JLL Pittsburgh Industrial Insight & Statistics - Q2 2020

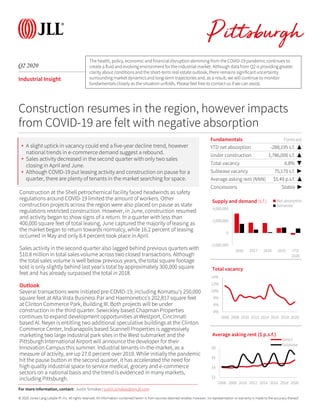

- 1. © 2020 Jones Lang LaSalle IP, Inc. All rights reserved. All information contained herein is from sources deemed reliable; however, no representation or warranty is made to the accuracy thereof. Q2 2020 Pittsburgh Industrial Insight Construction resumes in the region, however impacts from COVID-19 are felt with negative absorption The health, policy, economic and financialdisruption stemming from the COVID-19 pandemic continues to create a fluid and evolving environment for the industrial market. Although data from Q2 is providing greater clarity about conditions and the short-term real estate outlook, there remains significant uncertainty surrounding market dynamics and long-term trajectories and, as a result, we will continue to monitor fundamentalsclosely as the situation unfolds. Please feel free to contact us if we can assist. Construction at the Shell petrochemical facility faced headwinds as safety regulations around COVID-19 limited the amount of workers. Other construction projects across the region were also placed on pause as state regulations restricted construction. However, in June, construction resumed and activity began to show signs of a return. In a quarter with less than 400,000 square feet of total leasing, June captured the majority of leasing as the market began to return towards normalcy, while 16.2 percent of leasing occurred in May and only 8.4 percent took place in April. Sales activity in the second quarter also lagged behind previous quarters with $10.8 million in total sales volume across two closed transactions. Although the total sales volume is well below previous years, the total square footage sold is only slightly behind last year’s total by approximately 300,000 square feet and has already surpassed the total in 2018. Outlook Several transactions were initiated pre-COVID-19, including Komatsu’s 250,000 square feet at Alta Vista Business Par and Haemonetics’s 202,817 square feet at Clinton Commerce Park, Building III. Both projects will be under construction in the third quarter. Sewickley based Chapman Properties continues to expand development opportunities at Westport, Cincinnati based Al. Neyer is entitling two additional speculative buildings at the Clinton Commerce Center, Indianapolis based Scannell Properties is aggressively marketing two large industrial park sites in the West submarket and the Pittsburgh International Airport will announce the developer for their Innovation Campus this summer. Industrial tenants-in-the-market, as a measure of activity, are up 27.0 percent over 2019. While initially the pandemic hit the pause button in the second quarter, it has accelerated the need for high quality industrial space to service medical, grocery and e-commerce sectors on a national basis and the trend is evidenced in many markets, including Pittsburgh. • A slight uptick in vacancy could end a five-year decline trend, however national trends in e-commerce demand suggest a rebound. • Sales activity decreased in the second quarter with only two sales closing in April and June. • Although COVID-19 put leasing activity and construction on pause for a quarter, there are plenty of tenants in the market searching for space. For more information, contact: Justin Simakas | justin.simakas@am.jll.com Fundamentals Forecast YTD net absorption -288,195 s.f. ▲ Under construction 1,786,000 s.f. ▲ Total vacancy 6.8% ▼ Sublease vacancy 75,170 s.f. ▶ -2,000,000 0 2,000,000 4,000,000 2016 2017 2018 2019 YTD 2020 Supply and demand (s.f.) Net absorption Deliveries 4% 6% 8% 10% 12% 14% 2006 2008 2010 2012 2014 2016 2018 2020 Total vacancy $2 $4 $6 $8 2006 2008 2010 2012 2014 2016 2018 2020 Average asking rent ($ p.s.f.) Direct Sublease Average asking rent (NNN) $5.49 p.s.f. ▲ Concessions Stable ▶

