2022-07-26_LMT-MC-ValuationReport_Draft02.pdf

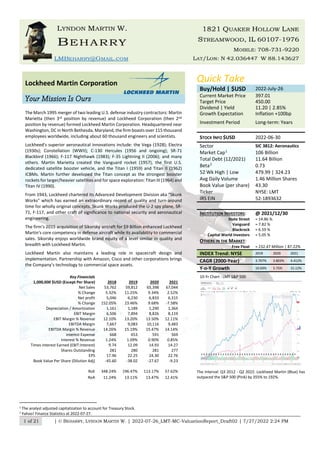

- 1. 1 of 21 | © BEHARRY, LYNDON MARTIN W. | 2022-07-26_LMT-MC-ValuationReport_Draft02 | 7/27/2022 2:24 PM Lockheed Martin Corporation Your Mission Is Ours The March 1995 merger of two leading U.S. defense industry contractors: Martin Marietta (then 3rd position by revenue) and Lockheed Corporation (then 2nd position by revenue) formed Lockheed Martin Corporation. Headquartered near Washington, DC in North Bethesda, Maryland, the firm boasts over 115 thousand employees worldwide, including about 60 thousand engineers and scientists. Lockheed's superior aeronautical innovations include: the Vega (1928); Electra (1930s); Constellation (WWII); C-130 Hercules (1956 and ongoing); SR-71 Blackbird (1966); F-117 Nighthawk (1983); F-35 Lightning II (2006); and many others. Martin Marietta created the Vanguard rocket (1957), the first U.S. dedicated satellite booster vehicle, and the Titan I (1959) and Titan II (1962) ICBMs. Martin further developed the Titan concept as the strongest booster rockets for larger/heavier satellites and for space exploration: Titan III (1964) and Titan IV (1990). From 1943, Lockheed chartered its Advanced Development Division aka "Skunk Works" which has earned an extraordinary record of quality and turn-around time for wholly original concepts. Skunk Works produced the U-2 spy plane, SR- 71, F-117, and other craft of significance to national security and aeronautical engineering. The firm's 2015 acquisition of Sikorsky aircraft for $9 Billion enhanced Lockheed Martin's core competency in defense aircraft while its availability to commercial sales. Sikorsky enjoys worldwide brand equity of a level similar in quality and breadth with Lockheed Martin. Lockheed Martin also maintains a leading role in spacecraft design and implementation. Partnership with Amazon, Cisco and other corporations brings the Company’s technology to commercial space assets. Key Financials 1,000,000 $USD (Except Per Share) 2018 2019 2020 2021 Net Sales 53,762 59,812 65,398 67,044 % Change 5.32% 11.25% 9.34% 2.52% Net profit 5,046 6,230 6,833 6,315 % Change 152.05% 23.46% 9.68% -7.58% Depreciation / Amortization 1,161 1,189 1,290 1,364 EBIT Margin 6,506 7,894 8,826 8,119 EBIT Margin % Revenue 12.10% 13.20% 13.50% 12.11% EBITDA Margin 7,667 9,083 10,116 9,483 EBITDA Margin % Revenue 14.26% 15.19% 15.47% 14.14% interest Expense 668 653 591 569 Interest % Revenue 1.24% 1.09% 0.90% 0.85% Times Interest Earned (EBIT:Interest) 9.74 12.09 14.93 14.27 Shares Outstanding 281 280 281 277 EPS 17.96 22.25 24.30 22.76 Book Value Per Share (Dilution Adj) -45.60 -38.02 -27.67 -9.23 RoE 348.24% 196.47% 113.17% 57.62% RoA 11.24% 13.11% 13.47% 12.41% Quick Take Buy/Hold | $USD 2022-July-26 Current Market Price 397.01 Target Price 450.00 Dividend | Yield 11.20 | 2.85% Growth Expectation Inflation +100bp Investment Period Long-term: Years STOCK INFO $USD 2022-06-30 Sector SIC 3812: Aeronautics Market Cap1 106 Billion Total Debt (12/2021) 11.64 Billion Beta2 0.73 52 Wk High | Low 479.99 | 324.23 Avg Daily Volume 1.46 Million Shares Book Value (per share) 43.30 Ticker NYSE: LMT IRS EIN 52-1893632 INSTITUTION INVESTORS: @ 2021/12/30 State Street ≈ 14.86 % Vanguard ≈ 7.82 % Blackrock ≈ 6.59 % Capital World Investors ≈ 5.05 % OTHERS IN THE MARKET: Free Float ≈ 232.47 Million | 87.22% INDEX Trend: NYSE 2019 2020 2021 CAGR (2000-Year) 3.707% 3.803% 4.412% Y-o-Y Growth 10.69% 5.75% 15.12% 10-Yr Chart : LMT S&P 500 The Interval: Q3 2012 - Q2 2022. Lockheed Martin (Blue) has outpaced the S&P 500 (Pink) by 355% to 192%. 1 The analyst adjusted capitalization to account for Treasury Stock. 2 Yahoo! Finance Statistics at 2022-07-27.

