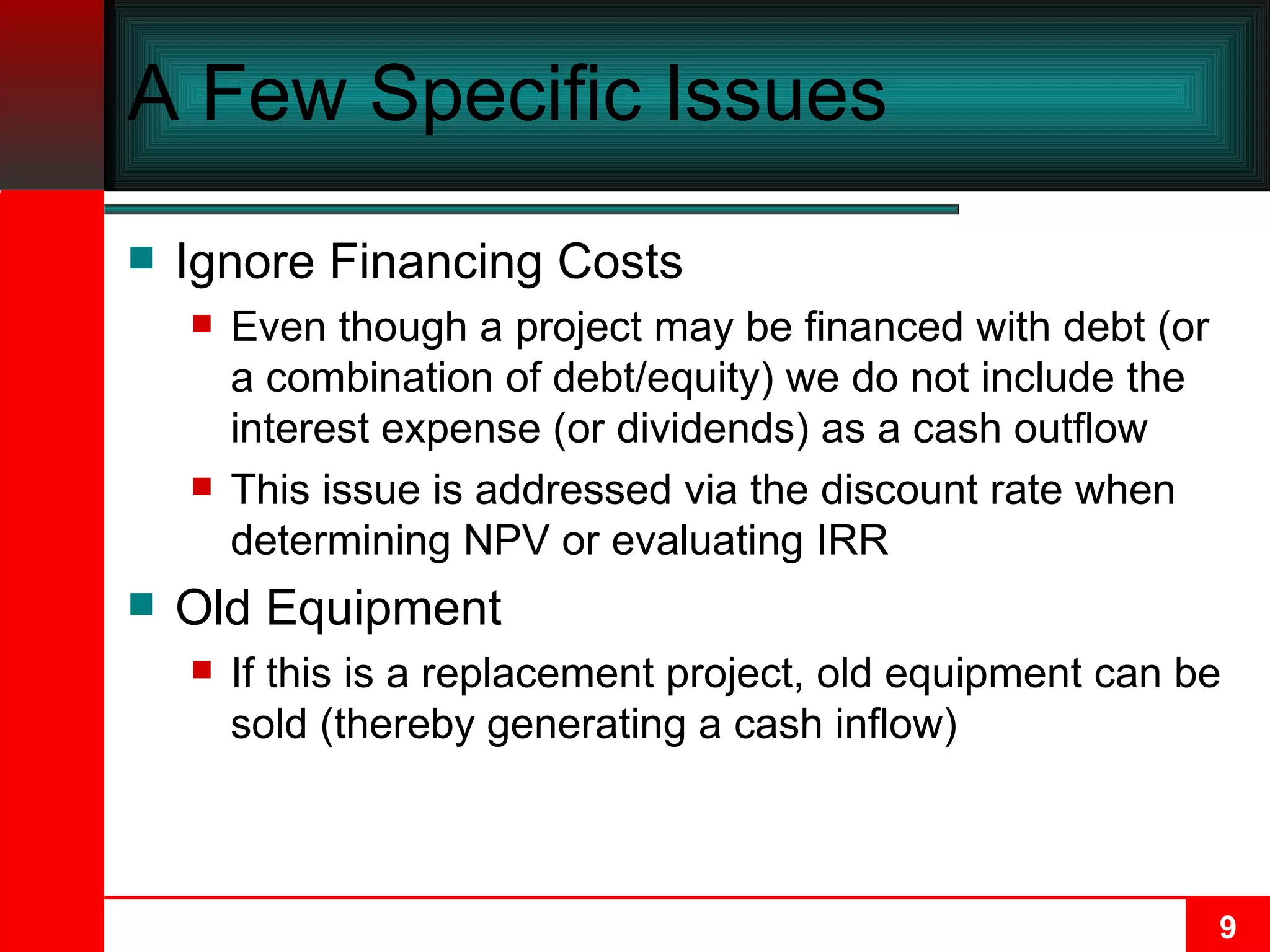

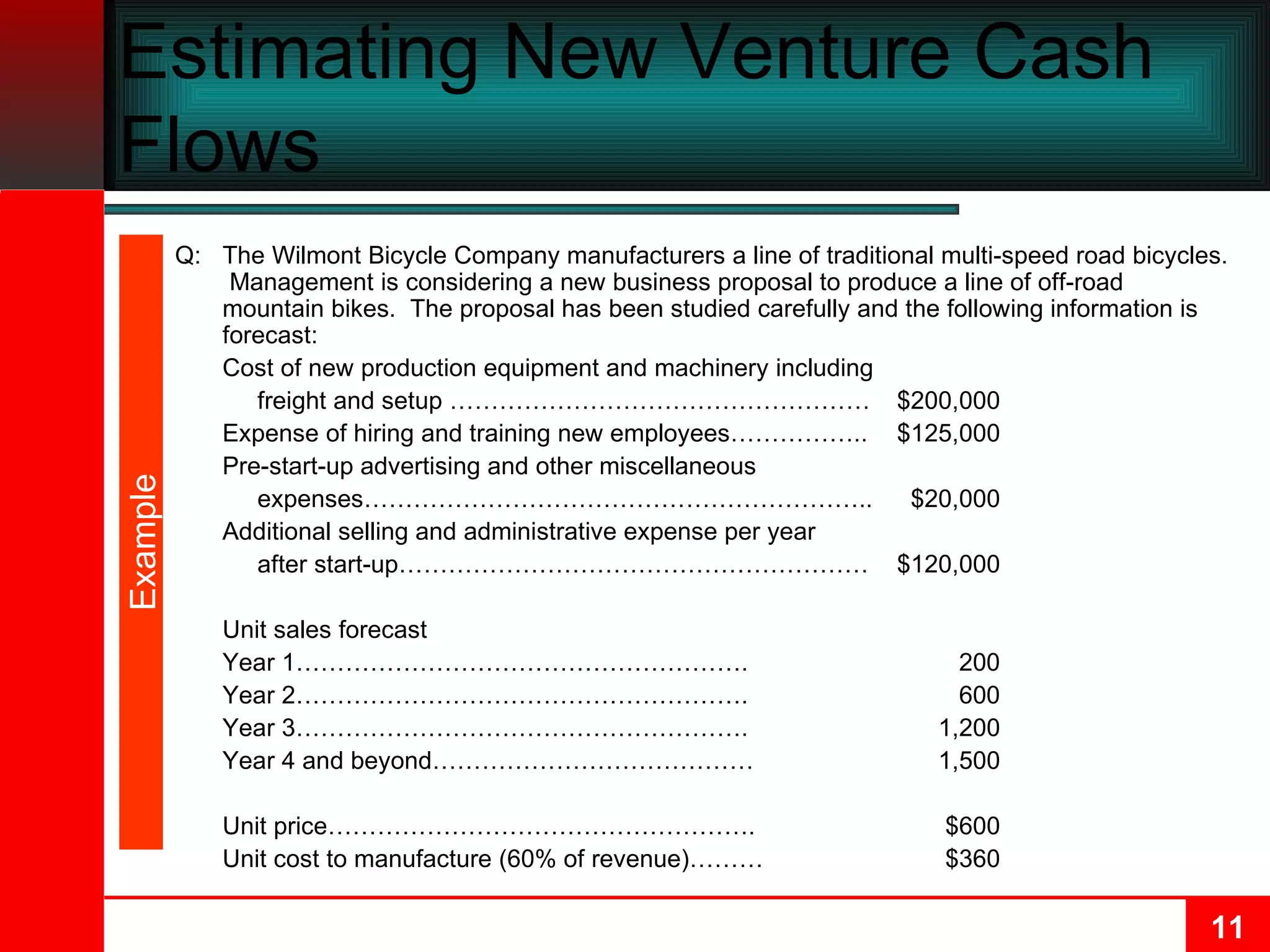

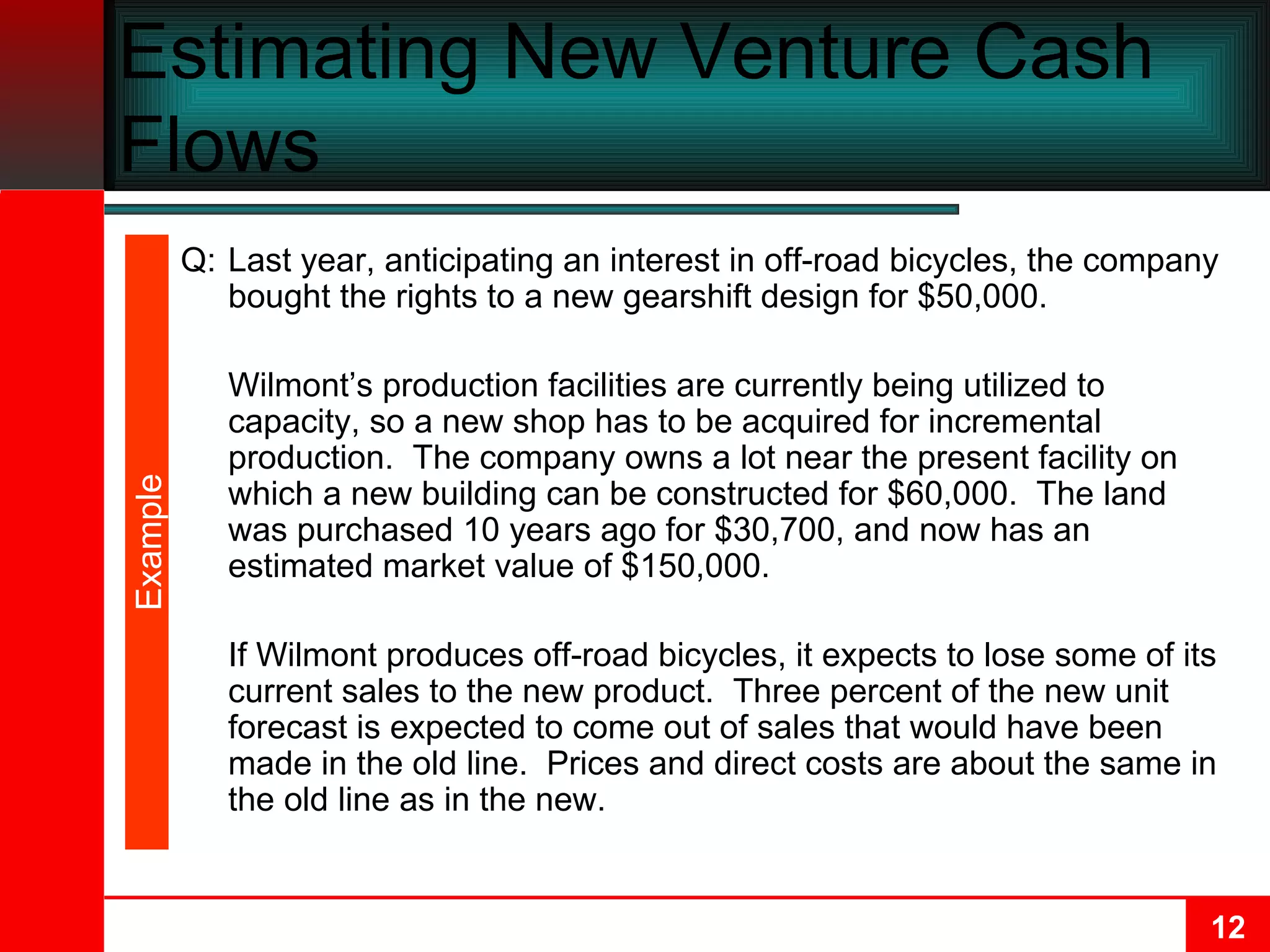

