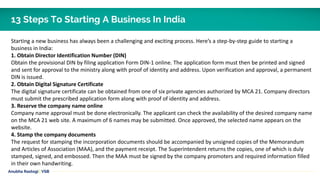

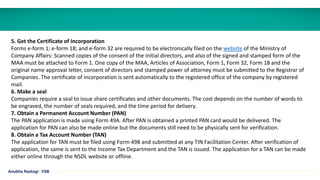

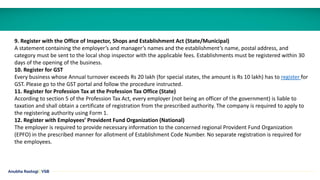

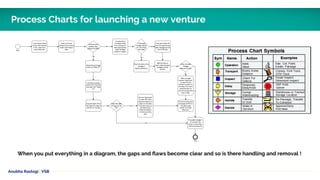

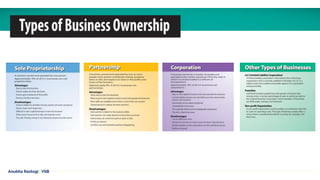

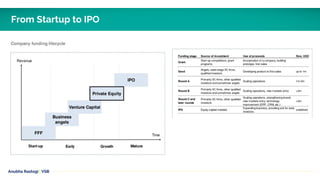

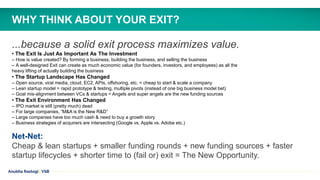

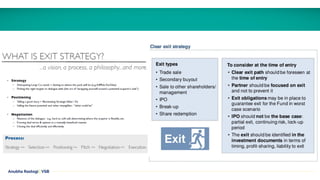

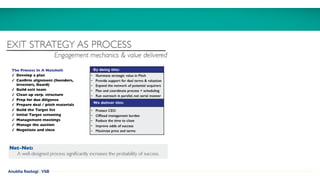

The document provides a comprehensive step-by-step guide for launching a business in India, detailing essential procedures such as obtaining a Director Identification Number, digital signature, and registering for various tax accounts. It emphasizes the importance of the exit strategy in startup lifecycle, noting the changing landscape of funding and company growth. Additionally, it discusses the advantages of a lean startup approach and the necessity for entrepreneurs to consider exit opportunities early in the business development process.