, Recent Trends in Capital Structure 16 Capital Structure: Basic Concepts Maximizing Firm Value versus Maximizing Stockholder Interests 26 Short-term Finance and Planning Operating & Cash Cycles, Cash Budgeting, Short-term Financial Plan Recommended Readings Atkinson, A.A., R.S. Kaplan, E.M. Matsumura, and S.M. Young (2011). Management Accounting: Information for Decision-making and Strategy Execution, International Edition. Pearson. ISBN: 0-273-76998-7 Damodaran, Aswath (2001) Corporate Finance: Theory and Practice, 2nd Ed. Wiley. ISBN: 0-471-28332-0 Methods of Teaching and Learning A combination of teaching, learning, and private-study methods shall be utilised in this module. Essential concepts will be presented and delivered in a sequence of 36-hour lectures plus a set of 24-hour practical learning exercises or case studies along with a 90-hour of students’ independent study throughout the semester that would culminate in their two assessable individual assignments. Performance Assessment Type Weight Assessment Topic Individual Assignment #1 66% Financial Accounting & Reporting and Managerial Accounting Individual Assignment #2 34% Financial Accounting & Reporting, Managerial Accounting, and Financial Decisions Total 100%

- 3. Module Handbook ACF405 Managing Financial Resources Semester 2 of 2014-15 Page 3 of 9 Revised on: June 16, 2015 Syllabus & Teaching Plan Date Study Topic Textbook Chapter June 22, 2015 Accounting for Limited Companies in order to explain a generic nature of and specific features in different types of limited-liability companies (i.e., firms), explore alternative frameworks that are designed to maximize while safeguarding their shareholders’ interests, and understand how financial-statement details are different across those firms. Chapters 2,3,4,5 June 23, 2015 Analysing and Interpreting Financial Statements in order to identify a firm’s measures of performance and value such as financial-ratio categories and key performance indicators (KPIs), determine such measures from calculations, and understand the pros and cons of each of those measures in financial analysis and decision-making. Chapter 6 June 24, 2015 Financial Modeling in order to use of Microsoft® Excel to build income statements, balance sheets, and cash flow statements from historic data and assumptions. The content is aimed at showing the functionality and shortcuts within Excel to build faster, more efficient and effective financial models which can be used for decisions. To be advised June 25, 2015 Cost-based Decisions in Business in order to explore cost behaviour based on the marginal- and full-costing approaches for short-term operating decisions, explain the cost-volume-profit relationship, and determine the optimal break-even point within the frameworks of marginal and full-costing analysis. Chapters 7 & 8 Activity-based Environments in order to assess the cost drivers and the application of activity-based costing (ABC) and activity-based management (ABM), the learning outcomes from which are developed through interactive seminars, problem-solving exercises and case studies. Chapter 8 June 26, 2015 Budgeting in order to consider various budgeting approaches and their critical appraisal methods within a firm for operating-and-financial-control purposes, the learning outcomes from which are developed through interactive seminars, problem-solving exercises and case studies. Chapter 9 Investing for Future Capabilities in order to explore a firm’s investment-appraisal techniques and the impacts of its long- term investment decisions on society and environment, the learning outcomes from which are developed through interactive seminars, problem-solving exercises and case studies. Chapter 10 Mon June 29, 2015 Availability of Individual Assignment #1 questions on ICE from 00:00 Beijing time 8 days to complete Mon July 6, 2015 Submission of Individual Assignment #1 answers through ICE by 23:55 Beijing time July 11, 2015 Capital Budgeting Decision in order to drive a firm’s future growth, which requires an analysis of not only relevant cash flows but also related downside variability and/or upside flexibility from new investment or restructuring opportunities. Case Study #1: Ocean Train PLC Chapter 7 Cost of Capital Measurement in order to derive a firm’s present value, which require an assessment of its risk-adjusted opportunity cost of capital (hurdle rate) for discounting its cash flows and embedded business volatility or flexibility. Case Study #2: Crowlands PLC Chapter 13 July 12, 2015 Capital Structure Decision in order to lower a firm’s funding costs, which requires a management of its capital structure (debt ratio) through theories and practices on financial leverage that affect firm value and its shareholders’ wealth. Case Study #3: Sorina PLC Chapter 16 Long-term Financing Decision in order to employ a firm’s external capital for its investment opportunities, which requires an awareness of alternative sources of funds as well as an assessment of their merits, costs, and risks. Case Study #4: Newton PLC Chapter 15 Short-term Financial Management in order to deploy a firm’s working capital into its current assets and liabilities, which affects its operating and cash cycles as well as financing cost and return based on the firm target cash levels. Case Study #5: Keafer PLC Chapter 26 Sun July 12, 2015 Availability of Individual Assignment #2 questions on ICE from 00:00 Beijing time 4 days to complete Thu July 16, 2015 Submission of Individual Assignment #2 answers through ICE by 23:55 Beijing time Study Topic Weights Financial Accounting & Reporting 33% Managerial Accounting 33% Financial Decisions 34% Total 100%

