This document provides guidance on how to approach and structure a consulting case interview. It recommends first understanding and clarifying the problem statement by asking clarifying questions. Next, structure the problem using a framework or technique like an A4 sheet to organize the information. Then analyze the case by drawing inferences, developing hypotheses, and validating assumptions. Finally, arrive at a conclusion by providing recommendations backed by a logical implementation plan. The approach emphasizes clear communication with the interviewer throughout to extract information and validate one's thinking.

![(C) Consult Club, IIM Ahmedabad

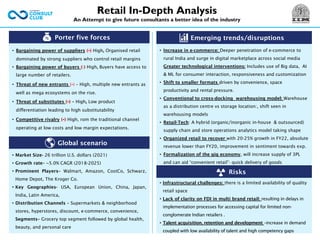

Estimate the number of Injections administered in Ahmedabad

Guesstimate 15

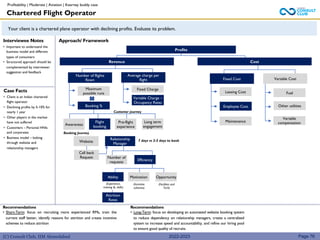

Approach / Framework

• Senior citizens are expected to visit

the doctor more often

• Children and seniors are most likely

to get medicines administered

through injections

• Senior citizens would require blood

tests most frequently

• Calculations for total injections :

[weighted avg. of income dist. and

injections/ individual * age population]

Observations / Suggestions

• A normal scenario is assumed, where vaccinations are only applicable to children from 0-14.

• In case of children, injection per individual and vaccine injection are added together.

• % for blood test required and % for injections administered are mutually exclusive and can be added since we are considering the total number of injections.

Total Population of

AMD (80 lac)

Adults (15-60 yrs)

65% = 50 lac

Instance Lower

income

(30%)

Middle &

upper

income

(70%)

Visits to doctor 1 2

% for blood

tests required

10% 10%

% for injections

administered

30% 40%

Injection per

individual

0.4 1.0

Instance Lower

income

(30%)

Middle

income

(60%)

Upper

income

(10%)

Visits to

doctor

1 2 4

% for blood

tests required

10% 10% 10%

% for

injections

administered

5% 10% 15%

Injection per

individual

0.15 0.4 1.0

Instance Lower

income

(30%)

Middle

income

(60%)

Upper

income

(10%)

Visits to

doctor

1 4 6

% for blood

tests required

20% 20% 20%

% for

injections

administered

20% 30% 40%

Injection per

individual

0.4 2.0 3.6

Additional

injections for

Vaccines

0.5 1

Professionally

administered (by

doctor/ pathology)

Self Administered

(by frequent users)

Number of

injections

% needing

insulin

% diabetic population

Insulin

patients

100 10% 5% 80 lac

Total Injections: Children (Normal + Vaccine) + Adults (15-60 yrs.) + Senior Citizens + Insulin Patients

= 1.67 * 20 + 0.385 * 50 + 1.68 * 10 + 0.4 * 80

= 101 lac (101,00,000)

Page 213

Estimate the number of injections administered in Ahmedabad

Facts/Assumptions

• Population of Ahmedabad is ~80 lac

• Average visits to doctors is 2.5 per

year by children (1-14 yrs) in US

(non-vaccine). Estimating 40% for

lower income and 70% for upper

income India.

• Average visits to doctor by adults

(15+) is 2 per year. Average visit is

4 by senior citizens.

• Diabetic population is 5%.

Senior Citizen (60+)

10% = 10 lac

Children (1- 14 yrs)

25% = 20 lac

Interviewee Notes

Types of

Administration

2022-2023](https://image.slidesharecdn.com/iimacasebook2022-23-220928132649-22d349db/85/IIMA-Casebook-2022-23-pdf-213-320.jpg)

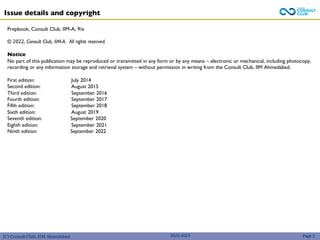

![Media

• Text Production

• Film Production

• Aggregation of content

• Advertisement

Placement

• Editorial Work

• Distribution

• Dealership

Management

• Print

• Infrastructure &

transmissibility

• Sale

• Transmission

• Portals

• Allocation of end

devices

• Content Acquisition

• Advertisement

Acquisition

• Purchase of film

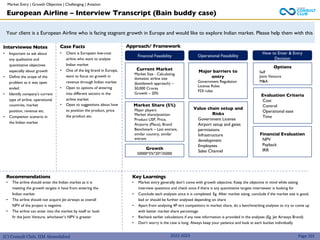

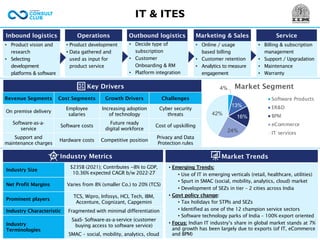

Procurement Production Product Packaging Technical Prodn Distribution

Key Drivers

Market Trends

Revenue Segments Cost Segments Growth Drivers Challenges

Advertising

Content

Acquisition

OTTs & Digital Media

Privacy impacting

advertis. revenues

Subscriptions Operating Costs

Online Gaming &

AR-VR

Online Piracy of

film & TV content

Content Licensing

(Films, Music, Shows)

Govt. Initiatives Google & Facebook

Emerging Trends:

• Roll out of 5G, Metaverse influencing digital space

• Rise in # of OTT platforms

• Digital advertising platforms are attracting revenues from

traditional advertising markets

Govt initiatives:

• FDI Limit: 74% to 100% | National Film Policy

• Centre of Excellence - Animation, Gaming, Visual Eff & Comics

Key Events:

• ZEE-Sony (2nd largest behind Disney) | PVR & INOX[Mergers]

• WPP acquired 50% stake in Madhouse (2018)

• IPL Bid, ICC T20 Bids

Industry Metrics

Industry Size $22B (2022); CAGR: 7.1% (2021-25)

Net Profit Margins

6-9% (Advertising); 11-15%

(Broadcasting/Integrated firms)

Prominent players

Television: Star India, Zee Ent, Sony

Print: Bennett Coleman, Jagran Prakashan

Films: Yash Raj, Eros Ent, Publicis, WPP

Industry Characteristic

Advertising (Consolidated), Broadcasting

(900+ private channels)

Industry Terminologies

Monthly Recurring Revenue (MRR)

Monthly Active Users (MAU)

Customer Acquisition Cost (CAC)

Industry Segmentation

Classification 1

Television : 49%

Digital Media: 17%

Print : 14%

Online Gaming: 5%

Classification 2

Advertising : 49%

Broadcasting

& Cable TV : 28%

Publishing : 22%

Movies & Ent. : 1%](https://image.slidesharecdn.com/iimacasebook2022-23-220928132649-22d349db/85/IIMA-Casebook-2022-23-pdf-241-320.jpg)