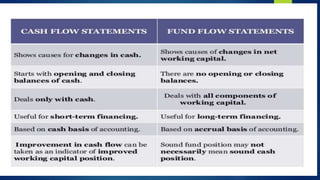

Cash flow is the net amount of cash moving in and out of a business. Positive cash flow means liquid assets are increasing, allowing a company to pay debts, reinvest, pay shareholders, and handle future challenges. Negative cash flow means liquid assets are decreasing. Cash flow statements focus on direct cash transactions and assess the quality of a company's income by showing if it can remain solvent. Fund flow shows net cash inflows and outflows between financial assets over time, without considering returns, to understand excess cash available to invest. Both cash flow and fund flow statements are important tools for short and long-term financial analysis and planning.