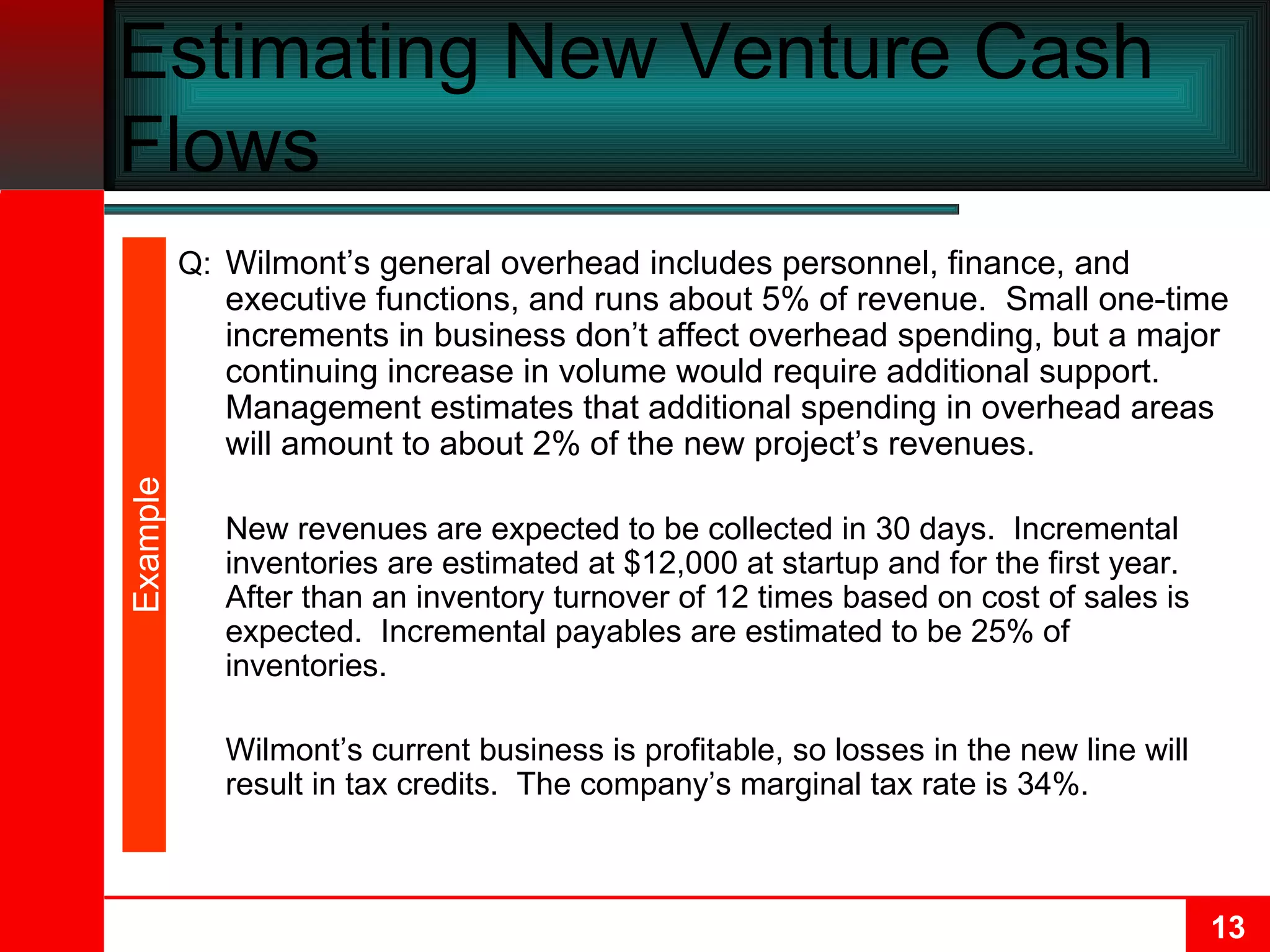

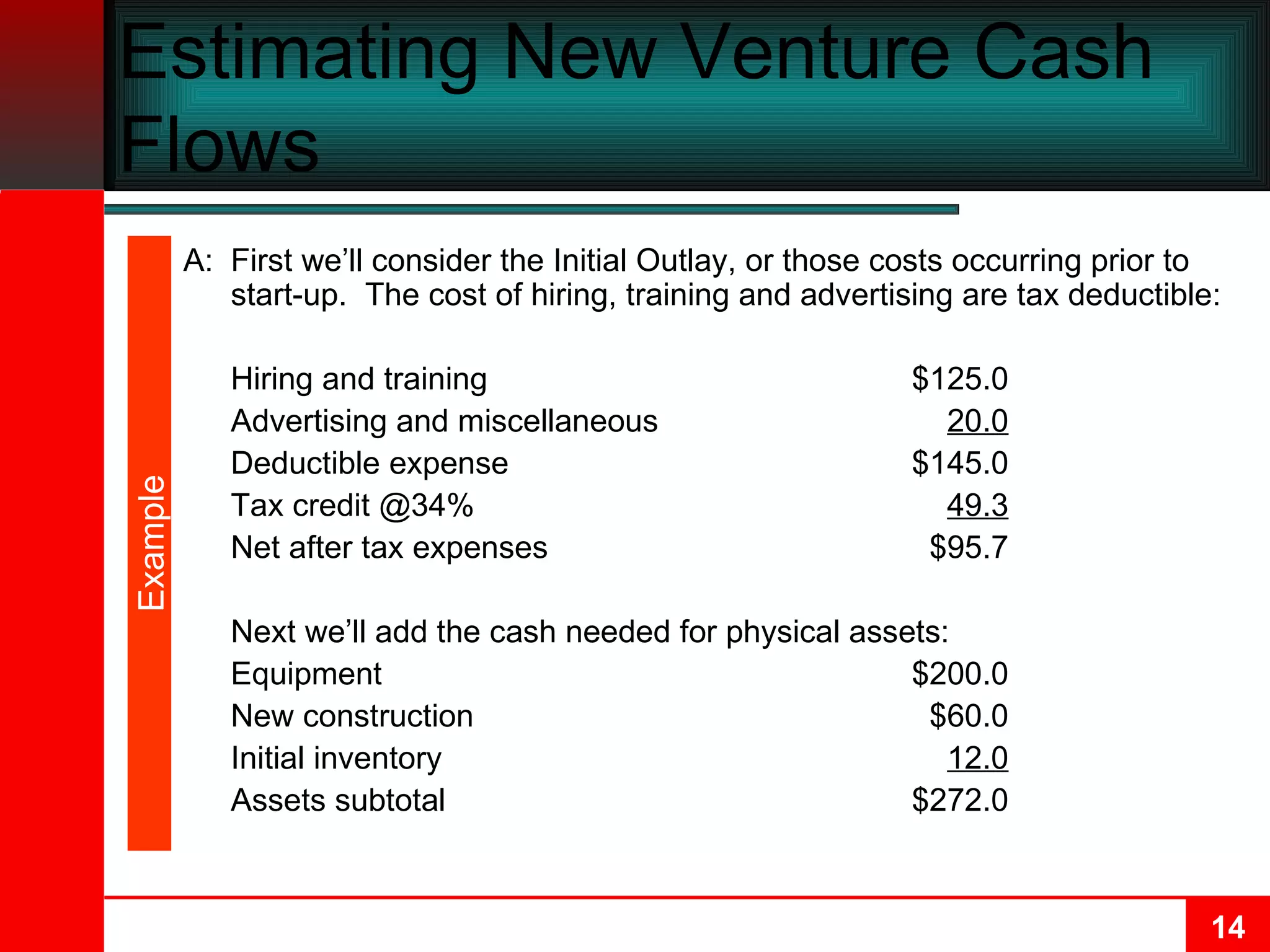

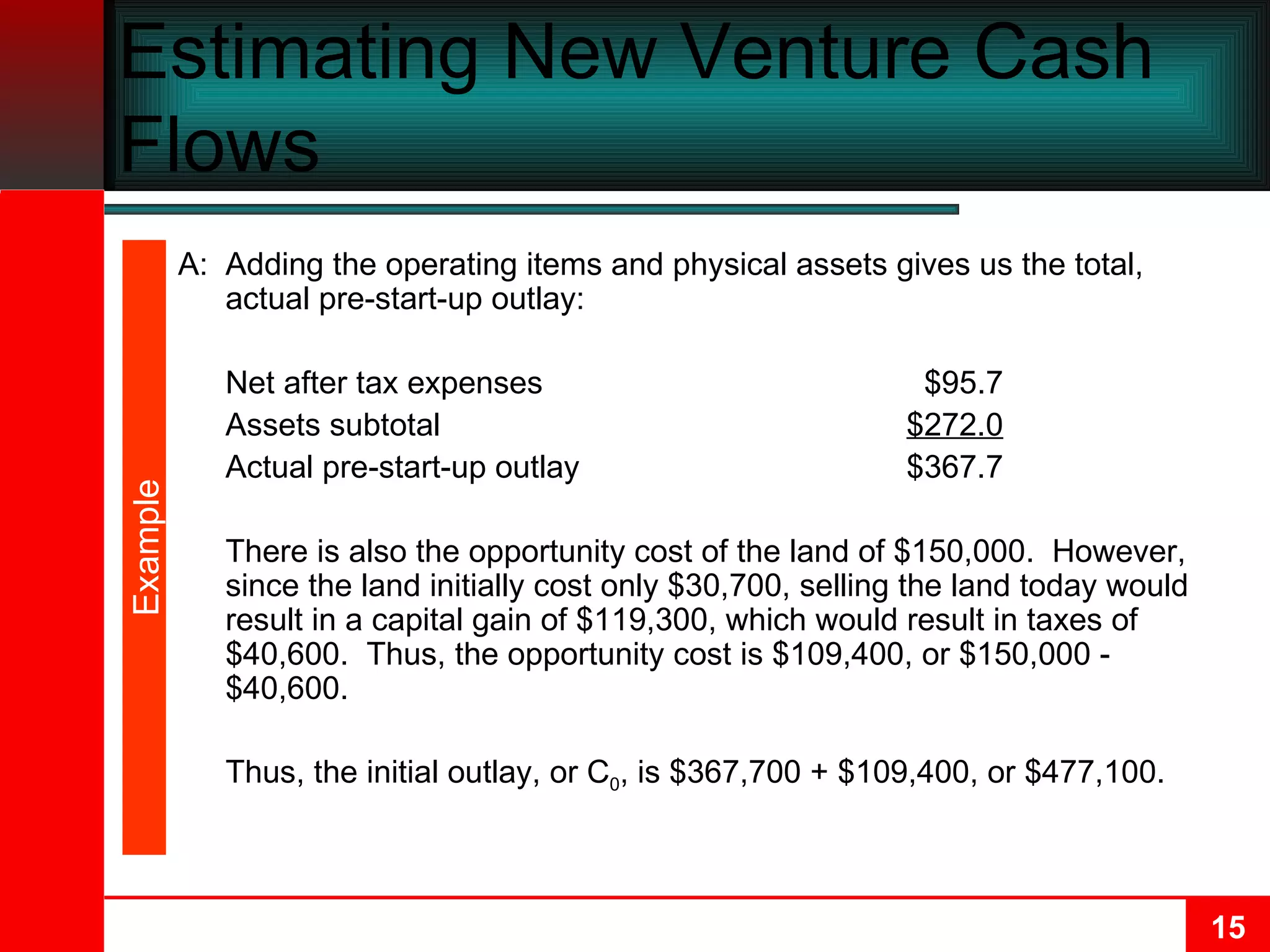

