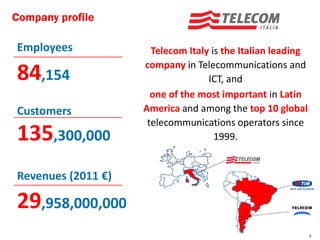

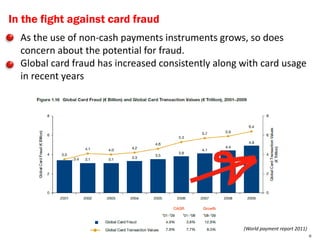

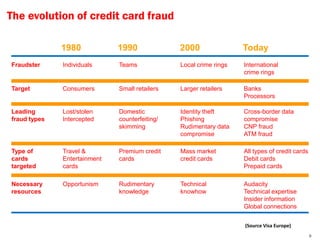

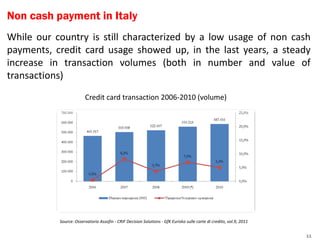

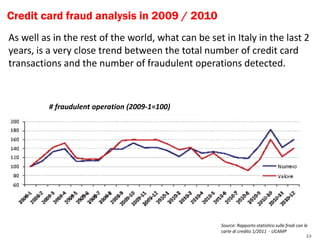

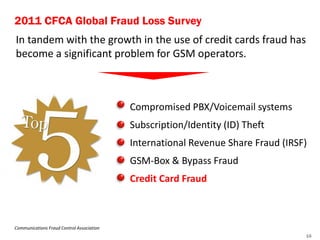

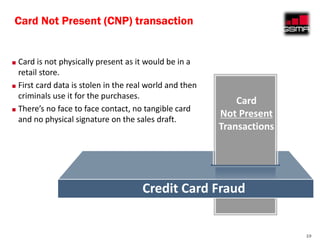

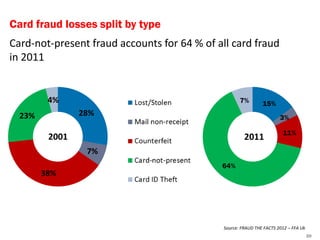

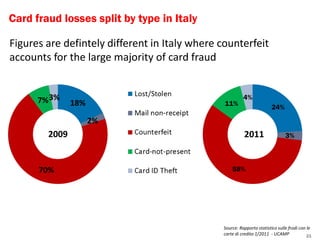

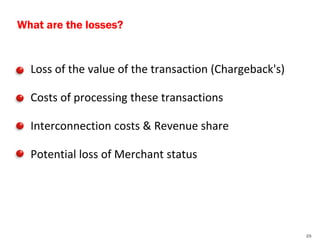

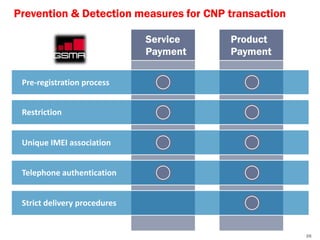

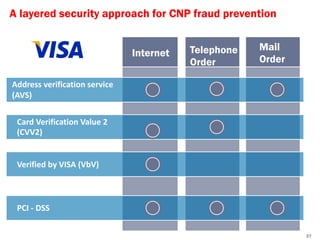

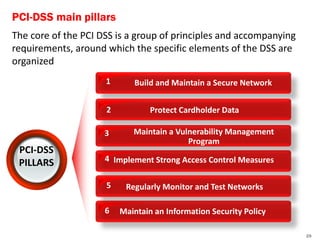

Telecom Italia is Italy's leading telecommunications company with over 84,000 employees and 135 million customers. As non-cash payments have increased, so too has credit card fraud. Specifically, card not present (CNP) fraud, where the physical card is not used, accounts for over 60% of fraud and is challenging for mobile operators due to purchases of devices, content, and services. Operators work to prevent CNP fraud through measures like registration requirements, authentication, and compliance with the Payment Card Industry Data Security Standard.