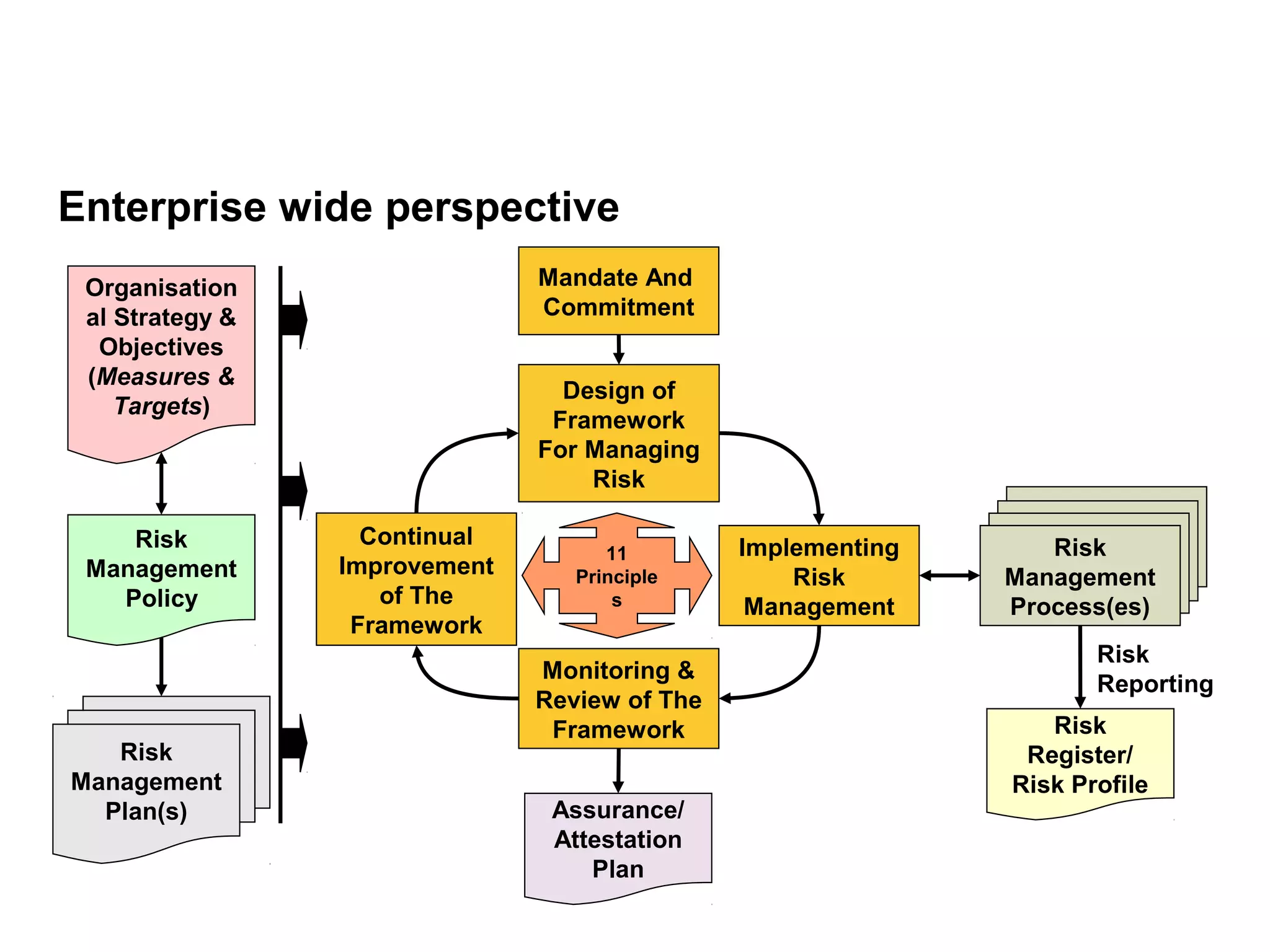

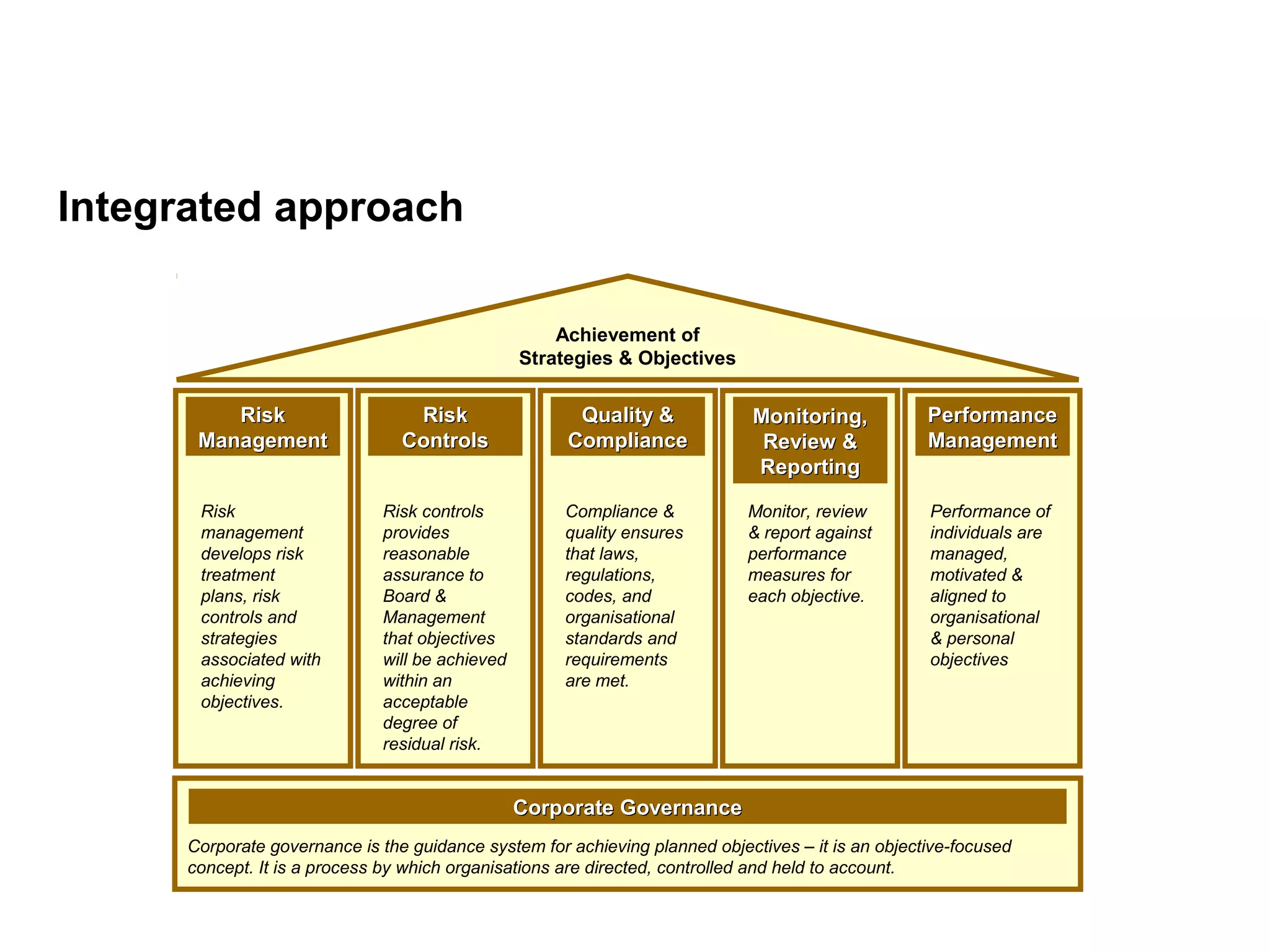

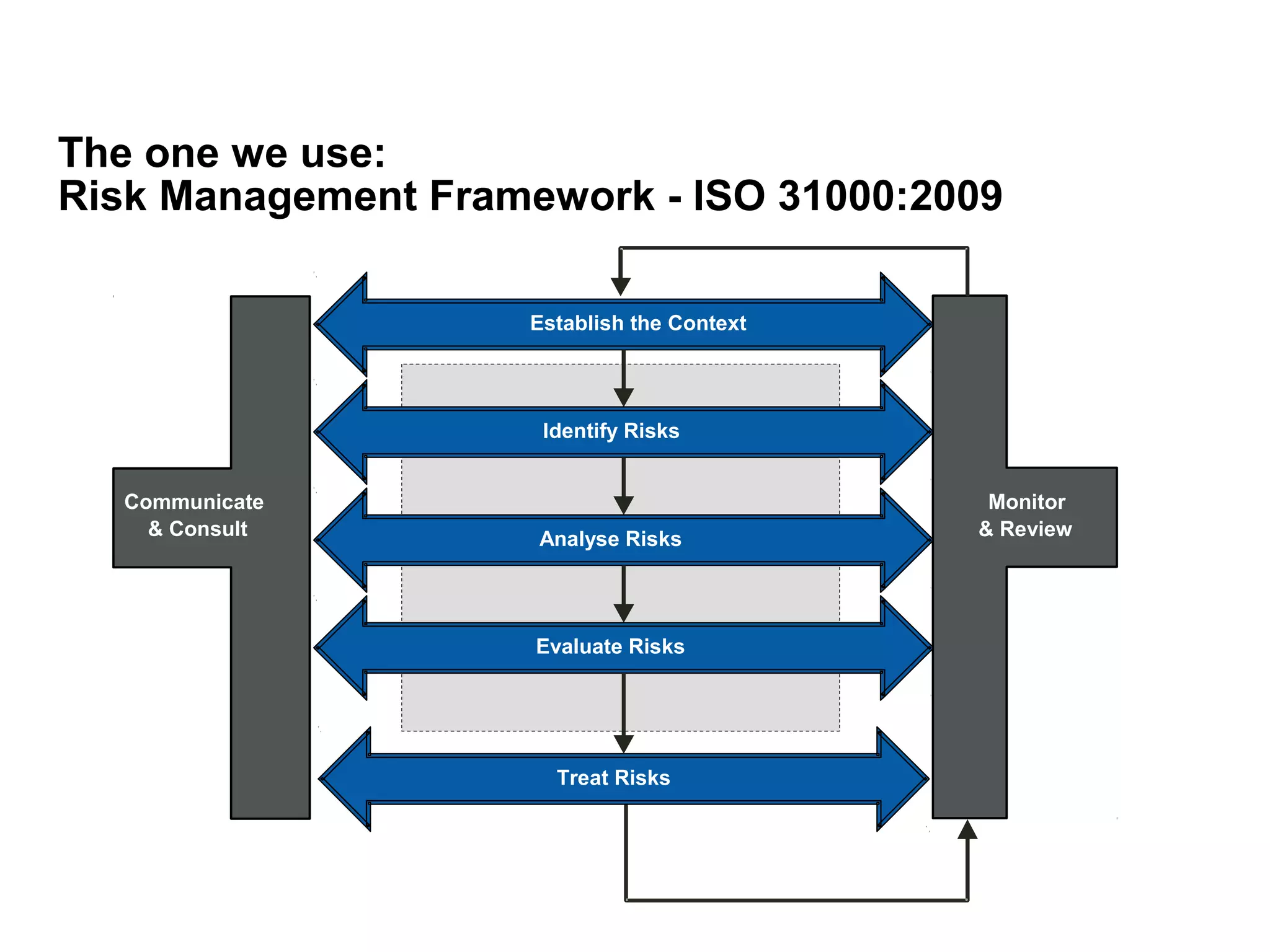

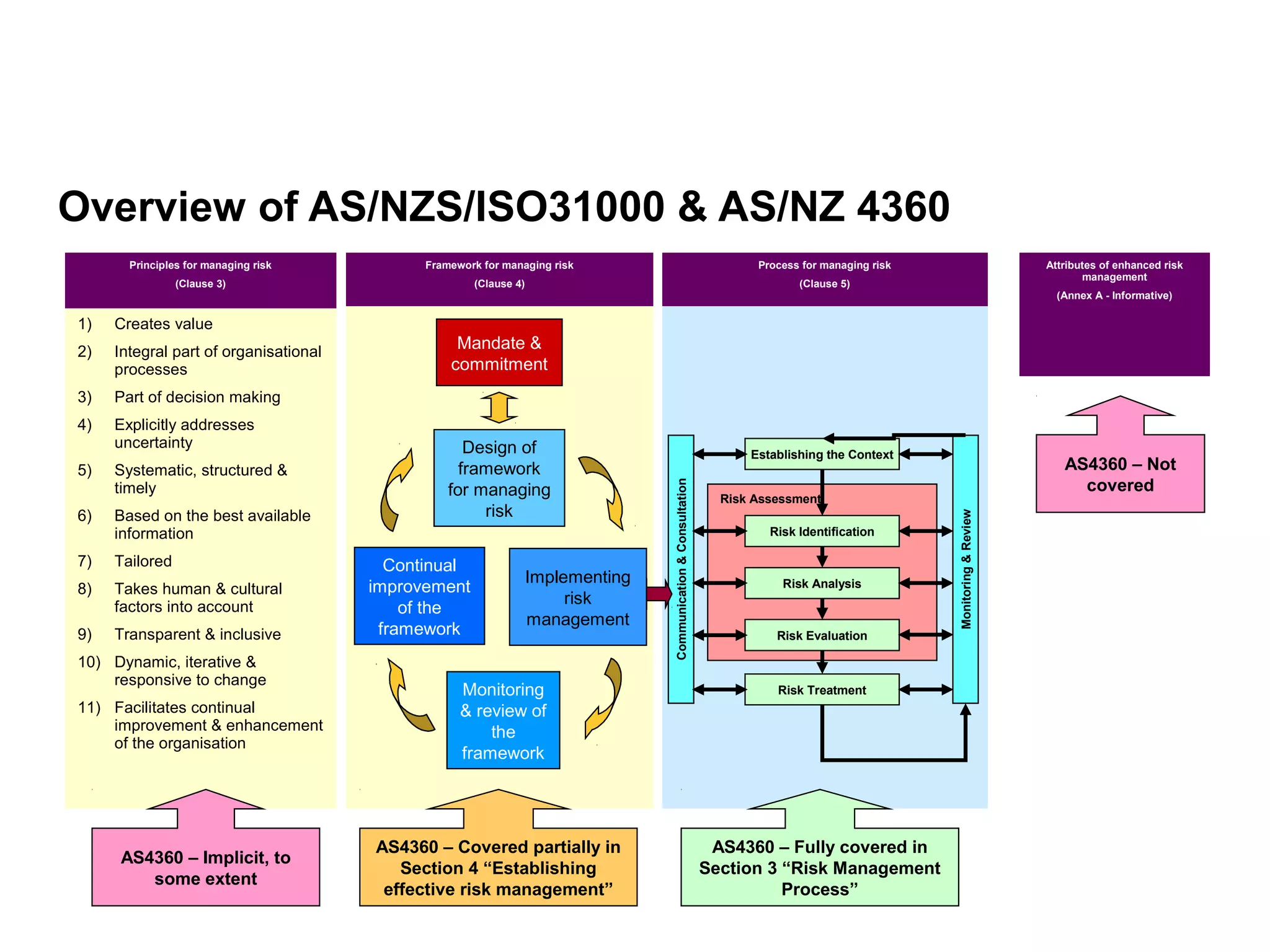

