JLL Grand Rapids Office Insight & Statistics - Q3 2019

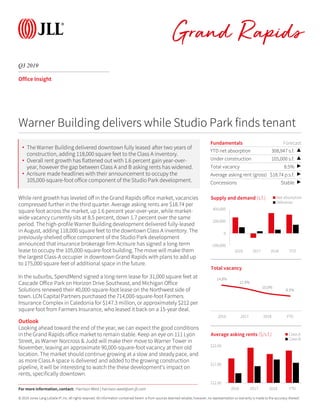

- 1. © 2019 Jones Lang LaSalle IP, Inc. All rights reserved. All information contained herein is from sources deemed reliable; however, no representation or warranty is made to the accuracy thereof. Q3 2019 Grand Rapids Office Insight While rent growth has leveled off in the Grand Rapids office market, vacancies compressed further in the third quarter. Average asking rents are $18.74 per square foot across the market, up 1.6 percent year-over-year, while market- wide vacancy currently sits at 8.5 percent, down 1.7 percent over the same period. The high-profile Warner Building development delivered fully-leased in August, adding 118,000 square feet to the downtown Class A inventory. The previously-shelved office component of the Studio Park development announced that insurance brokerage firm Acrisure has signed a long-term lease to occupy the 105,000-square-foot building. The move will make them the largest Class-A occupier in downtown Grand Rapids with plans to add up to 175,000 square feet of additional space in the future. In the suburbs, SpendMend signed a long-term lease for 31,000 square feet at Cascade Office Park on Horizon Drive Southeast, and Michigan Office Solutions renewed their 40,000-square-foot lease on the Northwest side of town. LCN Capital Partners purchased the 714,000-square-foot Farmers Insurance Complex in Caledonia for $147.3 million, or approximately $212 per square foot from Farmers Insurance, who leased it back on a 15-year deal. Outlook Looking ahead toward the end of the year, we can expect the good conditions in the Grand Rapids office market to remain stable. Keep an eye on 111 Lyon Street, as Warner Norcross & Judd will make their move to Warner Tower in November, leaving an approximate 90,000-square-foot vacancy at their old location. The market should continue growing at a slow and steady pace, and as more Class A space is delivered and added to the growing construction pipeline, it will be interesting to watch the these development’s impact on rents, specifically downtown. Fundamentals Forecast YTD net absorption 308,947 s.f. ▲ Under construction 105,000 s.f. ▲ Total vacancy 8.5% ▶ Average asking rent (gross) $18.74 p.s.f. ▶ Concessions Stable ▶ -200,000 0 200,000 400,000 2016 2017 2018 YTD Supply and demand (s.f.) Net absorption Deliveries Warner Building delivers while Studio Park finds tenant 14.8% 12.9% 10.0% 8.5% 2016 2017 2018 YTD Total vacancy $12.00 $17.00 $22.00 2016 2017 2018 YTD Average asking rents ($/s.f.) Class A Class B For more information, contact: Harrison West | harrison.west@am.jll.com • The Warner Building delivered downtown fully leased after two years of construction, adding 118,000 square feet to the Class A inventory. • Overall rent growth has flattened out with 1.6 percent gain year-over- year, however the gap between Class A and B asking rents has widened. • Acrisure made headlines with their announcement to occupy the 105,000-square-foot office component of the Studio Park development.

- 2. © 2019 Jones Lang LaSalle IP, Inc. All rights reserved. All information contained herein is from sources deemed reliable; however, no representation or warranty is made to the accuracy thereof. Q3 2019 Office Statistics Grand Rapids For more information, contact: Harrison West | harrison.west@am.jll.com Class Inventory (s.f.) Total net absorption (s.f.) YTD total net absorption (s.f.) YTD total net absorption (% of stock) Direct vacancy (%) Total vacancy (%) Average direct asking rent ($ p.s.f.) YTD Completions (s.f.) Under Development (s.f.) Downtown Totals 5,314,919 142,685 206,298 3.9% 7.5% 7.7% $21.20 118,000 105,000 Downtown Totals 5,314,919 142,685 206,298 3.9% 7.5% 7.7% $21.20 118,000 105,000 Northeast Totals 764,896 6,622 -11,998 -1.6% 6.7% 6.7% $16.80 0 0 Northwest Totals 411,996 0 20,474 5.0% 0.0% 0.0% NA 0 0 Southeast Totals 3,884,259 54,223 88,364 2.3% 9.8% 10.4% $16.76 23,448 0 Southwest Totals 461,442 -10,555 5,809 1.3% 10.7% 11.2% $15.75 0 0 Suburbs Totals 5,522,593 50,290 102,649 1.9% 8.7% 9.2% $16.67 23,448 0 West Michigan Totals 10,837,512 192,975 308,947 2.9% 8.1% 8.5% $18.74 141,448 105,000 Downtown A 1,944,250 137,010 149,259 7.7% 11.1% 11.2% $21.85 118,000 105,000 Downtown A 1,944,250 137,010 149,259 7.7% 11.1% 11.2% $21.85 118,000 105,000 Northeast A 121,746 0 0 0.0% 0.0% 0.0% NA 0 0 Southeast A 574,983 2,726 5,264 0.9% 20.5% 22.5% $18.76 23,448 0 Southwest A 18,800 0 0 0.0% 0.0% 0.0% NA 0 0 Suburbs A 715,529 2,726 5,264 0.7% 16.5% 18.1% $18.76 23,448 0 West Michigan A 2,659,779 139,736 154,523 5.8% 12.6% 13.1% $20.75 141,448 105,000 Downtown B 3,370,669 5,675 57,039 1.7% 5.3% 5.7% $20.40 0 0 Downtown B 3,370,669 5,675 57,039 1.7% 5.3% 5.7% $20.40 0 0 Northeast B 643,150 6,622 -11,998 -1.9% 7.9% 7.9% $16.80 0 0 Northwest B 411,996 0 20,474 5.0% 0.0% 0.0% NA 0 0 Southeast B 3,309,276 51,497 83,100 2.5% 7.9% 8.3% $15.84 0 0 Southwest B 442,642 -10,555 5,809 1.3% 11.2% 11.6% $15.75 0 0 Suburbs B 4,807,064 47,564 97,385 2.0% 7.5% 7.8% $15.95 0 0 West Michigan B 8,177,733 53,239 154,424 1.9% 6.6% 7.0% $17.45 0 0