- 2. 2022-07-26_LMT-MC-ValuationReport_Draft02 | Page 2 of 21 2 of 21 |© BEHARRY, LYNDON MARTIN W. | 2022-07-26_LMT-MC-ValuationReport_Draft02 | 7/27/2022 2:24 PM CORPORATE OVERVIEW: THE HISTORICAL RECORD The world's largest defense contractor (by revenue), Lockheed Martin Corporation enjoys a storied history dating back to the earliest days of powered flight. In those pioneering years, Glenn Luther Martin founded the Glenn L. Martin Company in 1912 Los Angeles; and Allan Loughead (pronounced Lockheed) and John Northrup formed Lockheed Aircraft Company in 1926 Hollywood with partners Kenneth Kay and Fred Keeler. By April 1929, the Lockheed's 300 workers were building five aircraft each week. Allan Loughead resigned in August 1929 protesting Fred Keeler’s sale of 87% of the company’s equity to Detroit Aircraft Corporation. After the autumn 1929 onslaught of the Great Depression, economic chaos first decimated the U.S. economy and then assailed the European economies. While the Detroit Aircraft Corporation folded, Martin weathered the Depression supplying dive bombers on military contracts. Along with partner Walter Varney, the Gross Brothers (Robert and Courtland) brought Detroit Aircraft out of receivership in 1932. They renamed it: Lockheed Aircraft Corporation. This iteration of Lockheed produced the Vega (favored by Amelia Earhart and other aviators), and then the Model 10 Electra. The Lockheed Model 12 Electra Junior and the Lockheed Model 14 Super Electra followed. Before and during WWII, the British RAF and the U.S. military flew the Hudson bomber based on the Model 14. Lockheed and Martin both supplied fighter craft and bombers to support the U.S. war effort. Martin’s most notable wartime product was the B-26 Marauder, a medium fighter-bomber. “By 1945, when production ended, 5,266 Marauders had been built, with U.S., British, Free French, Australian, South African and Canadian aircrews all having flown the B-26 in combat.”i The P-38 Lightning emerged as Lockheed’s most notable WWII design. Early on, Clarence “Kelly” Johnson, one of the all-time great aircraft engineers, submitted the P-38 Lightning fighter aircraft to a U.S. Army Air Corps call for an interceptor. Johnson devised this nimble aircraft as a twin-engine, twin-boom design. The P-38 was the only American fighter aircraft in production through the entirety of America’s involvement in the war. It flew missions from Pearl Harbor to Victory over Japan Day. By the end of this world-wide conflagration, Lockheed ranked tenth among U.S. corporations in production value. Lockheed and its Vega subsidiary had produced 19,278 aircraft, representing six percent of war production: 2,600 Venturas, 2,750 Boeing B-17 Flying Fortress bombers (under Boeing license), 2,900 Hudson bombers, and 9,000 Lightnings. Martin ranked fourteenth among U.S. materiel contractors in the value of wartime production. Notably, Martin manufactured both the Enola Gay and Bockscar, the two B-29s responsible for dropping the atomic weapons upon Hiroshima and Nagasaki, respectively. During the war, Lockheed and TWA jointly developed the L-049 Constellation. First introduced as the C-69 WWII military transport, this vehicle ultimately transformed the civilian transport market after the war. It is abundantly clear that U.S. military aviation contracts funded the advances which directly led to ubiquitous civilian air travel and the abundant and low-cost transit opportunities of our 21st century civilization. The immediate aftermath of WWII saw the U.S. economy rapidly transition to civilian production, but with renewed vitality and optimism brought about by America’s overarching victory highlighted also with a production infrastructure wholly intact and free of the ravages and devastation of world war. The U.S., the U.K., and France were quick to adapt military aviation discoveries toward civilian air travel. In addition, the U.S. recruited German scientists and engineers with former ties to the German Nazi party to buttress U.S. design and manufacture in aviation, avionics, and aeronautics. And as the Soviet Union absorbed Eastern European nation-states to serve as a buffer zone between it and the West, the U.S. government called upon Lockheed and Martin Marietta to develop the first generation of jet fighters, bombers, and missiles; particularly bombers and missiles capable of hauling thermonuclear weapons over and across the arctic to kill Soviet missiles and aircraft on the ground. The U.S. government also contracted for aircraft capable of stealth to spy on enemy positions and navigate safely back home. Finally, the U.S. demanded technology to launch missiles based within nuclear submarines, stealthily patrolling throughout the world’s oceans. From the 1950s and through the 2000s, Martin Marietta developed scores of ICBM models (Atlas, Peacekeeper, Titan, etc.), medium range missiles (Javelin, Midgetman, Pershing, etc.); and spacecraft (Magellan, Viking, Mars Polar Lander, etc.) to carry scientific instruments into space to investigate the far reaches of our solar system. And Lockheed? Lockheed came up with… Skunk Works Starting in 1943, Kelly Johnson spearheaded the creation of Lockheed's Skunk Works division. Skunk Works' P-80 Shooting Star became the first American jet fighter to score a kill, recording the first jet-to-jet aerial dispatch, downing a Mikoyan-Gurevich MiG-15 in Korea. Skunk Works went on to produce the U-2 Dragon Lady (1953), the A12 (1962) and SR-71 Blackbird (1966), and the F-117 Nighthawk (1978). Lockheed's other notable aeronautics innovations include: C-130 Hercules, the Poseidon and Trident nuclear missiles, and the C-141 Starlifter jet transport. Its post-1990s contributions to aviation and defense include its 5th Generation fighters: F-16 Fighting Falcon (1995-present), F-35 Lightning II (2015-present), and F- 22 Raptor (1997-present).