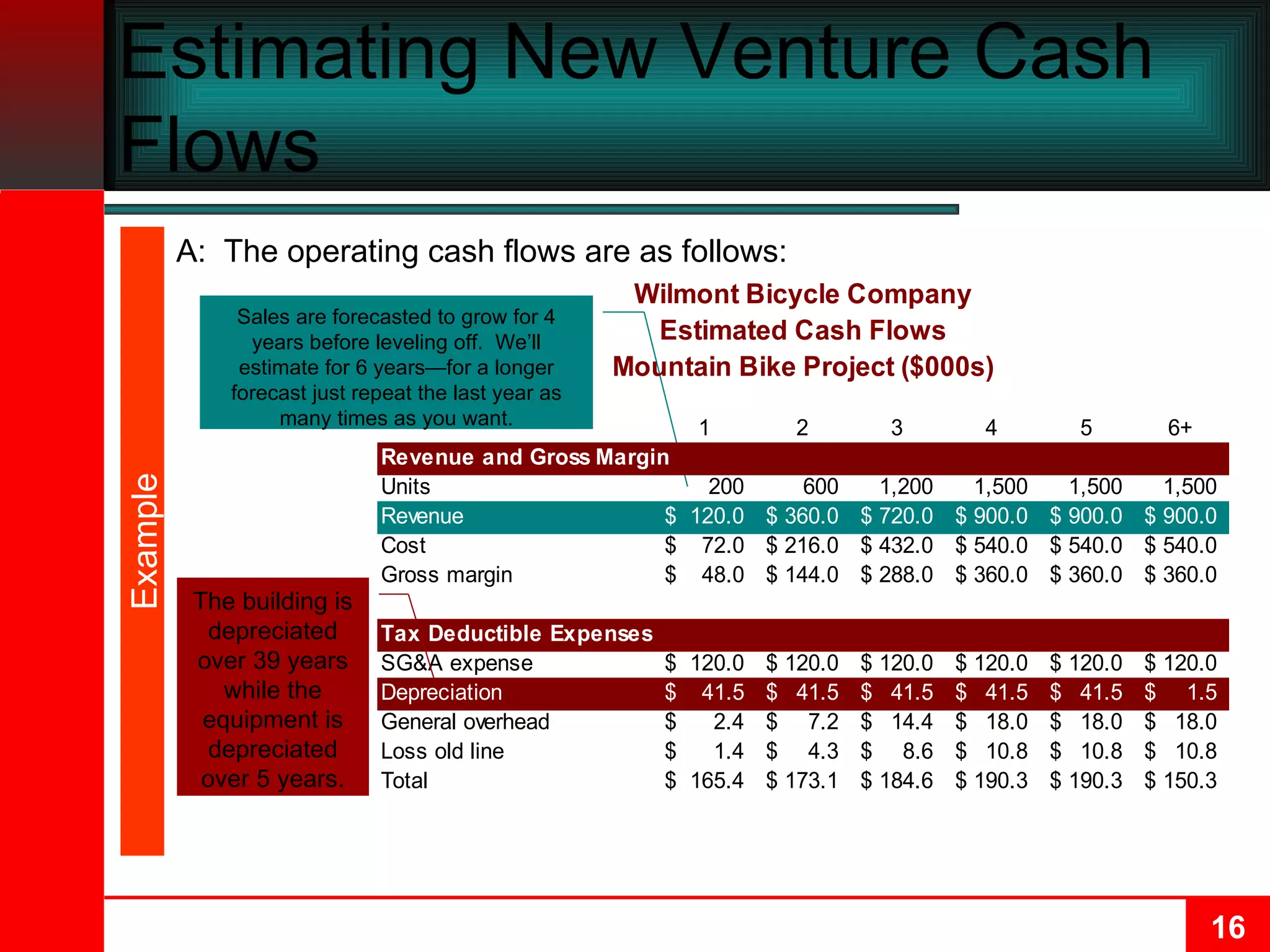

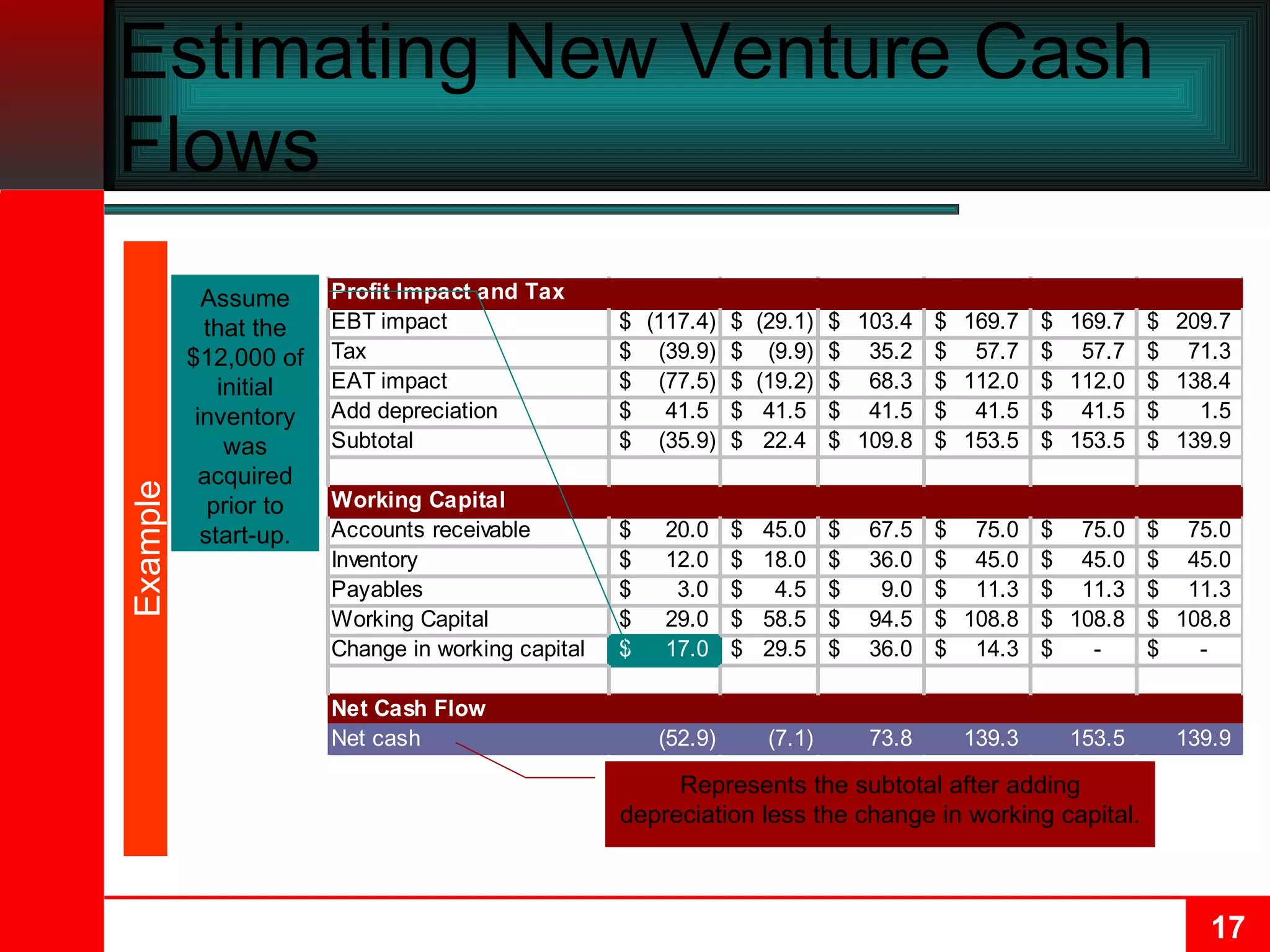

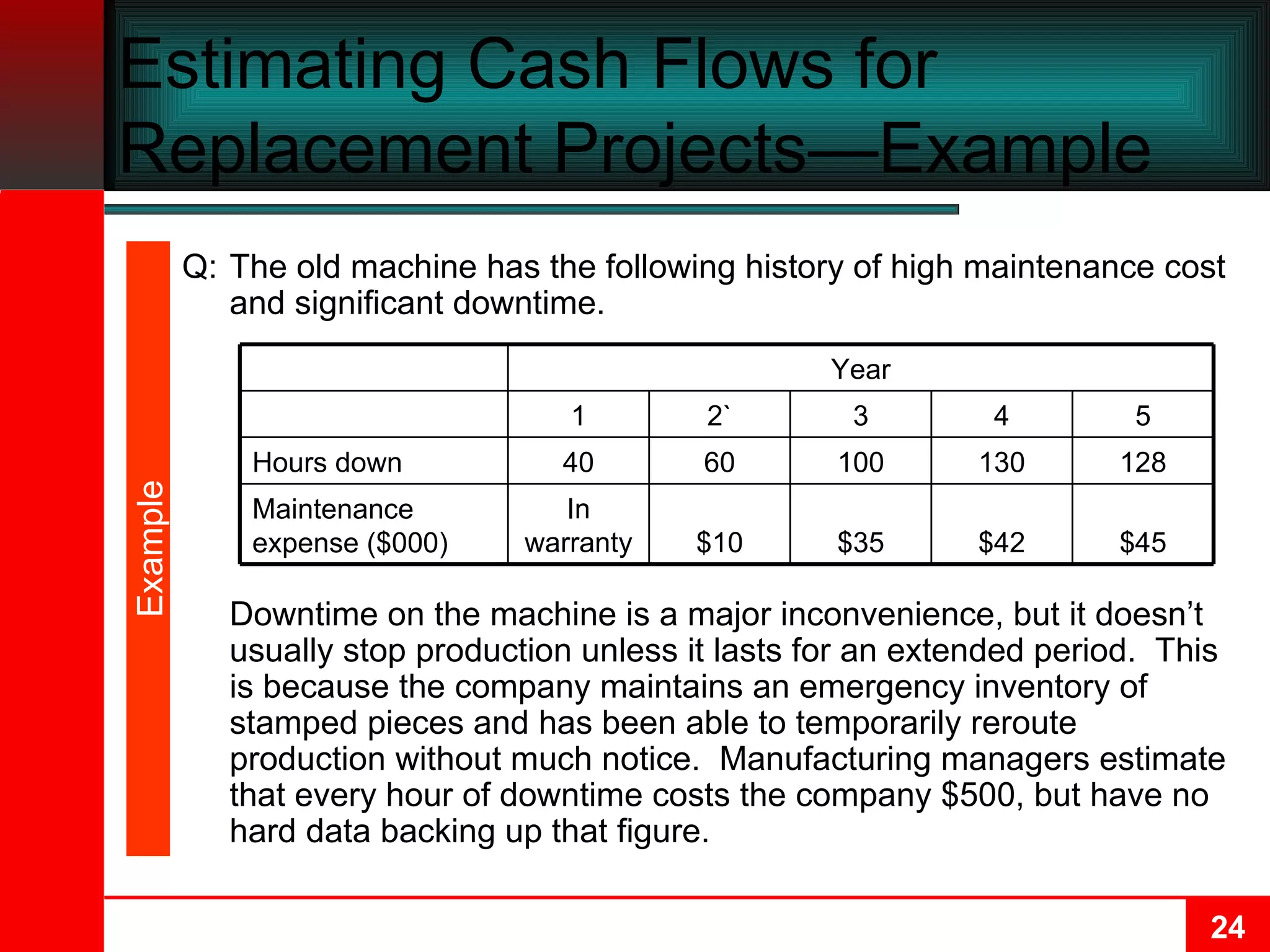

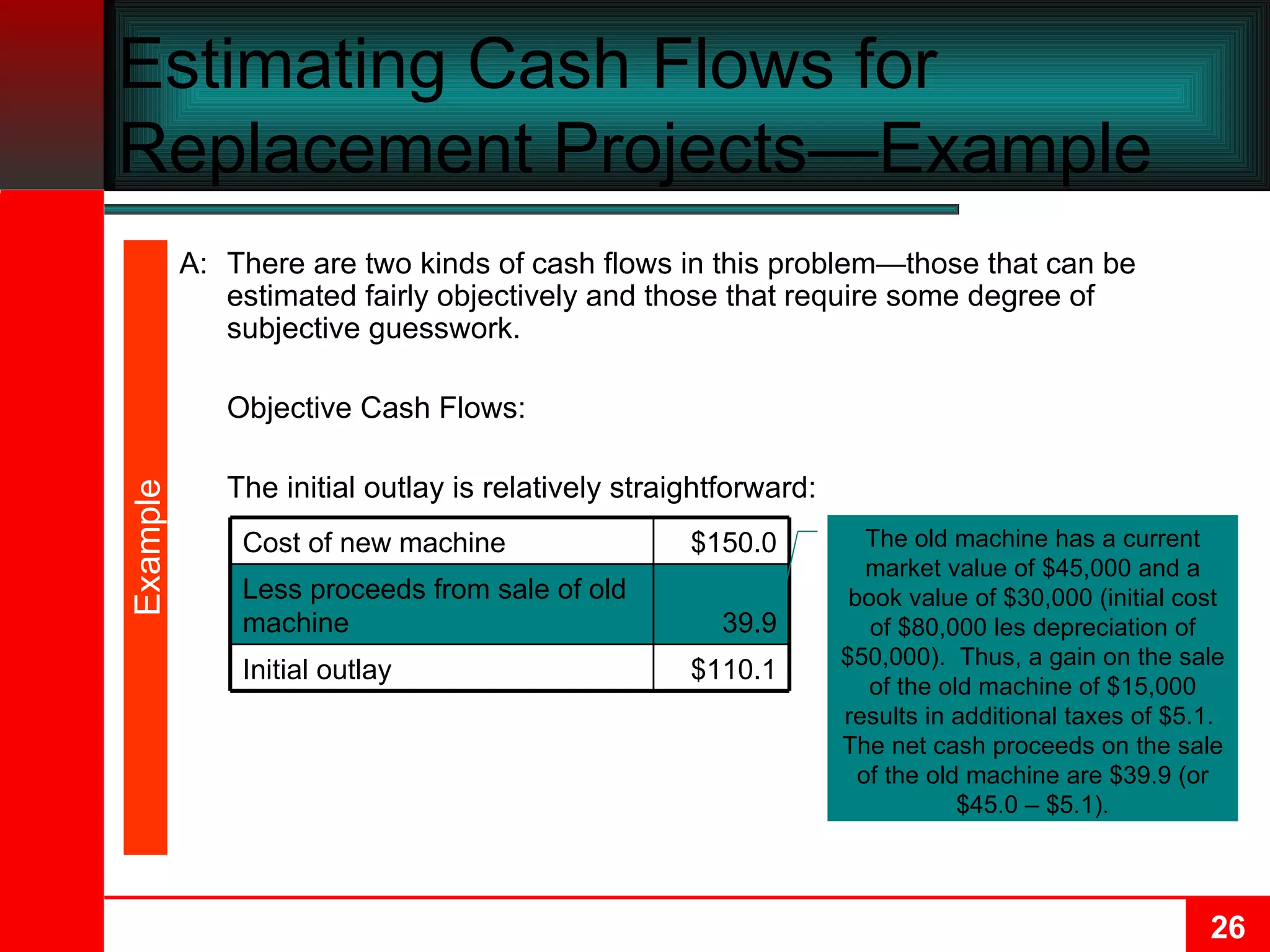

