JLL West Michigan Industrial Insight & Statistics - Q4 2018

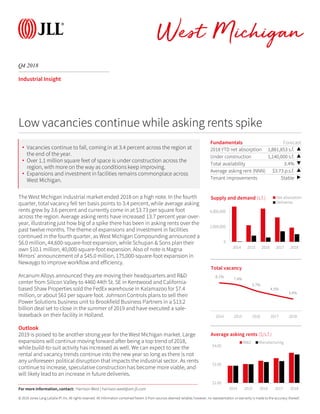

- 1. © 2019 Jones Lang LaSalle IP, Inc. All rights reserved. All information contained herein is from sources deemed reliable; however, no representation or warranty is made to the accuracy thereof. Q4 2018 West Michigan Industrial Insight The West Michigan industrial market ended 2018 on a high note. In the fourth quarter, total vacancy fell ten basis points to 3.4 percent, while average asking rents grew by 3.6 percent and currently come in at $3.73 per square foot across the region. Average asking rents have increased 13.7 percent year-over- year, illustrating just how big of a spike there has been in asking rents over the past twelve months. The theme of expansions and investment in facilities continued in the fourth quarter, as West Michigan Compounding announced a $6.0 million, 44,600-square-foot expansion, while Schupan & Sons plan their own $10.1 million, 40,000-square-foot expansion. Also of note is Magna Mirrors’ announcement of a $45.0 million, 175,000-square-foot expansion in Newaygo to improve workflow and efficiency. Arcanum Alloys announced they are moving their headquarters and R&D center from Silicon Valley to 4460 44th St. SE in Kentwood and California- based Shaw Properties sold the FedEx warehouse in Kalamazoo for $7.4 million, or about $61 per square foot. Johnson Controls plans to sell their Power Solutions business unit to Brookfield Business Partners in a $13.2 billion deal set to close in the summer of 2019 and have executed a sale- leaseback on their facility in Holland. Outlook 2019 is poised to be another strong year for the West Michigan market. Large expansions will continue moving forward after being a top trend of 2018, while build-to-suit activity has increased as well. We can expect to see the rental and vacancy trends continue into the new year so long as there is not any unforeseen political disruption that impacts the industrial sector. As rents continue to increase, speculative construction has become more viable, and will likely lead to an increase in future deliveries. Fundamentals Forecast 2018 YTD net absorption 1,881,853 s.f. ▲ Under construction 1,140,000 s.f. ▲ Total availability 3.4% ▼ Average asking rent (NNN) $3.73 p.s.f. ▲ Tenant improvements Stable ▶ 0 2,000,000 4,000,000 2014 2015 2016 2017 2018 Supply and demand (s.f.) Net absorption Deliveries Low vacancies continue while asking rents spike 8.1% 7.4% 5.7% 4.5% 3.4% 2014 2015 2016 2017 2018 Total vacancy For more information, contact: Harrison West | harrison.west@am.jll.com • Vacancies continue to fall, coming in at 3.4 percent across the region at the end of the year. • Over 1.1 million square feet of space is under construction across the region, with more on the way as conditions keep improving. • Expansions and investment in facilities remains commonplace across West Michigan. $2.00 $3.00 $4.00 2014 2015 2016 2017 2018 Average asking rents ($/s.f.) W&D Manufacturing

- 2. © 2019 Jones Lang LaSalle IP, Inc. All rights reserved. All information contained herein is from sources deemed reliable; however, no representation or warranty is made to the accuracy thereof. Q4 2018 West Michigan Industrial Statistics For more information, contact: Harrison West | harrison.west@am.jll.com Inventory (s.f.) Quarterly total net absorption (s.f.) YTD total net absorption (s.f.) YTD total net absorption (% of stock) Total availability (s.f.) Total availability (%) Average total asking rent ($ p.s.f.) Quarterly completions (s.f.) YTD completions (s.f.) Under construction (s.f.) Market Totals Warehouse & Distribution 106,556,806 -312,496 843,910 0.8% 5,445,568 5.1% $3.79 146,668 894,341 1,140,000 Manufacturing 130,965,095 214,425 1,037,943 0.8% 2,638,250 2.0% $3.59 0 117,712 0 Totals 237,521,901 -98,071 1,881,853 0.8% 8,083,818 3.4% $3.73 146,668 1,012,053 1,140,000 Flex 10,319,609 -199,259 -205,312 -2.0% 683,983 6.6% $8.38 0 0 0 Northeast Grand Rapids Warehouse & Distribution 6,941,239 0 80,628 1.2% 54,778 0.8% $2.66 0 12,000 0 Manufacturing 7,447,133 0 6,952 0.1% 27,570 0.4% $2.22 0 0 0 Totals 14,388,372 0 87,580 0.6% 82,348 0.6% $2.51 0 12,000 0 Flex 266,671 -8,392 -12,557 -4.7% 12,557 4.7% N/A 0 0 0 Northwest Grand Rapids Warehouse & Distribution 8,835,782 -72,443 -124,459 -1.4% 323,130 3.7% $3.49 0 36,250 0 Manufacturing 12,271,082 4,482 66,855 0.5% 595,889 4.9% $3.74 0 0 0 Totals 21,106,864 -67,961 -57,604 -0.3% 919,019 4.4% $3.65 0 36,250 0 Flex 1,179,861 0 -12,904 -1.1% 12,904 1.1% N/A 0 0 0 Southeast Grand Rapids Warehouse & Distribution 32,500,181 -70,860 180,897 0.6% 1,274,422 3.9% $3.57 0 441,028 850,000 Manufacturing 29,084,447 254,924 624,389 2.1% 252,823 0.9% $3.48 0 0 0 Totals 61,584,628 184,064 805,286 1.3% 1,527,245 2.5% $3.56 0 441,028 850,000 Flex 3,473,529 -212,476 -219,602 -6.3% 232,408 6.7% $9.25 0 0 0 Southwest Grand Rapids Warehouse & Distribution 14,411,602 -18,186 -74,793 -0.5% 469,486 3.3% $4.69 12,000 111,720 250,000 Manufacturing 28,394,787 -52,022 189,357 0.7% 265,653 0.9% $4.08 0 0 0 Totals 42,806,389 -70,208 114,564 0.3% 735,139 1.7% $4.47 12,000 111,720 250,000 Flex 789,977 0 1,809 0.2% 485 0.1% N/A 0 0 0 Southwest Michigan Warehouse & Distribution 22,086,101 31,820 924,999 4.2% 2,666,085 12.1% $3.88 134,668 163,343 0 Manufacturing 24,231,715 22,150 700,888 2.9% 535,233 2.2% $3.54 0 36,000 0 Totals 46,317,816 53,970 1,625,887 3.5% 3,201,318 6.9% $3.82 134,668 199,343 0 Flex 2,686,101 11,440 9,735 0.4% 261,339 9.7% $9.55 0 0 0 West Shore Warehouse & Distribution 21,781,901 -182,827 -143,362 -0.7% 657,667 3.0% $3.47 0 130,000 40,000 Manufacturing 29,535,931 -15,109 -550,498 -1.9% 961,082 3.3% $3.46 0 81,712 0 Totals 51,317,832 -197,936 -693,860 -1.4% 1,618,749 3.2% $3.46 0 211,712 40,000 Flex 1,923,470 10,169 28,207 1.5% 164,290 8.5% $6.61 0 0 0