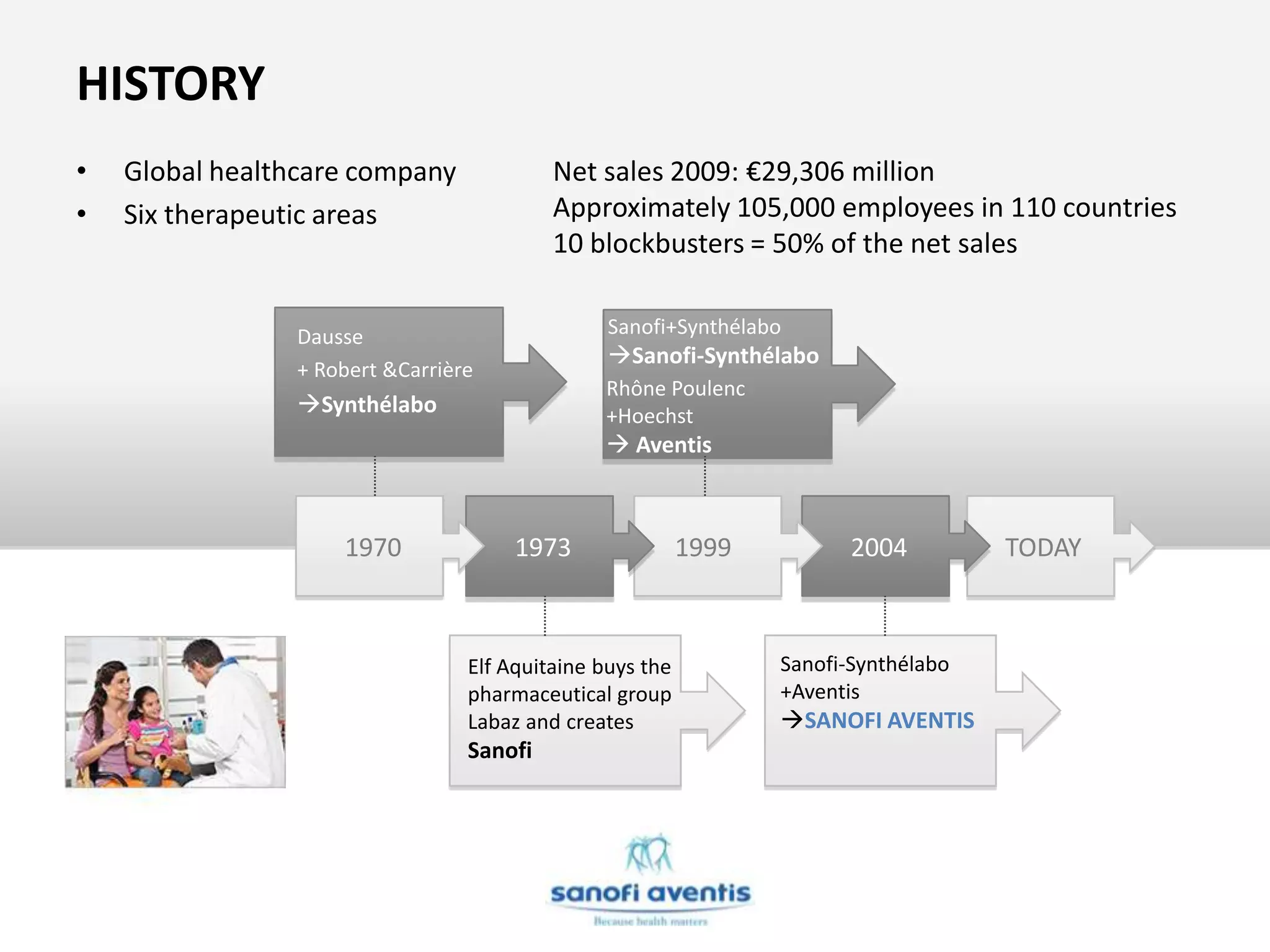

The document provides a comprehensive strategic analysis of Sanofi-Aventis, highlighting its history, market position, and various strategic recommendations to enhance its operations in the global pharmaceutical industry. Key points include a PESTEL analysis, competitive landscape assessment through Porter's Five Forces, and SWOT analysis, along with strategies for diversification, restructuring, and increasing R&D effectiveness. The emphasis is on adapting to market challenges, especially the impending loss of patent protections for major drugs, and capitalizing on emerging market opportunities.