2022 01-03 l-mw_b_exc-report

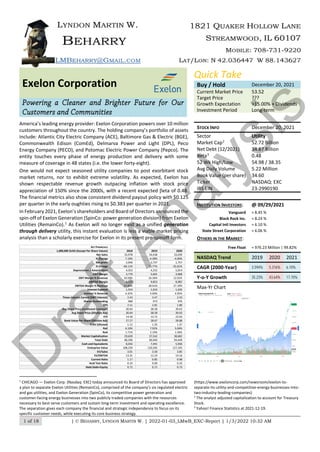

- 1. 1 of 18 | © BEHARRY, LYNDON MARTIN W. | 2022-01-03_LMwB_EXC-Report | 1/3/2022 10:32 AM Exelon Corporation Powering a Cleaner and Brighter Future for Our Customers and Communities America’s leading energy provider: Exelon Corporation powers over 10 million customers throughout the country. The holding company’s portfolio of assets include: Atlantic City Electric Company (ACE), Baltimore Gas & Electric (BGE), Commonwealth Edison (ComEd), Delmarva Power and Light (DPL), Peco Energy Company (PECO), and Potomac Electric Power Company (Pepco). The entity touches every phase of energy production and delivery with some measure of coverage in 48 states (i.e. the lower forty-eight). One would not expect seasoned utility companies to post exorbitant stock market returns, nor to exhibit extreme volatility. As expected, Exelon has shown respectable revenue growth outpacing inflation with stock price appreciation of 150% since the 2000s, with a recent expected βeta of 0.48. The financial metrics also show consistent dividend payout policy with $0.125 per quarter in the early oughties rising to $0.383 per quarter in 2021. In February 2021, Exelon’s shareholders and Board of Directors announced the spin-off of Exelon Generation (SpinCo: power generation division) from Exelon Utilities (RemainCo).1 As Exelon will no longer exist as a unified generation through delivery utility, this instant evaluation is less a viable market pricing analysis than a scholarly exercise for Exelon in its present pre-spinoff form. KEY FINANCIALS 1,000,000 $USD (Except Per Share Values) 2018 2019 2020 Net Sales 35,978 34,438 33,039 % Change 7.19% -4.28% -4.06% Net profit 2,046 2,737 1,757 % Change -48.11% 33.77% -35.81% Depreciation / Amortization 4,353 4,252 5,014 EBIT Margin 3,779 5,601 3,968 EBIT Margin % Revenue 10.50% 16.26% 12.01% EBITDA Margin 8,132 9,853 8,982 EBITDA Margin % Revenue 22.60% 28.61% 27.19% Interest Expense 1,554 1,616 1,635 Interest % Revenue 4.32% 4.69% 4.95% Times Interest Earned (EBIT:Interest) 2.43 3.47 2.43 Shares Outstanding 968 973 976 EPS 2.11 2.81 1.80 Avg Share Price (Undiluted Common) 30.64 38.58 39.63 Avg Share Price (Dilution Adj) 30.64 38.58 39.63 P/E 14.50 13.72 22.02 Book Value Per Share (Dilution Adj) 27.27 28.67 28.88 P/BV (Diluted) 1.12 1.35 1.37 RoE 6.19% 7.92% 5.04% RoA 1.71% 2.19% 1.36% Market Capitalization 29,659 37,542 38,682 Total Debt 86,596 90,404 94,449 Cash and Equivalents 8,016 7,441 5,936 Enterprise Value 108,239 120,505 127,195 EV/Sales 3.01 3.50 3.85 EV/EBITDA 13.31 12.23 14.16 Current Ratio 1.17 0.85 0.98 Acid Test Ratio 0.19 0.09 0.10 Debt:Debt+Equity 0.72 0.72 0.73 1 CHICAGO — Exelon Corp. (Nasdaq: EXC) today announced its Board of Directors has approved a plan to separate Exelon Utilities (RemainCo), comprised of the company’s six regulated electric and gas utilities, and Exelon Generation (SpinCo), its competitive power generation and customer-facing energy businesses into two publicly traded companies with the resources necessary to best serve customers and sustain long-term investment and operating excellence. The separation gives each company the financial and strategic independence to focus on its specific customer needs, while executing its core business strategy. Quick Take Buy / Hold December 20, 2021 Current Market Price 53.52 Target Price ??? Growth Expectation >15.00% + Dividends Investment Period Long-term STOCK INFO December 20, 2021 Sector Utility Market Cap2 52.72 Billion Net Debt (12/2021) 34.87 Billion Beta3 0.48 52 Wk High/Low 54.98 / 38.35 Avg Daily Volume 5.22 Million Book Value (per share) 34.60 Ticker NASDAQ: EXC IRS EIN 23-2990190 INSTITUTION INVESTORS: @ 09/29/2021 Vanguard ≈ 8.45 % Black Rock Inc. ≈ 8.24 % Capital Intl Investors ≈ 6.10 % State Street Corporation ≈ 6.06 % OTHERS IN THE MARKET: Free Float ≈ 976.23 Million | 99.82% NASDAQ Trend 2019 2020 2021 CAGR (2000-Year) 3.594% 5.316% 6.10% Y-o-Y Growth 35.23% 43.64% 17.70% Max-Yr Chart (https://www.exeloncorp.com/newsroom/exelon-to- separate-its-utility-and-competitive-energy-businesses-into- two-industry-leading-companies) 2 The analyst adjusted capitalization to account for Treasury Stock. 3 Yahoo! Finance Statistics at 2021-12-19. D r a f t A n a l y s i s