- 4. Module Handbook ACF405 Managing Financial Resources Semester 2 of 2014-15 Page 4 of 9 Revised on: June 16, 2015 Study Topic Learning Outcomes Financial Accounting & Reporting Understand the accounting principles for various forms of business organisations Demonstrate the capability to analyse companies financial statements Demonstrate the capability to Interpret companies financial reports Demonstrate the capability to measure companies financial positions and report their balance sheets Demonstrate the capability to measure companies financial performance and report their income statements Demonstrate the capability to measure companies cash-flow activities and report their cash flow statements Demonstrate the capability to utilise a spreadsheet software to build financial statements and analyse financial reports Managerial Accounting Compare fixed and variable costs and explain the relationship between cost, volume and profit. Calculate the break-even point for an activity and critically appraise the use of breakeven analysis. Deduce the full cost of a product. Apply the Activity-based Costing (ABC) technique and critically appraise its value to a given company. Understand the concept of the time value of money. Apply the concepts of net present value (NPV), the internal rate of return (IRR), the accounting rate of return (ARR) and payback period to capital-investment decisions. Critically discuss the investment appraisal techniques. Define a budget and relate it to the strategic objectives of an organisation. Appraise the different methods of budgeting commonly used within an organisation. Financial Decisions Identify relevant cash flows from a firm s new investment opportunity along with any additional implication arising from the firm s operating variability and/or flexibility. Perform a complex capital-budgeting analysis on new investment propositions in light of different sensitivity issues. Determine a firm s cost of equity and cost of debt from its market-risk exposure and other relevant data Derive a firm s weighted-average cost of capital for either its new projects or the whole firm. Analyse a firm s capital structure based on alternative theories and practices. Choose for a firm its long-term funding sources based on their impacts on shareholder value. Plan for a firm s short-term financial requirements based on its working-capital policy.

- 5. Module Handbook ACF405 Managing Financial Resources Semester 2 of 2014-15 Page 5 of 9 Revised on: June 16, 2015 Financial Decisions: Case Study Exercise #1 Capital Budgeting Decision Company Background Ocean Train PLC (Ocean) is considering establishing a premium, high-speed ferry service between Liverpool and the Isle of Man, which lies around 70 miles off the coast of the UK. Ocean has been researching the viability of this new service with a consultancy firm, Skudder Brothers SB . The service would be branded the Manx Link and would commence on January 20x3. SB has advised Ocean to appraise the project over a three-year investment horizon. Project Information SB has drawn up the following estimates for the new ferry service: Year to 31/12/2013 Year to 31/12/2014 Year to 31/12/2015 Total Number of Ferry Crossings 540 720 720 Average Number of Passengers per Ferry Crossing 100 125 150 SB has also made the following estimates at 31 December 2012 prices: The average ticket price per passenger will be £90; Port charges will be £1,100 per ferry crossing; Administrative costs will be £2 per passenger; Labour costs for on-board and port staff will be £600,000 per annum (p.a.); Ocean will have to spend £100,000 p.a. on servicing and maintenance; and Ocean will have to spend £ , p.a. advertising the Manx Link service. Given the environmentally-friendly nature of sea travel relative to air travel, the UK government has stated that it would subsidize Ocean s proposed service from its launch date making a payment to Ocean of % of annual sales revenue at the end of each calendar year. However, this subsidy will only cover the first two years of the service. The subsidy will have no tax impact. To operate the service, Ocean needs to purchase a new ship which has been confirmed that delivery could be made in time to start the service on 1 January 2013. The purchase price would be £8 million, payable on 31 December 2012. SB has looked into the likely residual value of the ship and feels that Ocean could expect to realize £4 million on 31 December 2015 if it were to sell the ship at that time. Directors’ Assumptions Ocean s directors believe that the ship will attract