State Bank of India: Absolute valuations, accumulate - Prabhudas Lilladher

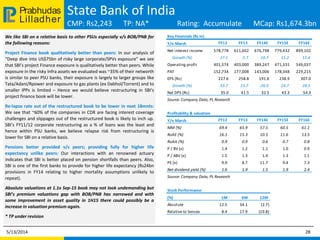

- 1. Lilladher Prabhudas State Bank of India CMP: Rs2,243 TP: NA* Rating: Accumulate MCap: Rs1,674.3bn We like SBI on a relative basis to other PSUs especially v/s BOB/PNB for the following reasons: Project Finance book qualitatively better than peers: In our analysis of “Deep dive into US$75bn of risky large corporate/SPVs exposure” we see that SBI’s project Finance exposure is qualitatively better than peers. While exposure in the risky Infra assets we evaluated was ~35% of their networth is similar to peer PSU banks, their exposure is largely to larger groups like Tata/Adani/Rpower and exposure to gas plants (ex Dabhol/Torrent) and to smaller IPPs is limited – Hence we would believe restructuring in SBI’s project finance book will be lower. Re-lapse rate out of the restructured book to be lower in next 18mnts: We see that ~60% of the companies in CDR are facing interest coverage challenges and slippages out of the restructured book is likely to inch up. SBI’s FY11/12 corporate restructuring as a % of loans was the least and hence within PSU banks, we believe relapse risk from restructuring is lower for SBI on a relative basis. Pensions better provided v/s peers; providing fully for higher life expectancy unlike peers: Our interactions with an renowned actuary indicates that SBI is better placed on pension shortfalls than peers. Also, SBI is one of the first banks to provide for higher life expectancy (Rs24bn provisions in FY14 relating to higher mortality assumptions unlikely to repeat). Absolute valuations at 1.1x Sep-15 book may not look undemanding but SBI’s premium valuations gap with BOB/PNB has narrowed and with some improvement in asset quality in 1H15 there could possibly be a increase in valuation premium again. * TP under revision 5/13/2014 28 Key Financials (Rs m) Y/e March FY12 FY13 FY14E FY15E FY16E Net interest income 578,778 611,602 676,798 779,432 899,102 Growth (%) 27.1 5.7 10.7 15.2 15.4 Operating profit 401,574 403,000 389,247 471,331 549,037 PAT 152,734 177,008 143,006 178,348 229,215 EPS (Rs) 227.6 258.8 191.6 238.9 307.0 Growth (%) 33.7 13.7 -26.0 24.7 28.5 Net DPS (Rs) 35.0 41.5 32.5 43.3 54.3 Source: Company Data, PL Research Profitability & valuation Y/e March FY12 FY13 FY14E FY15E FY16E NIM (%) 69.4 65.9 57.5 60.5 61.1 RoAE (%) 16.1 15.3 10.5 11.6 13.5 RoAA (%) 0.9 0.9 0.6 0.7 0.8 P / BV (x) 1.4 1.2 1.1 1.0 0.9 P / ABV (x) 1.5 1.3 1.4 1.3 1.1 PE (x) 9.9 8.7 11.7 9.4 7.3 Net dividend yield (%) 1.6 1.9 1.5 1.9 2.4 Source: Company Data, PL Research Stock Performance (%) 1M 6M 12M Absolute 12.5 34.1 (2.7) Relative to Sensex 8.4 17.9 (19.8)

