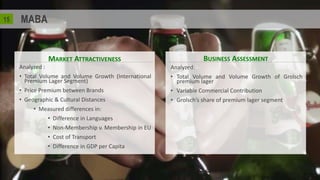

The brewing industry faces challenges as consumer preferences shift, leading Grolsch to aim for a resurgence of beer's premium status. The company has a rich history marked by significant developments, including its IPO and royal title, and now focuses on expanding in developing markets like Latin America and Africa while facing competition from craft beers and new entrants. Grolsch’s strengths lie in its premium product and historic brand recognition, but it must address its weaknesses in distribution and market presence, particularly in North America.

![216

Sources:

1- http://geert-hofstede.com/netherlands.html

2-http://www.dutycalculator.com/hs-lookup/626889/hs-tariff-code-for-beer/

3- http://hts.usitc.gov/

| SOUTH AFRICA

: Former Dutch Colony

: Similar language

: Emerging Market

: High levels of Indulgence1

: Existing presence SABMiller

C: [not significant]

A: [not significant]

G: Physical Distance

E: Different currencies

+

| COLOMBIA

: Existing presence SABMiller

: Emerging Market

: High levels of Indulgence1

: Virgin Premium Beer market

C: Different languages

A: [not significant]

G: Physical Distance

E: Different currencies &

Import Tariffs2

+

| USA

: Existing presence SABMiller

: No import tariffs on beer3

: High levels of Indulgence1

: American preference for

Imported beer

C: Different languages

A: Existence of Dry Laws

G: Physical Distance

E: Developed Market

+

| POLAND

: Relatively close

: Growing demand

: Familiar market

: Learn from past experience

C: Language, Indulgence

A: [not significant]

G: [not significant]

E: Different currencies

+](https://image.slidesharecdn.com/grolschcaseanalysis-team3final6-26-2014-150803205216-lva1-app6892/85/Grolsch-Growing-Globally-Case-Analysis-16-320.jpg)