- 3. 2022-07-26_LMT-MC-ValuationReport_Draft02 | Page 3 of 21 3 of 21 |© BEHARRY, LYNDON MARTIN W. | 2022-07-26_LMT-MC-ValuationReport_Draft02 | 7/27/2022 2:24 PM PESTLE: CHARACTERISTICS Economic In 2021, the firm derived 71% of its total consolidated net sales from the U.S. Government; 62% from the DoD; U.S. Congress allocates Defense budget spending on a FY basis, but contracts extend out for years and potentially decades. Because of this, contracts are initially only partly funded with additional financial commitments provided over time. Negative economic cycles may impact future funding for committed projects resulting in substantial lost sunk costs; Budget uncertainty, budget cuts, government shut-downs, and the federal debt ceiling may adversely affect the Company; Negative performance of F-35 Lightning II program would severely impact the Company’s financial performance. The F-35 represents 27% of the Company consolidated 2021 net sales; Lockheed Martin gains revenue from U.S. defense partners and friendly nation-states. Any change in U.S. behavior or recognition of its defense partners and/or trading partners could affect the Company’s financial performance; The U.S. Government may terminate any of its contracts for convenience or default. While the Company may recover sunk costs and associated profits for convenience-based cancelations; default- based cancelations are more problematic and may block the Company from cost recovery and also block its ability to compete for additional or potential contracts for similar work or product(s); As the leading U.S. defense contractor, Lockheed is somewhat insulated from the vagaries of routine economic cycles. While the U.S. had made a half-hearted attempt to recognize a “peace dividend” after the collapse of the Soviet Union in 1990, the post- September 11 2001 world has sealed the fate of the U.S. as the premiere World Policeman on duty. Because of this, U.S. federal government’s Executive and Legislature will continue to fund military expenditure through all types of economic climates. Furthermore, astute economic technicians have come to recognize that the design and geographical positioning of defense players like Lockheed Martin are practical counter-measures to negative Economic cycles. In other words, because Lockheed controls facilities, contractors, and subcontractors throughout the United States, federal economic policy closely works with defense policy to funnel money through the contractor to stimulate economy during downturns; in effect maintaining defense and national security while buttressing economic security <><><><> Environmental Lockheed Martin and its contractors and their subcontractors must adhere to stringent government guidelines for environmental security or risk forfeiture of contract funds; As of December 31, 2021, Lockheed recorded environmental contingencies of: $742 Million (aggregate liabilities recorded in non- current liabilities) which are offset by asset set-asides of $641 Million (non-current assets) (Lockheed Martin Corporation, 2022);ii Lockheed Martin’s normal business exposes the company, its employees and its properties (and also neighboring lands and waters) to potential damage and environmental liabilities; <><><><> Legal "We (the Company) are a party to litigation and other proceedings that arise in the ordinary course of our business, including matters arising under provisions relating to the protection of the environment, and are subject to contingencies related to certain businesses we previously owned.” Legal (cont.) “As a U.S. Government contractor, we (the Company) are subject to various audits and investigations by the U.S. Government to determine whether our operations are being conducted in accordance with applicable regulatory requirements. U.S. Government investigations of us, whether relating to government contracts or conducted for other reasons, could result in administrative, civil, or criminal liabilities, including repayments, fines or penalties being imposed upon us, suspension, proposed debarment, debarment from eligibility for future U.S. Government contracting, or suspension of export privileges.” <><><><> Political In general, the Company’s international sales are conducted through the U.S. Government and by direct commercial sales (DCS) to international customers. Such sales are subject to Treaties (particularly with regard to technology transfers abroad), U.S. Executive and Legislature policies, and the policies of foreign governments and the disposition of foreign nation-states’ to purchase products of U.S. manufacture; Post-WWII U.S. government contractors typically conduct operations in all or a substantial number of the 50 States. This has the effect that each Representative and Senator tends to support funding for production and research contracts out of concern that jobs would otherwise suffer in his/her home state; Political winds change with time. For much of the period from the late 1970s through the present, the U.S. political will had turned against what it perceived as exorbitant spending on space technology and exploration. The post- Obama climate has realized a dramatic shift and the federal government has ramped up its funding of R&D and manufactured hardware for space exploration – including orbital space stations, moon bases, and telescopes for deep- horizon views. This bodes well the Company’s future growth prospects; <><><><> Sociological To be direct and blunt, the Company positions itself to produce weapons of war – killing machines, in other words. Societal pressures urging national or regional action towards PEACE may have the effect of creating negative public relations for the Company and its products. <><><><> Technological Government contracts involving military, space and other market segments encourage highly competitive rivalries to create or acquire cutting-edge technology. This business involves partnerships among the Company, the Armed Services, and various universities and institutions and is threatened by industrial espionage and foreign spy activity; The Company grows its own technology through its base of Human Capital and arrangements with Universities and Institutions; The Company also secures technology through acquisition of other firms <><><><><>