- 2. Lilladher Prabhudas Financials State Bank of India 5/13/2014 29 Income Statement (Rs m) Y/e March FY12 FY13 FY14E FY15E FY16E Int. Earned from Adv. 1,113,415 1,264,422 1,514,947 1,714,116 1,955,824 Int. Earned from Invt. 337,052 387,032 426,508 476,219 532,724 Others - - - - - Total Interest Income 1,471,974 1,679,781 1,974,110 2,228,048 2,532,182 Interest expense 893,196 1,068,179 1,297,312 1,448,615 1,633,080 NII 578,778 611,602 676,798 779,432 899,102 Growth (%) 27.1 5.7 10.7 15.2 15.4 Treasury Income 22,394 14,162 21,850 18,400 17,250 NTNII 159,671 187,155 200,256 228,292 262,535 Non Interest Income 182,065 201,317 222,106 246,692 279,785 Total Income 1,654,039 1,881,098 2,196,216 2,474,739 2,811,967 Growth (%) 24.3 13.7 16.8 12.7 13.6 Operating Expense 359,269 409,920 509,656 554,793 629,850 Operating Profit 401,574 403,000 389,247 471,331 549,037 Growth (%) 22.2 0.4 (3.4) 21.1 16.5 NPA Provisions 155,147 159,973 175,331 216,549 221,586 Investment Provisions 8,556 (9,501) 12,500 - - Total Provisions 162,444 150,403 187,831 216,549 221,586 PBT 239,129 252,597 201,417 254,782 327,451 Tax Provisions 86,395 75,588 58,411 76,435 98,235 Effective Tax Rate (%) 36.1 29.9 29.0 30.0 30.0 PAT 152,734 177,008 143,006 178,348 229,215 Growth (%) 41.2 15.9 (19.2) 24.7 28.5 Source: Company Data, PL Research Balance Sheet (Rs m) Y/e March FY12 FY13 FY14E FY15E FY16E Par Value 10 10 10 10 11 No. of equity shares 671 684 747 747 679 Equity 6,710 6,840 7,465 7,465 7,465 Networth 1,062,300 1,250,330 1,464,927 1,605,426 1,787,182 Adj. Networth 851,349 962,506 916,229 954,453 1,047,231 Deposits 14,146,894 16,274,026 18,757,828 21,623,789 25,299,719 Growth (%) 12.7 15.0 15.3 15.3 17.0 Low Cost deposits 5,755,887 6,631,254 7,643,340 8,865,207 10,435,494 % of total deposits 40.7 40.7 40.7 41.0 41.2 Total Liabilities 18,262,305 21,289,045 24,486,513 28,198,553 32,812,368 Net Advances 11,636,702 13,926,080 16,154,253 18,738,934 21,924,552 Growth (%) 15.6 19.7 16.0 16.0 17.0 Investments 4,609,491 5,193,932 5,884,110 6,532,985 7,476,512 Total Assets 18,262,305 21,289,045 24,486,513 28,198,553 32,812,368 Source: Company Data, PL Research

- 3. Lilladher Prabhudas Disclaimer 5/13/2014 80 BUY : Over 15% Outperformance to Sensex over 12-months Accumulate : Outperformance to Sensex over 12-months Reduce : Underperformance to Sensex over 12-months Sell : Over 15% underperformance to Sensex over 12-months Trading Buy : Over 10% absolute upside in 1-month Trading Sell : Over 10% absolute decline in 1-month Not Rated (NR) : No specific call on the stock Under Review (UR) : Rating likely to change shortly This document has been prepared by the Research Division of Prabhudas Lilladher Pvt. Ltd. Mumbai, India (PL) and is meant for use by the recipient only as information and is not for circulation. This document is not to be reported or copied or made available to others without prior permission of PL. It should not be considered or taken as an offer to sell or a solicitation to buy or sell any security. The information contained in this report has been obtained from sources that are considered to be reliable. However, PL has not independently verified the accuracy or completeness of the same. Neither PL nor any of its affiliates, its directors or its employees accept any responsibility of whatsoever nature for the information, statements and opinion given, made available or expressed herein or for any omission therein. Recipients of this report should be aware that past performance is not necessarily a guide to future performance and value of investments can go down as well. The suitability or otherwise of any investments will depend upon the recipient's particular circumstances and, in case of doubt, advice should be sought from an independent expert/advisor. Either PL or its affiliates or its directors or its employees or its representatives or its clients or their relatives may have position(s), make market, act as principal or engage in transactions of securities of companies referred to in this report and they may have used the research material prior to publication. We may from time to time solicit or perform investment banking or other services for any company mentioned in this document. Prabhudas Lilladher Pvt. Ltd. 3rd Floor, Sadhana House, 570, P. B. Marg, Worli, Mumbai 400 018, India. Tel: (91 22) 6632 2222 Fax: (91 22) 6632 2209 PL’s Recommendation Nomenclature Rating Distribution of Research Coverage 27.2% 51.5% 21.4% 0.0% 0% 10% 20% 30% 40% 50% 60% BUY Accumulate Reduce Sell %ofTotalCoverage