- 2. 2022-01-03_LMwB_EXC-Report | Page 2 of 18 2 of 18 |© BEHARRY, LYNDON MARTIN W. | 2022-01-03_LMwB_EXC-Report | 1/3/2022 10:32 AM OVERVIEW OF THE BUSINESS: EXELON CORPORATION PECO Energy Company (PA) and the Unicom Corporation (IL) merged in October 2000 to form Exelon Corporation in Chicago under Unicom CEO John Rowe. With a growth mindset, Rowe sought to merge with Public Service Enterprise Group Inc. (NJ). And while FERC approved this deal in 2005, public interest groups pressured NJ Board of Public Utilities to halt merger talks and Exelon subsequently left the table. In Spring 2011, Exelon combined with Constellation Energy in a $7.9 Billion deal, giving the new company control over 34 gigawatts of power generation (55 percent nuclear, 24 percent natural gas, 8 percent renewable including hydro, 7 percent oil and 6 percent coal). Following Rowe's retirement, Christopher Crane was appointed CEO in 2008. By 2014, Exelon announced its proposal to purchase Pepco Holdings, Inc. in an all-cash $6.8 Billion deal. After the deal was rejected by the DC Public Service Commission in 2015, pressure by other state and federal regulators pushed Exelon and Pepco to revise terms to complete the merger in 2016. This made Exelon the largest U.S. regulated utility by customer count and total revenue. Finally, in winter 2021, the entity decided to detach its utility and competitive energy businesses into two separate publicly traded enterprises by Q2 2022. ASSESSMENT OF REVENUE GROWTH (C. 2011-2020) Exelon, America’s leviathan utility holding company has produced average Sales growth outpacing inflation: 6.57% from 2011 through 2020. From FY2011 through FY2020, EXC achieved a Compound Annual Growth Rate (CAGR) of revenue of 6.653% - even accounting for declines attributed to COVID and fossil fuel price volatility (deep declines in early-mid 2020). Fuel cost volatility impacts utility revenue as power cost to consumer is tied to fuel supply cost in the short-intermediate term. THREATS AND CHALLENGES Competition Because utility suppliers are laden with expensive infrastructure, they are relatively insulated from outright competition in the short-intermediate term. Public policy restricts entry while maintaining close relationships and tight regulations on the instant power suppliers. Long-Term Debt Exelon Corporation carries $35.5 Billion of long-term debt at a weighted average before tax cost of 4.5%; its debt ratio (Total Liabilities: Total Capitalization) is 0.7303 at FY2020.4 While slightly higher than the industry median of 0.66, the analyst believes this is of no concern. And EXC 2020 FCFFirm of $6.77 Billion (roughly 20.5% of revenue) is more than adequate to cover interest, CAPEX, Preferred dividends and Common dividends. Furthermore, finance mechanisms had long ago determined that large infrastructure projects including utilities’ economic capital is best served with long-term debt tied to the construction of the generating and transmission capacity. GHG and National / International Compliance5 Exelon supports comprehensive federal climate legislation, including a cap-and-trade program for GHG emissions that addresses the urgent need to substantially reduce national GHG emissions while providing appropriate protections for consumers, businesses, and the economy. In the absence of comprehensive federal legislation, Exelon supports EPA moving forward with meaningful regulation of GHG emissions under the 4 Long Term Debt: Total Capitalization ≃ 0.64984 5 Copied Verbatim from EXC FY2020 10K. Clean Air Act. The Registrants currently are subject to, and may become subject to additional, federal and/or state legislation and/or regulations addressing GHG emissions. Generation produces electricity predominantly from low- and zero-carbon generating facilities (such as nuclear, hydroelectric, natural gas, wind, and solar PV) and neither owns nor operates any coal-fueled generating assets. Generation’s natural gas and biomass fired generating plants produce GHG emissions, most notably CO2. However, Generation’s owned-asset emission intensity, or rate of carbon dioxide equivalent (CO e) emitted per unit of electricity generated, is among the lowest in the industry. Other GHG emission sources associated with the Utility Registrants include natural gas (methane) leakage on the natural gas systems, sulfur hexafluoride (SF6) leakage from electric transmission and distribution operations, refrigerant leakage from chilling and cooling equipment, and fossil fuel combustion in motor vehicles. In addition, PECO, BGE, and DPL distribute natural gas and Generation sells natural gas at retail; and consumers’ use of such natural gas produces GHG emissions. (FY2020 10K) On November 4, 2020, the United States formally withdrew from the Paris Agreement, retracting its commitment to reduce domestic GHG emissions by 26%-28% by 2025 compared with 2005 levels. However, on January 20, 2021, President Biden accepted the Paris Agreement, which resulted in the United States’ formal re- entry on February 19, 2021. The Biden administration has announced its intent to pursue ambitious GHG reductions in the United States and internationally. MEASURE UP, DIVERSITY, AND SOCIAL RESPONSIBILITY DIVERSITY METRICS6 Measure up Rank 217 Provides Day Care Services - Facilitates Employee Resource Groups Yes Has a Policy on Board Diversity Yes Has a Policy on Diversity and Opportunity Yes % Of Employees with Disabilities - % Of New Employees who are women - % Of Employees who are women - % Of Managers who are women 24% Gender pay Gap % 24% % Of Board Members who are Minorities - % Of Employees who are minorities 8% % Of Managers who are minorities 28% Minorities salary gap % 23% 6 https://fortune.com/company/exelon/fortune500/ D r a f t A n a l y s i s

