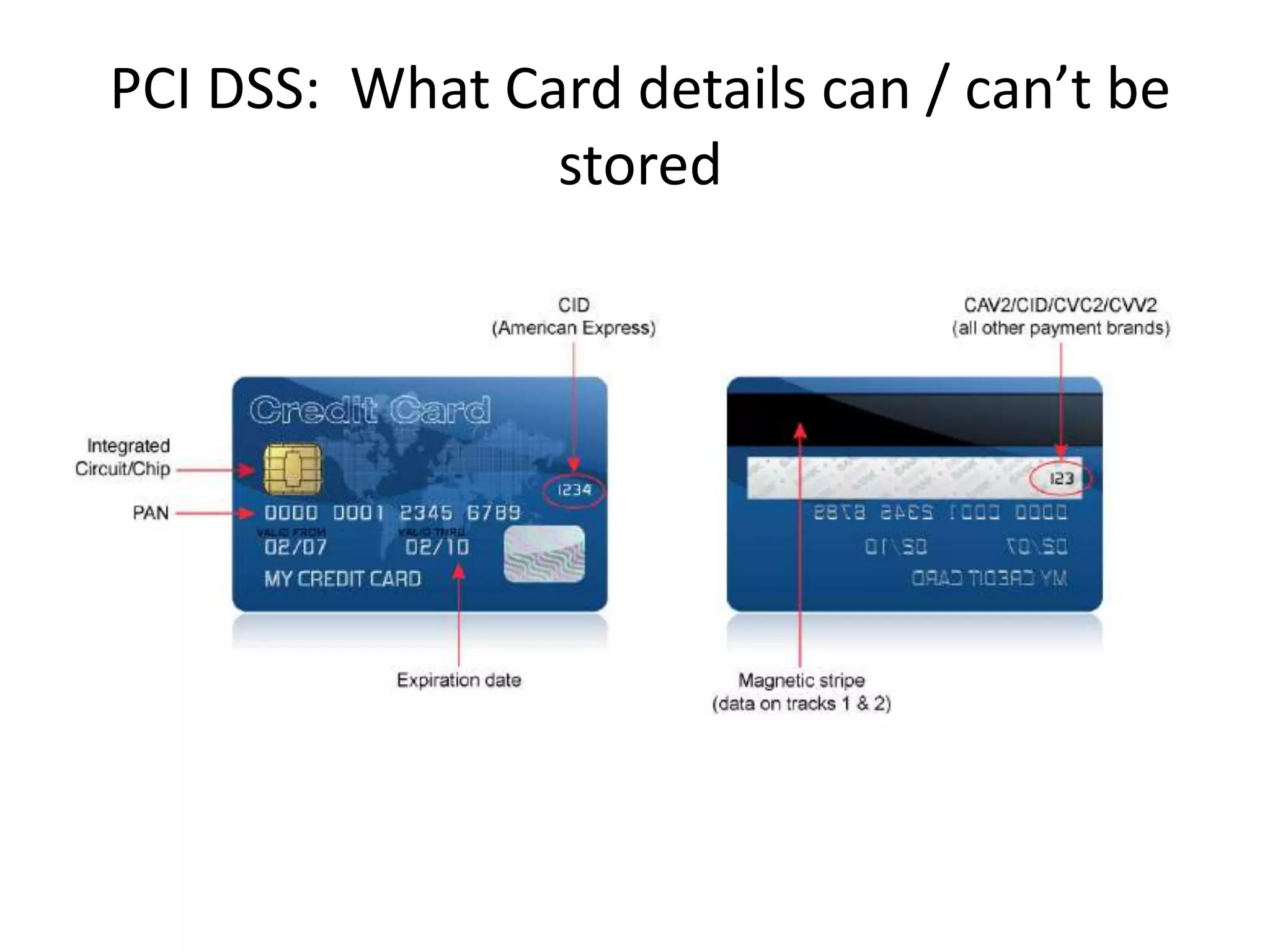

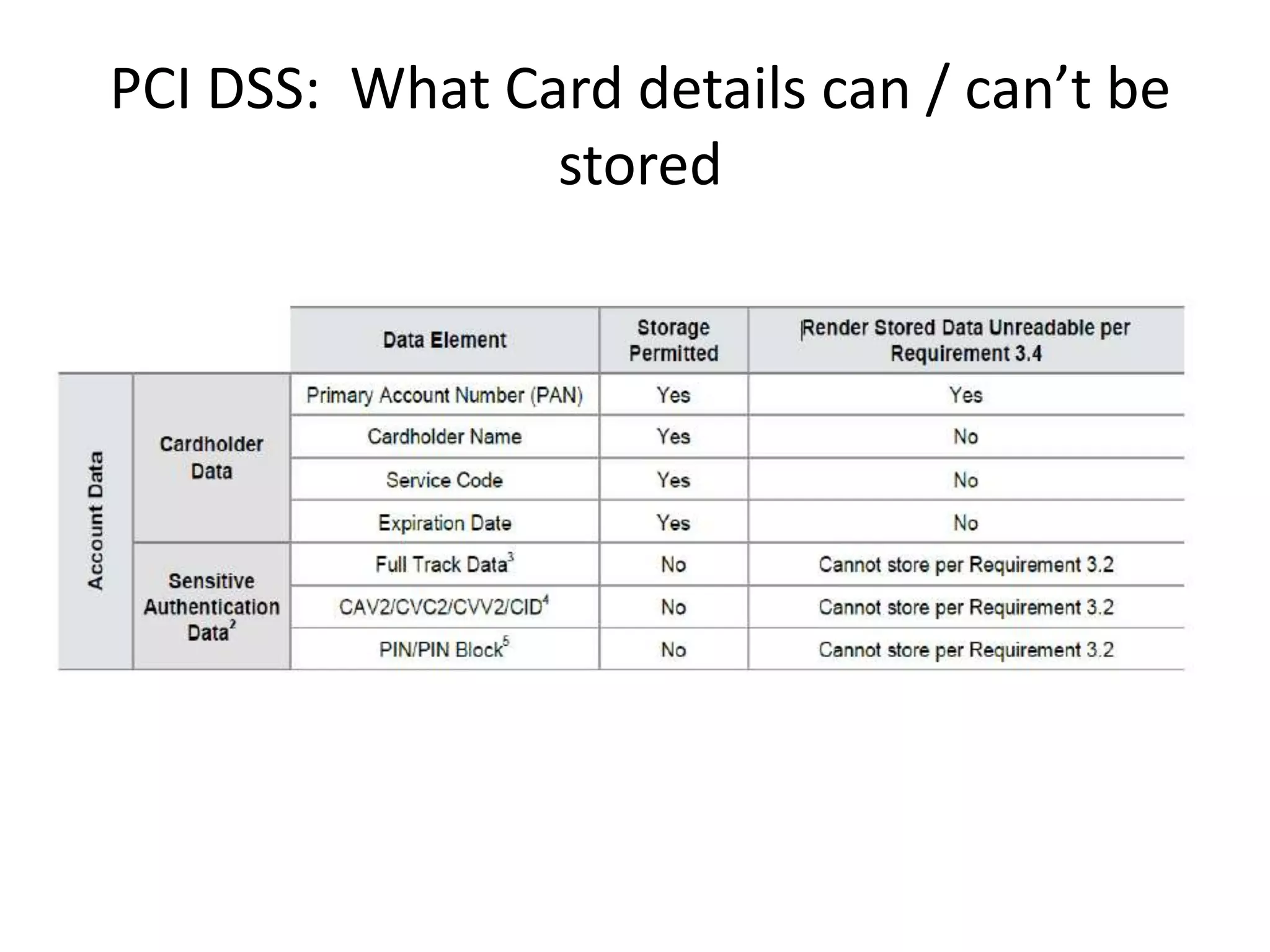

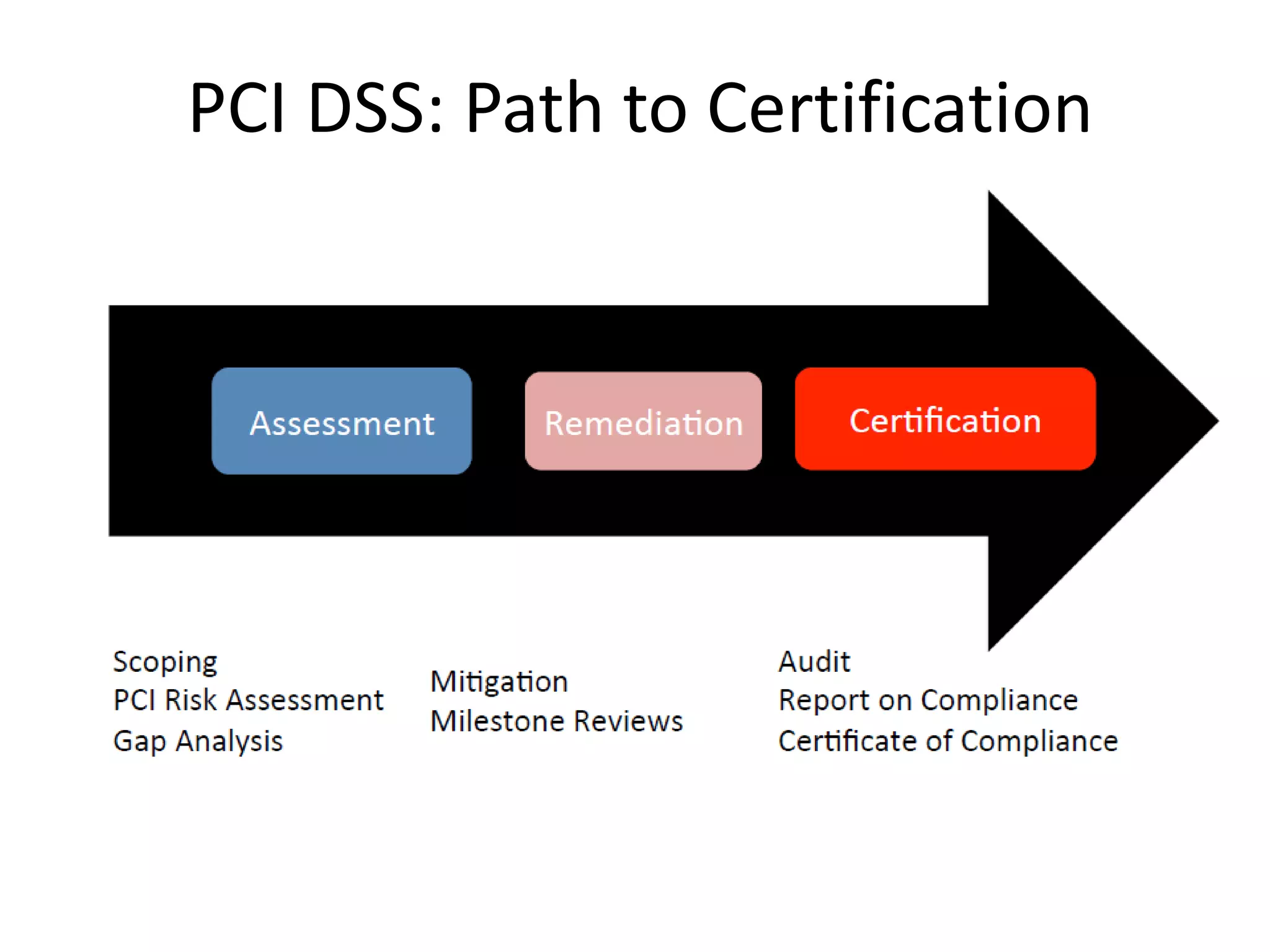

