JLL - Tampa Bay 2018 Q1 Industrial Outlook

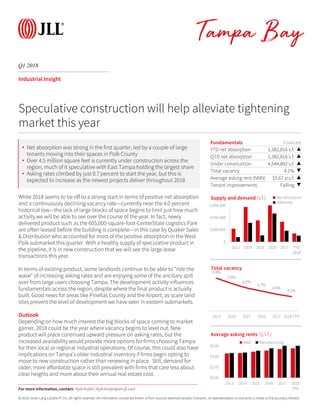

- 1. © 2018 Jones Lang LaSalle IP, Inc. All rights reserved. All information contained herein is from sources deemed reliable; however, no representation or warranty is made to the accuracy thereof. Q1 2018 Tampa Bay Industrial Insight While 2018 seems to be off to a strong start in terms of positive net absorption and a continuously declining vacancy rate—currently near the 4.0 percent historical low—the lack of large blocks of space begins to limit just how much activity we will be able to see over the course of the year. In fact, newly delivered product such as the 605,000-square-foot-CenterState Logistics Park are often leased before the building is complete—in this case by Quaker Sales & Distribution who accounted for most of the positive absorption in the West Polk submarket this quarter. With a healthy supply of speculative product in the pipeline, it is in new construction that we will see the large lease transactions this year. In terms of existing product, some landlords continue to be able to “ride the wave” of increasing asking rates and are enjoying some of the ancillary spill over from large users choosing Tampa. The development activity influences fundamentals across the region, despite where the final product is actually built. Good news for areas like Pinellas County and the Airport, as scare land sites prevent the level of development we have seen in eastern submarkets. Outlook Depending on how much interest the big blocks of space coming to market garner, 2018 could be the year where vacancy begins to level out. New product will place continued upward pressure on asking rates, but the increased availability would provide more options for firms choosing Tampa for their local or regional industrial operations. Of course, this could also have implications on Tampa’s older industrial inventory if firms begin opting to move to new construction rather than renewing in place. Still, demand for older, more affordable space is still prevalent with firms that care less about clear heights and more about their annual real estate cost. Fundamentals Forecast YTD net absorption 1,382,816 s.f. ▲ QTD net absorption 1,382,816 s.f. ▲ Under construction 4,544,892 s.f. ▲ Total vacancy 4.1% ▼ Average asking rent (NNN) $5.67 p.s.f. ▲ Tenant improvements Falling ▼ 0 2,000,000 4,000,000 6,000,000 2013 2014 2015 2016 2017 YTD 2018 Supply and demand (s.f.) Net absorption Deliveries Speculative construction will help alleviate tightening market this year 9.4% 7.9% 6.6% 5.7% 4.8% 4.1% 2013 2014 2015 2016 2017 2018 YTD Total vacancy For more information, contact: Kyle Koller | Kyle.Koller@am.jll.com • Net absorption was strong in the first quarter, led by a couple of large tenants moving into their spaces in Polk County • Over 4.5 million square feet is currently under construction across the region, much of it speculative with East Tampa holding the largest share • Asking rates climbed by just 0.7 percent to start the year, but this is expected to increase as the newest projects deliver throughout 2018 $0.00 $2.00 $4.00 $6.00 2013 2014 2015 2016 2017 2018 YTD Average asking rents ($/s.f.) W&D Manufacturing