- 3. 2022-01-03_LMwB_EXC-Report | Page 3 of 18 3 of 18 |© BEHARRY, LYNDON MARTIN W. | 2022-01-03_LMwB_EXC-Report | 1/3/2022 10:32 AM PESTLE: CHARACTERISTICS Economic Payroll conduit for 32,000 employees Changes in consumer demand brought on by contagion could adversely affect upstream and downstream service revenue o COVID: extension of consumer billing periods / severe reductions to demand contributed to over 4% per annum declines in revenue 2019, 2020, and likely 2021 Delayed collections of receivables could impact liquidity, credit ratings, and access to capital Environmental Risk management supervision/training is outsourced to Jensen Hughes (2019 IAEA document: 51081703-IAEA); Long-term on-site nuclear rods storage is problematic o Nuclear waste hazards require secure long-term depository; Astute transition from fossil fuels – underscore safe nuclear and increased capacity for atomic energy; Climate and weather variation may impact demand and supply; Operates within national framework for climate legislation (cap and trade GHG); supports EPA Clean Air Act; Wind power turbines use rare earth metals, particularly neodymium for super-magnets in the dynamo; Rare earth mining typically (with present-day low-cost/economical extraction methods) causes high levels of pollution (China). Legal SEC Federal litigation/settlement regarding lobbying activities in IL o Appearance of quid pro quo; Changing national safety regulations and safeguards on nuclear but also GHG could impact strategy and operations. Political Local and State government regulation may impact utilities’ rates, financial performance, and consumer base; Tax breaks may expire in the short term o Tax Cuts and Jobs Act brought Federal corporate tax to 21% (set to expire after 2125); Nuclear plants are an especially critical national security asset with unique safety protocols and safeguards subject to exhaustive oversight and regulatory adjustments as needed; Access to Uranium for fuel rods;7 U.S. does not currently use plutonium in nuclear power plants, but nuclear plants produce Pu through enrichment o Depending on political winds, lobbyists against nuclear weapons may find EXC an attractive target. Sociological Employs 32,000 workers with positive diversity initiatives; Supports employees’ involvement in community (arts, education, volunteerism, etc.); Good / above average health and leave benefits (GlassDoor); Limited Retirement Investment options (GlassDoor); Conduit for $US 33 billion of product and services; Services ten million individual customers among the mid-Atlantic states o social concern over environmental impact GHG and nuclear. Technological Safety first: drones image tension lines and transmission damage to better prepare crews (etc.); Cons: Emerging techs could impact the firm by stimulating expensive capital upgrades; 7 Canada, Australia, Russia, Kazakhstan, and Uzbekistan represented the top five countries of origin and together accounted for 84% of total U.S. uranium purchases in 2017. (https://www.eia.gov/todayinenergy/detail.php?id=37192) Over 10,000 nuclear professionals work in the nuclear power production; Constructing next generation nuclear power generation o Upgrading and refueling its nuclear plants in IL: “With this landmark legislation in place, we are moving quickly to restaff and refuel all of our nuclear plants for 24/7 operation, producing carbon-free, baseload electricity for more than 10 million homes and businesses,” said Dave Rhoades, Exelon Generation’s Chief Nuclear Officer. “These plants are not only important for the clean energy they produce, but they are massive economic engines for their local communities, contributing more than $1.6 billion to Illinois’ GDP each year.”8 PORTER ANALYSIS IN BRIEF Internal Rivalry Minimal to no internal rivalry because… o Size of the firm; o Public policy counters ubiquitous transmission lines… New Entrants Strong Economic / Financial barriers to entry o Little threat of new entrants; o Public policy counters ubiquitous transmission lines… Supplier power Fuel suppliers: Uranium; Wind Turbines; Solar panels; Fossil Fuels (gas, oil); Supply of neodymium and other rare earths could affect Exelon’s Wind Turbine fleet and solar array configuration; Rare earth metals are necessary for green energy technology… o neodymium, dysprosium, indium, selenium, tellurium, terbium and gallium are easily extracted in only a handful of geographic zones… U.S. sources its majority supply from China, which some perceive as a national security threat. Buyer / Consumer Power Consumers typically speak through community and state regulatory agencies… o Regulatory agencies often have strong voices. Threat of Substitutes Home energy production: Self-Sufficiency (solar, wind, and biodiesel) is not a viable alternative for most households o Little to no threat of substitutes. 8 https://www.power-eng.com/nuclear/saved-by-the-bill- exelon-now-planning-300m-in-capital-works-for-illinois- nuclear-plants/ D r a f t A n a l y s i s