- 4. 2022-07-26_LMT-MC-ValuationReport_Draft02 | Page 4 of 21 4 of 21 |© BEHARRY, LYNDON MARTIN W. | 2022-07-26_LMT-MC-ValuationReport_Draft02 | 7/27/2022 2:24 PM PORTER ANALYSIS IN BRIEF Internal Rivalry The business of U.S. government contracts for military and space hardware and technology has traditionally involved intense competition among the leading two or three Aviation/Avionics firms: Lockheed-Martin, Boeing, Northrup; while GE, General Dynamics (including Electric Boat), and Raytheon round out the top five or six for military contracts in general. But while competition is stiff, the firms are somewhat specialized insofar as aeronautics, for example, does not contend against boat-builders for the same funds. Each leading contractor has arranged itself with facilities and infrastructure located multiple state jurisdictions. This has the effect that Congresspersons and Senators are reluctant to cut funding as it risks curtailing projects which support employment in their home states. Hence, many contracts are awarded to more than one contractor as partial recipient with incentive for partnerships among other the leading contractors. During the post-Cold War environment, many contractors continue to partner with would-be competitors to gain scale and technological expertise. For instance, while Lockheed Martin and the Boeing Company (BA) have engaged in long- term rivalry, they have also enjoyed a long-term partnership (F22 Raptor, for one). <><><><> New Entrants The technology and manufacturing competencies/expense for Defense and Space assets form an effective barrier to entry. There is little potential for New Entrants to engage competition with well-established players. <><><><> Supplier power Lockheed Martin draws supply of components from thousands of contractors and subcontractors. While certain inputs and components are mission critical: rare-earth metals, specialty alloys, certain patented or esoteric processes; in general, no one supplier has material influence over process or production (except perhaps the supply of rare earth metals and specialty alloys for avionics or space assets); <><><><> Buyer / Consumer Power Lockheed Martin is generally beholden to the U.S. government procurement process and its rules concerning proposal bid, R&D, cost-plus allocations, and other criteria. The U.S. government and its budget have extreme influence upon how and when the Company may allocate assets for R&D, production, and foreign sales. <><><><> Threat of Substitutes Outside of its normal assortment of competitors (domestic and foreign), there is no Substitute for the Company’s special products and services <><><><>