- 2. Tampa Bay Q1 2018 Industrial Statistics Inventory (s.f.) Quarterly total net absorption (s.f.) YTD total net absorption (s.f.) YTD total net absorption (% of stock) Total vacancy (%) Total availability (%) Average total asking rent ($ p.s.f.) Quarterly completions (s.f.) YTD completions (s.f.) Under construction (s.f.) Tampa Bay Totals Warehouse & Distribution 151,133,249 1,490,431 1,490,431 1.0% 4.2% 10.9% $5.55 1,022,241 1,022,241 4,514,692 Manufacturing 53,810,073 -107,615 -107,615 -0.2% 3.7% 5.8% $6.31 0 0 30,200 Totals 204,943,322 1,382,816 1,382,816 0.7% 4.1% 9.6% $5.67 1,022,241 1,022,241 4,544,892 Submarkets North Pinellas Warehouse & Distribution 4,582,189 -2,843 -2,843 -0.1% 1.9% 3.1% $6.89 0 0 0 Manufacturing 2,018,122 0 0 0.0% 1.2% 2.5% $6.89 0 0 0 Totals 6,600,311 -2,843 -2,843 0.0% 1.7% 2.9% $6.89 0 0 0 Mid Pinellas Warehouse & Distribution 7,284,276 17,487 17,487 0.2% 2.5% 5.8% $6.24 32,000 32,000 136,450 Manufacturing 7,928,235 -500 -500 0.0% 5.7% 8.1% $6.51 0 0 0 Totals 15,212,511 16,987 16,987 0.1% 4.1% 7.0% $6.40 32,000 32,000 136,450 Gateway Warehouse & Distribution 9,917,207 -126,001 -126,001 -1.3% 5.4% 9.0% $6.59 0 0 0 Manufacturing 7,977,817 -67,523 -67,523 -0.8% 5.7% 9.6% $6.35 0 0 0 Totals 17,895,024 -193,524 -193,524 -1.1% 5.5% 9.3% $6.48 0 0 0 South Pinellas Warehouse & Distribution 7,016,165 9,958 9,958 0.1% 1.3% 6.2% $4.70 0 0 0 Manufacturing 3,046,789 3,031 3,031 0.1% 2.7% 7.3% $5.79 0 0 0 Totals 10,062,954 12,989 12,989 0.1% 1.7% 6.5% $5.07 0 0 0 Westshore/Airport Warehouse & Distribution 9,718,778 5,948 5,948 0.1% 3.3% 8.2% $6.62 0 0 21,000 Manufacturing 2,824,723 34,330 34,330 1.2% 1.8% 3.0% $6.10 0 0 0 Totals 12,543,501 40,278 40,278 0.3% 3.0% 7.0% $6.57 0 0 21,000 East Side Warehouse & Distribution 49,428,175 250,467 250,467 0.5% 6.0% 14.9% $5.41 132,041 132,041 2,179,008 Manufacturing 10,444,871 17,211 17,211 0.2% 3.2% 5.3% $5.15 0 0 0 Totals 59,873,046 267,678 267,678 0.4% 5.5% 13.2% $5.39 132,041 132,041 2,179,008 Manatee/Sarasota County Warehouse & Distribution 22,931,507 65,818 65,818 0.3% 3.3% 4.9% $8.41 28,200 28,200 220,000 Manufacturing 8,486,933 -65,828 -65,828 -0.8% 2.9% 4.8% $7.67 0 0 0 Totals 31,418,440 -10 -10 0.0% 3.2% 4.8% $8.21 28,200 28,200 220,000 East Polk Warehouse & Distribution 15,647,713 537,534 537,534 3.4% 4.5% 18.9% $4.70 830,000 830,000 207,676 Manufacturing 3,808,800 0 0 0.0% 1.2% 2.6% $2.33 0 0 0 Totals 19,456,513 537,534 537,534 2.8% 3.8% 15.7% $4.66 830,000 830,000 207,676 West Polk Warehouse & Distribution 24,607,239 732,063 732,063 3.0% 2.9% 9.6% $4.88 0 0 1,750,558 Manufacturing 7,273,783 -28,336 -28,336 -0.4% 3.9% 4.2% $6.96 0 0 30,200 Totals 31,881,022 703,727 703,727 2.2% 3.1% 8.4% $5.12 0 0 1,780,758 Kyle Koller | Senior Research Analyst 401 East Jackson, Suite 1500, Tampa Bay, FL 33602 | tel +1 813 387 1323 | kyle.koller@am.jll.com 2018 Jones Lang LaSalle IP, Inc. All rights reserved.