a full capital allowance at % p.a. on a reducing-balance basis commencing in the year of purchase and continuing throughout Ocean s ownership, except in the year of disposal when a balancing charge will arise. They also believe that Ocean would pay corporate tax at a rate of 21% payable at the end of the year to which profits relate. They use a real discount rate of 10% for investment appraisal. It is assume that all cash flows take place on the last day of Ocean s accounting year December . Except for the purchase price and anticipated residual value of the ship, all costs and revenues are subject to an inflation rate of 3% p.a. Ocean s finance director has estimated that loan interest charge of £168,000 p.a. will be incurred as a direct result of the investment and advised the board that SB s consultancy fee of £ , will be payable on December whether or not Ocean decides to proceed with the investment. One director has requested that the sensitivity of the project s net present value be examined in respect of two key variables, i.e., sale revenues and the residual value of the new ship. Requirements 1) Calculate the net present value (NPV) of the Manx Link investment proposal at December and advise Ocean s board of directors whether it should proceed with the investment. 2) Advise Ocean s board of directors of the sensitivity of the NPV of the Manx Link investment to: a) Changes in sales revenues; and b) Changes in the residual value of the ship

- 6. Module Handbook ACF405 Managing Financial Resources Semester 2 of 2014-15 Page 6 of 9 Revised on: June 16, 2015 Financial Decisions: Case Study Exercise #2 Cost of Capital Measurement Company Background Crowlands PLC (Crowlands) is a listed manufacturing company financed by a mixture of debt and equity. The firm s finance department is about to undertake its annual revision of the weighted average cost of capital (WACC) for use in all of its investment appraisals for the forthcoming year. Financial Information The following information on Crowlands s long-term financing was available as at 31 May 2011: 220 million Ordinary Shares of £0.25 each £ 55 m Share Premium £ 23 m Revaluation Reserve £ 26 m Retained Earnings £ 33 m 12% Loan Stock (mature in 2013) £ 100 m The loan stock interest for the year has just been paid. Interest on this loan will be paid on 31 May 2012 and 2013. On the latter date, the loan stock will be redeemed at par in case. The firm has also just paid a dividend on its ordinary shares of £0.23 each. This was the total dividend for the year. Dividends have grown by an average annual rate of 5% over recent years, but year-to- year growth has been as high as 10% and as low as 2% during individual years. The shares are currently quoted at £3.70 each, and the loan stock at £104 (£100 par . The firm s corporation tax rate is %. Directors’ Assumptions Crowlands s board of directors believes that the firm is relatively low-geared and there is talk of making a substantial loan- stock issue during the forthcoming year. Requirements 1) Determine Crowlands s WACC, ignoring any possibility of a further loan-stock issue. All calculations should be clearly explained and the weightings for debt and equity should be justified. 2) Explain any reservations you might have about using the figure determined in (1) for assessing all potential projects during the forthcoming year, still ignoring any possibility of the loan-stock issue. 3) Explain how, in theory and practice, a possible loan-stock issue would affect the validity of the WACC determined in (1). Financial Decisions: Case Study Exercise #3 Capital Structure Decision Company Background Sorina PLC (Sorina) has always been an all-equity financed company with a cost of capital of 15%. The finance director, Mr. Brush, has read an article extolling the benefits of raising debt finance and has asked you to provide him with advice as to how Sorina should finance itself for the future. He is also interested in what discount rate he should be using for project appraisal. Comparative Information In order to assist you, Mr. Brush has helpfully collected data on four companies, which is summarized below: Company Debt: Equity Ratio Ex-dividend Share Price Dividend per Share P 0 £ 1.00 £ 0.12 Q 1 : 1 £ 2.00 £ 0.36 R 0 £ 1.50 £ 0.24 S 1 : 3 £ 3.00 £ 0.58 For each of these companies, the dividends have been constant at the above levels for many years. Company P and Q operate in the same industrial sector, while companies R and S both operate in a different industrial sector that is perceived as more risky than that of companies P and Q. Director’s Assumptions Mr. Brush indicates that all four companies and Sorina itself operate in Widbergia, a country that is at present a tax-free society. Moreover, long-term debt which may be assumed to be risk-free is currently yielding 6% per annum to investors. Requirements 1) Comment on the data supplied by Mr. Brush in relation to the optimal capital structure of Sorina and advise him on an appropriate discount rate for project appraisal. 2) Indicate how your advice might change if corporate taxes were introduced into Widbergia.