- 5. 2022-07-26_LMT-MC-ValuationReport_Draft02 | Page 5 of 21 5 of 21 |© BEHARRY, LYNDON MARTIN W. | 2022-07-26_LMT-MC-ValuationReport_Draft02 | 7/27/2022 2:24 PM FINANCIAL MODEL: PROSPECTIVE VIEW Variables CRITERIA CoGS: F(Rev) 84.472% Depreciation/Amortization (CoGS): F(Rev) 02.153% SGA (Only): F(Rev) 00.000% R&D: F(Rev) 01.663% Depreciation/Amortization (SGA): F(Rev) 00.045% Other Expense (Income)/Overhead: F(Rev) 00.310% Interest Expense (Income): F(Rev) 01.250% Tax Rate: F(EBT) 21.000% Capital Expenditures: F(Rev) 02.467% Working Capital: F(Rev) 04.355% βeta 0.730 Shares Outstanding (Million) 266.110 Inflation Rate (Est.) 02.500% RF (T-bill annual) Rate 02.910% CAPM KE Calculation 05.531% KB Result 04.644% KB Result with Tax Shield 03.669% WACC 05.437% Market Historical Returns 06.500% Revenue Growth Rate (Projected Estimate) 03.500% Perpetuity Growth Rate (Inflation) 02.500% The analyst created prospective models and sensitivity analyses to objectively determine Lockheed Martin valuations from Free CashFlow to Equity (FCFE). By rigorously analyzing the firm’s historical efficient financial performance, the analyst derived costs and expense components as objective functions of Revenue F(Rev), or in the case of Taxation, F(EBT). This table recounts the summary of variables used in the Discounted Cash Flow analysis to isolate: 1) valuation of the Firm’s Free CashFlow to Equity; and 2) valuation per common equity share. Discussion The analyst produced three distinct prospective models of FCFE: 1) Static model varying WACC; 2) Static model varying Revenue Growth Rate; and 3) Dynamic multi- iterative Monte Carlo model oscillating all variables within a tolerance of 10% coefficient of variability. These models suggest a range of Equity valuation for Lockheed Martin. The results page discusses the outcomes of these Equity valuation simulations. Costs of Capital KE The U.S. S&P 500 has posted recent annual returns (2011-2021) of 14.252%; with long-term (30-year) CAGR of 8.416%. Valuing Lockheed Martin, this analyst reviewed the equity return of 5.531% following the Capital Asset Pricing Model. E(ri) = rf + β[E(rm)-rf] = 2.910% + 0.73 X (6.500%-2.910%) = 2.910% + 2.621% = 5.531% Alternative: GORDON DIVIDEND PAYOUT MODEL: Book Value of the Firm $USD1,000,000 10,959 Book Value Per Share BV0 41.18 Dividend Growth Rate (Gordon Model) gn 5.00% kE = [(RoE - gn ) X (BV0 / P0)] + gn 6.557% P0/BV0 = PBV = [(RoE-gn)/(ke-gn) 9.6354694 Price Multiple : BV0 9.635 Forecast Share Price From Multiple X BV0 396.810 KB Long-Term Debt 10K:2021 MatDate Coupon Value Annual 2021 3.350% 0.000 0 2023 3.100% 500.000 16 2025 2.900% 750.000 22 2026 3.550% 2,000.000 71 2030 1.850% 400.000 7 2035 3.600% 500.000 18 2036 5.325% 1,054.000 56 2042 4.070% 1,336.000 54 2045 3.800% 1,000.000 38 2046 4.700% 1,.326.000 62 2050 2.800% 750.000 21 2052 4.090% 1,578.000 65 2031 6.990% 1,605.000 112 -1,123.000 0 11,676.000 4.513% With Tax Shield (20%) 3.669% Weighted Average Cost of Capital 𝑊𝑊𝑊𝑊𝑊𝑊𝑊𝑊 = 𝐾𝐾𝐵𝐵𝐵𝐵+𝐾𝐾𝐸𝐸𝐸𝐸 B+E = [3.669%X0.38765]+[6.557%X0.61235] 1.000 = [1.422%] + [4.015%] 1.000 = .05437144 = 5.437144% Market Capitalization Basis; B=Total Debt (adj. with carrying costs); E=[Total Capitalization - (Preferred+Debt)]iii

- 6. 2022-07-26_LMT-MC-ValuationReport_Draft02 | Page 6 of 21 6 of 21 |© BEHARRY, LYNDON MARTIN W. | 2022-07-26_LMT-MC-ValuationReport_Draft02 | 7/27/2022 2:24 PM STATIC MODEL: PROSPECTIVE VIEW Results of the Variable Revenue Growth Rate This display reflects per share valuations from a 1.00% annual growth rate of revenue ($354.06 per share) through 6.00% annual revenue growth ($621.03 per share). The Prospective free cash-flow to equity analysis returned an expected per share valuation of $473.836 at a 3.50% growth rate, with WACC of 5.437%. Discussion The analyst expects the firm would regress to its mean revenue growth rate of 3.745% (mimicking the U.S. long- term inflation rate plus a small risk premium of approximately 200 basis points) with some upside potential as the U.S. economy overcomes COVID- induced economic retraction and the international climate grows more concerned of Russia and China influence beyond their traditional range of geography prodding many western countries to upgrade their military materiel. Results of the Variable WACC Growth Rate This chart plots Lockheed Martin valuations at different rates of capital costs. The expected value per share is $473.83 at the calculated WACC: 5.437% (roughly 250 bp above RF ). Higher WACC returns lower per share valuations. Discussion The analyst expects LMT’s weighted average cost of capital to be no less than 5.00%, but it may be higher. Thus, the Firm would produce true value only through increased growth in revenue (greater volumes of government contracts and foreign sales). As most LMT contracts are cost-plus-profit, the firm tends to keep its costs to minimum values within the constraints of quality control and the demands of U.S. government oversight. The Monte Carlo multi-iteration model (1,000,000 trials) varies the Weighted Average Cost of Capital to the following constraints: Mean: 5.437% Standard Deviation: 0.10874% (2.0% of the mean) Hence, the Monte Carlo results would likely capture the range of capital costs within its 1 Million iterations.