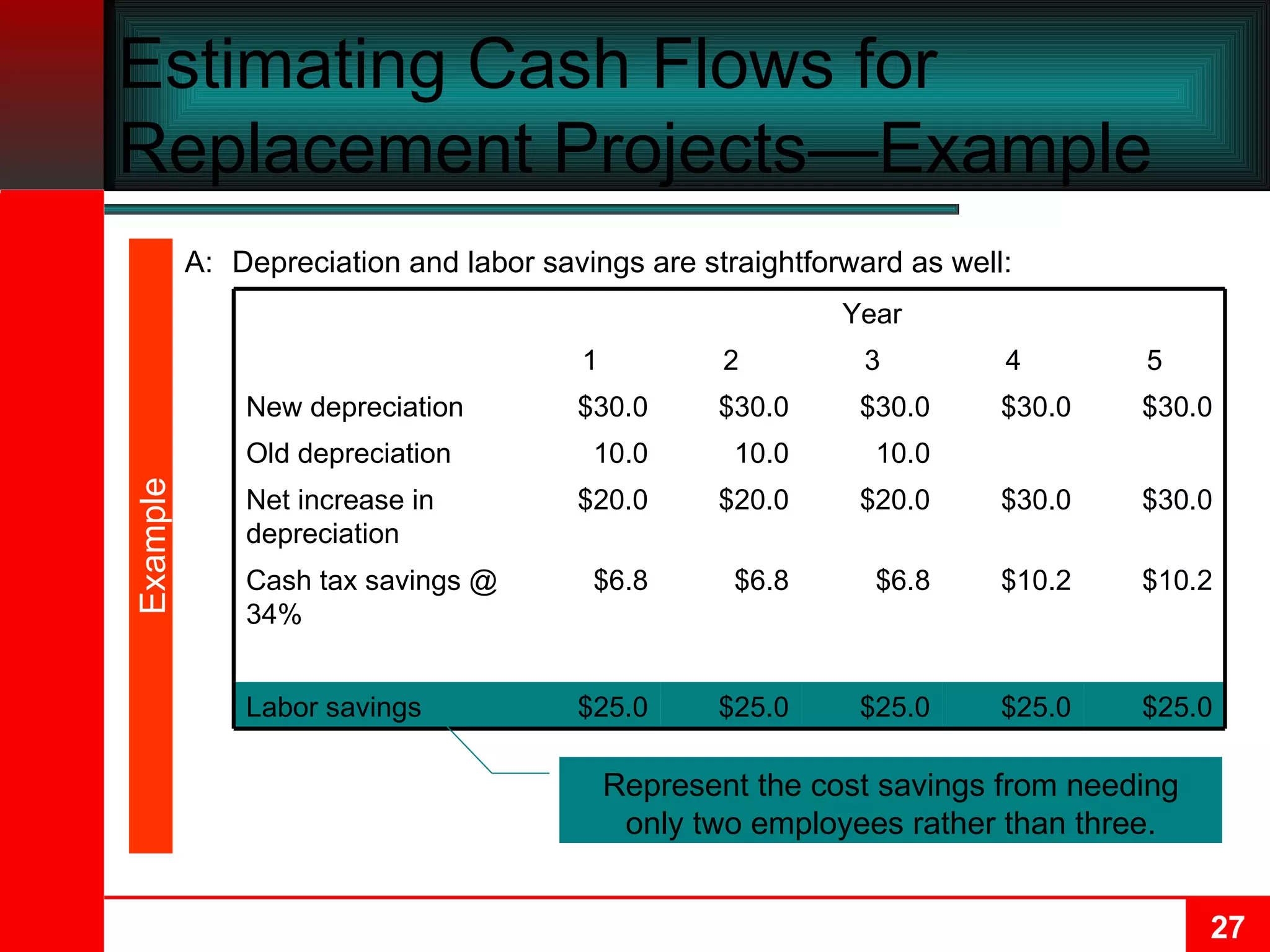

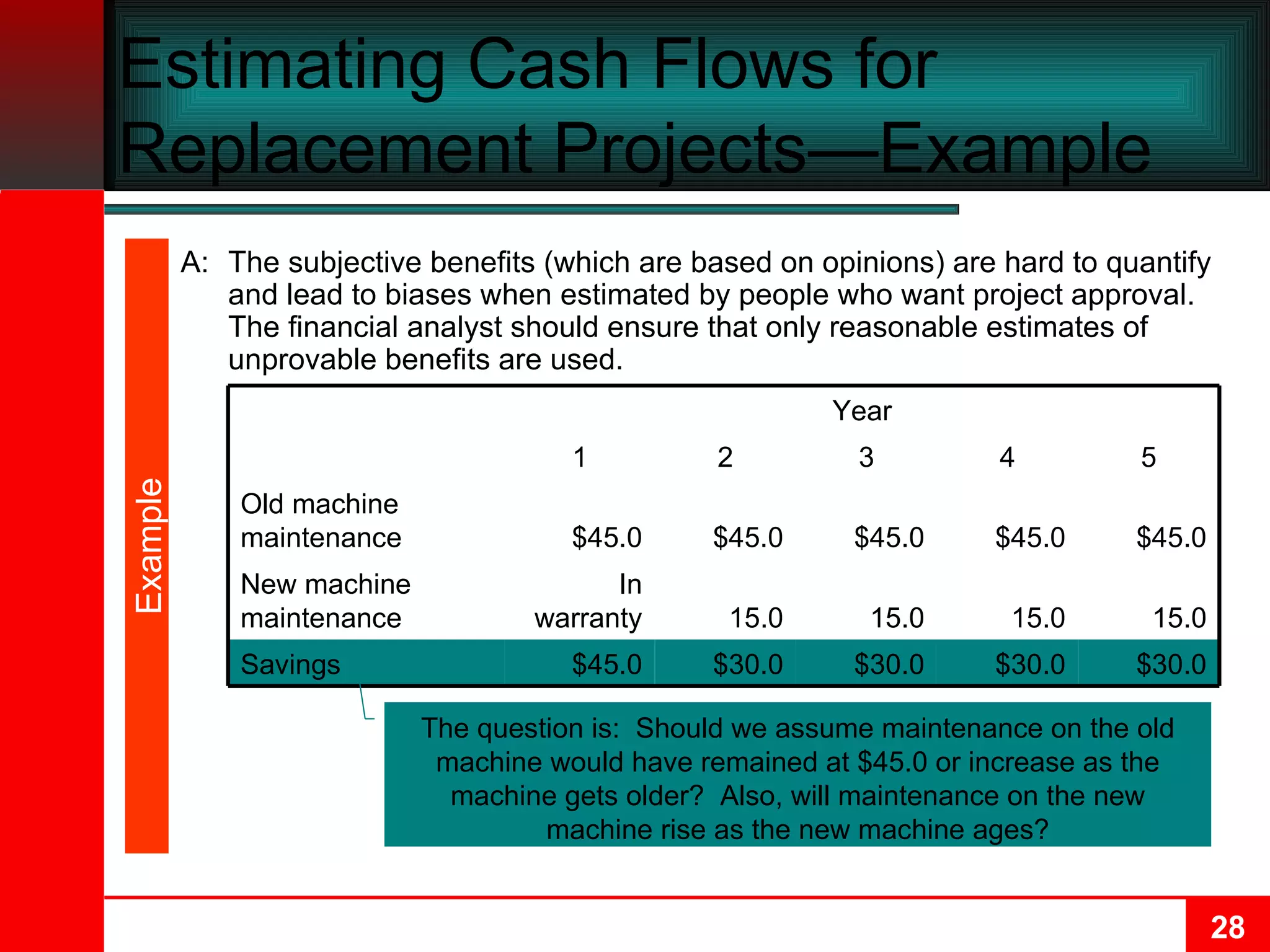

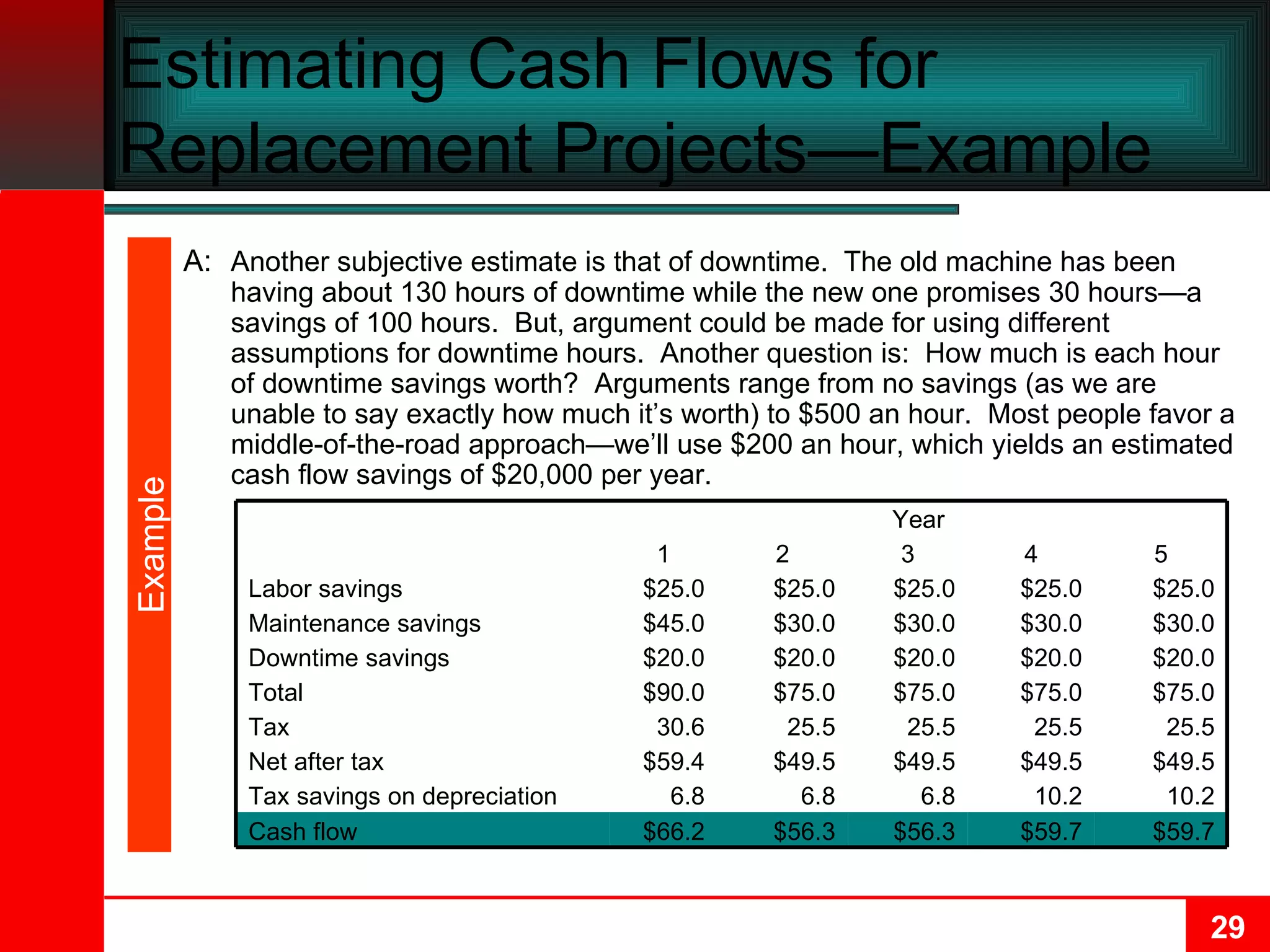

The document discusses estimating cash flows for capital budgeting projects. It explains that estimating cash flows is the most difficult and error-prone part of capital budgeting. The general approach to cash flow estimation is outlined, including forecasting sales, costs, assets, depreciation, taxes, and cash flows over multiple periods. Specific issues like sunk costs, opportunity costs, and taxes are also discussed. Methods for estimating cash flows for new ventures, expansions, and replacement projects are provided with examples.