- 7. Module Handbook ACF405 Managing Financial Resources Semester 2 of 2014-15 Page 7 of 9 Revised on: June 16, 2015 Financial Decisions: Case Study Exercise #4 Long-term Financing Decision Company Background Newton PLC (Newton) is a well-established retailer of gymnasium equipment. The firm s key market is in southern and central England. Extracts from its most recently published annual report as at 31 December 2006 are shown below. Newton’s Financial Statements (in thousand) Inventories £ 3,780 Trade Receivables £ 3,668 Non-current Assets £ 3,518 Short-term Borrowings £ 2,240 Trade Payables £ 2,870 Other Payables £ 372 Ordinary Shares (par £0.5o) £ 980 Retained Earnings £ 1,954 Financing Requirements Newton s finance director has calculated that the firm needs to raise £ , , of additional long-term funds to provide finance for the following three matters: Over the past three years, Newton s annual revenue has changed very little, and so its management is considering extending operations into northern England and Scotland. This would necessitate expenditure of £950,000 on new buildings and vehicles at the firm s existing distribution centre. Newton uses only bank overdraft as its short-term borrowings, and it is under pressure from the bank to reduce that, which has stayed close to its current level for the past 18 months to £2 million. Newton s trade suppliers are unhappy that they have to wait, on average, days to receive payment and would like this figure reduced by 10 days. Other information that happened during 2006 relevant to the situation includes: Total Revenue £ 28.5 m Net Margin before Interest 3.00% Bank Overdraft Interest Rate 17.50% Dividends per Share (DPS) £ 0.0500 Earnings per Share (EPS) £ 0.0925 Gearing using Book Value: Debt/(Debt+Equity) 46.5% Existing 8% Debentures (Redeemable in 2011) £ 2.55 m Newton s marketing director believes that the expansion into northern England and Scotland will generate additional revenue of £6 million in 2007 and, because of the impact of fixed costs, it is estimated that the net margin on these extra sales (before interest expense would be %. Newton s management estimates that the dividend per share will be maintained in . Financing Choices For the additional long-term funds, Newton s management wishes to use either An issue of irredeemable debentures with a coupon rate of 10%. Currently, investors expect a 12% return on similar debentures in the market, or A rights issue with new shares priced at 20% below the market value of £1.55 per share. The corporation tax rate is %. Newton s management has assumed that there will be no additional working-capital requirements associated with the additional revenue. Requirements 1) Assuming that Newton needs to raise £1,827,777, calculate its projected earnings per share and gearing figures for 2007 if it raises those funds by (i) a debenture issue or (ii) a rights issue. 2) Based on (1) above, recommend with reasons which method of long-term financing Newton s management should choose.

- 8. Module Handbook ACF405 Managing Financial Resources Semester 2 of 2014-15 Page 8 of 9 Revised on: June 16, 2015 Financial Decisions: Case Study Exercise #5 Short-term Financial Management Company Background Keafer PLC (Keafer) is a small manufacturing firm that produces highly customized cardboard boxes in a variety of sizes for different purchasers. Adam Keafer, the owner of the firm, works primarily in the sales and production areas of the company. Currently, the firm basically puts all receivables in one pile and all payables in another, and a part-time bookkeeper periodically comes in and handles those piles. Because of the disorganized system, the finance area needs to be improved. Current Information Keafer currently has a cash balance of £149,500, and it plans to purchase new machinery in the third quarter at a cost of £260,000. The purchase of this machinery will be made with cash balance of the discount offered for a cash purchase. Mr. Keafer would like to maintain a minimum cash balance of £90,000 to safeguard against unforeseen contingencies. All of the firm s sales to customers and purchases from its suppliers are made with credit, and no discounts are offered or taken. The firm had the following sales each quarter of the year just ended: Quarter 1 Quarter 2 Quarter 3 Quarter 4 Gross Sales £ 735,000 £ 761,000 £ 817,000 £ 709,000 The Analyst’s Tasks You have been hired by Keafer as a financial analyst to work in its accounting & finance department. After some research and discussion with customers, you are projecting that sales will be 8% higher in each quarter next year. Sales for the first quarter of the following year are also expected to grow at 8%. You calculate that Keafer currently has an accounts receivable period of 57 days and an accounts receivable balance of £553,000. However, 10% of the accounts receivable balance is from a company that has just entered bankruptcy, and it is likely that this portion will never be collected. You have also calculated that Keafer typically orders supplies each quarter in the amount of % of the next quarter s projected gross sales, and suppliers are paid in 53 days on average. Wages, taxes, and other costs run about 25% of gross sales. The firm has a quarterly interest payment of £148,000 on its long-term debt. Finally, the firm uses a local bank for its short-term financial needs. It currently pays 1.2% per quarter on all short-term borrowing and maintains a money-market account that pays 0.5% per quarter on all short-term deposits. Mr. Keafer has asked you to prepare a cash budget and short-term financial plan for the firm under the current policies. He has also asked you to prepare additional plans based on changes in several inputs. Requirements 1) Use the information provided above to complete the cash budget and short-term financial plan. 2) Rework the cash budget and short-term financial plan assuming Keafer changes to minimum cash balance of £70,000. 3) Rework the sales budget assuming an 11% growth rate in sales and a 5% growth rate in sales. Assume a £90,000 target cash balance. 4) Assuming the firm maintains its target cash balance at £90,000, what sales growth rate would result in a zero need for short-term financing? To answer this question, you may need to set up a spreadsheet and use the Solver function.

