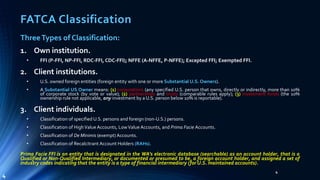

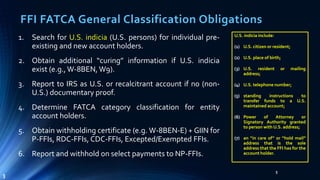

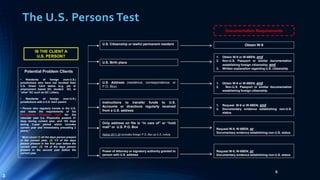

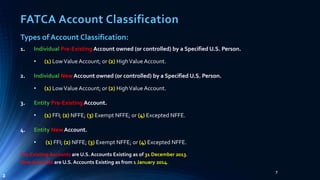

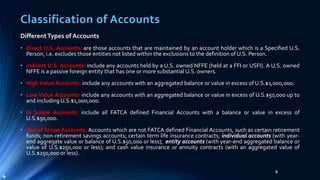

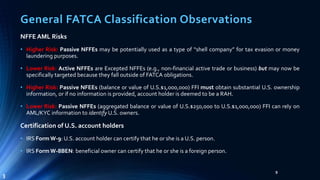

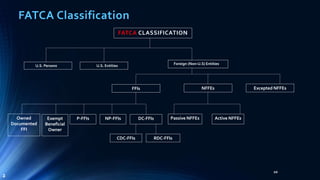

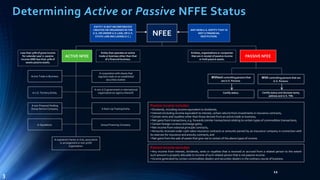

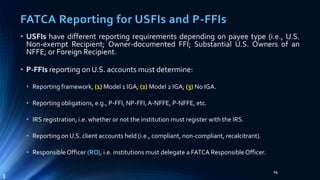

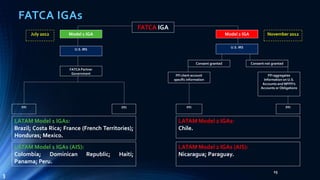

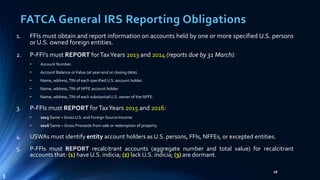

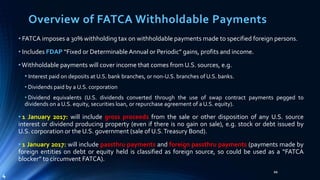

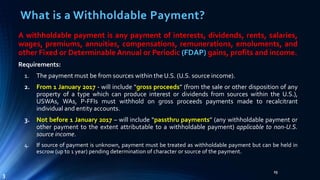

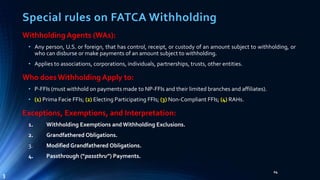

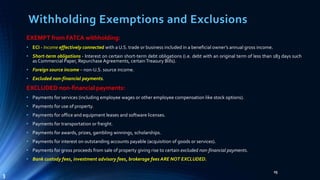

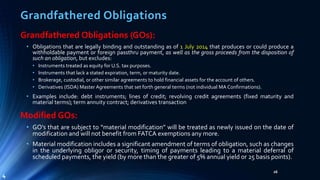

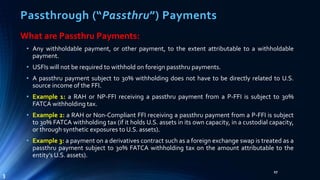

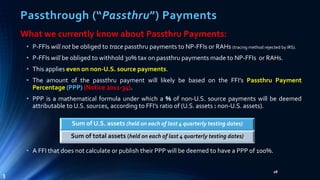

The document discusses the Foreign Account Tax Compliance Act (FATCA) and its three pillars: classification, reporting, and withholding. It provides details on how financial institutions are required to classify accounts as U.S. or foreign, individuals as U.S. persons or not, and entities as foreign financial institutions, non-financial foreign entities, or excepted entities. It also outlines reporting obligations such as reporting on U.S. accounts annually to the IRS. [END SUMMARY]