This document provides an overview of BASF, the world's leading chemical company. In 3 sentences:

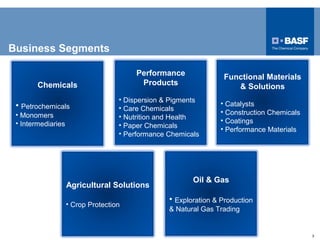

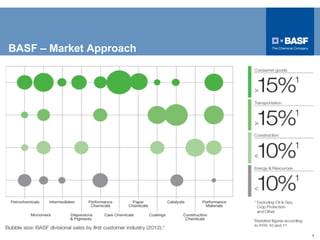

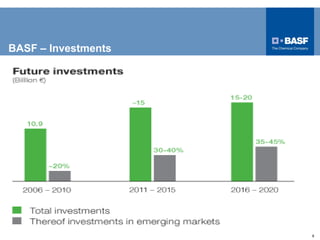

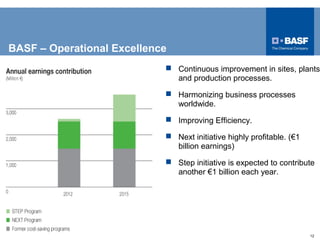

BASF is a global chemical company with over 110,000 employees worldwide. It has 6 major production sites and generates over €72 billion in annual sales. The presentation summarizes BASF's business segments and regions, strategic focus on innovation and growth, and key acquisitions to help achieve its financial targets of earning a premium on capital and growing profitability by 2020.