The document discusses the commercialization of floating wind turbine technologies, outlining the stages of technology readiness and market fit needed for successful deployment. It emphasizes the importance of demonstrating commercial viability through pilot projects and scaling up to larger operations while considering regional electricity market profiles and cost structures. Key takeaways include the need for strategic investment from established firms and government support to foster innovation in the offshore wind industry.

![5/9

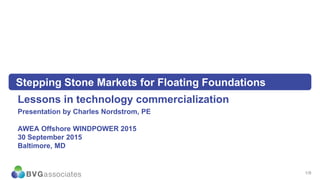

Product-Market Fit

Cost profile during scale-up

© BVG Associates 2015

$0

$100

$200

$300

$400

$500

$600

Commercial

readiness

index

Turbine

rating

(MW)

Number

of

turbines

Project

rating

(MW)

CAPEX per

MW

Annual

OPEX

per MW

Capacity

factor WACC

LCOE

low

($/MWh)

LCOE

high

($/MWh)

Minimum viable

product

2 to 7 1 2 to 7 $9 million

to $11 million

$250,000 35% 12% $ 423 $ 500

Commercial

trial

5 to 8 5 to 10 25 to 80 $7 million

to $9 million

$175,000 42% 12% $ 269 $ 333

Commercial

scale-up

5 to 8 10 to 20 50 to 160 $5.5 million

to $8 million

$125,000 48% 10% $ 157 $ 215

Multiple

commercial

applications

5 to 8 25 to 50 125 to

400

$3.5 million

to $6 million

$90,000 50% 8% $ 82 $ 127

LCOE [US$/MWh]

Progression through commercial readiness index ](https://image.slidesharecdn.com/nordstrom-steppingstonesforfloatingfoundationsr02-151016092423-lva1-app6891/85/Stepping-stones-for-floating-foundations-r02-5-320.jpg)

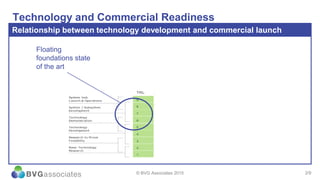

![7/9

$0

$100

$200

$300

$400

$500

$600

LCOE range [US$/MWh]

MVP

(<10 MW)

commercial trial

(25 to 80 MW)

commercial

scale-up

(50 to 160 MW)

multiple

commercial

(hundreds of MW

Product-Market Fit

The right product for the right market

© BVG Associates 2015

Total project up-charge in France: $100 million (6 MW)

Total project up-charge in Scotland: $400 million (30 MW)

Total project up-charge in Maine: $890 million (100 MW)

Commercially attractive in a wide range of

electricity markets (200+ MW)

Total project up-charge in US Virgin Islands: $20 million (6 MW)

Total project discount in US Virgin Islands: $160 million (30 MW)

Total project discount in Hawaii: $960 million (100 MW)](https://image.slidesharecdn.com/nordstrom-steppingstonesforfloatingfoundationsr02-151016092423-lva1-app6891/85/Stepping-stones-for-floating-foundations-r02-7-320.jpg)