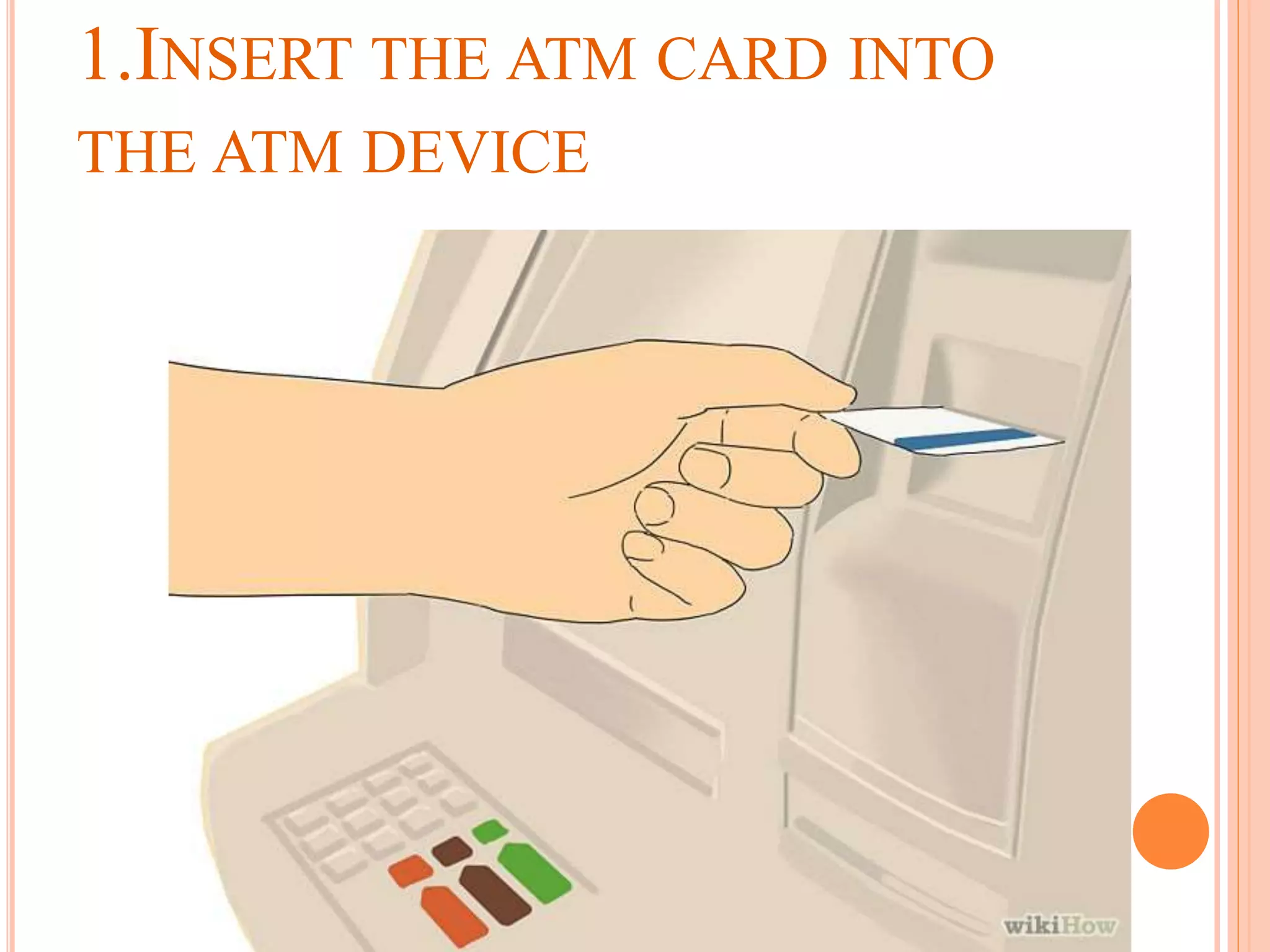

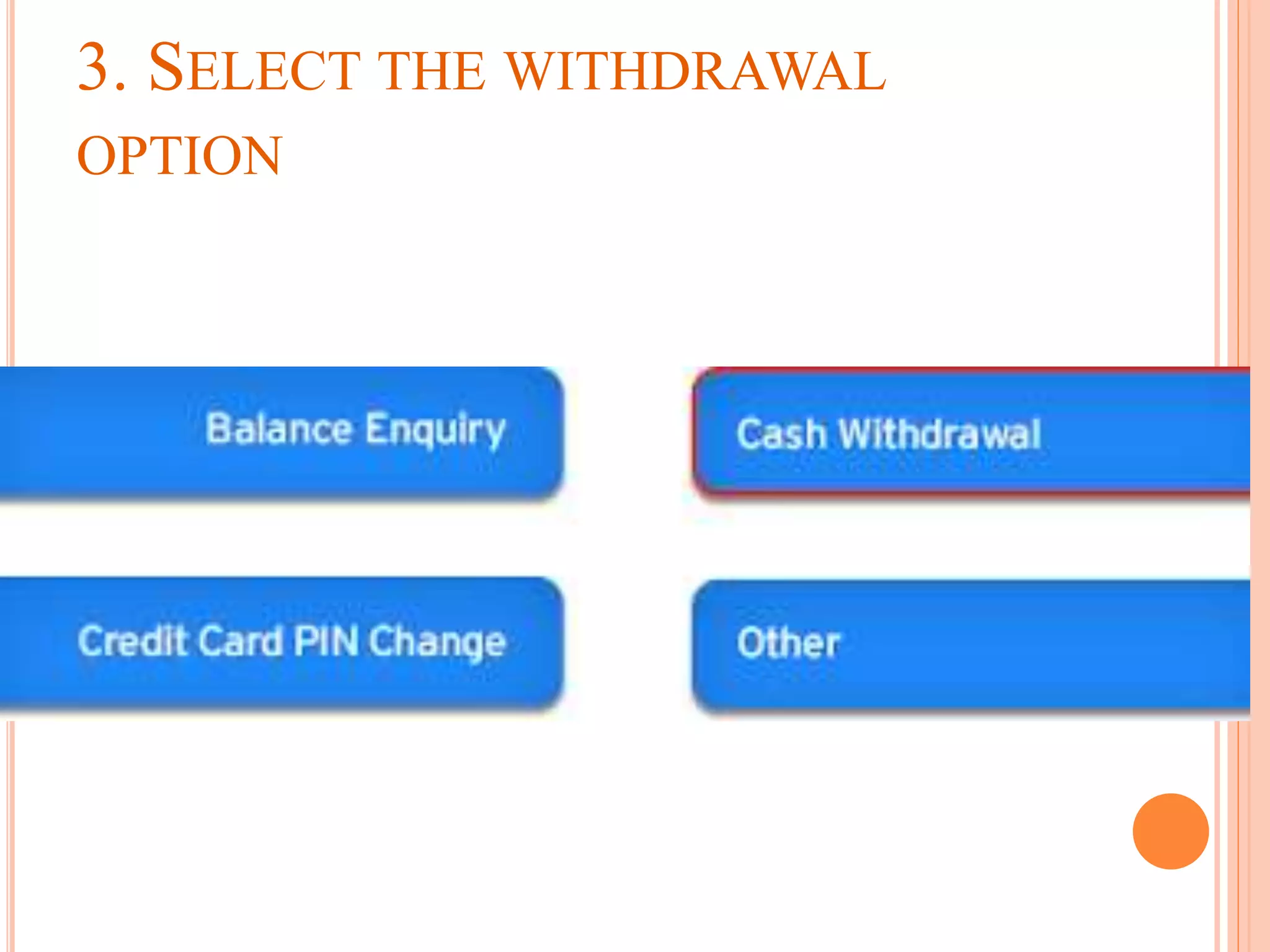

Automated teller machines (ATMs) facilitate basic banking transactions without the need for bank representatives, with various types including online, offline, onsite, and offsite ATMs. Customers can withdraw cash through a secure PIN-based system, with banks setting limits on transactions, and features such as cardless cash withdrawal are available. It’s important to safeguard ATM usage against fraud by following security measures like shielding the keypad and avoiding assistance from strangers.