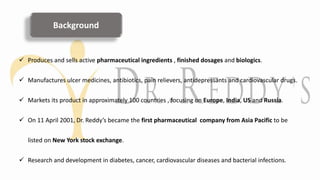

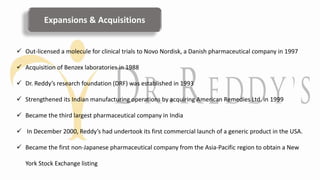

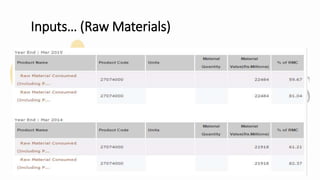

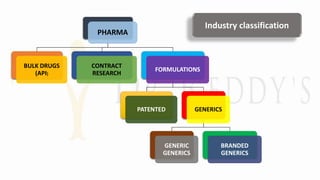

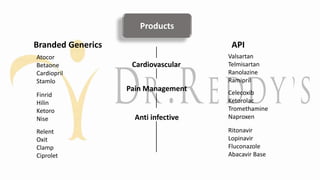

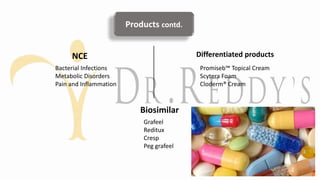

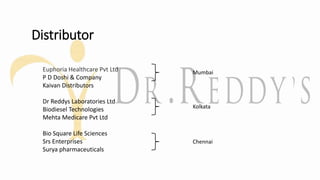

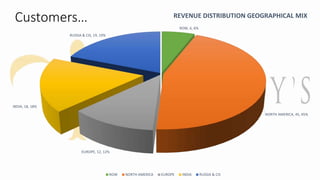

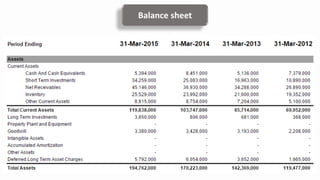

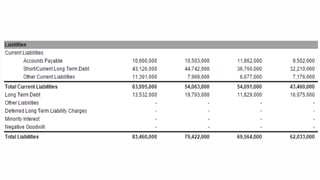

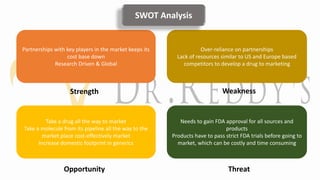

Dr. Reddy's Laboratories, founded in 1984 in Hyderabad, aims to be India's first global pharmaceutical company, focusing on innovative medicines to improve health. The company specializes in active pharmaceutical ingredients, generics, and biologics, with operations in around 100 countries and significant revenue growth since its establishment. Despite achieving notable milestones, including a NYSE listing and various acquisitions, Dr. Reddy's faces challenges like patent litigations and quality issues impacting its financial performance.