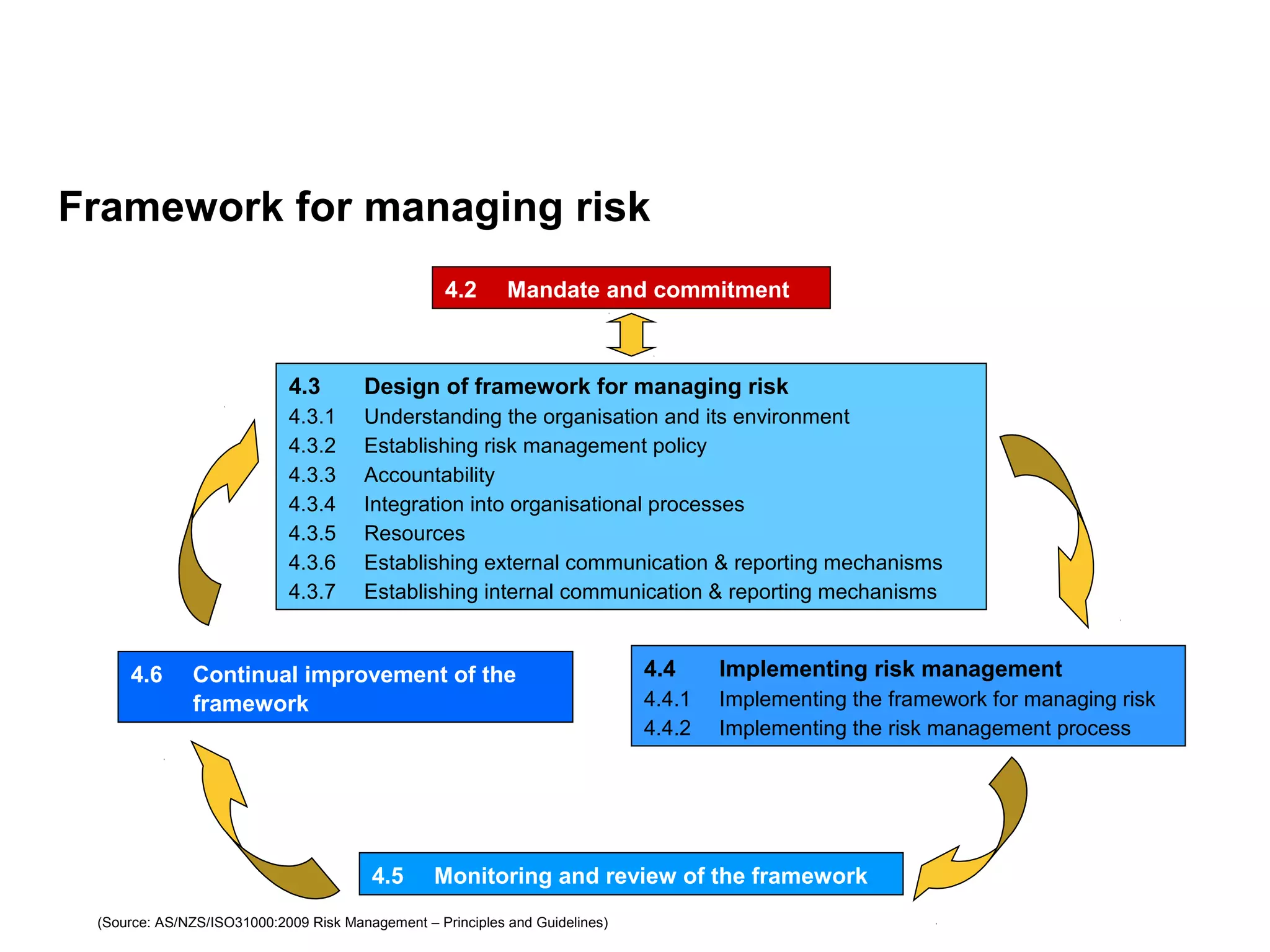

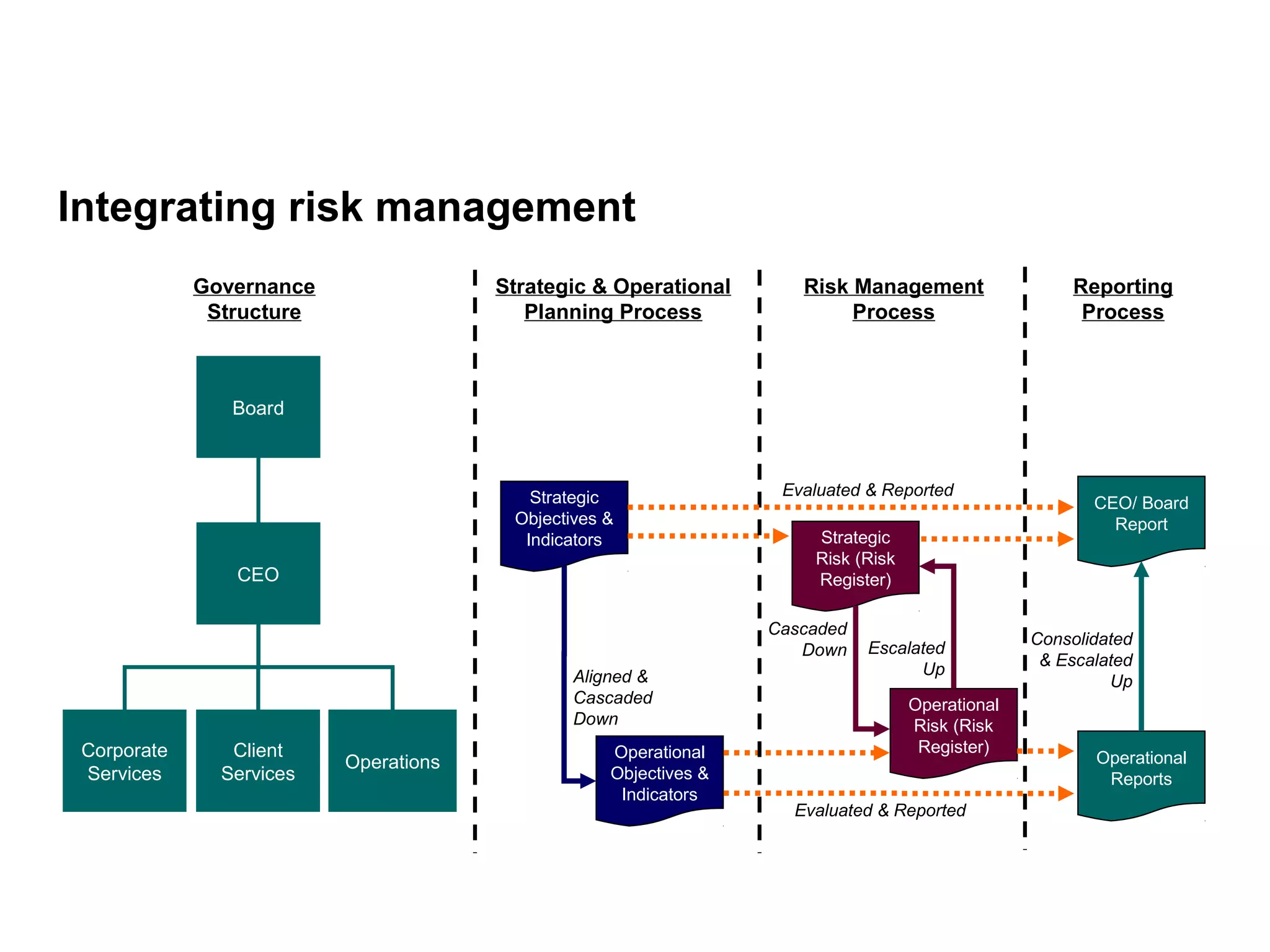

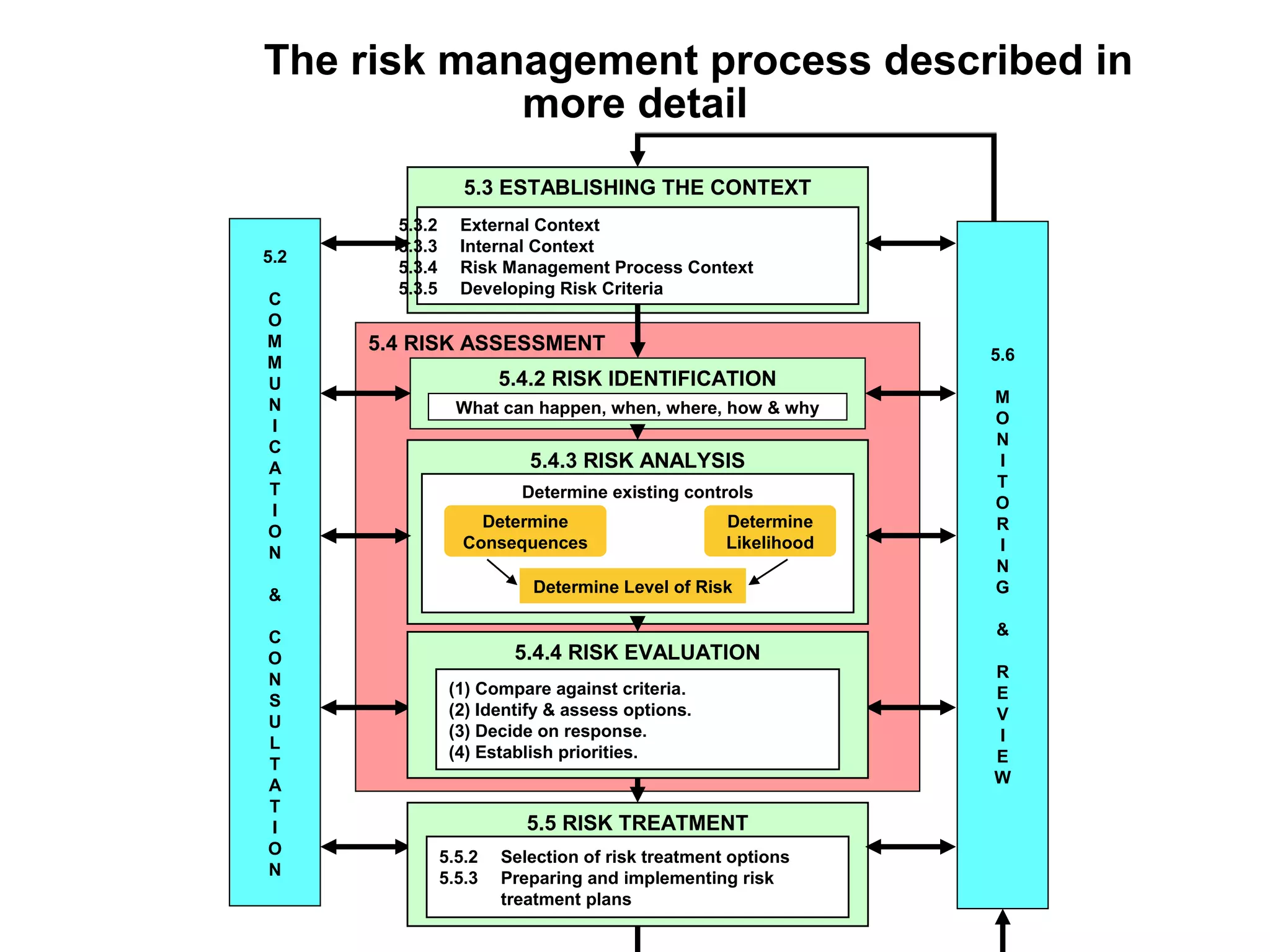

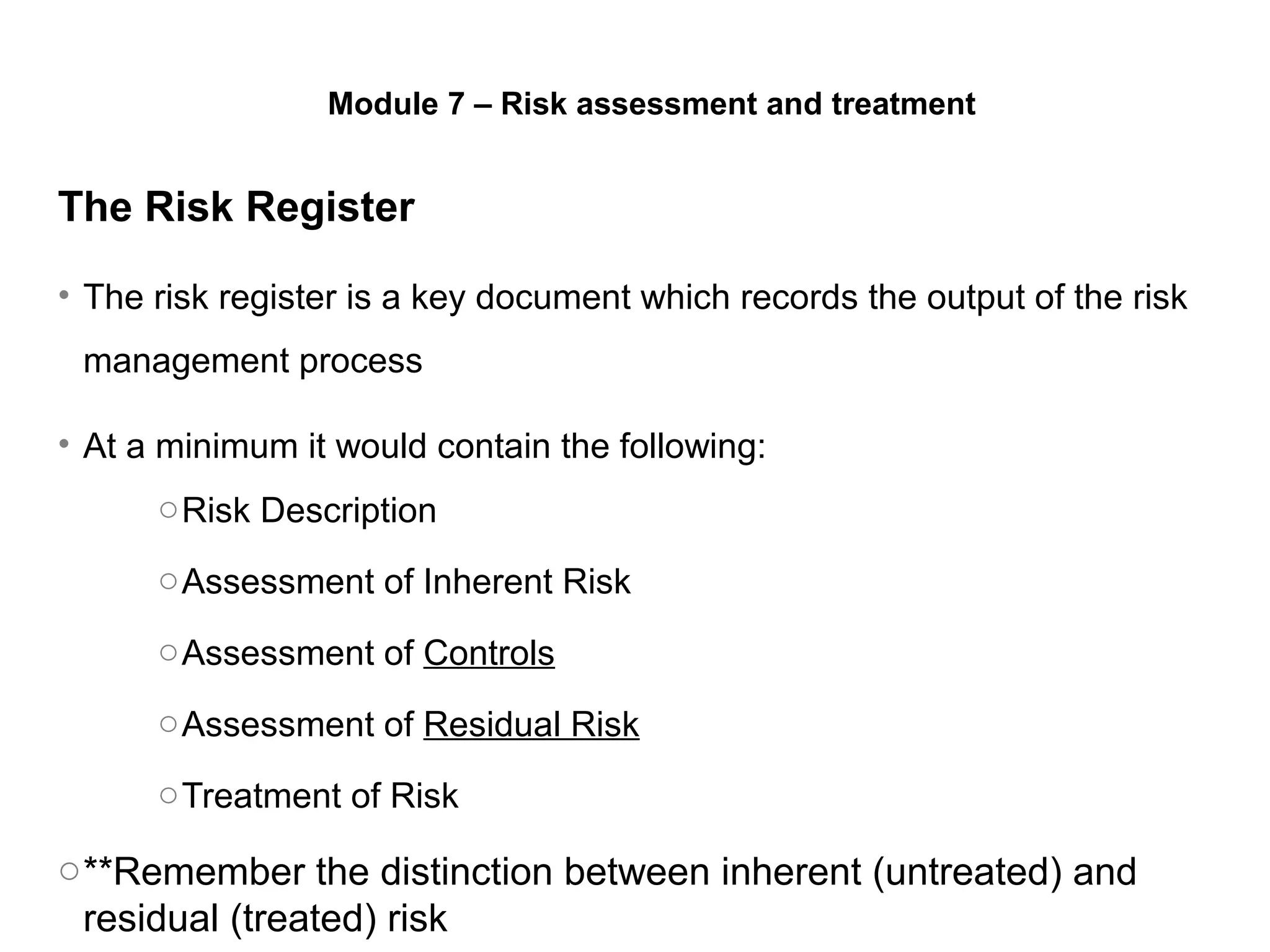