- 4. 2022-01-03_LMwB_EXC-Report | Page 4 of 18 4 of 18 |© BEHARRY, LYNDON MARTIN W. | 2022-01-03_LMwB_EXC-Report | 1/3/2022 10:32 AM FINANCIAL MODEL: PROSPECTIVE VIEW Variables CRITERIA CoGS: F(Rev) 77.080% Depreciation/Amortization (CoGS): F(Rev) 10.771% SGA (Only) : F(Rev) 0.000% R&D: F(Rev) 0.000% Depreciation/Amortization (SGA): F(Rev) 0.000% Other Expense (Income)/Overhead: F(Rev) -2.081% Interest Expense (Income): F(Rev) 1.250% Tax Rate: F(EBT) 20.000% Capital Expenditures: F(Rev) 10.000% Working Capital: F(Rev) 4.095% βeta 0.480 Shares Outstanding (Million) 978 Inflation Rate (Est.) 2.500% RF (T-bill annual) Rate 0.250% CAPM KE Calculation 6.802% KB Result 4.513% KB Result with Tax Shield 3.610% WACC 4.730% Market Historical Returns 13.900% Revenue Growth Rate (Projected Estimate) 5.000% Perpetuity Growth Rate (Inflation) 2.500% The analyst created prospective models and sensitivity analyses to objectively determine Exelon valuations from Free CashFlow to Equity (FCFE). By rigorously analyzing the firm’s historical efficient financial performance, the analyst derived costs and expense components as objective functions of Revenue F(Rev), or in the case of Taxation, F(EBT). This table recounts the summary of variables used in the Discounted Cash Flow analysis to isolate: 1) valuation of the Firm’s Free CashFlow to Equity; and 2) valuation per common equity share. Discussion The analyst produced three distinct prospective models of FCFE: 1) Static model varying WACC; 2) Static model varying Revenue Growth Rate; and 3) Dynamic multi-iterative Monte Carlo model oscillating all variables within a tolerance of 10% coefficient of variability. These models suggest a range of Equity valuation for Exelon. The results page discusses the outcomes of these Equity valuation simulations. Costs of Capital KE The U.S. S&P 500 has posted recent annual returns (2011- 2020) of 13.9%; with long-term (30-year) CAGR of 10.7%. Valuing Exelon, this analyst favors an equity return of 6.802% following the Capital Asset Pricing Model. E(ri) = rf + β[E(rm)-rf] = 0.250% + 0.48 X (13.9%-0.25%) = 0.250% + 6.552% = 6.802% KB Long-Term Debt 10K:2020 MatDate Coupon Value Annual 1/1/2050 4.045% 18,915 765 1/1/2050 5.025% 10,585 532 1/1/2050 4.375% 3,700 162 1/1/2020 2.600% 0 0 1/1/2022 3.150% 0 0 1/1/2053 5.045% 170 9 1/1/2022 3.500% 1,150 40 1/1/2024 3.950% 30 1 1/1/2024 0.935% 143 1 1/1/2017 7.720% 10 1 1/1/2021 5.550% 21 1 1/1/2023 2.000% 50 1 1/1/2037 4.145% 977 40 1/1/2027 3.085% 765 24 0.000% -77 0 0.000% -248 0 0.000% 721 0 0.000% -1,819 0 1/1/2033 6.350% 206 13 1/1/2028 6.315% 81 5 1/1/2033 5.750% 103 6 35,483 1,601 Weighted KB 4.513% With Tax Shield (20%) 3.610% Weighted Average Cost of Capital 𝑊𝑊𝑊𝑊𝑊𝑊𝑊𝑊 = 𝐾𝐾𝐵𝐵𝐵𝐵+𝐾𝐾𝐸𝐸𝐸𝐸 B+E = [3.610%X0.350159]+[6.802%X0.64984] 1.000 = [0.0234592] + [0.0238178] 1.000 = 0.047277 = 4.7277% D r a f t A n a l y s i s

