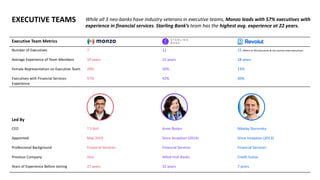

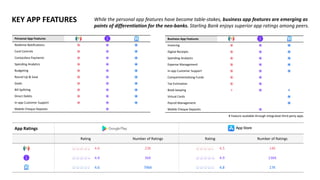

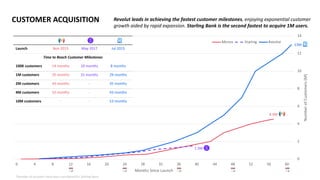

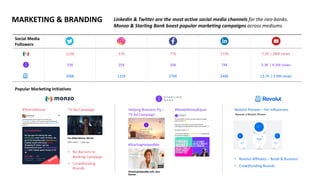

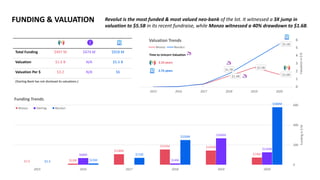

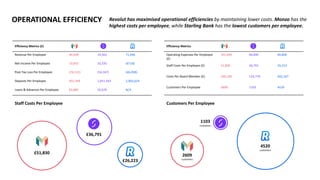

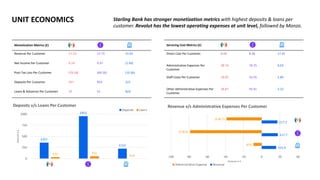

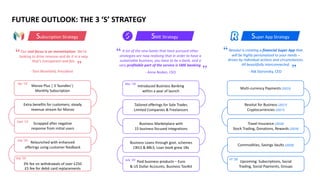

This document provides a comparative analysis of three UK neo-banks: Monzo, Starling Bank, and Revolut. It includes sections on their executive teams, go-to-market strategies, product portfolios, key app features, customer acquisition strategies, marketing and branding, funding and valuation, financial performance, and unit economics. The analysis finds that while all three neo-banks have experienced rapid customer growth, Revolut has achieved customer milestones the fastest and has the highest valuation at $5.5 billion. However, all three currently operate at a net loss due to high operating expenses compared to revenue.