- 7. 2022-07-26_LMT-MC-ValuationReport_Draft02 | Page 7 of 21 7 of 21 |© BEHARRY, LYNDON MARTIN W. | 2022-07-26_LMT-MC-ValuationReport_Draft02 | 7/27/2022 2:24 PM MONTE CARLO FINANCIAL MODEL: PROSPECTIVE VIEW Overview Monte Carlo quantitative analysis is a statistics-mathematics process. It mimics real-world volatility to probabilistically predict a range of outcomes. The analyst employed the identical variable structure for both the static and Monte Carlo equity valuation models. BUT, the Monte Carlo process dynamically alters the factors within defined constraints. In this instance, Monte Carlo uses the variables as the statistical mean (arithmetic average), and fluctuated each factor 1,000,000 times at a standard deviation of 10% of the mean values of the stated variables. Results This chart illustrates a potential range of valuation for Lockheed Martin common equity per share at a paltry 2.00% growth rate. Using this variable structure, the model delivers the following statistics: a) an expected median per share price of $487.78; with a b) projected maximum to $2,497. At a base 3.50% revenue growth rate, the simulation returned a 53.68% probability of a fair valuation of over $450 per share. LMT: LOCKHEED MARTIN MONTE CARLO5.00%: VALUATION PER SHARE CURVE SHAPE Lognormal TRIALS 1,000,000 MEAN 488.72 MEDIAN 487.78 MODE N/A ST DEV 414.44 MINIMUM -1,526.29 MAXIMUM 2,497.16 P(VALUE>$450) 53.6785% Discussion The analyst sculpts scenarios with cautious estimates, aiming to err on the side of restraint. The prospective cashflow models use a mean per annum revenue growth rate of 3.50%, mimicking the recent-term annual inflation index plus 100 basis points. This Monte Carlo prospective model also uses conservative estimates for cost/expense factors: costs following historical mean percentages, tempered against industry norms. On February 24, 2022, Russia invaded Ukraine. This bold- faced belligerence in violation of custom and affirmed international norms prompted the U.S. government to step up its humanitarian and military aid to Ukraine. Reading these promises and deliveries of military assistance, the U.S. equity investors rapidly pushed Lockheed Martin’s share price to a high of $479. During this same interval, some analysts (including this one) prognosticated tame revenue growth for this U.S. defense contractor. Indeed, LMT posted lackluster Q2 2022 earnings ($6.32 per share vs. FY2021 $6.42) and the Company projects total FY22 sales to be flat or a very slight decline over last year (FY21 Revenue was $66 Billion). Lockheed shares shed just north of ten percent of value during this interval (H1 2022), falling from $450 to just below $400 per share. Many investors may worry of the support for Lockheed shares. This analyst believes Lockheed is still a very strong play. At its current per share pricing, the firm yields a dividend of over 2.85% and the stock has strong upside potential on market share pricing. Furthermore, LMT is among the most stable investments short of purchasing U.S. Treasuries. Since the firm is so closely tied to government military expenditure (and in so many ways) the market sometimes values it as a bond – just on its dividend yield. So even as LMT shed pricing during this recent period of market volatility, its intrinsic value remains strong and stable. This analyst expects Lockheed Martin to exhibit flat earnings this Fiscal Year, but with a strong rebound starting FY 2023. A scrupulous investor ought to consider upgrades in the U.S. defense budget and allocations during Q4 2022, but also how the U.S. postures itself with EU and NATO vis-à-vis Russia’s maneuvers in Eastern Europe, and also vis-à-vis China’s next steps with naval power and its ongoing cross-the-line attitude alongside its neighbor, Taiwan. All of these international issues will necessarily play into how Lockheed Martin will see potential to participate in the U.S. push to safeguard international waters and airspace from belligerent states and renegade powers in the coming decades.

- 8. 2022-07-26_LMT-MC-ValuationReport_Draft02 | Page 8 of 21 8 of 21 |© BEHARRY, LYNDON MARTIN W. | 2022-07-26_LMT-MC-ValuationReport_Draft02 | 7/27/2022 2:24 PM 1) Cost of Sales dominates ultimate production of Shareholder Value and Returns on Equity. Businesses have recognized this truth since humanity’s early ancestors debated whether to hunt every day (including unhealthy hot days), or to gather shellfish, nuts, and greens on some days and expense hunting assets (experience, training, and energy) only within profitable conditions. But Lockheed Martin is structured as a Cost + Profit government contractor, under very strict government controls for both quality and cost control. In this case, Lockheed Martin can cut no costs (or potentially only very little costs). The only manner in which the firm could grow total profits is by earning greater volumes of contracts. 2) In ... Sensitivity Analysis The Monte Carlo FCFE DISCOUNTED CASH FLOW PROJECTION is sensitive to particular conditions: 1) Because the perpetuity CashFlow dwarfs estimated cash-flow in any given annum, the terminal year COST OF GOODS SOLD typically asserts dominance over the Firm and its weighted Equity valuation; 2) 2022 COGS; 3) 2023 COGS; 4) 2024 COGS; 5) 2025 COGS and 6) 2026 COGS The Tornado Chart sensitivity analysis of Lockheed Martin’s valuation with these instant variables imputes a heavy weighting upon the perpetuity model – likely because the near- term growth rate of 3.50% per annum is relatively low. This analyst believes that Lockheed Martin will actually earn some stability in 2022-2023 Y-o-Y revenue as the Russia-Ukraine conflict has sparked the U.S. government to increase support its new ally in eastern Europe.