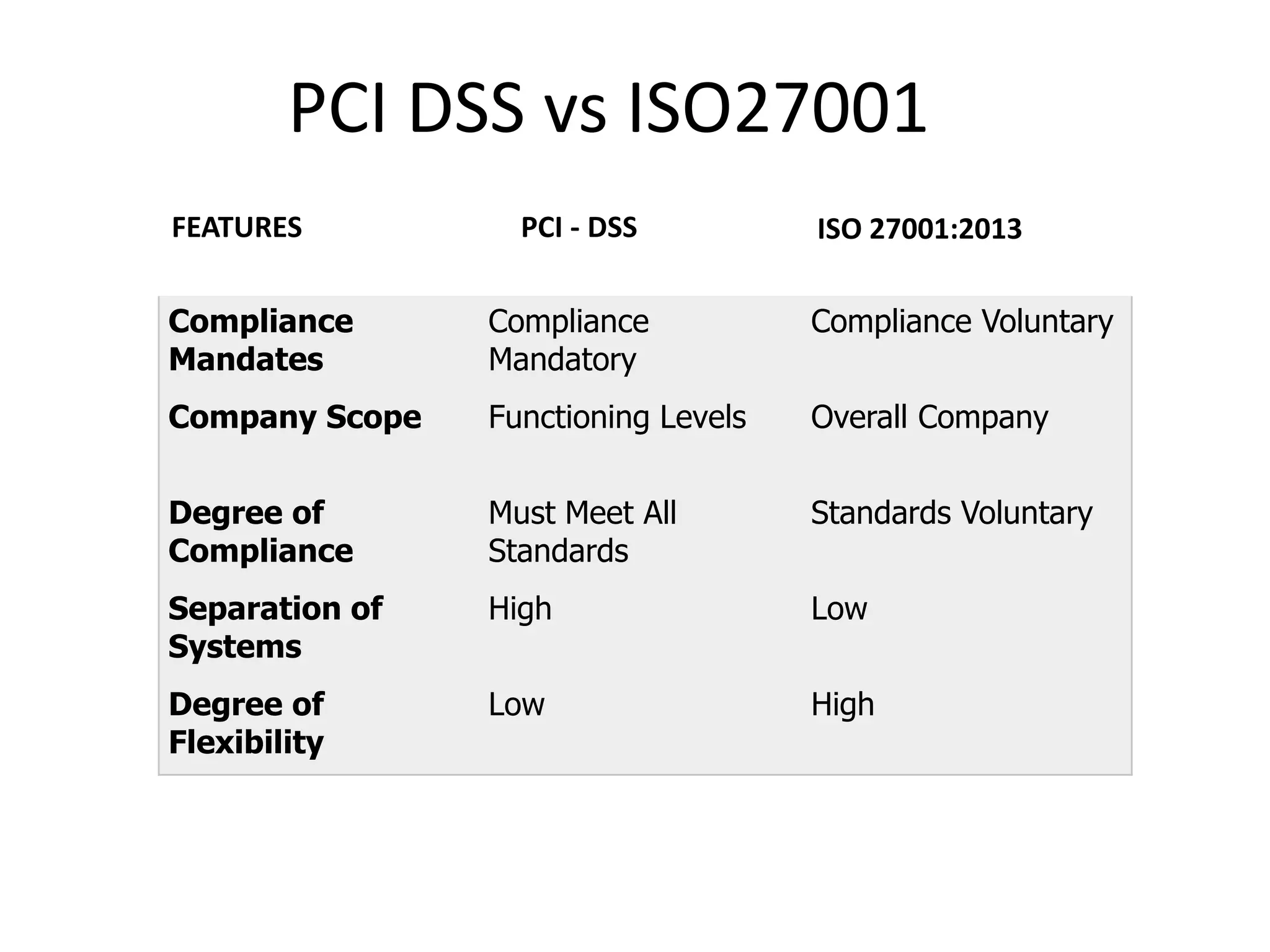

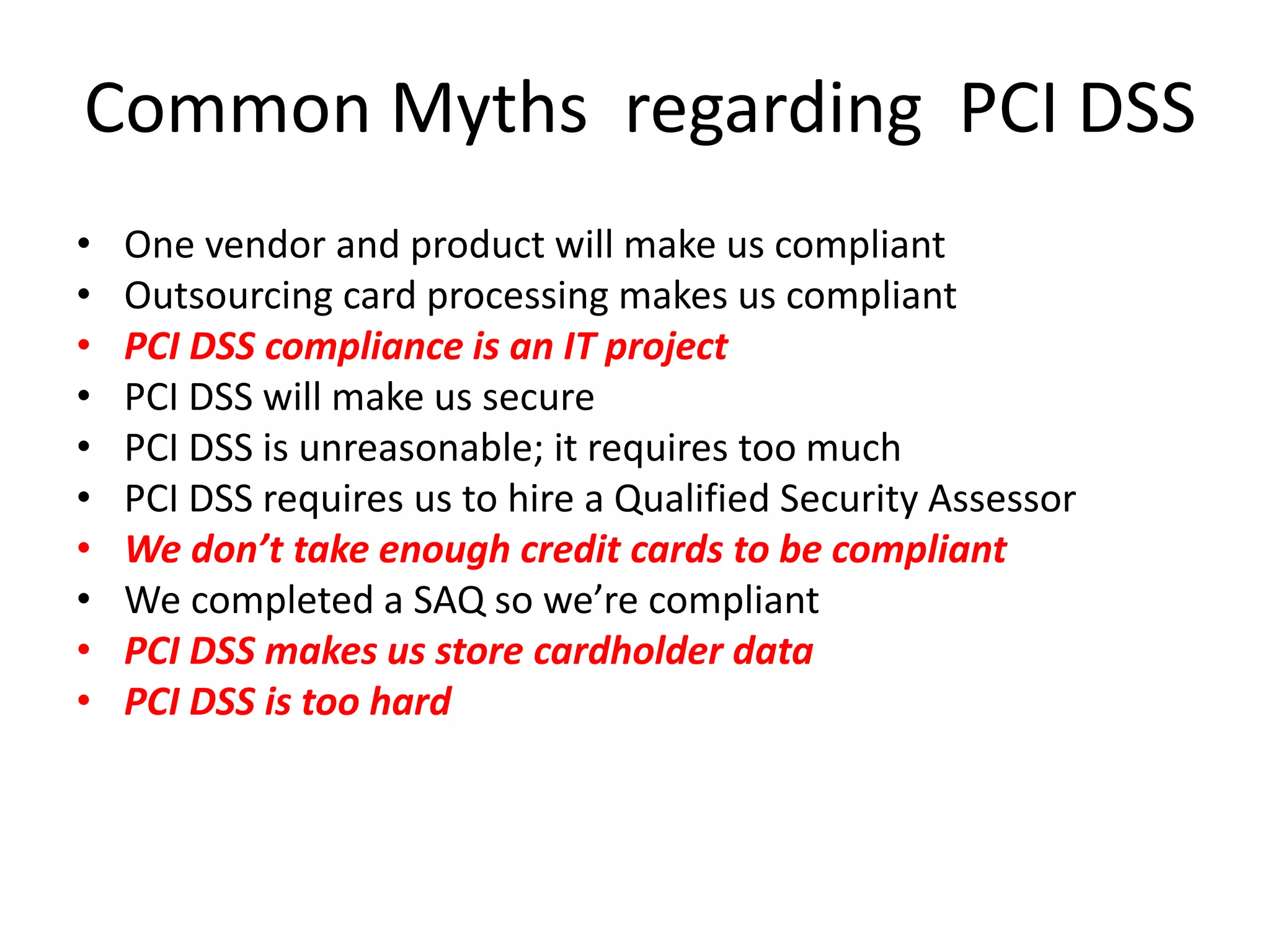

The document provides an overview of the Payment Card Industry Data Security Standard (PCI DSS v3), which outlines requirements for companies that handle credit card information to maintain secure environments. It discusses the importance of PCI DSS in the context of increasing card transactions, differentiates it from ISO 27001, and addresses common myths surrounding compliance. Additionally, it highlights the roles of various entities involved in PCI DSS and offers useful resources for further information.