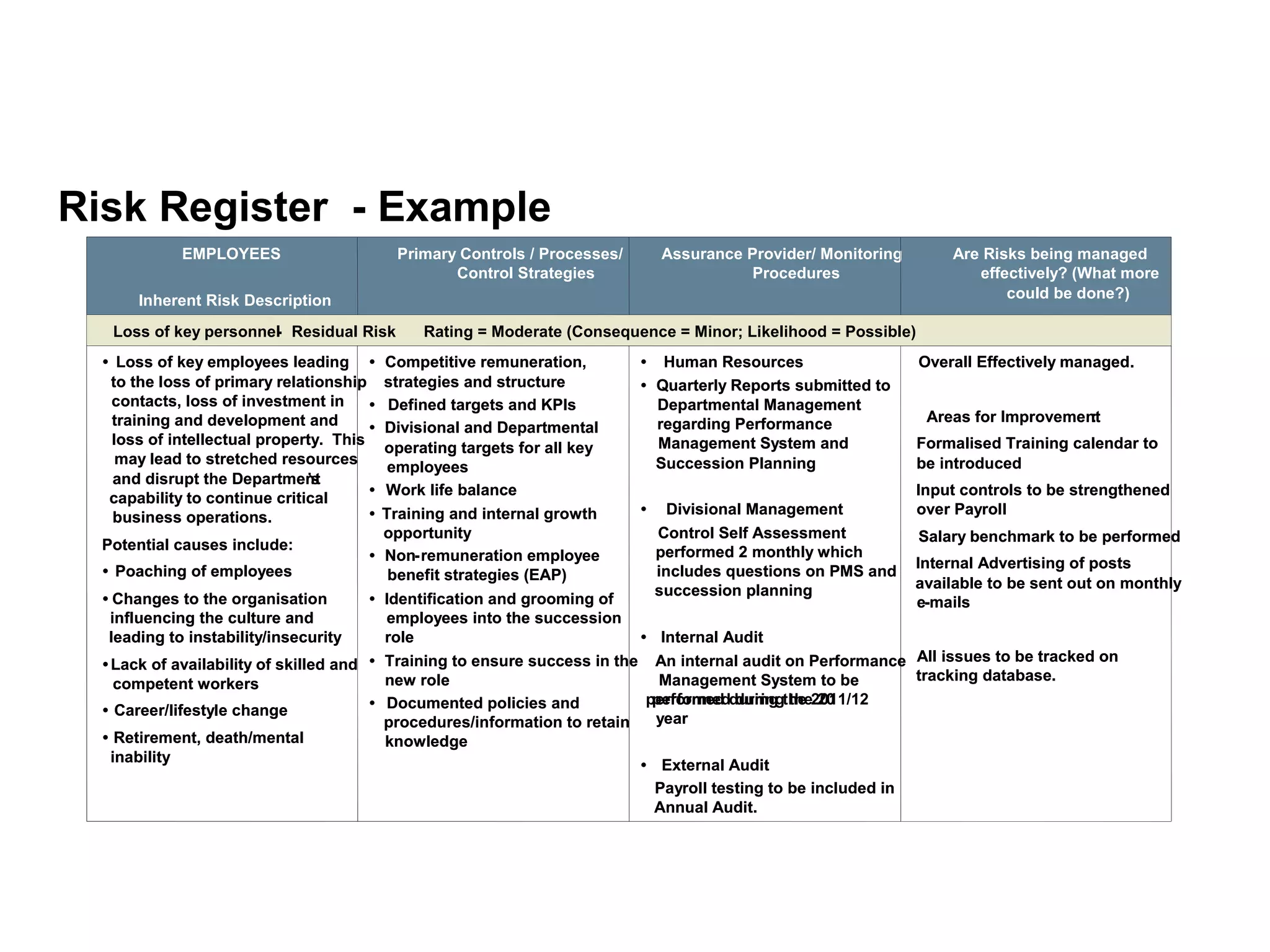

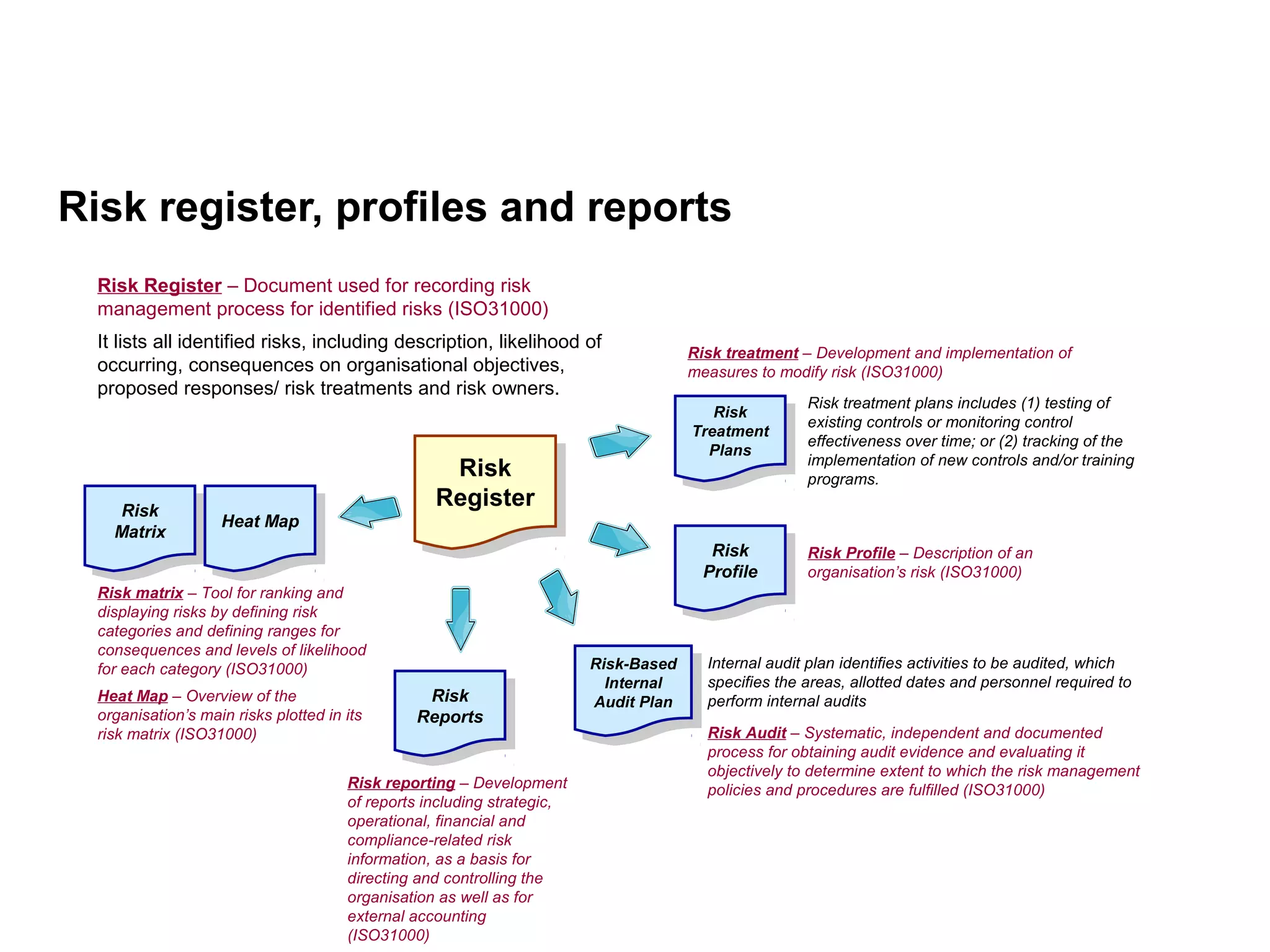

The document provides an overview of risk management fundamentals and processes. It defines risk, outlines the benefits of a risk management framework, and describes the key components of establishing and implementing an effective risk management system, including:

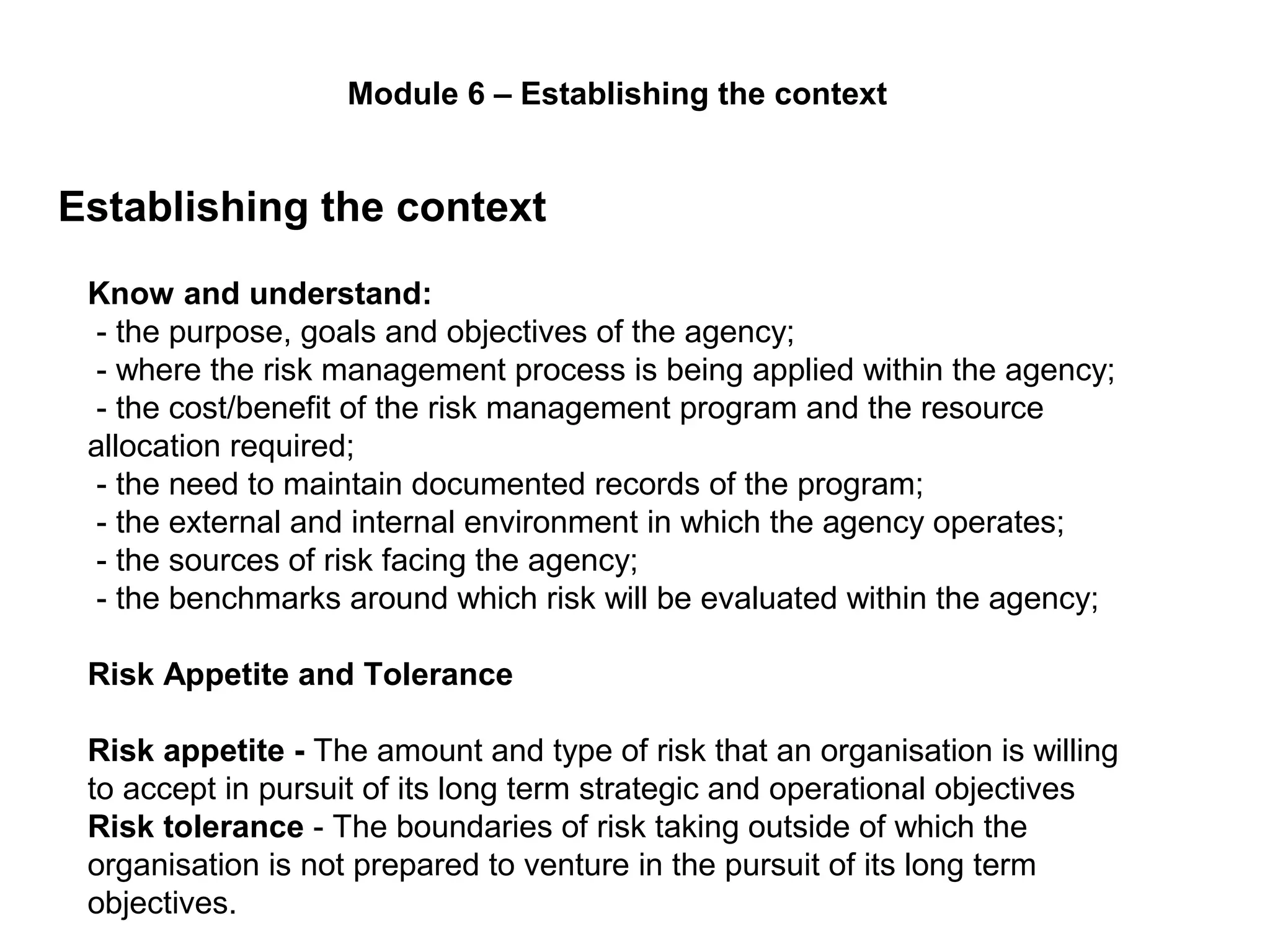

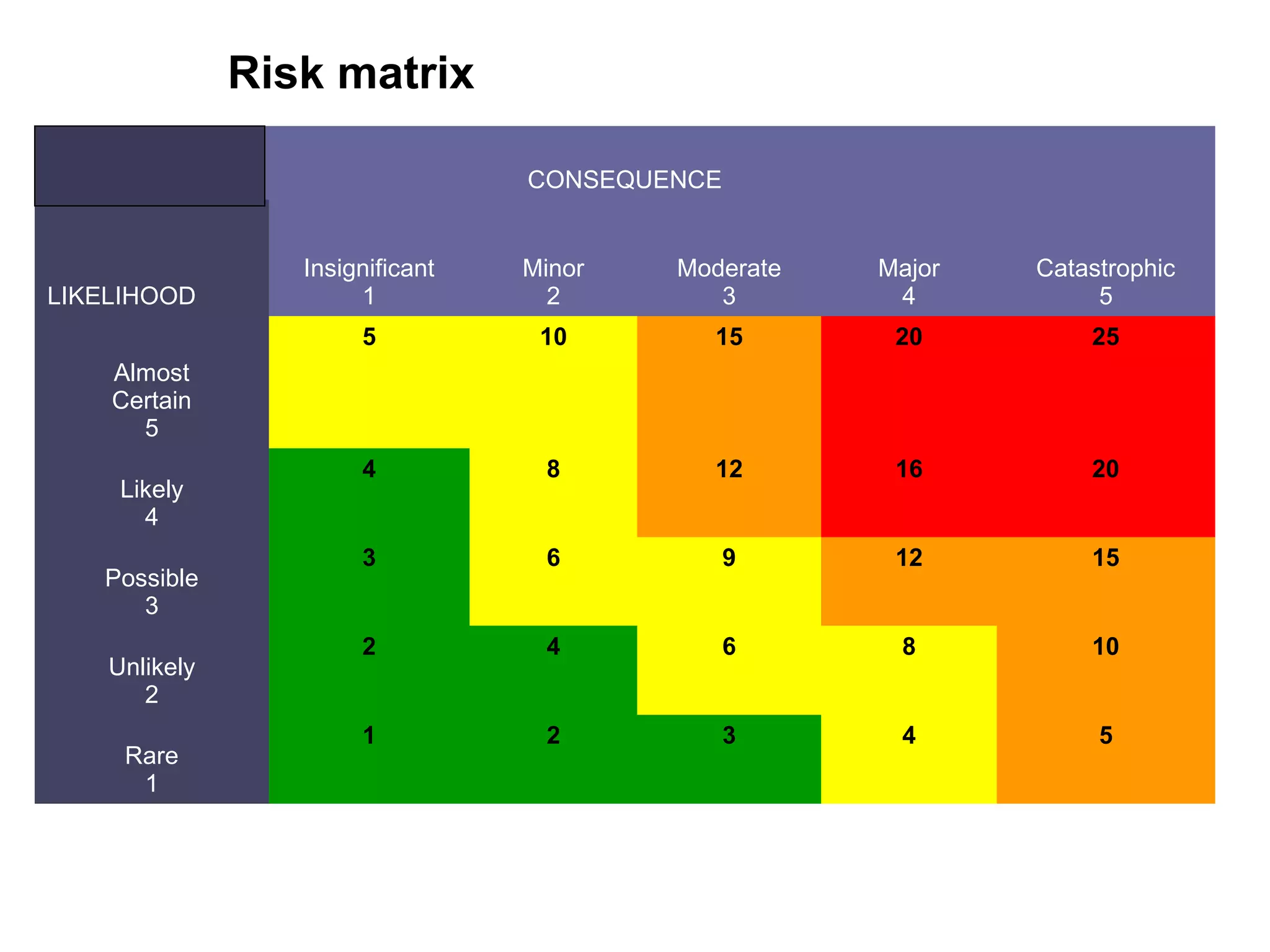

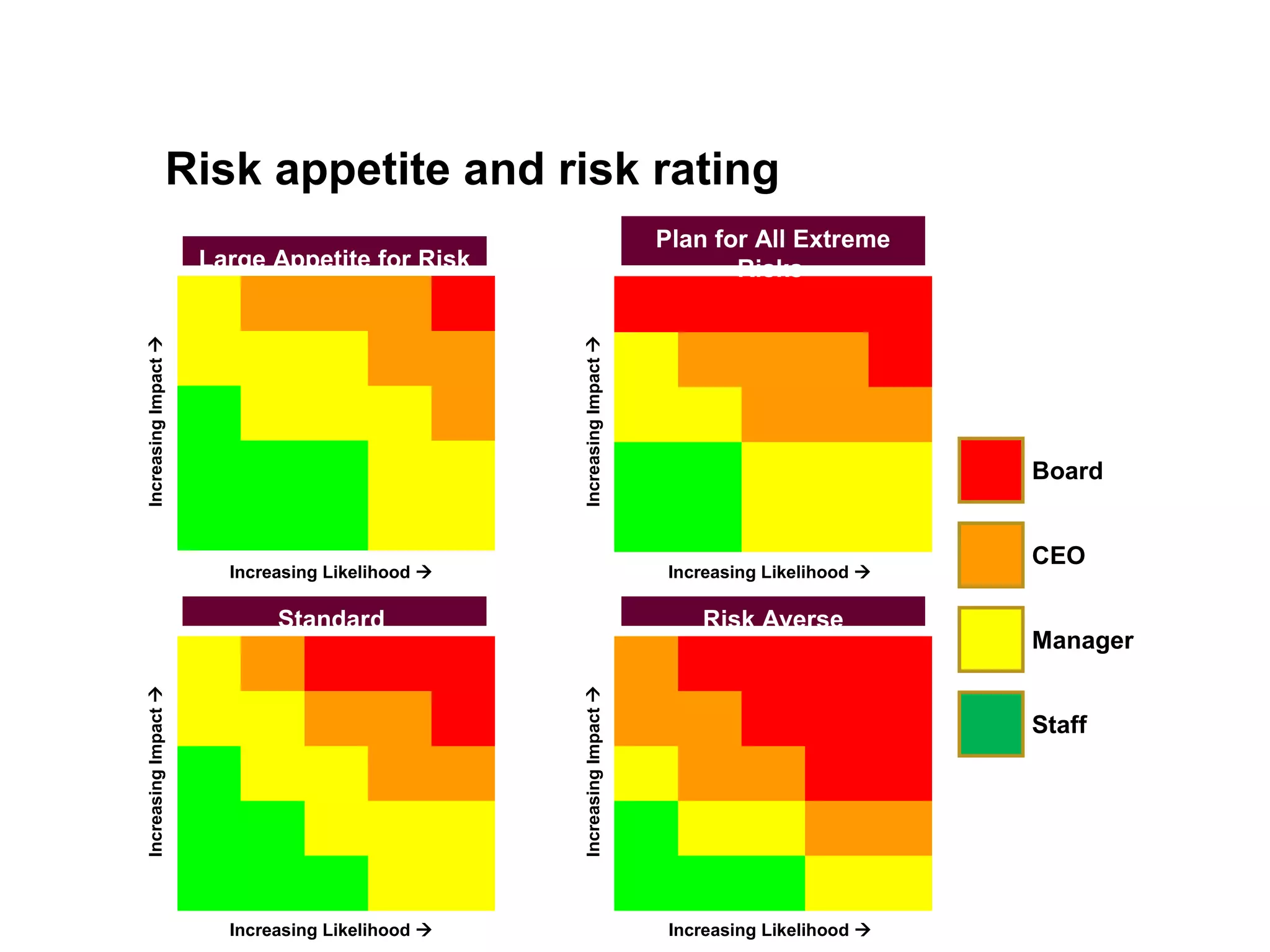

- Establishing the organizational context and risk criteria

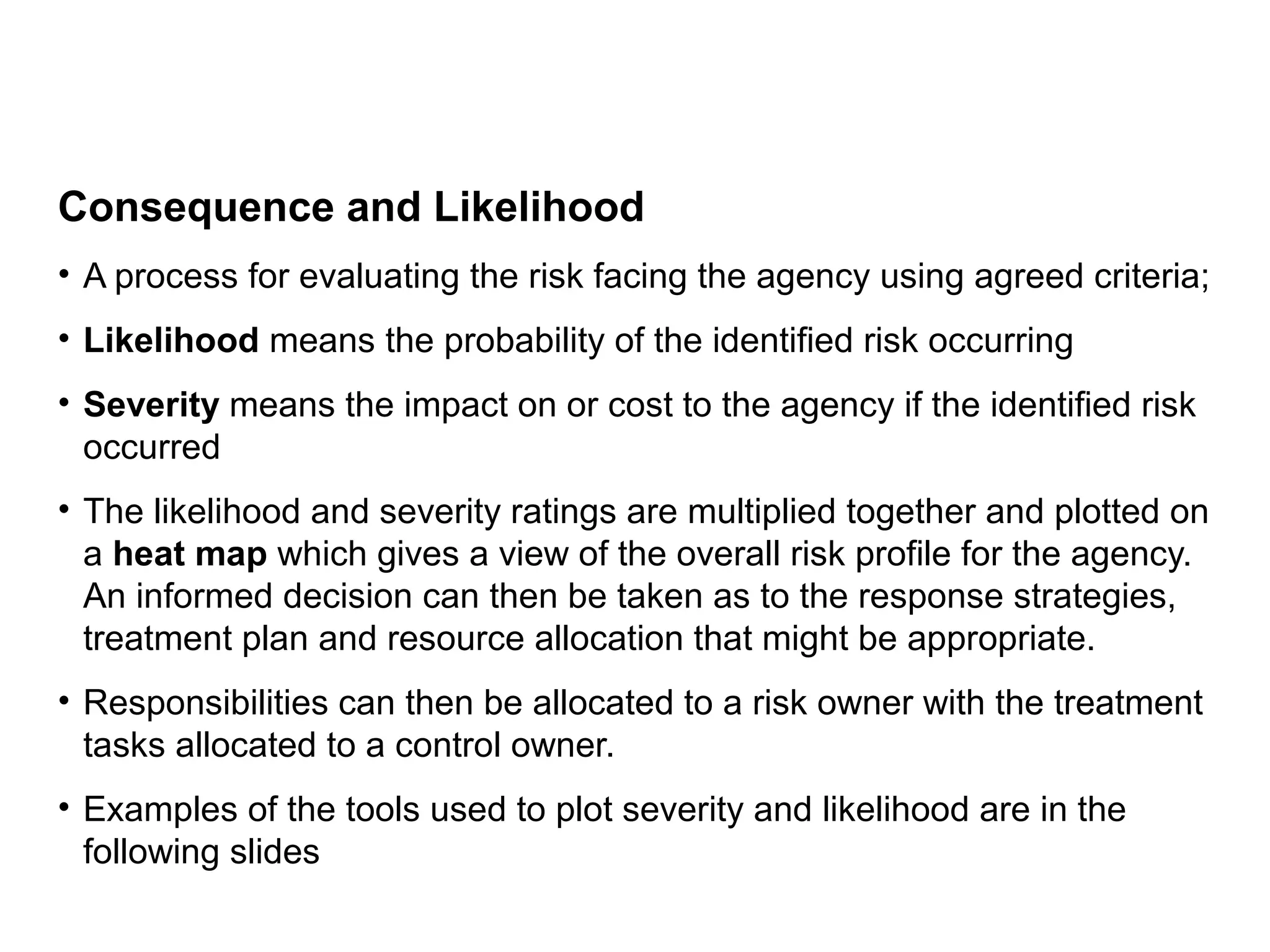

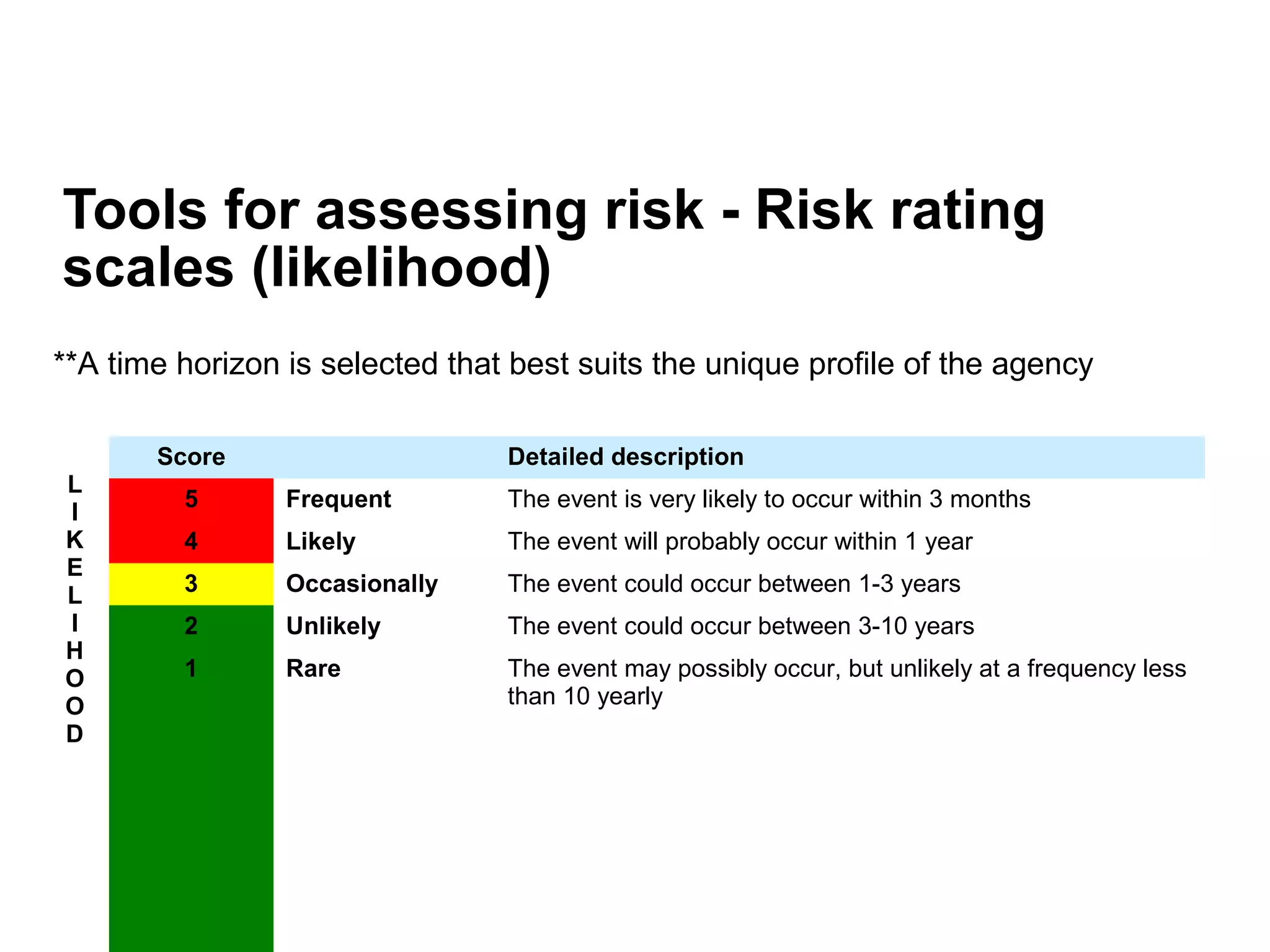

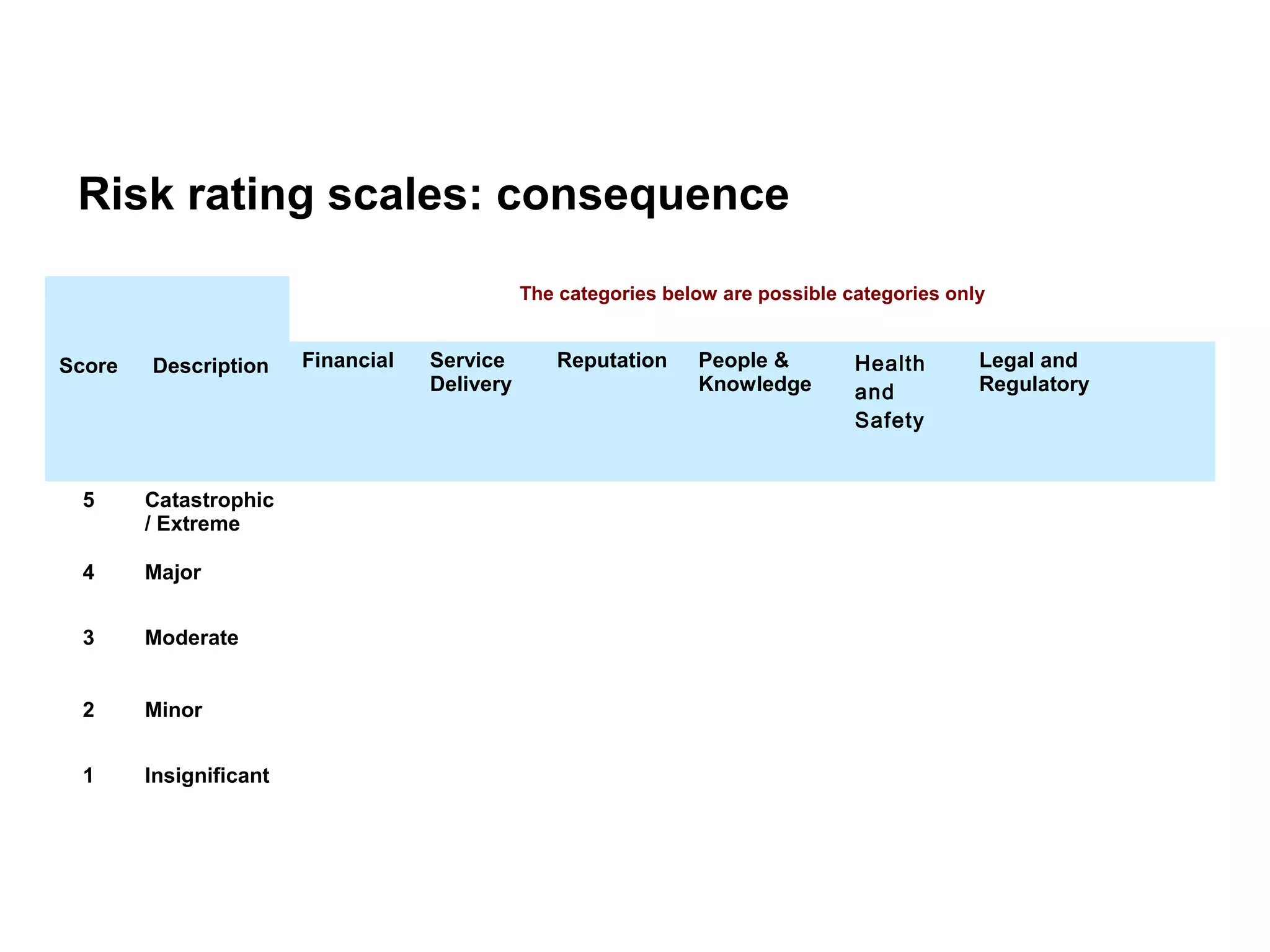

- Identifying, analyzing, and evaluating risks