- 5. 2022-01-03_LMwB_EXC-Report | Page 5 of 18 5 of 18 |© BEHARRY, LYNDON MARTIN W. | 2022-01-03_LMwB_EXC-Report | 1/3/2022 10:32 AM STATIC MODEL: PROSPECTIVE VIEW Results of the Variable Revenue Growth Rate This display reflects per share valuations from a 2.50% annual growth rate of revenue (per share $68.34) through 7.50% annual revenue growth ($159.87). The Prospective free cash-flow to equity analysis returned an expected per share valuation of $109.40 at a 5.00% growth rate, with WACC of 4.73%. Discussion The analyst expects the firm would regress to its mean revenue growth rate of 6.60% (intermediate term) with some upside potential as the U.S. economy overcomes COVID-induced economic retraction. Results of the Variable WACC Growth Rate This chart plots Exelon valuations at different rates of capital costs. The expected value per share is $109.40 at the calculated WACC: 4.73%. Higher WACC returns lower per share valuations. Discussion The analyst expects Exelon’s weighted average cost of capital to be no less than 4.73%, but it may be higher. Thus, the Firm would produce true value only through increased growth in revenue, and through cost reduction. MONTE CARLO FINANCIAL MODEL: PROSPECTIVE VIEW Overview Monte Carlo quantitative analysis is a statistics-mathematics process. It mimics real-world volatility to probabilistically predict a range of outcomes. The analyst employed the identical variable structure for both the static and Monte Carlo equity valuation models. BUT, the Monte Carlo process dynamically alters the factors within defined constraints. In this instance, Monte Carlo uses the variables as the statistical mean (arithmetic average), and fluctuated each factor 500,000 times at a standard deviation of 10% of the mean value. Results This chart illustrates a potential range of valuation for Exelon common equity per share at a paltry 5.00% growth rate. Using this variable structure, the model delivers the following statistics: a) an expected median per share price of $113.95; with a b) projected maximum to $623.21. At a base 5.00% revenue growth rate, the simulation returned a 70.88% probability of a fair valuation of over $60 per share. EXC: EXELON MONTE CARLO5.00%: VALUATION PER SHARE CURVE SHAPE Lognormal TRIALS 500,000 MEAN 114.19 MEDIAN 113.93 MODE N/A ST DEV 98.48 MINIMUM -374.45 MAXIMUM 627.24 VALUE >$50 74.25% VALUE >$75 65.40% VALUE >$100 55.65% VALUE >$125 45.49% D r a f t A n a l y s i s