- 9. 2022-07-26_LMT-MC-ValuationReport_Draft02 | Page 9 of 21 9 of 21 |© BEHARRY, LYNDON MARTIN W. | 2022-07-26_LMT-MC-ValuationReport_Draft02 | 7/27/2022 2:24 PM FRAUD ANALYSIS Statistics Testing for Anomalous Financial Reporting Benford’s Test Beneish M-Score METHODOLOGY OF FORENSIC ANALYSIS TO DETECT FRAUD Twenty-first century forensic analysis of financial records encourages mathematics and statistics to test anomalies in financial reporting. The analyst favors two forensic tests: Benford’s Test, and Beneish’s M-Score. Note: Forensic Accounting analysis cannot prove fraud; it simply suggests instances of potential anomalies in reporting. Benford’s (First Digits) Law Benford’s law (First Digits Law) predicts that the first digits in random sets of numbers which span across several orders of magnitude (i.e. ones, tens, hundreds, thousands, etc.) will conform to a set distribution (the bronze columns). Because of compounding over time intervals, the First Digits rule affirms that there are more instances of numbers beginning with 1, then 2, then 3, and so on. This analysis tested LMT’s Balance Sheet numbers against Benford’s Law. The first digits of the Balance Sheet numbers fall very close to expected outcomes; and the analyst believes this indicates fair and honest reporting. The Beneish M-Score calculations Lockheed Martin’s Beneish scores are excellent for several years running. They reflect no anomalous readings.

- 10. 2022-07-26_LMT-MC-ValuationReport_Draft02 | Page 10 of 21 10 of 21 |© BEHARRY, LYNDON MARTIN W. | 2022-07-26_LMT-MC-ValuationReport_Draft02 | 7/27/2022 2:24 PM OUTLOOK AND RECOMMENDATION For most of Q1 2022, this analyst argued that LMT was priced too high, too early. But deeper study of recent U.S. and European defense commitments indicate that western powers may be inclined to buttress military spending as a bellicose Russian BEAR continues to threaten regional stability in Eastern Europe by word and by deed. An astute observer may rightfully suggest placing a premium onto the share valuation precisely because of: A) Russia’s ongoing aggressive tendencies; and B) the rise of China and its military hardware poised to flex its musculature in southern Asia, throughout the Pacific, and potentially through the Indian Ocean into eastern Africa. These ongoing international developments most probably conclude with a tri-polar world: the U.S., Russia, and China. This new blossoming paradigm will propel the U.S. Executive and the Legislature to increase military spending in the near and intermediate term for several reasons: 1) Maintain U.S. long-standing commitments to regional partners: Australasia, Philippines, South Korea, Taiwan, and U.S. protectorates and territories in the Pacific; 2) Police the region for traffickers of contraband; and 3) Safeguard shipping and free trade. Additionally, the U.S. space agency NASA, the European space agency ESA, and China’s space agency CNSA are all ramping up R&D and infrastructure to place bases on the moon and potentially on Mars within the next several decades. And the particular competition between the western powers and China suggests that the respective governments/interests view this as a zero-sum game: that there will be loser(s) in the race to extract minerals from asteroids, for example; and loser(s) in the race to install permanent lunar bases with long-term military and national security implications. These developments are also supportive of increased contracts with potential for LMT to participate and grow revenue providing space technology. In sum, Lockheed Martin is an attractive intermediate- term growth stock (1-5 years) at any pricing below $425 level. The Company pays a decent dividend currently yielding 2.85% at the $397 per share pricing. And the company has maintained a regular decades-long practice of increasing its dividend payout. This analyst posts a strong BUY recommendation for the Company. Lockheed Martin is a long-standing world leader in aviation/avionics, space-faring technology, and armaments/munitions. It boasts over a century of experience in aircraft design and production. Its core competency in ballistic missile technology, launch control, and space habitat may emerge stronger in the coming years as the U.S. fulfills its volition to return to the Moon and also create colonies on Mars. Furthermore, as China and Russia become more assertive outside of their traditional spheres of influence, Lockheed Martin may be called upon even more to design and manufacture next-generation stealth, hypersonic, and drone technology to maintain world peace and assure the U.S. continues to lead in the patrol of international airspace, earth’s oceans, and ultimately the solar system beyond. Will Lockheed Martin experience a rapid run? Probably not. But in many ways, Lockheed Martin’s staid share price with dividend payout is one of its charms. Look for Lockheed to improve its dividend amount in the coming 12 to 18-month interval, and look for the share price to increase moderately over the same time frame. Target: $450-$475 Invest Responsibly! And remember… It's not the size of the dog in the fight, it's the size of the fight in the dog. …Mark Twain