- 2. © 2020 Jones Lang LaSalle IP, Inc. All rights reserved. All information contained herein is from sources deemed reliable; however, no representation or warranty is made to the accuracy thereof. Inventory (s.f.) Quarterly total net absorption (s.f.) YTD total net absorption (s.f.) YTD total net absorption (% of stock) Total vacancy (%) Total availability (%) Average total asking rent ($ p.s.f.) Quarterly Completions (s.f.) YTD Completions (s.f.) Under construction (s.f.) Pittsburgh total Warehouse & Distribution 89,292,798 -206,060 -57,442 -0.1% 6.7% 9.0% $5.89 0 726,704 1,786,000 Manufacturing 53,883,017 -211,892 -230,753 -0.4% 7.0% 8.2% $4.81 0 0 0 Totals 143,175,815 -417,952 -288,195 -0.2% 6.8% 8.7% $5.49 0 726,704 1,786,000 Beaver County Warehouse & Distribution 5,627,234 0 -16,800 -0.3% 13.2% 21.1% $4.92 0 130,000 521,000 Manufacturing 4,358,833 0 -14,125 -0.3% 10.8% 9.6% $3.77 0 0 0 Totals 9,986,067 0 -30,925 -0.3% 12.2% 16.3% $4.75 0 130,000 521,000 Butler County Warehouse & Distribution 4,136,199 -14,000 1,940 0.0% 17.4% 20.9% $4.53 0 0 0 Manufacturing 3,561,575 0 0 0.0% 7.4% 8.0% $2.77 0 0 0 Totals 7,697,774 -14,000 1,940 0.0% 12.8% 14.9% $4.07 0 0 0 Downtown Warehouse & Distribution 18,388,235 -4,182 -4,934 0.0% 4.2% 6.7% $11.08 0 0 0 Manufacturing 4,643,481 0 -1,200 0.0% 1.3% 4.1% $9.00 0 0 0 Totals 23,031,716 -4,182 -6,134 0.0% 3.6% 6.2% $11.04 0 0 0 East Warehouse & Distribution 5,969,910 -42,182 -38,512 -0.6% 4.5% 6.7% $5.87 0 0 0 Manufacturing 3,637,199 0 0 0.0% 5.7% 6.0% $3.44 0 0 0 Totals 9,607,109 -42,182 -38,512 -0.4% 4.9% 6.4% $4.52 0 0 0 Northeast Warehouse & Distribution 6,086,164 12,500 12,500 0.2% 2.0% 3.3% $4.69 0 0 0 Manufacturing 6,880,307 0 -21,250 -0.3% 5.6% 5.9% $3.63 0 0 0 Totals 12,966,471 12,500 -8,750 -0.1% 4.0% 4.7% $3.97 0 0 0 Northwest Warehouse & Distribution 10,525,275 -212,239 -302,136 -2.9% 6.1% 9.0% $6.09 0 0 0 Manufacturing 3,063,621 0 0 0.0% 0.3% 0.3% $0.00 0 0 0 Totals 13,588,896 -212,239 -302,136 -2.2% 4.8% 7.0% $6.09 0 0 0 South Warehouse & Distribution 5,521,847 949 -5,451 -0.1% 7.5% 9.7% $5.74 0 0 0 Manufacturing 7,892,472 0 0 0.0% 5.1% 5.1% $5.62 0 0 0 Totals 13,414,319 949 -5,451 0.0% 6.1% 7.0% $5.68 0 0 0 Washington County Warehouse & Distribution 6,423,088 8,800 45,133 0.7% 10.2% 15.0% $5.53 0 0 165,000 Manufacturing 4,736,380 0 -50 0.0% 2.4% 2.4% $5.08 0 0 0 Totals 11,159,468 8,800 45,083 0.4% 6.9% 9.7% $5.51 0 0 165,000 West Warehouse & Distribution 12,115,232 45,772 156,526 1.3% 6.5% 6.0% $6.14 0 596,704 1,100,000 Manufacturing 2,706,639 0 1,284 0.0% 2.4% 4.4% $5.15 0 0 0 Totals 14,821,871 45,772 157,810 1.1% 5.8% 5.8% $6.11 0 596,704 1,100,000 Westmoreland County Warehouse & Distribution 14,499,614 -1,478 94,292 0.7% 5.7% 6.7% $4.99 0 0 0 Manufacturing 12,402,510 -211,892 -195,412 -1.6% 14.4% 18.0% $5.42 0 0 0 Totals 26,902,124 -213,370 -101,120 -0.4% 9.7% 11.9% $5.31 0 0 0 Q2 2020 Industrial Statistics Pittsburgh For more information, contact: Justin Simakas | justin.simakas@am.jll.com