- 6. 2022-01-03_LMwB_EXC-Report | Page 6 of 18 6 of 18 |© BEHARRY, LYNDON MARTIN W. | 2022-01-03_LMwB_EXC-Report | 1/3/2022 10:32 AM Discussion The analyst sculpts scenarios with cautious estimates, aiming to err on the side of restraint. This Monte Carlo prospective model uses conservative estimates for growth and cost/expense factors: growth rate approximating recent U.S. or world historical inflation; and costs following historical mean percentages, tempered against industry norms. But when Exelon emerges from COVID conditions, revenue growth rates may well rise over 5.00% for a half-decade or more. Although this potential is captured within the Monte Carlo model, the conservative parameters pull valuation potentials back toward the mean. And while this particular model only returns a 55.65% probability of per share equity warranting values greater than $100, the region of 10.00% growth is well within the realm of possibility when the U.S. emerges from COVID constraints. The static model sensitivity analysis predicts a per share value of over $155.00 at 7.50% Revenue growth. And one must also consider how an upgraded infrastructure regime supporting new atomic and green energy production will buttress Exelon’s cash position and increase shareholder value. 1) Cost of Sales dominates ultimate production of Shareholder Value and Returns on Equity. Businesses have recognized this truth since humanity’s early ancestors debated whether to hunt every day (including unhealthy hot days), or to gather on some days and expense hunting assets (experience, training, and energy) only within profitable conditions. 2) In ART OF WAR, Sun Tsu ordered the army to gain its sustenance off the enemy’s land. In other words, neither the troops nor the generals should reap any excessive rewards unless and until the Firm earns command over Revenue in the target market. In the case of Exelon, the firm should manage its back- office payroll and executive bonus structures until the firm secures success in mastering energy production in the post-GHG eco-friendly environment. 3) Certainly, Exelon must invest in capital infrastructure and with foresight. The firm must tightly control its investment in capital infrastructure, and safely squeeze additional years from equipment. In addition, the firm may wish to create an internal R&D department. While R&D is a cost center that bills expense to production; over years, R&D may well engender significant shareholder value in new production fleet assets. <><><><> Sensitivity Analysis The Monte Carlo FCFE DISCOUNTED CASH FLOW PROJECTION is sensitive to particular conditions: 1) Because the perpetuity CashFlow dwarfs estimated cash-flow in any given annum, the terminal year COST OF GOODS SOLD typically asserts dominance over the Firm and its weighted Equity valuation; 2) 2031 CAPEX; 3) 2031 TAX RATE; 4) 2031 DEPRECIATION AND AMORTIZATION; 5) 2031 OTHER EXPENSE (INCOME) and 6) 2030 REVENUE The Tornado Chart sensitivity analysis of Exelon’s valuation with these instant variables imputes a heavy weighting upon the perpetuity model – likely because the near-term growth rate of 5% per annum is relatively low. This analyst believes that Exelon will actually suffer a Y-o-Y loss of revenue in 2021 due to COVID’s effect on the U.S. economy. D r a f t A n a l y s i s