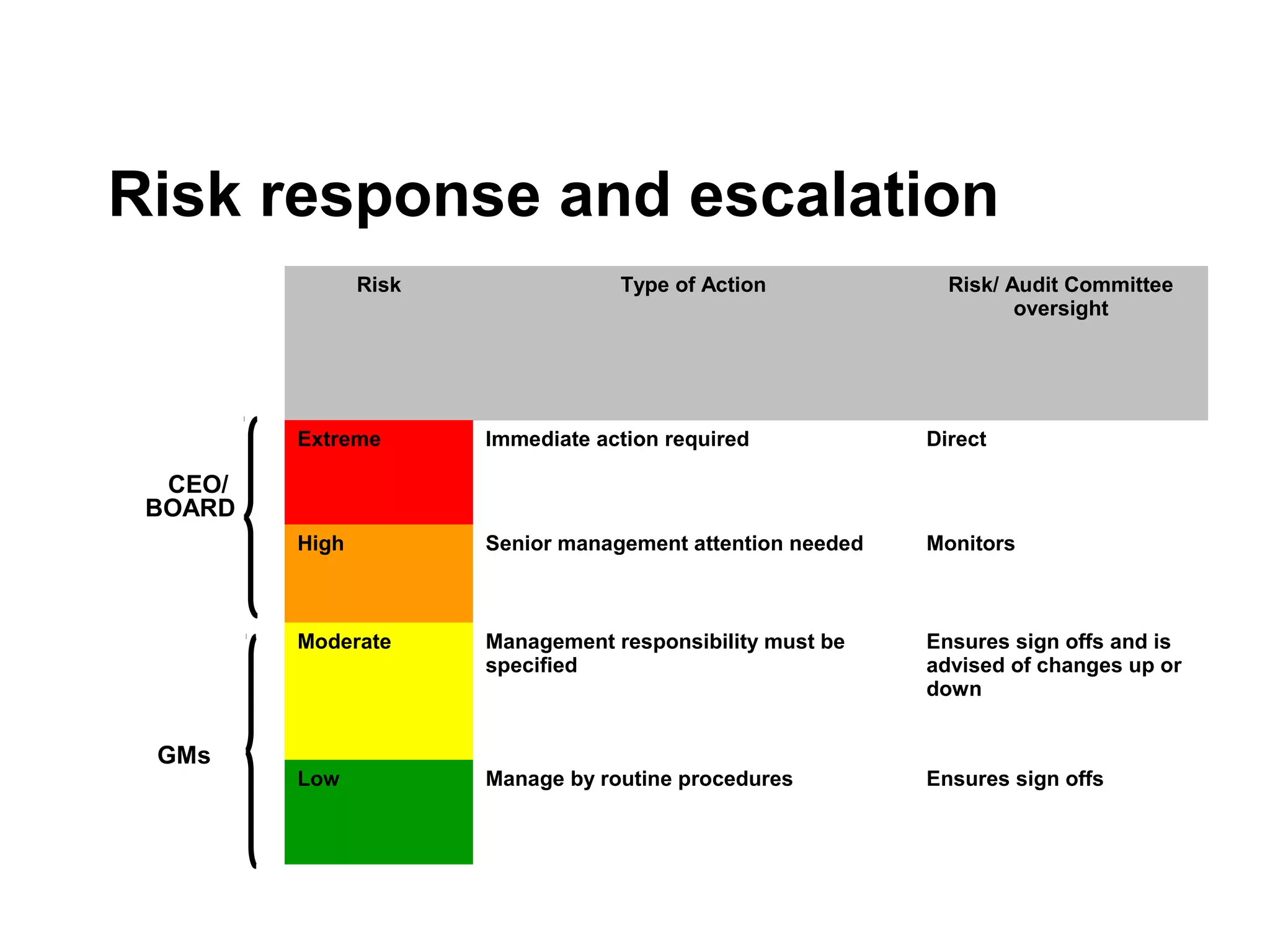

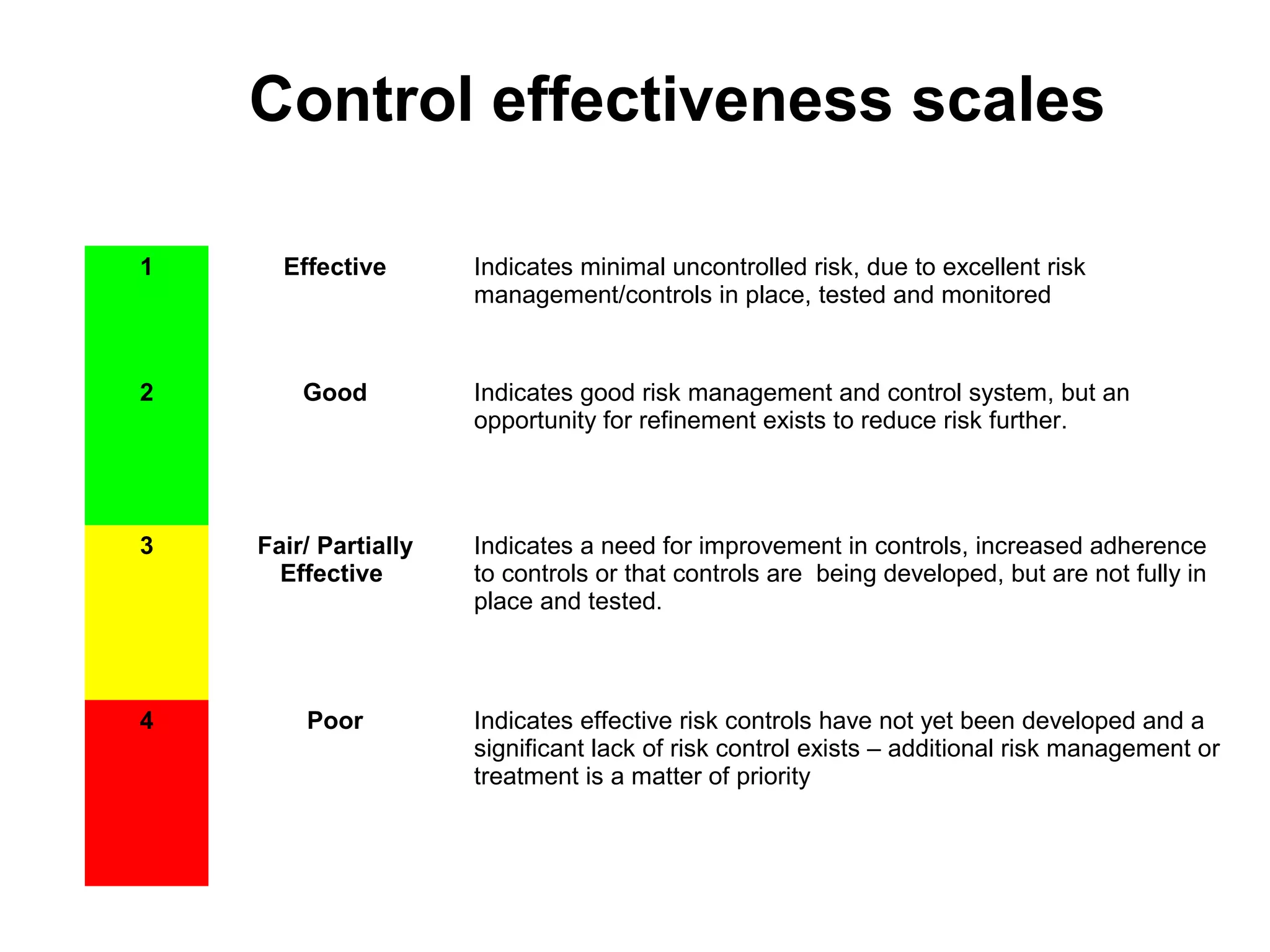

- Developing and implementing risk treatment plans

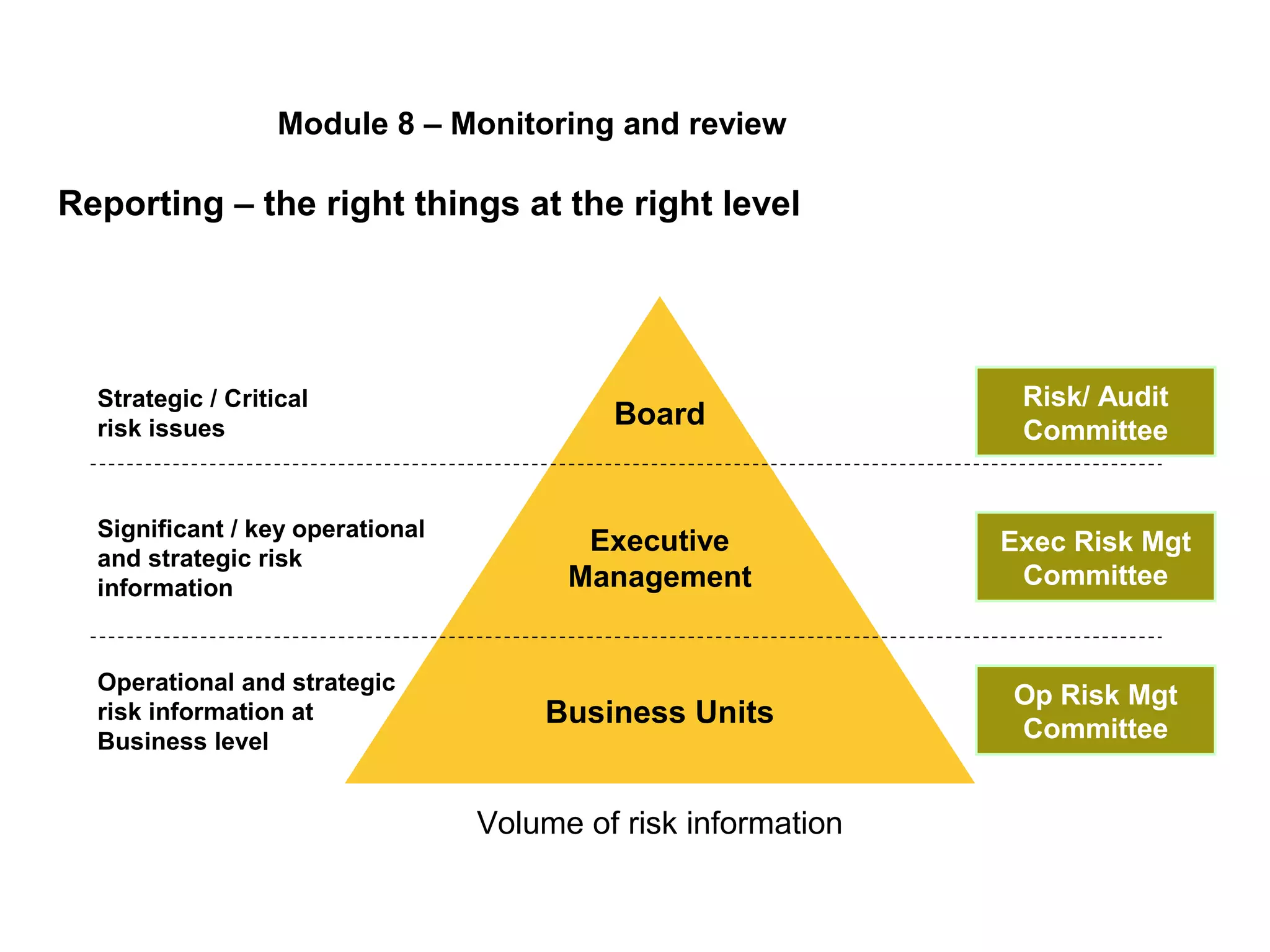

- Monitoring and reviewing the risk management process on an ongoing basis

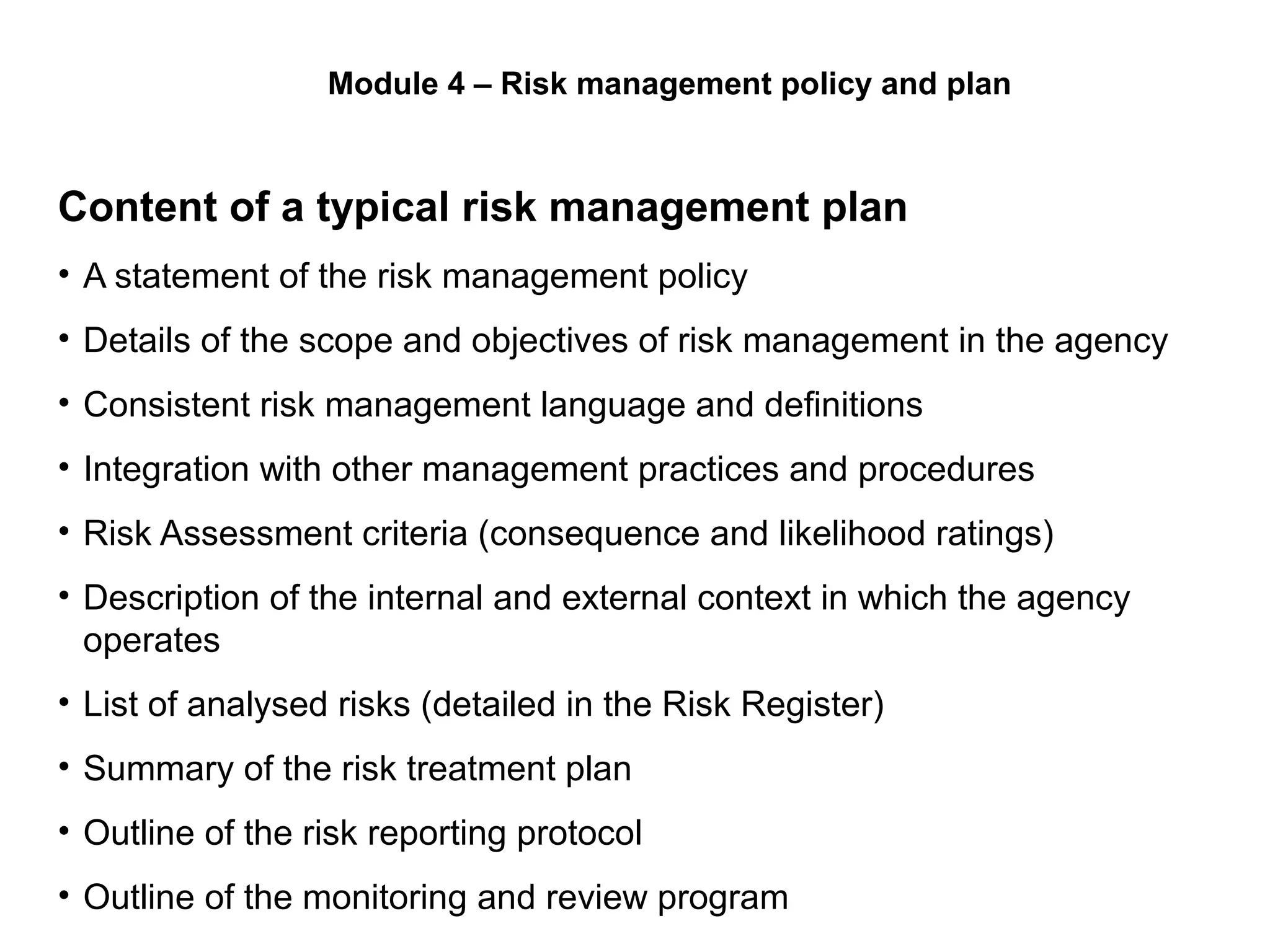

![Example of an attestation clause (VGRMF)

I, [Accountable Officer], certify that as at 30th June 20XX the

[Department] has risk management processes in place consistent with

the Australian/New Zealand Risk Management

Standard (or equivalent designated standard) and

an internal control system is in place that enables the executive to

understand, manage and satisfactorily control risk exposures. The

audit committee verifies this assurance and that the risk profile of the

[Department] has been critically reviewed within the last 12 months.

(Source: Victorian Government Risk Management Framework, July 2007, Attachment A, p. 21)](https://image.slidesharecdn.com/riskmanagementfundamentals-140804013405-phpapp01/75/Risk-Management-Fundamentals-7-2048.jpg)