- 9. Module Handbook ACF405 Managing Financial Resources Semester 2 of 2014-15 Page 9 of 9 Revised on: June 16, 2015 Biographies of Teaching Staff Kieran Maguire is an ICAEW Chartered Accountant who started his career specialising in corporate restructuring for Grant Thornton. He then moved into training in the private sector for ATC International, specialising in financial accounting, financial reporting, economics, auditing, and taxation. In 2001 he moved to Manchester Metropolitan University Business School. During his time there he won the innovation in teaching and learning prize twice, the most inspirational lecturer award for the business school, the best overall lecturer award for the MMU, and the PQ Magazine best public sector lecturer award for the whole of the UK. The awards were partly due to his introduction of technology into lecturing, such as merging screen capture software to produce video podcasts, SMS polling and web based teaching from 2005 onwards. Kieran has also been an examiner for ICAEW in respect of Financial Reporting, Business Strategy and Accounting. He has been an associate for a training organisation in the investment banking industry, teaching accounting, financial modelling and valuation. He has taught in London, New York, Paris, Frankfurt and other leading financial centres. Kieran's specialist area is soccer finance. He has appeared on many occasions on BBC TV and Radio in relation to this topic, as well as being interviewed by the Financial Time, The Times, Guardian, Observer and other national and local media outlets. Kieran was also the script editor for the pilot shows of Accountancy TV in the UK, as well as the business news commentator for Manchester based Cable TV operation Channel M. Paul Summers is a chartered management accountant and experienced consultant working in the retail banking sector for 12 years. He started his career at Lloyds Banking Group in 1998 and held a variety of positions in finance divisions across the retail bank. Having graduated from Cambridge University’s Financial Modelling programme, he led a team to develop various financial decision making tools for retail banking sales directors including the analytical insight models behind Lloyds Banking Group’s successful bid to become the main banking sponsor for the London 2012 Olympic Games. In 2007, Paul joined Lloyds Banking Group’s Retail Mortgage Finance division to deliver strategic income management capabilities to sales directors and later, as Head of Commercial Finance, led a finance team to support the UK’s number one mortgage lender. Since leaving banking in 2010, Paul has worked with a number of leading UK and international universities, lecturing on MBA programmes and developing postgraduate programmes for professional accountants. He has held the position of Senior Global Examiner for the Chartered Institute of Management Accountants (CIMA) for the Performance Management paper and is also Assistant Examiner for the Association of Chartered Certified Accountants (ACCA). He has also been an advisor to CIMA in the strategic development of the qualification that has resulted in the adoption of the new framework for the 2015 syllabus and examinations for the qualification. Paul specialises in training accounting, corporate finance and financial modelling and has worked with numerous clients including: Deutsche Bank, HSBC, Islamic Development Bank and Saudi Arabian Airlines. Warren Wu, also known as Worapot Ongkrutaraksa, is an associate professor of finance and Director of Postgraduate Studies with substantial experiences in industry, government, and education with appointments in the United States, Australia, New Zealand, Macao SAR, Thailand, and China. His industry experiences began in the oil and gas industry with Shell and later in the public sector where he became a policy researcher for Thai Finance Ministry. As a Fulbright Scholar in financial economics, he has delivered a number of academic and professional services in finance and banking, and specialized in analytics and modeling for risk estimation, project simulation, and portfolio optimization. While serving as a dean for a Thai business school, he initiated an entrepreneurially oriented doctoral program and a coaching platform to support various professional certifications. Warren completed numerous consulting projects for Australian banks and non-bank institutions as well as authored many articles and publications, including two editions of his textbook entitled Financial Modeling and Analysis (Pearson).