- 7. 2022-01-03_LMwB_EXC-Report | Page 7 of 18 7 of 18 |© BEHARRY, LYNDON MARTIN W. | 2022-01-03_LMwB_EXC-Report | 1/3/2022 10:32 AM FRAUD ANALYSIS Statistics Testing for Anomalous Financial Reporting Benford’s Test Beneish M-Score METHODOLOGY OF FORENSIC ANALYSIS TO DETECT FRAUD Twenty-first century forensic analysis of financial records encourages mathematics and statistics to test anomalies in financial reporting. The analyst favors two forensic tests: Benford’s Test, and Beneish’s M-Score. Note: Forensic Accounting analysis cannot prove fraud; it simply suggests instances of potential anomalies in reporting. Benford’s (First Digits) Law Benford’s law (First Digits Law) predicts that the first digits in random sets of numbers which span across several orders of magnitude (i.e. ones, tens, hundreds, thousands, etc.) will conform to a set distribution (the bronze columns). Because of compounding over time intervals, the First Digits rule affirms that there are more instances of numbers beginning with 1, then 2, then 3, and so on. This analysis tested Exelon’s Balance Sheet numbers against Benford’s Law. The first digits of the Balance Sheet numbers fall very close to expected outcomes; and the analyst believes this indicates fair and honest reporting. The Beneish M-Score calculations Exelon’s Beneish scores are excellent for several years running. They reflect no anomalous readings. D r a f t A n a l y s i s

- 8. 2022-01-03_LMwB_EXC-Report | Page 8 of 18 8 of 18 |© BEHARRY, LYNDON MARTIN W. | 2022-01-03_LMwB_EXC-Report | 1/3/2022 10:32 AM OUTLOOK AND RECOMMENDATION This analyst is optimistic for Exelon’s growth and value prospects going forward. Since its founding, the Firm’s senior management has exhibited leadership and has typically seized first mover advantage. Exelon’s realignments to detach its generating division from its transmission and utilities indicates continued entrepreneurial focus seeking superior stakeholder value. Success in transitioning to more carbon-neutral energy production produces valuable public relations for the company. Its long-standing core competency in atomic energy generation also contributes to its national leadership position. This nuclear competency may also give the firm an edge in prospective international endeavors if management is so inclined. The firm should consider whether it is beneficial to mitigate supply risks through vertical integration and/or public private partnership to secure rare earth inputs for wind and solar infrastructure. But such a move is particularly challenging. On the one hand, if the Firm partners with mining/extraction firms or public institutions, it gains more control over its supply source. On the other hand, such enterprise would expose Exelon to risks associated with long-tail pollution and land degradation. Such endeavors require extreme foresight and substantial investment into capital infrastructure, and new core competences for environmental control, remediation, and monitoring. This analyst posts a strong BUY recommendation for the Company. Exelon is the long-standing leader in America’s energy industry. It boasts decades of experience in generating, transmission, and maintenance of power infrastructure. Its core competency in nuclear power generation is particularly valuable as the world transitions away from GHG power production. Furthermore, as the U.S. economy emerges from COVID restrictions and the associated economic malaise, the Firm will achieve robust growth and accelerate its free-cash- flow levels. Will the stock run-up? Probably not – especially since Exelon GENERATING will split from Exelon UTILITY TRANSMISSION in Q2 2022. But present-day Exelon, and likely both of the newly formed spun-off entities will continue to generate excellent cash-flow and returns for the investors in regular dividends after Q2 2022. Enjoy your investments! And remember… It's not the size of the dog in the fight, it's the size of the fight in the dog. …Mark Twain D r a f t A n a l y s i s