- 11. 2022-07-26_LMT-MC-ValuationReport_Draft02 | Page 11 of 21 11 of 21 |© BEHARRY, LYNDON MARTIN W. | 2022-07-26_LMT-MC-ValuationReport_Draft02 | 7/27/2022 2:24 PM FINANCIAL INDICES

- 12. 2022-07-26_LMT-MC-ValuationReport_Draft02 | Page 12 of 21 12 of 21 |© BEHARRY, LYNDON MARTIN W. | 2022-07-26_LMT-MC-ValuationReport_Draft02 | 7/27/2022 2:24 PM

- 13. 2022-07-26_LMT-MC-ValuationReport_Draft02 | Page 13 of 21 13 of 21 |© BEHARRY, LYNDON MARTIN W. | 2022-07-26_LMT-MC-ValuationReport_Draft02 | 7/27/2022 2:24 PM FINANCIAL INDICES

- 14. 2022-07-26_LMT-MC-ValuationReport_Draft02 | Page 14 of 21 14 of 21 |© BEHARRY, LYNDON MARTIN W. | 2022-07-26_LMT-MC-ValuationReport_Draft02 | 7/27/2022 2:24 PM FINANCIAL INDICES

- 15. 2022-07-26_LMT-MC-ValuationReport_Draft02 | Page 15 of 21 15 of 21 |© BEHARRY, LYNDON MARTIN W. | 2022-07-26_LMT-MC-ValuationReport_Draft02 | 7/27/2022 2:24 PM FINANCIAL INDICES

- 16. 2022-07-26_LMT-MC-ValuationReport_Draft02 | Page 16 of 21 16 of 21 |© BEHARRY, LYNDON MARTIN W. | 2022-07-26_LMT-MC-ValuationReport_Draft02 | 7/27/2022 2:24 PM FINANCIAL INDICES

- 17. 2022-07-26_LMT-MC-ValuationReport_Draft02 | Page 17 of 21 17 of 21 |© BEHARRY, LYNDON MARTIN W. | 2022-07-26_LMT-MC-ValuationReport_Draft02 | 7/27/2022 2:24 PM FINANCIAL INDICES

- 18. 2022-07-26_LMT-MC-ValuationReport_Draft02 | Page 18 of 21 18 of 21 |© BEHARRY, LYNDON MARTIN W. | 2022-07-26_LMT-MC-ValuationReport_Draft02 | 7/27/2022 2:24 PM

- 19. 2022-07-26_LMT-MC-ValuationReport_Draft02 | Page 19 of 21 19 of 21 |© BEHARRY, LYNDON MARTIN W. | 2022-07-26_LMT-MC-ValuationReport_Draft02 | 7/27/2022 2:24 PM

- 20. 2022-07-26_LMT-MC-ValuationReport_Draft02 | Page 20 of 21 20 of 21 |© BEHARRY, LYNDON MARTIN W. | 2022-07-26_LMT-MC-ValuationReport_Draft02 | 7/27/2022 2:24 PM

- 21. 2022-07-26_LMT-MC-ValuationReport_Draft02 | Page 21 of 21 21 of 21 |© BEHARRY, LYNDON MARTIN W. | 2022-07-26_LMT-MC-ValuationReport_Draft02 | 7/27/2022 2:24 PM i Lockheed Martin: Innovation With A Purpose (2013) p. 70 ii "At December 31, 2021 and 2020, the aggregate amount of liabilities recorded relative to environmental matters was $742 million and $789 million, most of which are recorded in other noncurrent liabilities on our consolidated balance sheets. We have recorded assets for the portion of environmental costs that are probable of future recovery totaling $645 million and $685 million at December 31, 2021 and 2020, most of which are recorded in other noncurrent assets on our consolidated balance sheets. See “Note 1 – Organization and Significant Accounting Policies” for more information." (Lockheed Martin Corporation, 2022) p. 103 iii See the WACC Worksheet for details of each component. The Monte Carlo Workbook algorithm is hard coded to calculate WACC using various methods: CAPM, Gordon Dividend Growth Model, RoE model, or combinations. In this instant, the system derived the WACC using market capitalization with the then share price of $460 and with weighted number of shares equivalent to the average of 273 Millions (Yahoo Finance value for shares outstanding) and 266 Millions (the 2021-12-31 10-K value). The coded WACC calculation used the Book Value of all Debt (B) to calculate its percentage of total capitalization, which also provided the arithmetic reciprocal for the Equity weighting. The cost of debt (B) was derived above. The cost of Equity emerged from the Gordon Dividend Growth Model using the then share price of $440.56