- 9. 2022-01-03_LMwB_EXC-Report | Page 9 of 18 9 of 18 |© BEHARRY, LYNDON MARTIN W. | 2022-01-03_LMwB_EXC-Report | 1/3/2022 10:32 AM FINANCIAL INDICES D r a f t A n a l y s i s

- 10. 2022-01-03_LMwB_EXC-Report | Page 10 of 18 10 of 18 |© BEHARRY, LYNDON MARTIN W. | 2022-01-03_LMwB_EXC-Report | 1/3/2022 10:32 AM FINANCIAL INDICES D r a f t A n a l y s i s

- 11. 2022-01-03_LMwB_EXC-Report | Page 11 of 18 11 of 18 |© BEHARRY, LYNDON MARTIN W. | 2022-01-03_LMwB_EXC-Report | 1/3/2022 10:32 AM D r a f t A n a l y s i s

- 12. 2022-01-03_LMwB_EXC-Report | Page 12 of 18 12 of 18 |© BEHARRY, LYNDON MARTIN W. | 2022-01-03_LMwB_EXC-Report | 1/3/2022 10:32 AM FINANCIAL INDICES D r a f t A n a l y s i s

- 13. 2022-01-03_LMwB_EXC-Report | Page 13 of 18 13 of 18 |© BEHARRY, LYNDON MARTIN W. | 2022-01-03_LMwB_EXC-Report | 1/3/2022 10:32 AM FINANCIAL INDICES D r a f t A n a l y s i s

- 14. 2022-01-03_LMwB_EXC-Report | Page 14 of 18 14 of 18 |© BEHARRY, LYNDON MARTIN W. | 2022-01-03_LMwB_EXC-Report | 1/3/2022 10:32 AM FINANCIAL INDICES D r a f t A n a l y s i s

- 15. 2022-01-03_LMwB_EXC-Report | Page 15 of 18 15 of 18 |© BEHARRY, LYNDON MARTIN W. | 2022-01-03_LMwB_EXC-Report | 1/3/2022 10:32 AM FINANCIAL INDICES D r a f t A n a l y s i s

- 16. 2022-01-03_LMwB_EXC-Report | Page 16 of 18 16 of 18 |© BEHARRY, LYNDON MARTIN W. | 2022-01-03_LMwB_EXC-Report | 1/3/2022 10:32 AM D r a f t A n a l y s i s

- 17. 2022-01-03_LMwB_EXC-Report | Page 17 of 18 17 of 18 |© BEHARRY, LYNDON MARTIN W. | 2022-01-03_LMwB_EXC-Report | 1/3/2022 10:32 AM D r a f t A n a l y s i s

- 18. 2022-01-03_LMwB_EXC-Report | Page 18 of 18 18 of 18 |© BEHARRY, LYNDON MARTIN W. | 2022-01-03_LMwB_EXC-Report | 1/3/2022 10:32 AM D r a f t A n a l y s i s